United States Precast Concrete Market Size, Share, Trends and Forecast by Type, Product, End Use, and Region, 2025-2033

United States Precast Concrete Market Size and Share:

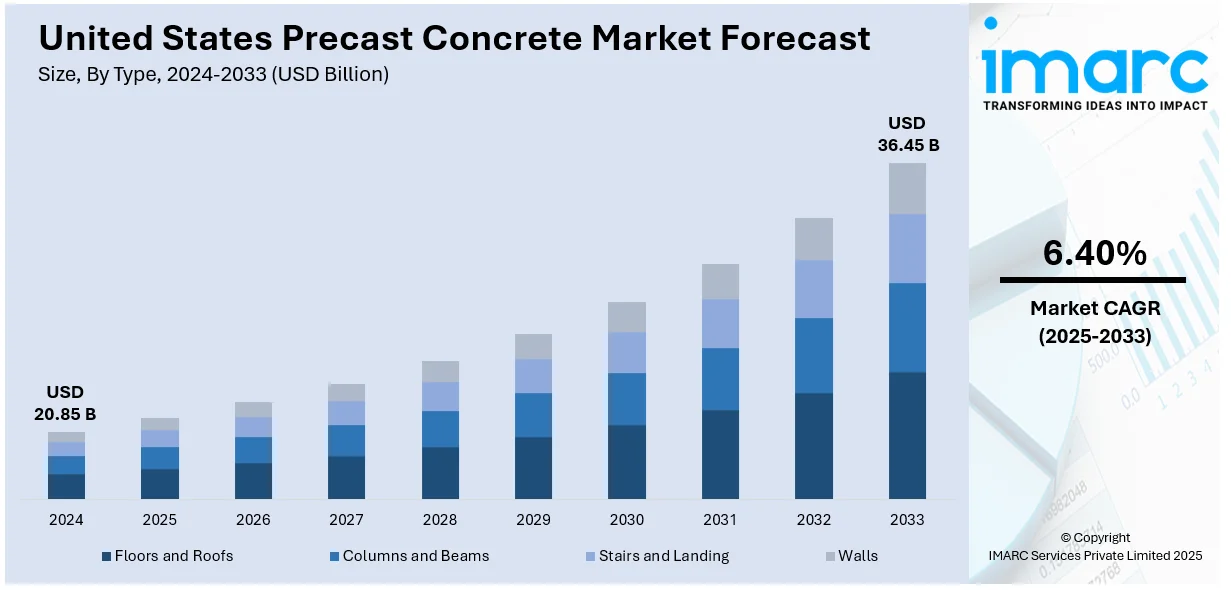

The United States precast concrete market size was valued at USD 20.85 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 36.45 Billion by 2033, exhibiting a CAGR of 6.40% from 2025-2033. The market is driven by rising construction activities, infrastructure modernization, cost efficiency, durability, reduced construction time, growing urbanization, technological advancements, sustainable building practices, stringent regulations, and increasing demand for prefabricated building components across residential and commercial sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 20.85 Billion |

| Market Forecast in 2033 | USD 36.45 Billion |

| Market Growth Rate (2025-2033) | 6.40% |

The expansion of the United States precast concrete industries is largely fueled by the rise in infrastructure development and urbanization. With substantial investments directed toward infrastructure projects, including roads, bridges, and utilities, the need for durable and economical construction solutions like precast concrete has grown significantly. The Infrastructure Investment & Jobs Act passed in late 2021, allocates $1 trillion over eight years for various infrastructure projects across the U.S., many of which utilize precast concrete components. This surge in infrastructure spending positively impacting the U.S. precast concrete market size.

Furthermore, the swift pace of urbanization, coupled with the growth of residential and commercial construction projects, has amplified the demand for precast concrete components, valued for their versatility and efficiency. In 2023, U.S. construction spending reached $1.9 trillion, marking a 5.7% increase from 2022. U.S. precast concrete market size & trends are further driven by the numerous benefits of precast concrete, such as faster construction timelines, reduced labor expenses, and superior durability, positioning it as a preferred solution for contemporary construction demands.

United States Precast Concrete Market Trends:

Labor Shortages and the Demand for Efficient Construction Solutions

The construction industry in the U.S. is grappling with a persistent labor shortage, which has intensified the demand for efficient building methods. As of 2023, the industry employed approximately 8 million workers across over 919,000 establishments. Despite this substantial workforce, the sector continues to face challenges in meeting the growing construction demands. Precast concrete provides an answer by allowing the off-site manufacture of components, reducing the labor force required on-site, and shortening project durations. This approach addresses labor constraints while improving construction efficiency and quality control.

Emphasis on Sustainability and Environmental Considerations

Due to the growing need for environmentally conscious building practices, construction has strongly focused on being sustainable. Some of the modern trends that will impact the future of precast concrete industry in the U.S. include durable and energy-efficient materials that can also be made of recycled materials. The commitment of the industry to sustainable practice is visible through the huge impact it leaves on the economy: U.S. precast concrete manufacturers bring in more than $25.8 billion in revenue and $5.1 billion in worker wages in 2022. It is also in line with green building standards, reduces waste, is more thermally efficient, and has lower lifecycle environmental impacts compared to other traditional construction materials. All these features make it a go-to option for sustainability certification-seeking projects and low-carbon-footprint projects.

Technological Advancements and Modernization of Infrastructure

Precast concrete is the cutting edge of innovation in construction processes. Innovations in design software, automation, and manufacturing technology have further advanced the precision and versatility of precast components. This technological advancement allows the industry to grow and satisfy the demand for modern infrastructure solutions. Modernizing infrastructure in the U.S. requires strong, flexible construction materials. Precast concrete is a good fit because it is strong and flexible enough for a variety of applications, including bridges and highways, as well as residential and commercial buildings. This has significantly boosted the demand for precast concrete products in the U.S.

United States Precast Concrete Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States precast concrete market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, product, and end use.

Analysis by Type:

- Floors and Roofs

- Columns and Beams

- Stairs and Landing

- Walls

The demand for precast concrete floors and roofs in the United States is for rapid installation, and superior load-bearing capacity, essential for large-scale commercial and industrial structures. This is crucial in ensuring that tight construction schedules are met and on-site labor costs are reduced.

Columns and beams are part of structural frameworks, and their precast versions offer higher strength and uniformity. Increasing complexity in modern architectural designs requires strong support systems; hence, columns and beams of precast form are the best options for maintaining structural integrity and design flexibility.

Precast stairs and landings are in greater demand for precision and safety features. Multi-story residential and commercial buildings need consistent quality as well as building codes to provide safety and accessibility to occupants, which increases their demand.

Precast concrete walls are excellent for thermal insulation and soundproofing, meeting the increasing demand for energy-efficient and acoustically optimized buildings. This is especially important in urban areas where environmental control within structures is a priority for enhancing occupant comfort.

Analysis by Product:

- Structural Building Components

- Architectural Building Components

- Transportation Products

- Water and Waste Handling Products

- Others

Structural building component dominate the market with 38.7% shares. The demand for precast concrete structural building components in the U.S. remains strong, mainly based on speeding up construction timelines and potentially improving their structural integrity, especially for massive commercial and industrial projects.

Architectural building components produced with precast concrete are in high demand due to their aesthetic versatility and durability, which may reflect intricate designs and finishes to improve building facades while remaining long-lasting.

Transportation products, including precast concrete bridge components and railroad ties, are in high demand due to the ongoing expansion and maintenance of the U.S. transportation infrastructure, necessitating durable and quickly deployable solutions.

Precast concrete products, such as pipes and culverts, have gained increased use in water and waste management systems because of their superior strength and longevity, which are essential for sustainable infrastructure development.

Other precast concrete products like utility structures and retaining walls are highly demanded because they are flexible and resistive, adapting to different construction requirements in various industries.

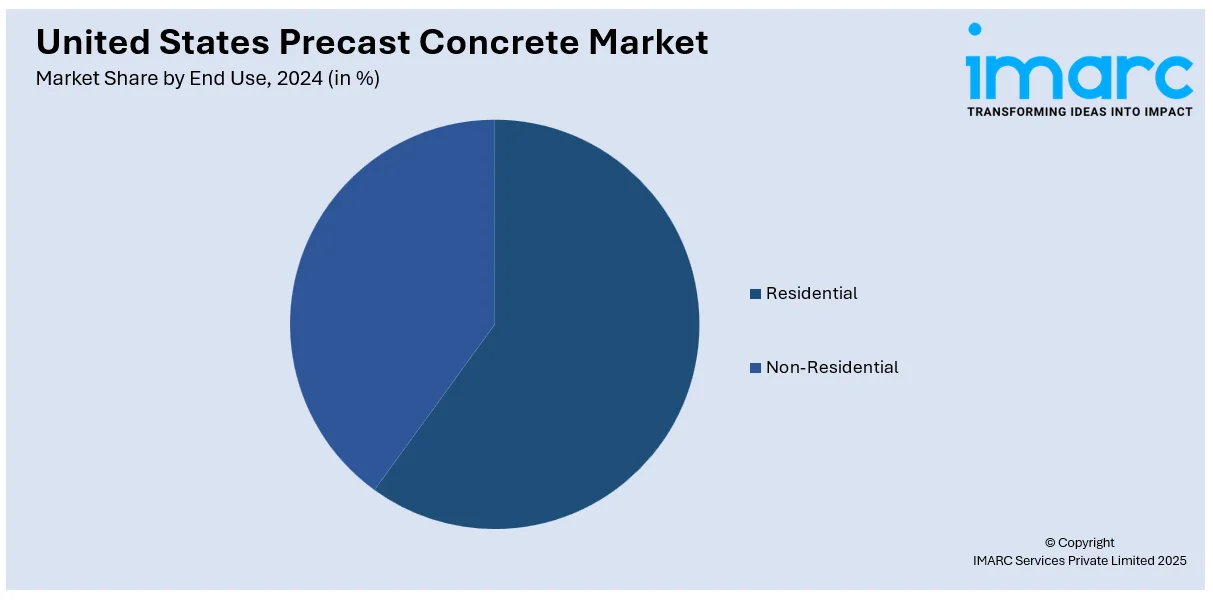

Analysis by End Use:

- Residential

- Non-Residential

Residential leads the market with 63.2% shares. The demand for precast concrete in the U.S. residential sector remains high because of growing needs for safe, sustainable, affordable housing solutions. Precast concrete has good thermal insulation properties, thereby helping save homeowners' energy. It is also resistant to floods and fires; hence, it stands a better chance of building safe, lasting homes in vulnerable areas.

Demand for precast concrete in the non-residential sector is strongly influenced by fulfilling large commercial, industrial, and institutional projects requirements. Precast concrete walls offer exceptional thermal insulation and soundproofing properties, catering to the growing demand for energy-efficient and acoustically enhanced buildings. These features are particularly crucial in urban settings, where maintaining environmental control within structures is essential for improving occupant comfort.

Regional Analysis:

- Northeast

- Midwest

- South

- West

In the Northwestern United States, the precast concrete industry is fueled by the region's emphasis on sustainable construction practices and the need for seismic-resilient building solutions. Precast concrete's durability and energy efficiency align with the Northwest's environmental priorities, while its structural integrity meets the area's seismic requirements.

The demand for precast concrete in the Midwest is driven by the region's strong industrial and agricultural sectors. Precast concrete is utilized in constructing durable facilities and infrastructure to support these industries, contributing to the region's economic development.

In the South, rapid population growth and urbanization have spurred a rise in residential and commercial construction projects. Precast concrete's cost-effectiveness and speed of installation make it a preferred choice to meet the high demand for new structures in this region.

The Western United States, particularly California, faces stringent seismic building codes due to earthquake risks. Precast concrete's strength and flexibility in design make it suitable for constructing earthquake-resistant structures, driving its demand in this region.

Competitive Landscape:

The U.S. precast concrete industry is largely characterized as a competitive landscape with many established players and regional manufacturers competing to establish themselves as a market leader through innovations and efficient operations. The key players in this market are companies that boast a broad product range and advanced manufacturing capabilities. Firms here use technological products such as 3D modeling and automation with an edge in producing efficient, quality products. Furthermore, partnerships with construction firms and infrastructure developers help secure large-scale projects. Regional players focus on niche markets, where they provide niche precast solutions that are suitable for local conditions. Sustainability initiatives, such as producing eco-friendly precast materials with reduced carbon footprints, are becoming the major competitive differentiator.

The report provides a comprehensive analysis of the competitive landscape in the United States precast concrete market with detailed profiles of all major companies, including:

- Balfour Beatty plc

- CEMEX S.A.B. de C.V.

- HOLCIM

- Olson Precast Company

- Wells Concrete

- Tindall Corporation

- Coreslab Structures

- Gage Brothers Concrete

- Cemstone

Latest News and Developments:

- In January 2025, TCC Materials merged its Minnesota subsidiaries, Amcon Concrete Products LLC and Borgert Products LLC, into its primary business, creating four distinct divisions: Standard Products Packaging, Specialty & Chemicals Packaging, Masonry, and Hardscapes & Precast. This consolidation aims to boost efficiency, streamline management, and improve overall business performance. TCC Materials has also made significant expansions and acquisitions to further enhance its product offerings in the Building Materials market.

- In December 2024: Vulcan Materials agreed to purchase Superior Ready Mix Concrete L.P. in Escondido, California. It owns 13 ready-mix plants, two asphalt plants, and six aggregates businesses. The acquisition will bring over 50 years of quality reserves to Vulcan's business in California, which will further strengthen its commitment to excellence and expand the reach of the company to serve better areas within the United States.

- In July 2024, the National Precast Concrete Association (NPCA), Precast/Prestressed Concrete Institute (PCI), and American Concrete Pipe Association (ACPA) were awarded a $9.975 million grant from the EPA for a collaborative project. The initiative aims to update the precast concrete Product Category Rule (PCR) and develop product-specific Environmental Product Declarations (EPDs). The initiative will create an EPD generator while also providing training and support to member firms. The five-year project will give significant tools to manufacturers while also assisting associations with the costs of developing or upgrading EPDs.

- In March 2024, Coreslab Structures, Inc. launched a new line of eco-friendly precast concrete panels. These panels utilize recycled materials and offer better thermal insulation, thereby providing more energy-efficient building designs.

- In May 2023: The UB received $1.6 million to join the Tier 1 University Transportation Center (TRANS-IPIC) seeks to build more robust and durable transport infrastructure through innovative materials, construction, and structural health monitoring technologies. A facility, facilitated by the United States Department of Transportation, is going to be merged with new technology into a popular material that is used to build transportation infrastructures in the United States precast concrete. Precast concrete is of better quality, requires less maintenance, and lasts longer.

United States Precast Concrete Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Floors and Roofs, Columns and Beams, Stairs and Landing, Walls |

| Products Covered | Structural Building Components, Architectural Building Components, Transportation Products, Water and Waste Handling Products, Others |

| End Uses Covered | Residential, Non-Residential |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States precast concrete market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States precast concrete market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States precast concrete industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States precast concrete market was valued at USD 20.85 Billion in 2024.

Key factors driving the growth of the U.S. precast concrete market include increasing demand for energy-efficient, sustainable building solutions, faster construction timelines, and the material’s durability. Technological advancements, urbanization, and infrastructure development also contribute, alongside government support for resilient, disaster-resistant construction practices.

IMARC estimates the United States precast concrete market to exhibit a CAGR of 6.40% during 2025-2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)