United States Peracetic Acid Market Size, Share, Trends and Forecast by Grade, Application, End Use Industry, and Region, 2025-2033

United States Peracetic Acid Market Size and Share:

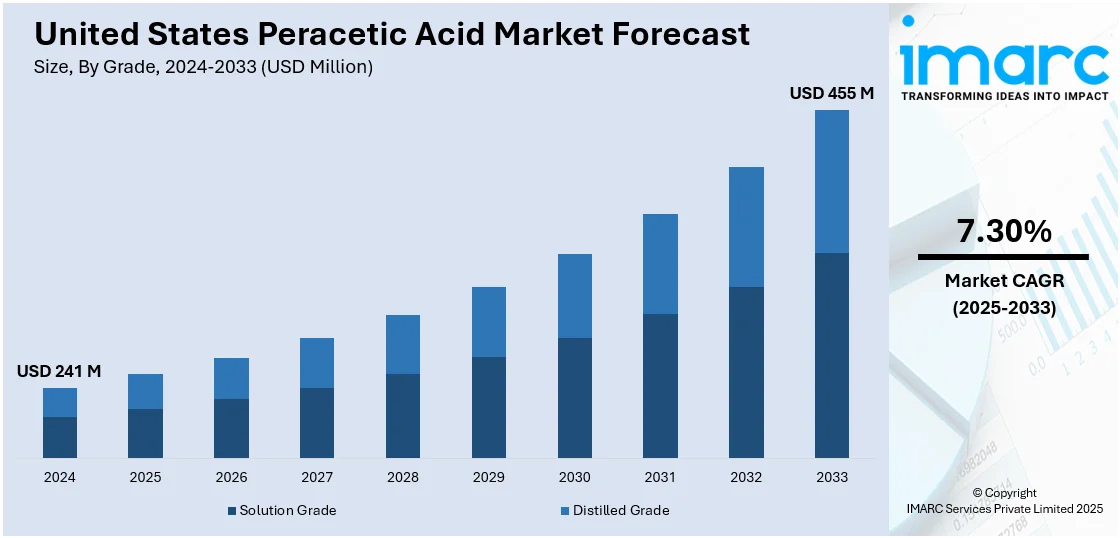

The United States peracetic acid market size was valued at USD 241 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 455 Million by 2033, exhibiting a CAGR of 7.30% from 2025-2033. The market is significantly expanding due to the increasing use of peracetic acid in agricultural and livestock sanitation for pathogen control, growing demand for industrial sterilization in sectors like pharmaceuticals and biotechnology, and ongoing integration with advanced disinfection technologies such as fogging and advanced oxidation processes.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 241 Million |

| Market Forecast in 2033 | USD 455 Million |

| Market Growth Rate (2025-2033) | 7.30% |

The market in the United States is mainly driven by increasing concerns over public health and safety, particularly in healthcare and food processing sectors. In line with this, the rising incidence of healthcare-associated infections (HAIs) heightened demand for effective disinfectants and sterilants, with peracetic acid playing a crucial role in sterilizing medical equipment and surfaces. In the food and beverage market, awareness over foodborne illness is increasing demands for advanced sanitization solutions. Furthermore, in the food-processing sector, it aids in ensuring hygiene standards, allowing safer, pathogen-free products. A key example was the presentation of its PAA monitoring technology by ChemDAQ at the National Safety Conference for the Poultry Industry on August 28, 2024. This also discussed PAA's role in reducing foodborne illnesses, as ChemDAQ's technology was deemed "the new norm" for ensuring safe exposure levels in poultry processing facilities.

With rising public pressure against harmful chemicals, peracetic acid stands out as a "green" disinfectant, decomposing into non-toxic byproducts like acetic acid and water, thereby providing a preferred method of sterilization for ecologically friendly applications. The water treatment industry, among others, reaps the environmentally friendly and efficient nature of peracetic acid. For instance, the study "Peracetic Acid Activation by Modified Hematite for Water Purification" (July 9, 2024) showed that modified Hematite (Hematite-(R)) activated PAA to enhance cefazolin (CFZ) degradation by 21.7% within 80 minutes. This demonstrated the compound’s efficient, eco-friendly performance across a wide pH range, further cementing peracetic acid’s potential in sustainable water purification and its growing market demand. Other drivers for regional market growth include tighter environmental regulations and a push toward greener chemical alternatives.

United States Peracetic Acid Market Trends:

Expansion in Agricultural and Livestock Sanitation

As per the United States peracetic acid market forecast, the peracetic acid (PAA) market in the United States is experiencing rapid growth, particularly in the agricultural and livestock sanitation sectors. Farmers and agricultural producers are increasingly adopting PAA for its effectiveness in controlling pathogens and ensuring the safety of produce and livestock. PAA is widely used for disinfecting animal housing, food processing areas, irrigation systems, and produce washing, reducing the risk of contamination and improving food safety standards. Its ability to break down into non-toxic byproducts further supports sustainable agricultural practices. For example, the study "Control of rotavirus by sequential stress of disinfectants and gamma irradiation in leafy vegetable industry," published in January 2025, found that 120 ppm PAA reduced rotavirus (RV) on lettuce by 0.75 log, while 2,000 ppm PAA reduced RV on stainless steel by over 4 logs. The combination with gamma irradiation (1.5 kGy) enhanced inactivation effects, confirming PAA's pivotal role in enhancing food safety across agricultural operations.

Rise in Demand for Industrial Sterilization Solutions

The industrial sterilization market in the United States is witnessing a rising demand for peracetic acid (PAA), driven by its strong antimicrobial properties and its increasing use in industries like pharmaceuticals, biotechnology, and manufacturing. As these sectors scale, stringent cleanliness and sterilization standards are vital, making PAA an essential tool for disinfecting surfaces, equipment, and environments. Notably, on January 8, 2024, the FDA updated its guidelines on medical device sterility, recognizing vaporized hydrogen peroxide as a Category A sterilization method, while also listing vaporized peracetic acid as a novel sterilization method in another category. This move aims to enhance sterilization safety, efficiency, and address potential device shortages. PAA’s broad-spectrum efficacy and versatility in both liquid and vapor forms render it ideal for maintaining high standards of sterilization, positioning it as a preferred agent in industries focused on quality control and safety.

Rapid Integration with New Disinfection Technologies

The U.S. peracetic acid (PAA) market share is expanding as industries adopt innovative disinfection technologies to enhance efficiency and safety. PAA is increasingly integrated with advanced oxidation processes (AOPs) and photocatalysis systems, improving its ability to eliminate harmful microorganisms and pollutants. Moreover, the use of PAA in fogging and aerosolization technologies is gaining momentum, as these methods penetrate hard-to-reach areas more effectively. The study "Disinfection Efficacy of Peroxyacetic Acid Against Bacterial Spores" (January 4, 2025) highlights the efficacy of PAA fogging, showing a 6-log reduction in Bacillus subtilis spores at 68% humidity using just 10 mg·m⁻³ of fog in 120 minutes, achieving superior results with less PAA than vapor. These advances in disinfection technologies signal the growing importance of PAA in various sectors, positioning it as a key agent in future sanitation and safety efforts, and fueling market growth.

United States Peracetic Acid Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States peracetic acid market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on grade, application, and end use industry.

Analysis by Grade:

- Solution Grade

- Distilled Grade

Solution grade is important in the United States peracetic acid market, especially in food processing, agriculture, and healthcare. The growing focus on food safety and hygiene, especially with the increasing number of foodborne illnesses, increased the demand for solution grade peracetic acid. In addition, its efficiency in controlling pathogens in the food and beverage industry is driving its acceptance. The demand for environmentally friendly and non-toxic sanitizing solutions is on the rise, which further adds to growth for the segment. Its application in water treatment processes, where it provides a more sustainable alternative to chlorine-based disinfectants, is also driving its market penetration.

Distilled grade is also gaining significant traction in the market, particularly in high-precision applications such as medical sterilization, biotechnology, and laboratory settings. The demand for distilled grade peracetic acid is driven by its superior purity and stability, which are critical for ensuring the highest standards of safety and efficacy in sensitive applications. With the growing healthcare sector and the rise of hospital-acquired infections, the need for effective and reliable sterilizing agents like distilled grade peracetic acid is expanding. Furthermore, the emerging trend of biotechnological research, which requires high-quality disinfectants for contamination control, is contributing to its market growth. The acid’s role in pharmaceutical production, where precise cleaning and sterilization processes are paramount, further supports its increasing demand in the United States industry.

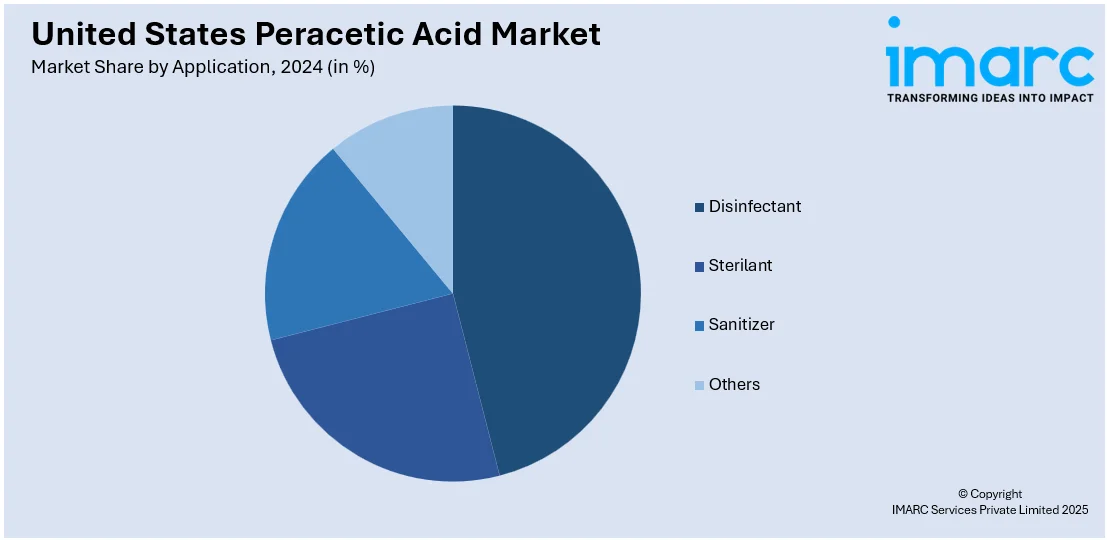

Analysis by Application:

- Disinfectant

- Sterilant

- Sanitizer

- Others

Disinfectants are crucial in the market, especially concerning the control of bacteria, viruses, and other pathogens spread throughout various industries in healthcare, food processing, and water treatment. Due to the powerful antimicrobial properties of peracetic acid, it has become a commonly used disinfecting agent in hospitals and other medical facilities. The growing HAIs concern, plus the rising implementation of strict hygiene in food production processes, creates a powerful drive for disinfectant products. As consumers demand safer food products and more efficient prevention of diseases, more consumers have requested their use of peracetic acid disinfectants. Moreover, awareness about proper sanitation during pandemics such as COVID-19 boosts the need for effective disinfectant solutions.

An important application of peracetic acid is sterilants, which are critical in contexts such as medical equipment sterilization and the pharmaceutical industry where high-level disinfection is needed. The steady growth of sterilized medical devices due to the increased number of surgical procedures and chronic diseases also drives growth in sterilant-based peracetic acid solutions. Another reason peracetic acid is a popular choice for pharmaceutical and biotechnology applications is that it can offer sterilization without any harmful residues, which are considered critical in purity-based applications. Regulatory pressure for greater sterilization requirements in the health care industry, especially in terms of preventing the spread of infections, is fueling the use of peracetic acid sterilizers. Furthermore, the trend toward outpatient surgery and medical tourism further fueled the demand for sterilants.

Peracetic acid-based sanitizers are gaining popularity in the United States due to increased consumer concern over cleanliness and hygiene in public and private places. Growing awareness of the role of sanitation in the prevention of infectious diseases, especially in public places, restaurants, and households, is driving the demand for peracetic acid-based sanitizers. The growth in hygienic compliance is also expanding industry-specific standards involving food processing and hospitality. Hospitals are under particular pressure with tightened hygiene control within their operating wards. Peracetic acid-based cleaners and disinfectants offer enhanced safety compared to competing products, while also ensuring a reduced profile of hazardous chemicals and emissions when used as sanitizer ingredients. Ongoing emphasis on the issues of cleanliness and hygiene at all levels of life continues to support growth in the market for peracetic acid sanitizers.

Analysis by End Use Industry:

- Healthcare

- Food and Beverage

- Water Treatment

- Pulp and Paper

- Others

The healthcare sector in the United States significantly contributes to the peracetic acid market, where it is extensively used for disinfecting and sterilizing medical equipment, surfaces, and healthcare environments. The demand for peracetic acid in healthcare is primarily driven by the increasing emphasis on infection control, particularly within hospitals and outpatient facilities. As concerns regarding healthcare-associated infections (HAIs) grow and the need for advanced disinfection in surgeries and medical procedures intensifies, peracetic acid’s ability to effectively eliminate a wide range of pathogens makes it a critical solution. Additionally, the growing volume of medical treatments and surgeries, along with improvements in healthcare infrastructure, is further fueling the market for peracetic acid as stringent sterilization and cleanliness standards continue to evolve.

The food and beverage industry in the United States is another major driver of the market, as it relies heavily on the compound for sanitation and disinfection during food processing and packaging. The increasing emphasis on food safety, particularly in response to foodborne illnesses and contamination outbreaks, is pushing manufacturers to adopt more effective antimicrobial solutions like peracetic acid. Peracetic acid is commonly used to sanitize processing equipment, production lines, and food storage areas due to its ability to control harmful bacteria, fungi, and viruses. The growing demand for organic and preservative-free food products, where peracetic acid serves as a safer, eco-friendly alternative to traditional chemicals, is also accelerating its adoption. Additionally, stricter regulations and consumer demand for higher food safety standards continue to contribute to market growth.

In the water treatment industry, peracetic acid is increasingly being utilized for its powerful disinfectant properties, particularly for wastewater and potable water treatment. The growing concerns over water quality, contamination, and the need for sustainable treatment solutions are key factors driving the adoption of peracetic acid in this sector. Peracetic acid provides an effective alternative to chlorine and other harsh chemicals in the disinfection of drinking water and wastewater treatment processes. With the rising importance of environmental sustainability and the need to meet stricter water quality standards, peracetic acid is becoming a preferred choice for municipalities and industries. Furthermore, the expanding population and urbanization, which place higher demands on water treatment infrastructure, are pushing the need for more efficient and eco-friendly solutions, further driving peracetic acid adoption.

Regional Analysis:

- Northeast

- Midwest

- South

- West

In the Northeast region of the United States, the market is driven by a combination of advanced healthcare facilities, food processing industries, and strict environmental regulations. The presence of major healthcare hubs and medical research centers in states like New York and Massachusetts increases the demand for peracetic acid in medical sterilization and disinfectant applications. Additionally, the region’s robust food and beverage sector, which focuses on high-quality standards and food safety, is contributing to the rising adoption of peracetic acid for sanitation purposes. With the Northeast’s emphasis on sustainability and environmental conservation, peracetic acid's eco-friendly profile also aligns with regional policies focused on reducing harmful chemical usage in industrial applications. These factors collectively drive strong market growth in the Northeast.

In the Midwest, the peracetic acid market is primarily driven by the strong agricultural and food processing industries. States like Illinois, Ohio, and Michigan, with their significant food production and meat processing sectors, see increased demand for peracetic acid as a cleaning and sanitizing agent. The need to meet stringent food safety standards, especially in the wake of rising foodborne illness concerns, escalated the use of peracetic acid in the food and beverage sector. Moreover, the Midwest’s role as a major agricultural producer fosters the demand for peracetic acid in crop protection and water treatment applications. Additionally, the increasing focus on sustainable and environmentally friendly practices in agriculture and food production further supports market expansion in this region.

The South is a major region in the United States for the peracetic acid market, mainly due to its massive manufacturing base, especially in food production, water treatment, and healthcare. Texas, Georgia, and Florida are among the states that have strong food processing industries that depend on peracetic acid for cleaning, sterilization, and sanitization. The increasing demand for high-quality, safe food products from consumers compels food manufacturers to adopt peracetic acid for enhanced microbial control. Moreover, the rapid population growth and urbanization in the South lead to increased demand for water treatment solutions, where peracetic acid plays an essential role in ensuring safe drinking water and wastewater treatment. The region's expanding healthcare infrastructure also contributes to the growing use of peracetic acid in medical applications.

Peracetic acid, in the Western region, is experiencing growth that is supported by the presence of various diversified industries within this region, which include agriculture and food processing. California is also a key area for agricultural practices, hence peracetic acid is widely in demand both as a crop protectant and a water sanitizer. The sustainability focus and environmentally friendly attitude of the region support the application of peracetic acid in the agricultural and industrial sectors. Moreover, in states such as California and Washington, the food and beverage industry is increasingly relying on peracetic acid for maintaining food safety standards in processing plants. With drought conditions prevailing in the West, the increasing importance of water conservation and treatment also increases the demand for peracetic acid in water treatment solutions to ensure a safe and clean water supply.

Competitive Landscape:

The competitive landscape of the United States peracetic acid market is defined by prominent chemical manufacturers, distributors, and specialized suppliers. Key players prioritize expanding product portfolios, enhancing production efficiency, and delivering tailored solutions for industries like healthcare, food processing, and water treatment. Strategies such as partnerships, mergers, and acquisitions strengthen market presence. Competitive dynamics revolve around pricing, product quality, and adherence to regulatory standards, with a growing focus on sustainability and eco-friendly solutions to meet evolving consumer and industry demands.

The report provides a comprehensive analysis of the competitive landscape in the United States peracetic acid market with detailed profiles of all major companies, including:

- BioSafe Systems LLC.

- Diversey Inc.

- Ecolab Inc.

- Enviro Tech Chemical Services Inc

- Evonik Industries

- Hydrite Chemical Co.

- Seeler Industries

- Solvay

- Univar Solutions Inc

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- September 1, 2024: Evonik completed the sale of its superabsorbents business to the International Chemical Investors Group (ICIG), which includes five production sites in Germany and the U.S. The division, generating EUR 892 Million in 2023, will support Evonik’s green transformation. ICIG, now generating over EUR 4 Billion in sales, also expands its portfolio with peracetic acid applications in disinfection, adding environmental and industrial uses to its range of chemicals.

- March 31, 2023: Enviro Tech showcased its peracetic acid (PAA) solutions at Texas Water 2023. Peragreen® WW, available in 15% and 22% formulations, offering superior wastewater disinfection, requiring fewer chemicals compared to chlorine. Its oxidizing properties reduce costs by eliminating the need for neutralizers. Enviro Tech’s PAA solutions enhance water safety while optimizing wastewater treatment efficiency.

- May 9, 2023: Evonik's VIGOROX® Trident, a peracetic acid-based biocide, received U.S. EPA approval for use in recirculating aquaculture systems (RAS) and ponds. It combats fish pathogens while breaking down into water, oxygen, and acetic acid, ensuring no residue cleanup. Effective even with fish present, it simplifies water quality management and aligns with environmental compliance standards.

United States Peracetic Acid Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Grades Covered | Solution Grade, Distilled Grade |

| Applications Covered | Disinfectant, Sterilant, Sanitizer, Others |

| End Use Industries Covered | Healthcare, Food and Beverage, Water Treatment, Pulp and Paper, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Companies Covered | BioSafe Systems LLC., Diversey Inc., Ecolab Inc., Enviro Tech Chemical Services Inc, Evonik Industries, Hydrite Chemical Co., Seeler Industries, Solvay, Univar Solutions Inc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States peracetic acid market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States peracetic acid market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States peracetic acid industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Peracetic acid refers to a powerful, organic disinfectant and sterilizing agent with the chemical formula CH3CO3H. It is widely used in healthcare for sterilizing medical equipment, in food processing for sanitizing surfaces, and in water treatment for disinfection. Its effectiveness against a broad range of pathogens makes it ideal for high-level sanitation.

The United States peracetic acid market was valued at USD 241 Million in 2024.

IMARC estimates the United States peracetic acid market to exhibit a CAGR of 7.30% during 2025-2033.

The key factors driving the market majorly include increasing demand for eco-friendly disinfectants, stringent public health, and safety regulations, rising adoption in healthcare for infection control, expanding use in food safety and sanitation, and growth in water treatment and agricultural applications.

Some of the major players in the United States peracetic acid market include BioSafe Systems LLC., Diversey Inc., Ecolab Inc., Enviro Tech Chemical Services Inc, Evonik Industries, Hydrite Chemical Co., Seeler Industries, Solvay, and Univar Solutions Inc, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)