United States Patient Monitoring Market Size, Share, Trends and Forecast by Type of Device, Application, End User, and Region, 2025-2033

United States Patient Monitoring Market Size and Share:

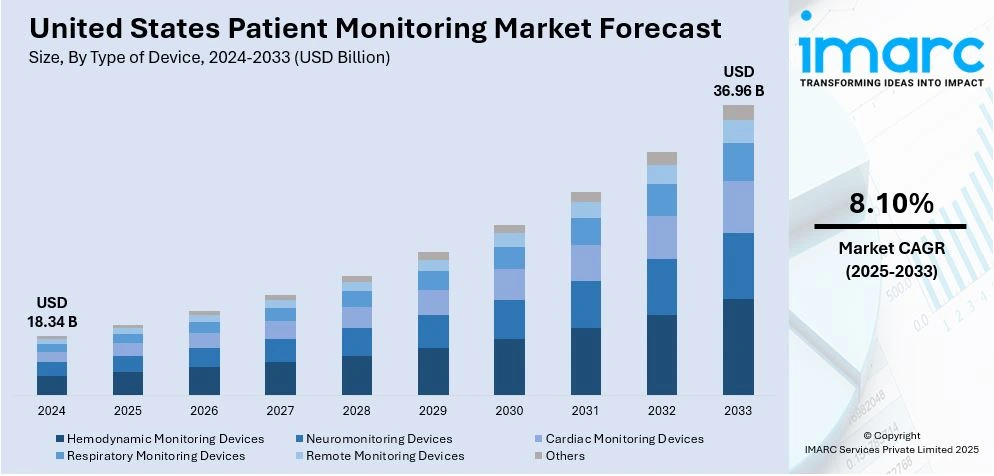

The United States patient monitoring market size was valued at USD 18.34 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 36.96 Billion by 2033, exhibiting a CAGR of 8.10% from 2025-2033. The market share is increasing due to the prevalence of chronic diseases, the use of remote monitoring, the aging population increased healthcare spending, regulatory backing, and AI-driven analytics thus surging the United States patient monitoring market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 18.34 Billion |

| Market Forecast in 2033 | USD 36.96 Billion |

| Market Growth Rate (2025-2033) | 8.10% |

United States Patient Monitoring Market Analysis:

- Major Drivers: Increasing incidence of chronic conditions such as diabetes, cardiovascular diseases (CVD), and respiratory diseases fuels demand for ongoing patient monitoring. An aging population, with 80 million Americans projected to be 65+ by the year 2040, creates the need for sophisticated monitoring solutions to efficiently handle age-related health issues.

- Key Market Trends: Remote patient monitoring (RPM) expands with growing adoption of wearable technologies and telehealth services that allow real-time monitoring of health. Integration of artificial intelligence (AI) and big data analytics strengthens predictive medicine and custom treatment plans. The move towards home-based monitoring enhances convenience for patients while lowering healthcare expenditure.

- Market Challenges: Based on the United States patient monitoring market analysis, the ongoing technological costs are high, and intricate regulatory demands hinder extensive adoption. Security and privacy issues regarding data challenge healthcare professionals in implementing electronic monitoring systems. Restricted reimbursement for some monitoring technology limits market penetration, especially in rural health facilities.

- Market Opportunities: Government incentives via liberal reimbursement policies make market conditions favorable. Convergence of 5G and IoT-enabled devices revolutionizes healthcare connectivity and effectiveness. The COVID-19 pandemic drove demand for remote monitoring solutions, making opportunities in the marketplace permanent for United States patient monitoring market demand and innovation.

The United States patient monitoring market growth is attributed to the prevalence of chronic diseases such as diabetes, cardiovascular disorders, and respiratory illnesses. As the population ages and more will be affected by such conditions, the need for monitoring of patients continuously will continue to grow. According to the Urban Institute, there will be 80 Million Americans 65 and older by 2040, more than doubling in the following 40 years. This aging trend is anticipated to greatly influence healthcare, spurring demand for advanced patient monitoring solutions to effectively address age-related ailments. Wearable devices and telehealth solutions allow for real-time tracking and analysis of health data, making the rise of remote patient monitoring (RPM) technologies a key accelerator. These innovations improve patient outcomes and decrease hospital visits.

To get more information on this market, Request Sample

The government initiatives and liberal reimbursement policies has paved the way for the integration of these healthcare technologies. Additionally, the COVID-19 pandemic increased the urgency to offer remote monitoring around the home, reducing the need for in-person care, which is necessary to achieve the most effective management of patients. Market dynamics growing emphasis on personalized medicine and home-based care is another crucial factor driving the growth of the market. Healthcare providers invest in advanced monitoring systems for better disease management and early detection. With increasing knowledge of preventive healthcare, hospitals, and clinics are implementing new solutions for improved patient care and operational efficiency, thus influencing US patient monitoring market trends. AI-based analytics and cloud-based configuration are making the management of patient data easier for better decision-making by doctors. In addition, the increasing adoption of less invasive monitoring devices further fuels market growth due to their ease of use and accurate data collection. The growth of the American patient monitoring market expansion remains high as healthcare reform improves healthcare delivery using data-driven monitoring solutions.

United States Patient Monitoring Market Trends:

Growth of remote patient monitoring (RPM)

Remote patient monitoring (RPM) is revolutionizing the U.S. patient monitoring market by allowing healthcare professionals to monitor patients’ vital signs in real time using wearable devices and smart sensors. Remote patient monitoring (RPM) This technology helps the healthcare provider to monitor the patient outside of conventional clinical settings. RPM is being increasingly adopted due to the increase in chronic disease incidence, an aging population, and continued pressure to reduce the cost of delivering healthcare. According to the U.S. Food and Drug Administration (FDA), chronic illnesses account for 7 of the 10 leading causes of death in the United States (CCDs). The COVID-19 pandemic also pushed healthcare providers toward RPM which can replace in-person visits. Based on proven evidence, RPM has been shown to work with diabetes, hypertension, and heart disease, leading to better compliance by patients and lower emergency hospital admissions. Emerging RPM Technologies and Advancements in AI and Data Analytics. Through AI-powered algorithms, anomalies are detected in patient data, allowing for early intervention. Moreover, government support and reimbursement policies are fueling adoption, cementing RPM as a key component of contemporary healthcare. As the technology matures, RPM will help practitioners better manage patients, improve patient health, and lower costs, securing it as a long-term fixture in the future state of U.S. healthcare.

AI and big data integration in patient monitoring

Artificial intelligence and massive data examination are remodeling patient observation by enabling predictive healthcare and customized treatment plans. AI-powered observing frameworks can break down tremendous measures of ongoing information to detect early indications of deterioration, permitting healthcare suppliers to take preventive steps. This innovation is especially valuable for overseeing constant illnesses, post-surgical recovery, and urgent care patients. Colossal information examination is likewise improving choice-making in clinics by distinguishing examples and patterns in patient well-being estimations. These bits of knowledge help doctors streamline treatment designs, diminish clinic readmissions, and upgrade general patient results. Additionally, AI-driven observing arrangements are diminishing the weight on healthcare staff by robotizing customary errands, for example, notice the executives and information interpretation. Another central point of preference for AI in patient observation is its consolidation with wearable gadgets and IoT-empowered sensors. These apparatuses consistently gather and dissect patient information, giving real-time experiences that improve early finding and infection administration. As AI innovation propels, its job in prescient examination and computerized healthcare arrangements will keep on expanding, reshaping the U.S. patient observing scene.

Expansion of home-based and personalized monitoring solutions

The level of the healthcare system in the United States is gradually transitioning to home and personalized patient monitoring to improve convenience, lower costs, and improve patient outcomes. Healthcare spending is $4.3 Trillion accounting for 18% of the U.S. economy as per the Peterson Center on Healthcare. This growing need is changing how to deliver that care and the solutions that cut down on immediate hospitalizations and long-term costs. Real-time tracking of vital signs using home monitoring devices can be used to help manage chronic conditions such as diabetes, heart disease, and respiratory disorders. This information is used in conjunction with cloud-based platforms to remotely monitor patients and intervene when needed. Furthermore, personalized monitoring solutions allow tailored treatment strategies according to the individual patient health data, enhancing compliance and long-term management. The rise of AI-powered predictive analytics and mobile health apps is an extra lever driving adoption, giving patients instantaneous feedback on their habits and motivating them to manage their health proactively, thus propelling the patient monitoring market in the U.S. With the healthcare system continuing its transition to a patient-centered approach, home-based monitoring solutions will be a key enabler of care efficiency and affordability, which will help ease the total economic burden of healthcare.

United States Patient Monitoring Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States patient monitoring market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type of device, application, and end user.

Analysis by Type of Device:

- Hemodynamic Monitoring Devices

- Neuromonitoring Devices

- Cardiac Monitoring Devices

- Respiratory Monitoring Devices

- Remote Monitoring Devices

- Others

Hemodynamic monitoring solutions that measure blood pressure, cardiac output, and circulation are playing an increasingly important function in managing cardiovascular sickness and seriously ill patients by allowing for early detection of critical conditions. Advanced neurological monitors aid in assessing brain activity, detecting issues, and forestalling complications during operations, while other cardiac tracking devices such as electrocardiograms and Holter checkers help pinpoint irregular heartbeats, heart failure, and different heart-related problems. Furthermore, respiratory screens, including pulse oximeters and capnography, facilitate the management of persistent conditions such as chronic obstructive pulmonary disease and asthma. Concurrently, the escalating need for telehealth answers comprising wearable sensors and cellular applications permits real-time tracking and quick intercession, uniquely for long-term sickness administration and postoperative care. COVID-19 infections persist in climbing, with predictions from the Centers for Disease Control and Prevention indicating 64,000 and 110,000 hospitalizations from October 1 to November 30, 2024. As medical services adapt to evolving challenges, AI-combined screens are anticipated to play a pivotal role in improving affected person outcomes and decreasing health center strain.

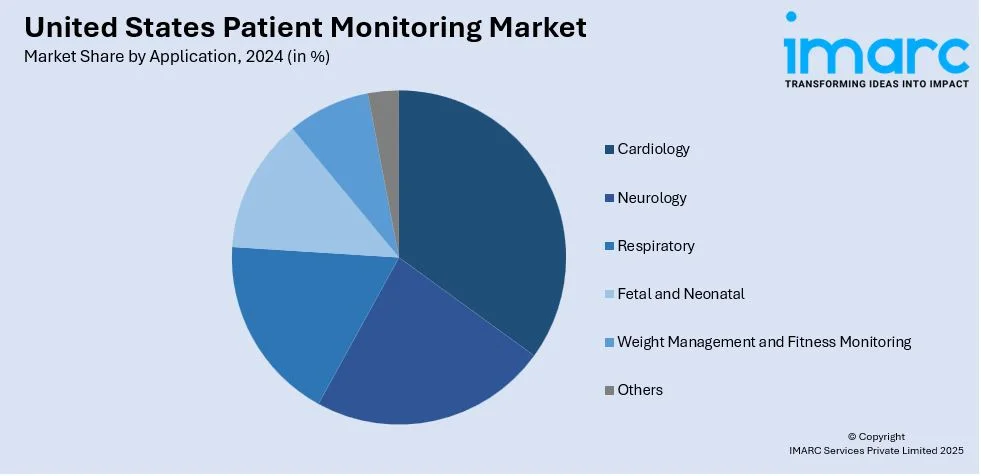

Analysis by Application:

- Cardiology

- Neurology

- Respiratory

- Fetal and Neonatal

- Weight Management and Fitness Monitoring

- Others

Cardiology monitoring addresses the proliferating prevalence of cardiovascular ailments, necessitating perpetual heart observation through EKGs and wearable mechanisms. Neurological tracking centers on circumstances such as epileptic seizures, strokes, and traumatic encephalon injuries, employing EEGs and intracranial stress gauges for untimely identification and intercession. Pulmonary observation apparatuses play a pivotal part in managing persistent lung states like persistent obstructive pulmonary disease and asthma, ensuring ideal oxygen levels and forestalling complications. This is particularly significant considering almost 28 Million individuals in the U.S. have asthma, influencing 1 in 12 persons, according to the Asthma and Allergy Foundation of America. Meanwhile, fetal and newborn observation confirms the health of infants, identifying fetal distress for safer deliveries. The ascent of wearable health trackers has likewise energized interest in weight administration and fitness tracking, advancing preventive healthcare and more beneficial ways of life. With synthetic intelligence and information examinations improving analytic exactness, patient-observing applications keep on creating and supporting preferable well-being results across different clinical fields.

Analysis by End User:

- Home Healthcare

- Hospitals

- Others

As per US patient monitoring market analysis, home healthcare is quickly broadening as more individuals decide on remote tracking and customized care. Folks with persistent conditions, decreased flexibility, or post-operative recuperation necessities benefit from wearable tracking gadgets, diminishing medical clinic visits and enabling live well-being. The selection of telehealth administrations and expanded protection inclusion for home-based checking additionally drive this pattern. This change is additionally reflected in work power development, as per the U.S. Bureau of Labor Statistics expects a 21% expansion in home health and personal care aide work by 2033, underscoring the developing interest in in-home human services administrations. Medical clinics are the essential end clients of patient-checking innovations. Basic care units, crisis divisions, and medical procedures depend on propelled observing frameworks to guarantee the early location of intricacies, improving treatment proficiency and survival rates. The coordination of AI-driven observing arrangements is likewise changing medical clinic work processes, enhancing patient consideration, and diminishing the weight on human services experts. As innovation propels, both home human services and clinic observation will keep on creating, making patient consideration increasingly proficient and available.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast, with its established healthcare infrastructure and advanced technology adoption, has set targets to lower heart and diabetes deaths as well as screen cancer mortality through expanded chronic illness monitoring. NYC Health states that they aim to cut cardiac and chronic disease fatalities by 5% and cancers by 20% by 2030, fueling demand for cardiac and remote sickness tracking. The expansive healthcare networks and study institutions of the Midwest are witnessing a growth in telehealth and distant patient oversight, improving care access in rural regions. Texas and Florida in the South see a surge in need due to a high rate of long-term sicknesses and aging residents, amplifying the necessity for remote patient tracking and wearable medical gadgets to watch indicators. At the vanguard of innovation, states like California and Washington in the West are powering AI-integrated oversight solutions. Fluctuating plans, payment frameworks, and advancing technologies across areas persist in shaping market growth and chances, with a robust focus on prevention and digital health take-up.

Competitive Landscape:

Key players in the industry are heavily investing in technological progress, strategic collaborations, and merchandise innovations to strengthen their positions. A notable pattern is the joining of artificial intelligence and large information examination, allowing expected medical care and live information evaluation. Following the COVID-19 pandemic, the need for remote patient tracking (RPM) remedies surged, resulting in amplified investment in wearable and AI-driven monitoring technologies. Mergers and acquisitions are commonplace, with larger corporations obtaining start-ups specializing in clever sensors and cloud-based tracking platforms. Regulatory approvals, like FDA consents, are designing the market by confirming adherence to protection standards. Moreover, the adoption of 5G and IoT-enabled tracking gadgets is transforming healthcare connectivity and efficiency. Significantly, investments in public health infrastructure also are enjoying a component in market expansion. The Public Health Infrastructure Grant program has invested over $4.4 Billion to support 107 health departments, backing progressions in patient tracking and digital healthcare solutions, as per the Public Health Infrastructure Center. With growing demand for home healthcare and personalized care, market players continue to expand their offerings, driving the next wave of innovation in patient monitoring.

The report provides a comprehensive analysis of the competitive landscape in the United States patient monitoring market with detailed profiles of all major companies.

Recent News and Developments:

- In September 2025, Philips launched a smart telemetry platform, including the Telemetry Monitor 5500, to enhance cardiac patient monitoring across healthcare facilities. The platform provides continuous, enterprise-wide connectivity, streamlines alarm management, and automates clinical tasks to reduce staff burden. With data-driven insights, advanced decision support tools, and secure networking, it enables clinicians to respond efficiently to patient needs, improve operational performance, and deliver safer, more effective care throughout the care continuum.

- In July 2025, TeleMedCare introduced a remote patient monitoring (RPM) initiative in collaboration with one of the top U.S. health insurance companies, focusing on chronically ill patients from five states. The pilot program starts with 300 patients diagnosed with cardiac, respiratory, and metabolic conditions such as CHF, COPD, diabetes, and hypertension. Appreciated for its flexibility and adjustability, TeleMedCare's RPM technology aligns with the insurer's $2 billion worldwide health initiative, responding to COVID-19 issues and long-term care management of chronic patients.

- August 2024: The Initial Entry Training Cognitive Monitoring Program was started at Fort Moore, Georgia, to monitor soldiers' cognitive health throughout their careers. With the goal of early identification and action, the facility signaled a change from reactive to continuous monitoring. Military commanders emphasized its importance in improving the long-term brain health and preparedness of soldiers.

- June 2024: For diabetic patients enrolled in remote care programs, Prevounce Health introduced the Pylo GL1-LTE, its first remote blood glucose monitoring gadget. It had 4G connectivity for real-time data transfer and was FDA-approved and FCC-certified. Along with quick countrywide shipment and support services for healthcare companies, the device guarantees accuracy, use, and customization.

- December 2024: To improve remote patient monitoring, A&D Medical introduced weight scales and blood pressure monitors with cellular capabilities. The instruments guaranteed accurate measurements, dependable data transfer, and extensive network coverage. With their user-friendly tools and on-site technical assistance, they blended in well with the current systems.

- June 2024: In collaboration with the Current Health platform from Best Buy Health, UC Davis Health introduced an at-home monitoring service for individuals with hypertension. Patients sent real-time data to physicians via linked gadgets. The program's objectives were to increase access, reduce readmissions to hospitals, and provide remote coaching, monitoring, and intervention to improve patient outcomes.

United States Patient Monitoring Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types of Device Covered | Hemodynamic Monitoring Devices, Neuromonitoring Devices, Cardiac Monitoring Devices, Respiratory Monitoring Devices, Remote Monitoring Devices, Others |

| Applications Covered | Cardiology, Neurology, Respiratory, Fetal and Neonatal, Weight Management and Fitness Monitoring, Others |

| End Users Covered | Home Healthcare, Hospitals, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States patient monitoring market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States patient monitoring market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States patient monitoring industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The patient monitoring market in the United States was valued at USD 18.34 Billion in 2024.

The United States patient monitoring market is projected to exhibit a CAGR of 8.10% during 2025-2033, reaching a value of USD 36.96 Billion by 2033.

The market is driven by increasing prevalence of chronic diseases, aging population growth, government support through reimbursement policies, COVID-19 pandemic impact accelerating remote monitoring adoption, and AI-driven analytics integration enhancing predictive healthcare capabilities for improved patient outcomes.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)