United States Paper Packaging Market Report by Product Type (Corrugated Boxes, Folding Boxes and Cases, Liquid Paperboard Cartons, Paper Bags and Sacks, and Others), Grade (Solid Bleached, Coated Recycled, Uncoated Recycled, and Others), Packaging Level (Primary Packaging, Secondary Packaging, Tertiary Packaging), End Use Industry (Food, Beverages, Personal Care and Home Care, Healthcare, and Others), and Region 2026-2034

Market Overview:

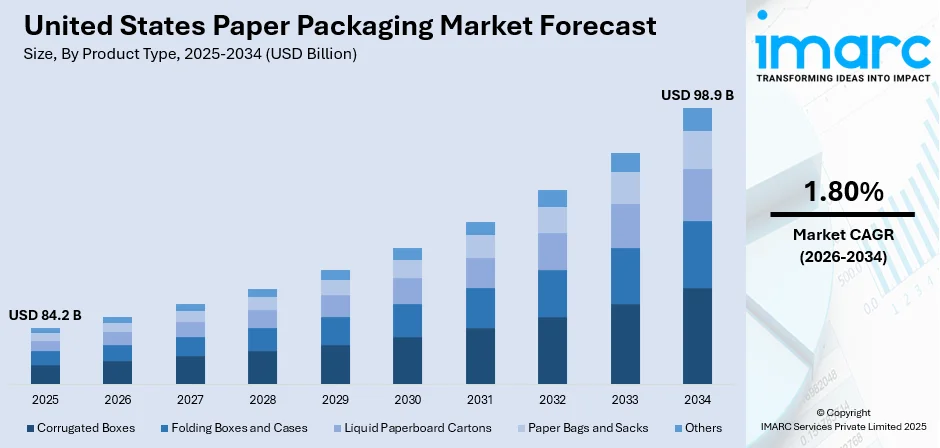

The United States paper packaging market size reached USD 84.2 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 98.9 Billion by 2034, exhibiting a growth rate (CAGR) of 1.80% during 2026-2034.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 84.2 Billion |

|

Market Forecast in 2034

|

USD 98.9 Billion |

| Market Growth Rate (2026-2034) | 1.80% |

Access the full market insights report Request Sample

Paper packaging is a cost-efficient and versatile method of protecting, transporting and preserving items using rigid and flexible packaging materials. It is durable, versatile, lightweight, recyclable and widely available in different shapes, sizes and colors depending on the requirement of the end users. Therefore, it finds extensive applications in the food and beverage (F&B), retail, cosmetics and healthcare industries across the United States.

To get more information on this market Request Sample

Rising environmental concerns are escalating the demand for environment-friendly packaging solutions in the United States. This represents one of the major factors driving the growth of the paper packaging market. Moreover, the increasing sales through online shopping platforms are positively influencing the demand for secondary and tertiary packaging products in the country. Apart from this, the implementation of stringent policies by the US Government is promoting the utilization of paper-based packaging to minimize pollution and toxin levels in the atmosphere, which is facilitating the market growth. However, the supply chain of the paper packaging market is severely affected due to the surging cases of the coronavirus disease (COVID-19) and the subsequent lockdown restrictions imposed by governing agencies of the country.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States paper packaging market report, along with forecasts at the country level from 2026-2034. Our report has categorized the market based on product type, grade, packaging level, and end use industry.

Breakup by Product Type:

- Corrugated Boxes

- Folding Boxes and Cases

- Liquid Paperboard Cartons

- Paper Bags and Sacks

- Others

Breakup by Grade:

- Solid Bleached

- Coated Recycled

- Uncoated Recycled

- Others

Breakup by Packaging Level:

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

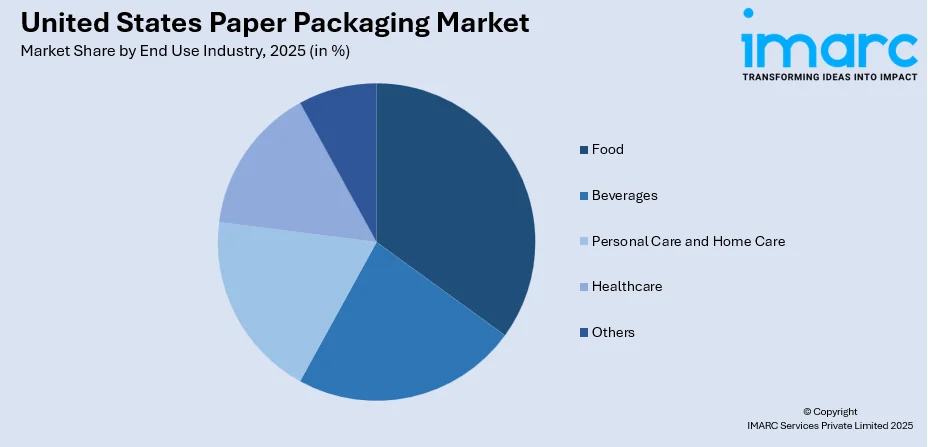

Breakup by End Use Industry:

To get detailed segment analysis of this market Request Sample

- Food

- Beverages

- Personal Care and Home Care

- Healthcare

- Others

Breakup by Region:

- Northeast

- Midwest

- South

- West

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Segment Coverage | Product Type, Grade, Packaging Level, End Use Industry, Region |

| Region Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the United States paper packaging market performed so far and how will it perform in the coming years?

- What are the key regional markets?

- What is the breakup of the market based on the product type?

- What is the breakup of the market based on the grade?

- What is the breakup of the market based on the packaging level?

- What is the breakup of the market based on the end use industry?

- What are the various stages in the value chain of the industry?

- What are the key driving factors and challenges in the industry?

- What is the structure of the United States paper packaging market and who are the key players?

- What is the degree of competition in the industry?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)