United States Peanut Butter Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

United States Peanut Butter Market Size and Share:

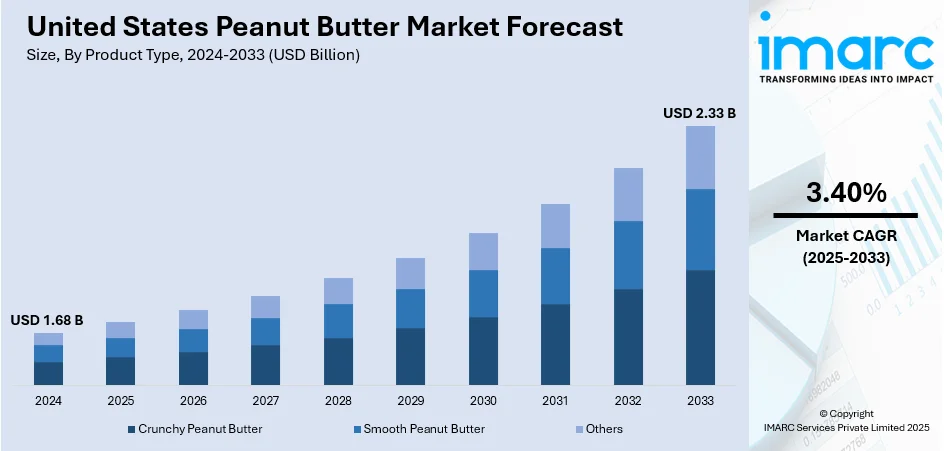

The United States peanut butter market size was valued at USD 1.68 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.33 Billion by 2033, exhibiting a CAGR of 3.40% from 2025-2033. The market is witnessing consistent growth fueled by increasing consumer interest in nutritious, protein-rich foods and the versatility of peanut butter across various meal occasions. The market benefits from rising demand for clean-label products, innovative packaging formats, and evolving dietary preferences. Strong distribution through retail and online channels, along with expanding usage in both sweet and savory recipes, continues to enhance the United States peanut butter market share nationwide.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.68 Billion |

| Market Forecast in 2033 | USD 2.33 Billion |

| Market Growth Rate (2025-2033) | 3.40% |

The peanut butter market in the United States is experiencing growth due to changing consumer preferences and a heightened emphasis on health and wellness. As individuals look for nutritious and protein-rich food options, peanut butter has become more popular for its natural properties and health benefits. For example, in May 2024, Jif introduced its Peanut Butter & Chocolate Flavored Spread, which is its first significant flavor innovation in almost ten years. This new offering blends smooth peanut butter with a chocolate taste and has 50% less sugar than popular hazelnut spreads. It fits well within plant-based diets and is frequently chosen as a healthy snack or meal addition. This increased awareness of nutritional value is driving consistent United States peanut butter market demand, particularly among younger and health-focused consumers.

To get more information on this market, Request Sample

Another important factor contributing to market expansion is the increase in product innovation and evolving consumption patterns. For instance, Genius Gourmet announced its partnership with SKIPPY peanut butter at Expo West 2025, launching SKIPPY Inspired Protein Nut Rolls. The new snack features the iconic peanut butter flavor with 0 grams of added sugar. This collaboration aims to enhance shelf appeal and expand the protein snack market. Brands are broadening their selections with distinctive flavors, clean-label ingredients, and added nutrients to reach a wider consumer base. Additionally, people are using peanut butter in unconventional ways, such as in smoothies, desserts, and savory dishes. This versatility in its use is reinforcing its status as a staple food item in American homes, which further propels market growth.

United States Peanut Butter Market Trends:

Cross-Category Integration

Peanut butter is no longer just a traditional breakfast spread; it has become a popular ingredient across a wide range of food categories, mirroring shifts in consumer preferences and culinary innovation. From being integral to baked goods and protein bars to enhancing smoothies, savory sauces, and ready-to-eat meals, its versatility is driving demand in both retail and foodservice markets. For instance, in March 2025, Justin’s announced its plans to launch new products such as Classic Crunchy Peanut Butter and Peanut Caramel Nougat Chocolate Candy Bars. Additionally, the brand is collaborating with Rudi's Rocky Mountain Bakery to launch frozen Sandos that highlight Justin's peanut butter. This expanded use not only increases its popularity but also boosts its appeal as a nutrient-rich, flavorful, and adaptable ingredient. According to United States peanut butter market forecast, this trend is anticipated to strengthen its market presence and support continued growth across various consumption channels.

Shift Toward Clean-Label and Natural Products

In response to evolving consumer preferences, the peanut butter market in the United States is experiencing a significant shift towards clean-label and natural product offerings. Shoppers are showing a growing interest in peanut butter with only a few ingredients, mainly peanuts and salt, without any artificial preservatives, added sugars, or hydrogenated oils. The demand for transparency in labeling and an emphasis on health-oriented choices are particularly influencing purchasing decisions among millennials and families. This trend is encouraging manufacturers to streamline their recipes and to prominently feature claims of non-GMO, organic, and additive-free products on their packaging. As natural lifestyles gain popularity, brands that prioritize ingredient purity and integrity are earning greater consumer confidence. The United States peanut butter market outlook indicates that this trend for clean-label products will continue to influence brand strategies and product development.

Alternative Formats Driving Convenience-Led Growth

Convenience is becoming a vital factor in determining consumer behavior within the peanut butter sector. The rise of alternative formats, such as squeezable pouches, resealable snack packs, and single-serve containers, is addressing the demand for on-the-go usability and portability. These innovative formats have gained traction, particularly among busy individuals, school-aged children, and fitness enthusiasts seeking quick, mess-free snack options. They also address portion control and on-the-go consumption, aligning with contemporary lifestyle needs. Brands are focusing on packaging innovations that not only extend shelf life but also enhance the consumer experience. As noted in United States peanut butter market trends, the increasing popularity of these formats is broadening consumer access to peanut butter beyond the conventional kitchen or breakfast table.

United States Peanut Butter Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States peanut butter market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type and distribution channel.

Analysis by Product Type:

- Crunchy Peanut Butter

- Smooth Peanut Butter

- Others

Smooth peanut butter stands as the largest product type in 2024, holding 59.7% of the market. Its smooth texture appeals to a diverse audience, including children and busy professionals, making it a common item in household kitchens and school lunches. The ability to incorporate it into a variety of dishes from sandwiches and baked treats to smoothies and sauces—further boosts its popularity. Its reliable quality and convenience have contributed to its success over crunchy and flavored alternatives. The ongoing preference for smooth textures plays a significant role in driving United States peanut butter market growth.

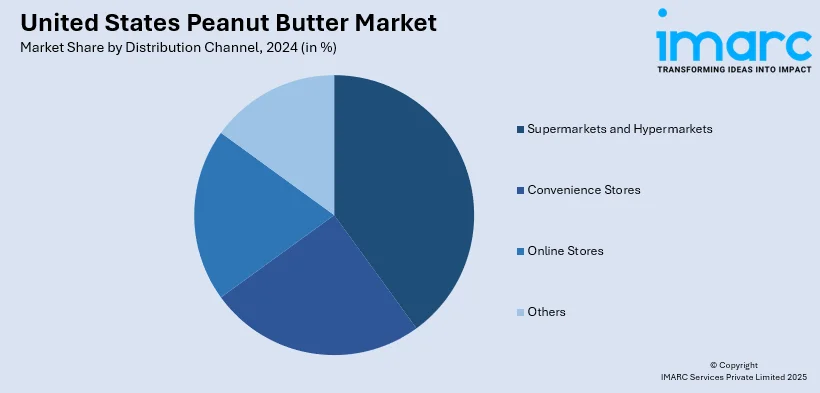

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

Supermarkets and hypermarkets lead the market with around 53.3% of market share in 2024. These retail outlets provide shoppers with the convenience of comparing various brands, sizes, and flavors all in one location, often featuring promotional discounts and good visibility in-store. The opportunity to physically examine products before buying, along with access to familiar household names, makes these stores a popular choice for many consumers. Furthermore, the strategic shelf placement and regular restocking of peanut butter items contribute to high consumer interest. Their significant presence is vital in influencing sales volume and maintaining steady market performance throughout the country.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region of the United States experiences consistent demand for peanut butter, largely fueled by health-conscious consumers seeking natural and organic food options. Urban centers, in particular, embrace a varied product assortment, featuring clean-label and specialty peanut butter varieties. The presence of high-end retail stores and growing awareness of nutritional benefits further enhance sales in this area. Advancements in products and focused marketing approaches in cities such as New York and Boston significantly influence consumer buying behaviors.

The Midwest enjoys a substantial share of the peanut butter market in the US due to high household consumption rates and strong brand loyalty among consumers. Many people in this region prefer traditional smooth peanut butter, a common staple in family meals and lunchboxes. Bulk purchases driven by large retailers and discount chains contribute to stable demand. With a blend of urban and rural customers, the Midwest supports both mainstream and budget-friendly products, ensuring consistent market performance and sustaining national sales volumes.

In the Southern United States, there is notable growth in the peanut butter market, bolstered by cultural familiarity and broad consumption across different age groups. The region’s large population and emphasis on comfort foods have led to steady demand for both smooth and crunchy peanut butter varieties. Retail promotions and budget-conscious buying habits make supermarkets and mass retailers crucial distribution channels. As health trends become more prominent, there is increasing interest in low-sugar and protein-rich options, broadening the variety of products available in this region.

The Western region, including states such as California and Washington, exhibits a vibrant peanut butter market shaped by lifestyle and health trends. Consumers in this area tend to favor organic, plant-based, and clean-label products, fostering the growth of niche and premium brands. The popularity of peanut butter in health-focused diets and alternative recipes enhances demand among various demographic groups. Retailers in the West place a strong emphasis on innovation, creating engaging in-store experiences, and sustainable packaging, all of which influence buying behavior and contribute to market development in the region.

Competitive Landscape:

The peanut butter market in the United States is marked by a competitive environment that includes both well-established brands and new entrants. Companies strive to attract consumers through high product quality, competitive pricing, innovative packaging, and health-oriented formulations. There is a noticeable growth in niche products, such as organic, flavored, and high-protein options, which help newer brands carve out their own space in the market. Additionally, private-label brands are becoming increasingly popular as they provide cost-effective choices in major retail stores. Effective marketing strategies, including health-focused claims and messages about sustainability, are crucial for brand positioning. Furthermore, e-commerce and direct-to-consumer sales channels are becoming vital for competition, allowing brands to connect with larger audiences. This dynamic landscape encourages ongoing innovation and strategic adjustments to maintain customer loyalty and relevance.

The report provides a comprehensive analysis of the competitive landscape in the United States peanut butter market with detailed profiles of all major companies.

Latest News and Developments:

- May 2025: Ferrero announced its first-ever Nutella flavor variation, Nutella Peanut, blending peanut butter with its classic hazelnut spread. The product was developed over five years and set for 2026 release. Ferrero invested USD 75 Million to expand its Illinois plant, adding jobs and the first U.S. Nutella production line.

- March 2025: Drumstick® launched its first-ever peanut butter sundae cones nationwide with the “We Love Peanut Butter” 8-pack, featuring peanut butter and chocolate peanut butter flavors. Each cone included a peanut butter center, a chocolatey coating with cookie pieces, and the brand’s signature crispy cone, catering to growing consumer demand for peanut butter snacks.

- February 2025: Honey Stinger introduced a new range of organic peanut butter energy waffles available in three flavors: plain peanut butter, peanut butter chocolate, and peanut butter strawberry. Each one of them contains a filling made with honey-infused peanut butter. While they were initially sold online, the brand aimed to expand into national retail stores to cater to the rising demand for functional snacks made with peanut butter.

United States Peanut Butter Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Crunchy Peanut Butter, Smooth Peanut Butter, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Regions Covered | Northeast, Midwest, South, and West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States peanut butter market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States peanut butter market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States peanut butter industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The peanut butter market in the United States was valued at USD 1.68 Billion in 2024.

The United States peanut butter market is projected to exhibit a CAGR of 3.40% during 2025-2033, reaching a value of USD 2.33 Billion by 2033.

Rising health awareness, demand for plant-based protein, and the versatility of peanut butter in various meals are key drivers. Additionally, product innovations, clean-label trends, and the convenience of ready-to-use spreads continue to boost consumer interest and overall market growth.

The smooth peanut butter segment holds the largest market share, driven by its widespread preference for easy spreadability, consistent texture, and appeal across all age groups, making it a staple in households and a top choice for daily consumption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)