United States Plastics Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2026-2034

United States Plastics Market Summary:

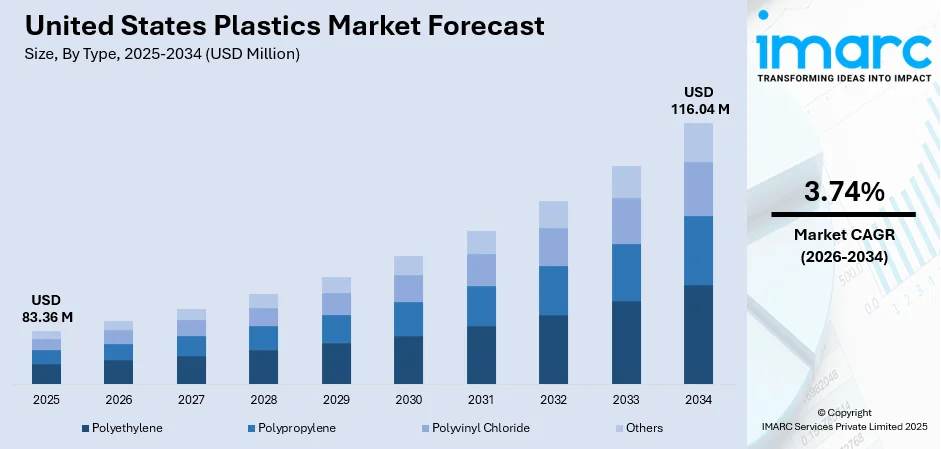

The United States plastics market size was valued at USD 83.36 Million in 2025 and is projected to reach USD 116.04 Million by 2034, growing at a compound annual growth rate of 3.74% from 2026-2034.

The United States plastics market is experiencing robust growth driven by expanding packaging demand, automotive lightweighting requirements, and increasing healthcare applications. The petrochemical industry concentration along the Gulf Coast provides feedstock advantages, while sustainability initiatives and recycling innovations are reshaping manufacturing practices. Government infrastructure investments and the electric vehicle transition are creating new demand vectors across the United States plastics market share.

Key Takeaways and Insights:

-

By Type: Polyethylene dominates the market with a share of 25.33% in 2025, driven by versatility in packaging, ease of processing, and strong recyclability profile.

-

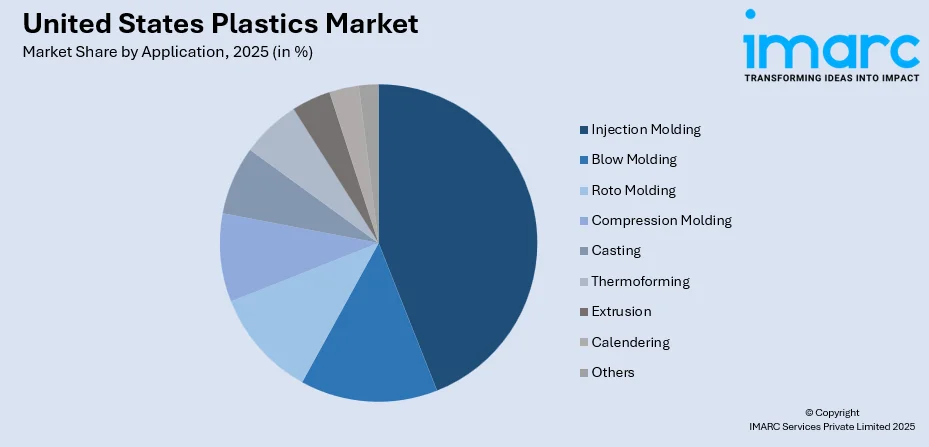

By Application: Injection molding leads the market with a share of 43.25% in 2025, owing to efficiency in mass production and precision manufacturing capabilities.

-

By End User: Packaging represents the largest segment with a market share of 37.04% in 2025, fueled by e-commerce expansion and food industry growth.

-

Key Players: The market exhibits moderate consolidation with major multinational chemical corporations and specialized regional processors competing through product innovation, sustainability initiatives, vertical integration strategies, and recycling infrastructure investments.

To get more information on this market Request Sample

The United States plastics industry represents one of the nation's most significant economic contributors, generating substantial economic output and supporting millions of American jobs across the value chain. Operating thousands of facilities nationwide, the industry directly employs a substantial workforce with competitive wages. The Plastics Industry Association reported in September 2025 that the industry produced nearly USD 23.7 Billion worth of plastic resins and products in 2024. The strong domestic production capacity has positioned the United States as a global leader with a trade surplus in plastic resins. The industry continues investing in new facilities and equipment modernization to maintain competitive advantages. Favorable natural gas pricing provides feedstock cost advantages compared to international competitors, while ongoing infrastructure development supports capacity expansion across multiple polymer categories and processing technologies.

United States Plastics Market Trends:

Accelerating Circular Economy and Advanced Recycling Initiatives

The United States plastics industry is witnessing a transformational shift toward circular economy principles, with manufacturers investing heavily in mechanical and advanced recycling technologies. Brand owners are increasingly committing to recycled content targets, driving demand for post-consumer recycled materials. In September 2024, the Accelerating a Circular Economy for Plastics and Recycling Innovation Act was introduced as the first comprehensive bipartisan federal effort to modernize recycling infrastructure.

Growing Integration of Plastics in Electric Vehicle Manufacturing

The electric vehicle revolution is generating substantial demand for high-performance plastics as automakers prioritize lightweighting strategies to extend battery range and enhance driving efficiency. Engineering plastics and thermoplastic composites are expanding rapidly across battery housings, interior components, and exterior panels, replacing traditional metal components to improve vehicle efficiency, reduce overall weight, and deliver superior performance capabilities.

Expansion of Sustainable and Bio-Based Polymer Development

The development of bio-based and biodegradable plastics continues gaining momentum as manufacturers respond to consumer preferences and regulatory pressures for sustainable alternatives. Major chemical companies are investing in renewable feedstock technologies and plant-derived polymer production capabilities. These sustainable materials offer reduced carbon footprints while maintaining comparable mechanical properties to conventional plastics, supporting brand owner sustainability commitments and addressing environmental concerns across packaging and consumer goods applications.

Market Outlook 2026-2034:

The United States plastics market outlook remains positive through the forecast period, supported by diversified end-use demand, technological innovation, and strategic infrastructure investments. Lower interest rates are expected to support capital expenditures and capacity utilization improvements across manufacturing facilities. The packaging sector will continue driving volume growth as e-commerce expansion sustains demand for protective and flexible packaging solutions. Automotive lightweighting requirements and electric vehicle adoption will accelerate engineering plastics consumption, while healthcare applications present high-value growth opportunities. Sustainability initiatives are reshaping product development priorities, with manufacturers investing in recycling technologies and circular economy solutions. The Gulf Coast petrochemical corridor maintains feedstock cost advantages supporting competitive positioning. Construction sector recovery and infrastructure development programs will generate additional demand across building materials and piping applications throughout the forecast period. The market generated a revenue of USD 83.36 Million in 2025 and is projected to reach a revenue of USD 116.04 Million by 2034, growing at a compound annual growth rate of 3.74% from 2026-2034.

United States Plastics Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Polyethylene | 25.33% |

| Application | Injection Molding | 43.25% |

| End User | Packaging | 37.04% |

Type Insights:

- Polyethylene

- Polypropylene

- Polyvinyl Chloride

- Others

The polyethylene dominates with a market share of 25.33% of the total United States plastics market in 2025.

Polyethylene maintains its leadership position due to exceptional versatility, cost-effectiveness, and broad application range across packaging, construction, and consumer goods sectors. The material's availability in multiple density variants enables manufacturers to address diverse performance requirements. In June 2024, NOVA Chemicals received FDA approval for its Connersville, Indiana mechanical-recycling process, enabling SYNDIGO rLLDPE films with up to 100% recycled content for food contact applications.

The segment continues benefiting from innovations in metallocene catalyst technology enabling higher-performance films with reduced gauge requirements, contributing to material savings of eight to ten percent. Growing demand from e-commerce packaging, agricultural films, and infrastructure applications supports sustained volume growth, while bio-based polyethylene derived from sugarcane offers reduced carbon footprint while maintaining equivalent mechanical properties.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Injection Molding

- Blow Molding

- Roto Molding

- Compression Molding

- Casting

- Thermoforming

- Extrusion

- Calendering

- Others

The injection molding segment leads with a share of 43.25% of the total United States plastics market in 2025.

Injection molding maintains dominant position due to unparalleled efficiency in mass production, dimensional precision, and ability to manufacture complex geometries. The technology enables high-volume production of automotive components, medical devices, and packaging containers with consistent quality and minimal material waste. Advanced process controls ensure repeatability across production runs, while versatility in compatible polymer types allows manufacturers to address diverse application requirements spanning rigid containers, precision engineering components, and consumer goods manufacturing.

The injection molding sector is experiencing technological transformation through smart manufacturing integration, with machine-learning-based process optimization reducing unplanned downtime and improving production efficiency. Industry adoption of automation and robotics enhances precision while minimizing material waste. Rising demand from automotive, medical, and building applications continues driving capacity investments. Manufacturers are expanding cleanroom capabilities to serve stringent healthcare requirements, while automotive suppliers invest in multi-cavity tooling to meet lightweighting component demand.

End User Insights:

- Packaging

- Automotive

- Infrastructure and Construction

- Consumer Goods

- Others

The packaging segment exhibits clear dominance with a 37.04% share of the total United States plastics market in 2025.

The packaging sector maintains position as the largest consumer of plastics, driven by e-commerce expansion, food and beverage industry growth, and increasing demand for convenience formats. Rigid and flexible packaging solutions continue displacing alternative substrates due to superior barrier properties, lightweight characteristics, and cost-effectiveness. Extended shelf-life capabilities and product protection advantages support sustained adoption across food, pharmaceutical, and consumer goods applications, with resealable and portion-control formats gaining significant consumer preference.

Sustainability initiatives are accelerating development of recyclable mono-material structures and reduced-gauge films across the packaging value chain. Brand owners are increasingly committing to recycled content targets, driving demand for post-consumer recycled materials in packaging applications. Extended producer responsibility programs across multiple states are creating cost incentives for eco-modulated packaging designs. The transition toward tethered closures, compostable films, and high-barrier recyclable laminates reflects evolving regulatory requirements and consumer environmental preferences.

Regional Insights:

- Northeast

- Midwest

- South

- West

Northeast maintains strong plastics demand driven by concentrated pharmaceutical and healthcare industries, established packaging manufacturing clusters, and proximity to major consumer markets along the Atlantic corridor.

Midwest exhibits significant plastics consumption powered by automotive manufacturing concentration in Michigan and Ohio, agricultural applications across farming states, and Indiana maintaining the nation's highest concentration of plastics industry workers.

The South region dominates national plastics production with Texas leading employment and the Gulf Coast petrochemical corridor providing feedstock advantages, with ongoing expansion projects strengthening regional capacity.

West is experiencing the fastest growth driven by rapid urbanization, expanding construction activities, rising e-commerce packaging demand, strong government support for recycling initiatives, and growing electronics manufacturing in California.

Market Dynamics:

Growth Drivers:

Why is the United States Plastics Market Growing?

Expanding E-Commerce and Packaging Industry Demand

The exponential growth of e-commerce has fundamentally transformed packaging requirements, creating sustained demand for protective, lightweight plastic solutions. Online retail expansion necessitates durable packaging capable of withstanding distribution network handling and multiple touchpoints. Flexible packaging formats including pouches and air cushioning materials have experienced accelerated adoption. Rising consumer expectations for product integrity during shipping are driving innovation in protective packaging designs, while subscription box services and direct-to-consumer models generate additional demand.

Automotive Lightweighting and Electric Vehicle Transition

The automotive industry's strategic shift toward lightweight materials presents substantial growth opportunities for engineering plastics and advanced polymer composites. Vehicle manufacturers are systematically replacing metal components with high-performance plastics to improve fuel efficiency and extend electric vehicle battery range. Interior trim, exterior body panels, under-hood components, and structural applications increasingly utilize specialized polymers offering weight reduction without compromising safety or performance. This transition supports both regulatory compliance objectives and consumer preferences for improved vehicle efficiency.

Healthcare and Medical Device Applications Expansion

The healthcare sector represents a high-growth application area for medical-grade plastics, driven by aging demographics and technological advancement in medical devices. Medical device applications rely on specialized polymers that withstand sterilization while maintaining dimensional stability and biocompatibility requirements. Single-use medical instruments, diagnostic equipment housings, pharmaceutical packaging, and implantable devices utilize advanced polymer formulations. Growing demand for home healthcare products and wearable monitoring devices continues expanding the addressable market for medical-grade plastics applications.

Market Restraints:

What Challenges the United States Plastics Market is Facing?

Regulatory Pressures and Single-Use Plastics Restrictions

Increasing regulatory scrutiny at federal, state, and municipal levels presents ongoing challenges for conventional plastics manufacturers. Legislation targeting single-use plastics, mandatory recycled content requirements, and extended producer responsibility programs require significant operational adjustments and capital investments across the value chain to ensure compliance.

Competition from Bio-Based and Alternative Materials

The development of bio-based polymers, paper-based alternatives, and other sustainable materials creates competitive pressure for traditional petroleum-derived plastics. Brand owner preferences for materials with improved environmental profiles may shift market share toward alternatives in certain packaging and consumer goods applications.

Feedstock Price Volatility and Supply Chain Disruptions

Fluctuations in crude oil and natural gas prices directly impact resin production costs and market pricing dynamics. Global supply chain disruptions and shipping route constraints affect raw material availability and increase logistics costs for manufacturers, creating uncertainty in production planning and pricing strategies.

Competitive Landscape:

The United States plastics market exhibits a moderately consolidated competitive structure characterized by large multinational chemical corporations competing alongside specialized regional processors and converters. Major players differentiate through product innovation, sustainability credentials, and vertical integration strategies spanning feedstock production to finished goods manufacturing. Companies are investing heavily in recycling infrastructure and advanced manufacturing technologies to address evolving customer requirements and regulatory demands. Strategic acquisitions continue reshaping the competitive landscape as organizations pursue scale advantages and expanded geographic presence. The market demonstrates robust competition in pricing and distribution channels, with established players leveraging diverse product portfolios across multiple polymer categories. Regional processors compete effectively through application-specific expertise, rapid turnaround capabilities, and customized service offerings. Partnerships between resin producers and brand owners are accelerating development of sustainable packaging solutions and closed-loop recycling systems.

Recent Developments:

-

June 2024: Dow announced the acquisition of Circulus, a leading North American polyethylene recycler with facilities in Oklahoma and Alabama, with total annual capacity of 50,000 metric tons, to support its goal to convert 3 million metric tons of plastic waste into circular solutions by 2030.

United States Plastics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Polyethylene, Polypropylene, Polyvinyl Chloride, Others |

| Applications Covered | Injection Molding, Blow Molding, Roto Molding, Compression Molding, Casting, Thermoforming, Extrusion, Calendering, Others |

| End Users Covered | Packaging, Automotive, Infrastructure and Construction, Consumer Goods, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The United States plastics market size was valued at USD 83.36 Million in 2025.

The United States plastics market is expected to grow at a compound annual growth rate of 3.74% from 2026-2034 to reach USD 116.04 Million by 2034.

Polyethylene dominated the market with a share of 25.33% in 2025, driven by versatility across packaging applications, established recyclability infrastructure, ease of processing, and cost-effectiveness in consumer and industrial end-uses.

Key factors driving the United States plastics market include expanding e-commerce and packaging sector, automotive lightweighting trends driven by electric vehicle adoption, growing healthcare and medical device applications, and sustained demand from consumer goods manufacturing.

Major challenges include increasing regulatory pressures on single-use plastics, competition from bio-based and alternative materials, feedstock price volatility, supply chain disruptions, and the need for significant capital investments in recycling infrastructure modernization.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)