United States Power Rental Market Report by Equipment Type (Generator, Transformer, Load Bank, and Others), Fuel Type (Diesel, Natural Gas, and Others), Power Rating (Up to 50 kW, 51 –500 kW, 501 –2,500 kW, Above 2,500 kW), Application (Peak Shaving, Standby Power, Base Load/Continuous Power), End Use Industry (Utilities, Oil & Gas, Events, Construction, Mining, Data Centers, and Others), and Region 2025-2033

Market Overview:

The United States power rental market size reached USD 6.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 9.2 Billion by 2033, exhibiting a growth rate (CAGR) of 4.56% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.0 Billion |

|

Market Forecast in 2033

|

USD 9.2 Billion |

| Market Growth Rate (2025-2033) | 4.56% |

Power rental refers to a service that provides temporary power equipment for heavy industrial construction, oil and gas exploration activities, mine excavation, and big infrastructure projects. This equipment can be used in various stages, ranging from power plant pre-commissioning activities to construction and site development activities. In the United States, most end users are adopting power rental services due to the increasing awareness of numerous monetary benefits, along with various functional advantages provided by these solutions.

The United States power rental market is primarily driven by the growing need for continuous and uninterrupted power supply for several critical application areas, including nuclear power plants, data centers, hospitals and commercial establishments. The implementation of stringent governmental regulations for emission control and the introduction of green power rental solutions have also positively impacted the market growth. Besides this, with the rising concerns about global warming, service providers are offering renewable power equipment to end users. For instance, Tesla, Inc., a US-based automotive and energy company, has recently launched a solar rental program for six states across the United States - New Mexico, Massachusetts, California, New Jersey, Connecticut and Arizona.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States power rental market report, along with forecasts at the region levels from 2025-2033. Our report has categorized the market based on equipment type, fuel type, power rating, application and end use industry.

Breakup by Equipment Type:

- Generator

- Transformer

- Load Bank

- Others

Breakup by Fuel Type:

- Diesel

- Natural Gas

- Others

Breakup by Power Rating:

- Up to 50 kW

- 51 –500 kW

- 501 –2,500 kW

- Above 2,500 kW

Breakup by Application:

- Peak Shaving

- Standby Power

- Base Load/Continuous Power

Breakup by End Use Industry:

- Utilities

- Oil & Gas

- Events

- Construction

- Mining

- Data Centers

- Others

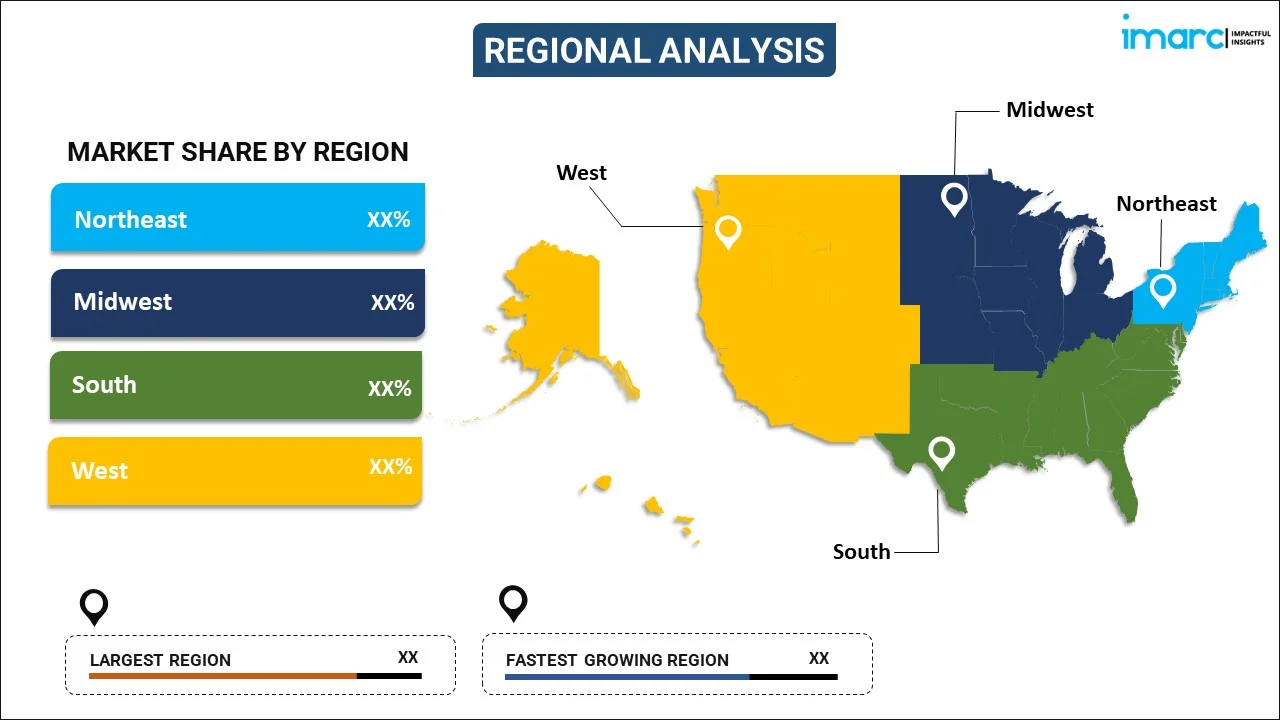

Breakup by Region:

- Northeast

- Midwest

- South

- West

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

|

Scope of the Report

|

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Equipment Types Covered | Generator, Transformer, Load Bank, Others |

| Fuel Types Covered | Diesel, Natural Gas, Others |

| Power Ratings Covered | Up to 50 kW, 51 –500 kW, 501 –2,500 kW, Above 2,500 kW |

| Applications Covered | Peak Shaving, Standby Power, Base Load/Continuous Power |

| End Use Industries Covered | Utilities, Oil & Gas, Events, Construction, Mining, Data Centers, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the United States power rental market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the United States power rental market?

- What are the key regional markets?

- What is the breakup of the market based on the fuel type?

- What is the breakup of the market based on the equipment type?

- What is the breakup of the market based on the power rating?

- What is the breakup of the market based on the application?

- What is the breakup of the market based on the end use industry?

- What are the various stages in the value chain of the industry?

- What are the key driving factors and challenges in the industry?

- What is the structure of the United States power rental market and who are the key players?

- What is the degree of competition in the industry?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)