United States Perfume Market Size, Share, Trends and Forecast by Perfume Type, Category, and Region, 2026-2034

United States Perfume Market Summary:

The United States perfume market size was valued at USD 10.04 Billion in 2025 and is projected to reach USD 19.55 Billion by 2034, growing at a compound annual growth rate of 7.68% from 2026-2034.

The United States perfume market is propelled by changing preferences toward personal grooming and expressing one's identity. Increasing disposable income, enhanced focus on individuality, and rising social media platforms accelerate the demand for different types of fragrances. The premiumization trend, along with continuous innovation in fragrance formulation and sustainable practices, is remodeling consumer purchase behavior. Promotional activities, such as celebrity endorsements and influencer marketing, along with increasing e-commerce channels, further drive United States perfume market share.

Key Takeaways and Insights:

- By Perfume Type: Premium perfume products dominate the market with a share of 63% in 2025, owing to increasing consumer inclination towards luxury and exclusive fragrance experiences, higher concentration formulations that deliver superior longevity, and growing demand for artisanal and niche scent profiles among affluent consumers.

- By Category: Female fragrances lead the market with a share of 50% in 2025. This dominance is driven by the deep cultural association of perfumes with feminine grooming routines, diverse product offerings spanning floral to oriental scent families, and strong emotional connections that fragrances create with personal identity.

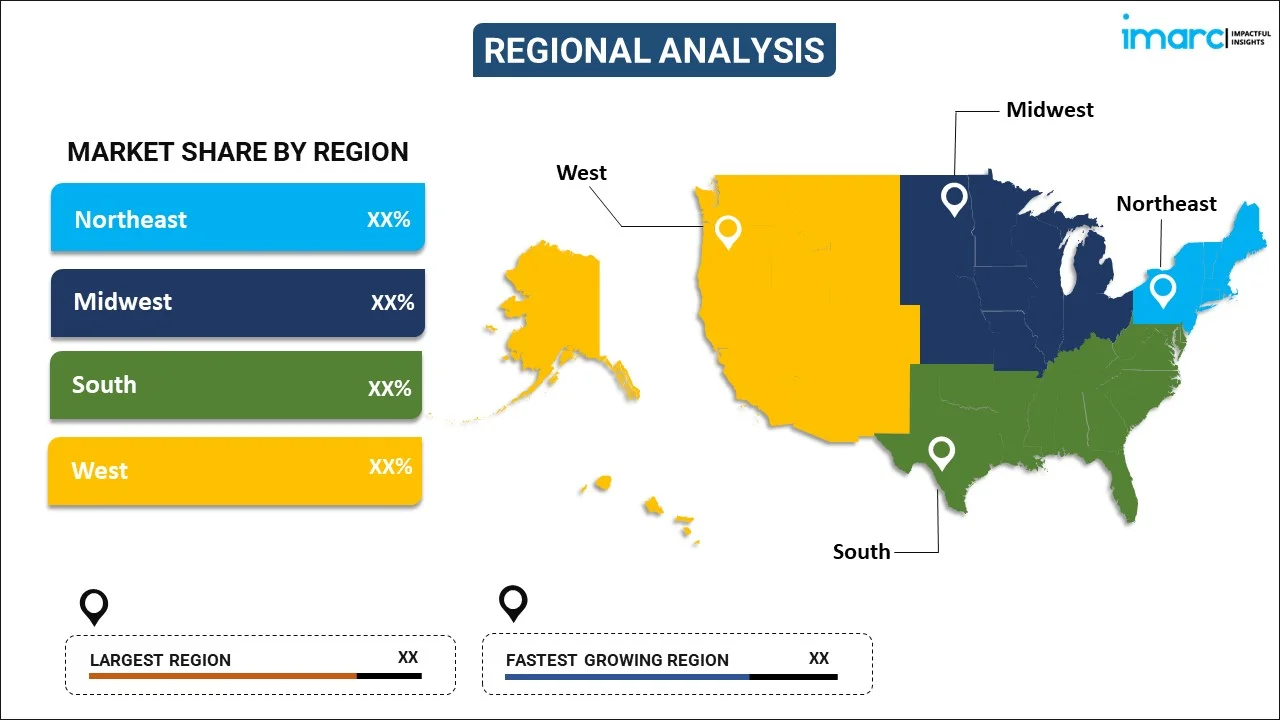

- By Region: South represents the largest region with 31% share in 2025, fueled by a strong retail infrastructure that serves a variety of customer categories, high population density in cities like Miami, Atlanta, and Dallas, and higher disposable incomes that allow luxury scent purchases.

- Key Players: Key players drive the United States perfume market by expanding premium and niche portfolios, investing in sustainable sourcing and refillable packaging innovations, strengthening omnichannel distribution networks, and leveraging celebrity partnerships and digital marketing strategies to enhance brand visibility and consumer engagement across demographic segments.

The United States perfume market continues to witness transformative growth as consumers increasingly view fragrances as essential components of personal identity and wellness routines. The market demonstrates sophisticated consumer behavior patterns characterized by fragrance wardrobing, where individuals curate multiple scents for different occasions, moods, and seasons. In SoHo, New York, Parfums Christian Dior launched its first fragrance and cosmetics store in November 2024, offering Haute Parfumerie by Francis Kurkdjian, La Collection Privée Christian Dior, and individual consultations. This strategic retail expansion exemplifies the industry's commitment to experiential shopping that combines sensory engagement with expert guidance. The emergence of clean beauty preferences, natural ingredient formulations, and eco-conscious packaging solutions reflects evolving consumer values prioritizing transparency, sustainability, and ethical sourcing practices that are reshaping United States perfume market growth.

United States Perfume Market Trends:

Rising Demand for Niche and Artisanal Fragrances

American consumers are increasingly gravitating towards unique, exclusive scent profiles that differentiate them from mainstream fragrance offerings. This trend reflects a broader cultural shift towards individuality and self-expression through personal care products. Niche perfume houses are gaining significant market traction by offering distinctive formulations, compelling brand narratives, and limited-edition releases that appeal to discerning consumers seeking authenticity. Independent fragrance companies focus on rare materials, artisanal craftsmanship, and narratives that appeal to wealthy consumers building customized fragrance wardrobes. This premiumization movement continues reshaping competitive dynamics across the United States perfume market.

Sustainability and Clean Beauty Integration

Environmental consciousness is fundamentally reshaping fragrance development and consumer purchasing decisions across the United States. Brands are prioritizing sustainable sourcing practices, recyclable packaging solutions, and clean ingredient formulations free from harmful chemicals. This movement aligns with growing consumer demand for transparency regarding environmental impact and ethical production methods. Refillable bottle programs have gained substantial momentum, with luxury brands introducing innovative systems that reduce single-use plastic consumption while maintaining premium positioning. DSM-Firmenich's biodegradable fragrance encapsulation technology, PopScent Eco Max, exemplifies industry innovation toward environmentally responsible product development.

Expansion of Men's Fragrance Segment

The men's fragrance segment is experiencing unprecedented growth as shifting grooming norms position scent as an essential masculine accessory. Teen boys and younger male consumers are driving substantial increases in fragrance spending, reflecting broader cultural acceptance of personal scent as integral to daily grooming routines. Male consumers are diversifying beyond traditional woody and aromatic profiles, embracing gourmand and floral notes previously associated with feminine fragrances. Premium launches from luxury houses are resonating strongly with younger demographics seeking sophisticated, long-lasting scent experiences that express individual identity and style.

Market Outlook 2026-2034:

The United States perfume market demonstrates promising growth prospects driven by evolving consumer preferences, technological innovations, and expanding distribution channels. Premiumization trends continue accelerating as consumers increasingly invest in higher-concentration formulations and luxury brand offerings. The proliferation of direct-to-consumer business models, subscription services, and immersive retail experiences is expected to strengthen consumer engagement. Strategic investments in sustainable practices, natural ingredient innovations, and personalized fragrance solutions will create competitive advantages. The market generated a revenue of USD 10.04 Billion in 2025 and is projected to reach a revenue of USD 19.55 Billion by 2034, growing at a compound annual growth rate of 7.68% from 2026-2034.

United States Perfume Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Perfume Type | Premium Perfume Products | 63% |

| Category | Female Fragrances | 50% |

| Region | South | 31% |

Perfume Type Insights:

To get detailed segment analysis of this market Request Sample

- Premium Perfume Products

- Mass Perfume Products

Premium perfume products dominate with a market share of 63% of the total United States perfume market in 2025.

The premium perfume segment maintains commanding market leadership driven by increasing consumer willingness to invest in luxury fragrance experiences that deliver superior quality, longevity, and exclusivity. American consumers increasingly view premium fragrances as accessible luxury items that enhance personal identity and emotional wellbeing. Higher concentration formulations, typically containing 15-20% fragrance oils in Eau de Parfum products, offer extended wear time and sophisticated scent evolution that justify premium pricing. In October 2025, The Estée Lauder Companies' global network of research and innovation across the United States (New York and Minnesota) is further strengthened by The Atelier.

The segment benefits from extensive retail distribution networks, immersive store experiences, and personalized consultation services that differentiate premium offerings from mass-market alternatives. Luxury brands are pioneering sustainable innovations including refillable packaging systems and ethically sourced ingredients that resonate with environmentally conscious consumers. The emergence of masstige products, blending premium experiences with accessible pricing, is expanding the addressable market while maintaining aspirational brand positioning. Digital platforms have democratized access to premium fragrances, enabling consumers to explore exclusive offerings through sophisticated e-commerce experiences and personalized recommendations that drive segment growth.

Category Insights:

- Female Fragrances

- Male Fragrances

- Unisex Fragrances

Female fragrances lead with a share of 50% of the total United States perfume market in 2025.

Female fragrances maintain dominant market position reflecting the deeply embedded cultural association between perfumes and feminine grooming routines. The segment demonstrates remarkable diversity spanning multiple scent families including floral, oriental, woody, and fresh compositions that cater to varying preferences, occasions, and seasons. American women exhibit strong fragrance wardrobing behavior, curating multiple scents for professional environments, social occasions, and personal relaxation. While marketing methods utilizing celebrities successfully convey aspirational lifestyle connotations, major luxury houses continue to provide unique formulations that capture growing consumer tastes.

The emotional and psychological appeal of fragrances significantly drives segment growth, with women associating scents with confidence, self-expression, and personal identity. Major product launches continue energizing the segment, with luxury houses introducing innovative formulations that capture emerging consumer preferences. Marketing strategies featuring female celebrities and influencers effectively communicate brand values and aspirational lifestyle associations. The segment showcases continuous innovation in packaging design, ingredient transparency, and sustainable practices that align with evolving consumer expectations. Online channels have expanded accessibility, enabling discovery of niche and premium offerings that complement established designer fragrances across diverse consumer demographics.

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Northeast

- Midwest

- South

- West

South exhibits a clear dominance with a 31% share of the total United States perfume market in 2025.

The South continues to have market dominance due to the large, concentrated population in major cities like Miami, Atlanta, Dallas, Houston, and Charlotte. These cities have strong retailing infrastructure that covers department stores, specialty boutiques, and upscale shopping destinations; thereby favoring various fragrances available in the market. With respect to rising Sunbelt economies that generate higher disposable incomes, individuals can now splurge on higher-end fragrances. The South receives a large number of tourists, especially in Florida, where people tend to make purchases as souvenirs from fragrances vendors.

The market benefits from the densely populated and warm climatic environment that favors year-round fragrance consumption. The market represents diverse market preferences that mirror the multicultural population, with diverse scent profiles from traditional florals to distinctive scents. Increased retail development in specialist retail outlets and luxury department stores will improve market accessibility and engagement. Online retailing remains at its acceleration stage, allowing rural and suburban consumers to enjoy luxury fragrance profiles, which were previously accessible in metropolitan cities.

Market Dynamics:

Growth Drivers:

Why is the United States Perfume Market Growing?

Increasing Emphasis on Personal Grooming and Self-Expression

American consumers are placing unprecedented importance on personal grooming and self-expression, fundamentally transforming fragrance from occasional luxury to daily essential. This cultural shift reflects broader societal trends prioritizing individuality, wellness, and self-care as integral components of personal identity. Fragrances have evolved beyond merely masking odors to become powerful tools for mood enhancement, confidence building, and emotional wellbeing. The concept of fragrance wardrobing, where consumers curate multiple scents for different occasions, seasons, and moods, has gained substantial traction among diverse demographic groups. In 2024, the industry surveys recorded USD 8.8 Billion in United States fragrance sales for the 52 weeks ending August 10, representing a 22.1% year-over-year increase, with both brick-and-mortar and online channels demonstrating robust double-digit growth. This remarkable expansion reflects sustained consumer commitment to personal fragrance investment.

Rising Disposable Incomes and Premiumization Trends

The rising trend of economic prosperity in the United States, coupled with the increase in disposable incomes of American households, is facilitating investments in the purchase of high-quality fragrance products. Consumers are increasingly becoming amenable to the idea of purchasing higher-concentration fragrances, unique fragrances, and specialty brands that provide the best quality fragrances that last for an extended period of time. The luxury fragrance market in the United States is anticipated to grow, reflecting the continued demand for high-quality fragrance offerings amongst the affluent class, who are looking for something different and unique in the fragrance market.

Digital Transformation and E-Commerce Expansion

Digital technologies and e-commerce platforms are revolutionizing fragrance discovery, selection, and purchasing experiences across the United States. The United States e-commerce market size reached USD 1,236.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 2,160.3 Billion by 2034, exhibiting a growth rate (CAGR) of 6.40% during 2026-2034. Online retail channels have dramatically expanded accessibility, enabling consumers to explore extensive product portfolios, read reviews, and make informed purchasing decisions from anywhere. Sophisticated digital tools including artificial intelligence-driven recommendations, virtual scent profiling, and augmented reality experiences are reducing traditional barriers associated with purchasing fragrances online. Social media platforms, particularly TikTok and Instagram, have emerged as powerful discovery engines that introduce consumers to emerging brands and trending products through influencer content and viral recommendations.

Market Restraints:

What Challenges the United States Perfume Market is Facing?

Proliferation of Counterfeit Products

The ready availability of counterfeit perfumes is a serious challenge to genuine manufacturers. This is because counterfeit perfumes are often sold at a lower cost compared to perfumes sold by genuine manufacturers. As a result, consumers tend to lose trust due to lower quality. Additionally, health is compromised due to the lower quality. On the same note, e-commerce has continued to make it easy to distribute counterfeit perfumes. This is because of increased online sales.

High Premium Product Pricing

High premium and luxury prices are major deterrents for wider market shares. Only high-end clientele can be prey to such high prices, whereas lower-middle-class groups of customers have limited purchasing power. Economic flux and inflation lead to substantial changes in discretionary expenditure on fragrances. This pricing barrier would lead some consumers to seek more affordable alternatives, counterfeit items, or other cheaper options, placing boundaries on what could be done to spread the premium segments to other demographic groups.

Regulatory Compliance and Ingredient Restrictions

Increasingly demanding regulations on fragrance ingredients and disclosure requirements entail a number of operational challenges for the manufacturer. Laws such as Washington State's Toxic-Free Cosmetics Act ban some chemicals in cosmetics and fragrances, impacting product development and strategies for market entry. Compliance with evolving safety standards requires significant investments in reformulation, testing, and research facilities. It requires balance between the traditional composition of fragrances and consumer preferences and regulatory requirements through continuous innovation and supply chain adaptation.

Competitive Landscape:

The United States perfume industry has a degree of moderately low competition, which seems to be dominated by large global beauty conglomerates. The large players in the fragrance market have strong marketplace positions, mainly due to their large portfolio brands, comprehensive distribution networks, and innovative product development activities on a continuous basis. The level of competition has been increasing as companies strategically acquire smaller niche fragrance houses, participate in digital transformation activities, as well as build on their Direct-to-Consumer models. Celebrity endorsements, as well as influencer marketing, continue to be very important for the marketing functions of companies within the fragrance marketplace.

United States Perfume Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Perfume Types Covered | Premium Perfume Products, Mass Perfume Products |

| Categories Covered | Female Fragrances, Male Fragrances, Unisex Fragrances |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The United States perfume market size was valued at USD 10.04 Billion in 2025.

The United States perfume market is expected to grow at a compound annual growth rate of 7.68% from 2026-2034 to reach USD 19.55 Billion by 2034.

Premium perfume products dominated the market with a share of 63%, driven by increasing consumer preference for luxury fragrance experiences, higher concentration formulations delivering superior longevity, and growing demand for exclusive artisanal scents.

Key factors driving the United States perfume market include rising emphasis on personal grooming and self-expression, increasing disposable incomes enabling premium purchases, digital transformation expanding e-commerce accessibility, and celebrity endorsements influencing consumer preferences.

Major challenges include proliferation of counterfeit products undermining brand trust, high premium product pricing limiting broader market penetration, stringent regulatory compliance requirements affecting ingredient formulations, and intense market competition requiring continuous innovation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)