United States Pallet Market Report by Type (Wood, Plastic, Metal, Corrugated Paper), Application (Food and Beverages, Chemicals and Pharmaceuticals, Machinery and Metal, Construction, and Others), Structural Design (Block, Stringer, and Others), and Region 2025-2033

Market Overview:

The United States pallet market size reached 2.23 Billion Units in 2024. Looking forward, IMARC Group expects the market to reach 2.94 Billion Units by 2033, exhibiting a growth rate (CAGR) of 2.95% during 2025-2033. The significant growth of e-commerce especially during the COVID-19 pandemic, the growing demand for shipping and logistics services across the country, and standardization and compliance with regulations are among the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 2.23 Billion Units |

| Market Forecast in 2033 | 2.94 Billion Units |

| Market Growth Rate 2025-2033 | 2.95% |

A pallet is a portable platform used to hold and transport goods in a stable manner, facilitating easier handling and storage. It is typically manufactured of wood, plastic, or metal. It serves as the foundational base for assembling, storing, and transporting items. In a logistics or warehouse environment, goods are placed on a pallet and usually secured with straps, shrink wrap, or other packing materials for safe transport. It is commonly lifted by forklifts, pallet jacks, or conveyor belts, and they play an integral role in supply chain management. Its standardized sizes help optimize storage space in trucks and warehouses. Utilizing pallets is cost-effective and increases operational efficiency by speeding up the loading and unloading processes. Moreover, pallets are a crucial component in modern commerce, enabling safer and more efficient handling of goods.

One of the most significant market drivers for the pallet industry in the United States is the exponential growth of e-commerce. Online shopping has been consistently expanding, especially during the COVID-19 pandemic, which led to a rise in demand for shipping and logistics services. As the e-commerce sector shows no signs of slowing down, the importance of pallets in optimizing the supply chain is significantly supporting the market. Along with this, the manufacturing sector in the United States is a key contributor to the growth of the pallet industry. The sector's expanding output has led to an increased need for efficient logistics and storage solutions, including pallets. As manufacturing businesses aim to scale up their operations, the requirement for durable and efficient pallets grows concurrently. Thus, it is positively influencing the market. With the growth of the retail industry, the consumption of pallets for logistical needs is accelerating. Seasonal sales and promotional events also add to peaks in demand, making the pallet industry crucial for the retail sector's functioning. Moreover, standardization and compliance with regulations have also emerged as factors driving the market. Various industries are obligated to meet strict regulatory guidelines for shipping and storage, often necessitating the use of pallets that conform to particular specifications.

United States Pallet Market Trends/Drivers:

Increasing Initiatives for Sustainability

Sustainability is a business imperative that is affecting a wide range of industries, including the pallet sector. As companies aim to reduce their carbon footprint, there is a growing emphasis on using pallets produced from sustainable materials, such as recycled plastic or sustainably harvested wood. These eco-friendly pallets meet regulatory requirements and offer the dual benefits of being both reusable and recyclable. Along with this, the accelerated focus on sustainability is pushing companies to replace single-use packaging materials with more durable options, thereby driving demand. Moreover, sustainability initiatives extend to the practice of pallet pooling, where pallets are shared, reused, and recycled among multiple businesses. This brings about cost savings and substantially reduces waste, further aligning with sustainability goals. As more companies adopt eco-friendly practices, the demand for sustainable pallet solutions is significantly supporting the market.

Continuous Technological Advancements

Technological innovation is a significant driver affecting the pallet industry's growth in the United States. With advancements in automation, Internet of Things (IoT), and RFID (Radio-Frequency Identification) technologies, the way pallets are used, tracked, and managed has evolved. For instance, smart pallets equipped with IoT sensors can provide real-time tracking and condition monitoring. This technological incorporation helps in enhancing supply chain visibility, improving inventory management, and reducing theft or loss of goods. Additionally, automation in warehouses and distribution centers, including robotic forklifts and automated storage and retrieval systems (ASRS), is becoming more prevalent. These automated systems often require pallets that meet specific design and durability standards. Consequently, the demand for high-quality, standardized pallets compatible with automated systems is on the rise. These technological trends are pushing companies to innovate and create pallet solutions that can easily integrate into a modern, tech-enabled supply chain. This drive towards technological integration is stimulating further growth in the pallet industry.

United States Pallet Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States pallet market report, along with forecasts at the country and regional levels from 2025-2033. Our report has categorized the market based on type, application and structural design.

Breakup by Type:

- Wood

- Plastic

- Metal

- Corrugated Paper

Wood dominates the market

The report has provided a detailed breakup and analysis of the market based on the type. This includes wood, plastic, metal, and corrugated paper. According to the report, wood represented the largest segment.

The wood type remains the most popular choice in the United States pallet industry, driven by several market factors. Wood pallets are cost-effective, offering a high strength-to-weight ratio that makes them ideal for transporting heavy loads without breaking the bank. Their affordability appeals to businesses looking for economical logistics solutions, thereby fueling market demand. Along with this, wood pallets are highly customizable and can be easily repaired or recycled, contributing to their sustainability. This aligns well with the growing focus on eco-friendly practices in various industries, encouraging businesses to opt for wooden pallets. In addition, regulatory compliance is easier to achieve with wood pallets, especially those that are heat-treated to meet international shipping standards. This eliminates concerns about contamination and pests, making them a preferred choice for sectors. Moreover, wood pallets are well-suited for advanced storage systems and automated handling equipment, seamlessly integrating into modern supply chain operations. Their compatibility with existing infrastructure and technology enhances operational efficiency.

Breakup by Application:

- Food and Beverages

- Chemicals and Pharmaceuticals

- Machinery and Metal

- Construction

- Others

Food and beverages hold the largest share in the market

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes food and beverages, chemicals and pharmaceuticals, machinery and metal, construction, and others. According to the report, food and beverages accounted for the largest market share.

The food and beverage sector is a significant market driver for the pallet industry in the United States, due to unique logistical and regulatory demands. Pallets are crucial for the efficient storage and transportation of perishable items like fruits, vegetables, meat, and dairy products. The ability to quickly move large quantities of goods is essential for minimizing spoilage and reducing costs, making pallets an indispensable tool in this sector. Additionally, the industry faces strict hygiene and safety regulations, which necessitate the use of specialized pallets. For instance, plastic or heat-treated wood pallets are often preferred due to their ability to meet sanitation guidelines, thereby ensuring compliance with food safety standards. Furthermore, the trend towards just-in-time delivery models in the food and beverage industry emphasizes the need for reliable and efficient logistics solutions, a requirement that pallets readily fulfill. Seasonal fluctuations in demand for certain food items also lead to peaks in the usage of pallets.

Breakup by Structural Design:

- Block

- Stringer

- Others

Block dominates the market

The report has provided a detailed breakup and analysis of the market based on the structural design. This includes block, stringer, and others. According to the report, block represented the largest segment.

The block structural design has been gaining momentum as a significant market driver in the United States pallet industry. One of the primary factors behind its increasing adoption is its durability and load-bearing capacity. Block pallets are often more robust than their stringer counterparts, offering better support for heavy or unevenly distributed loads. This makes them particularly appealing for industries that require the safe and secure transport of high-value or bulky items. Moreover, block pallets are more compatible with modern automated handling systems, such as conveyor belts and automated forklifts. Their four-way entry design makes it easier for equipment to maneuver them, thereby enhancing operational efficiency in warehouses and distribution centers. Additionally, block pallets are more versatile in storage configurations, allowing for both stacking and racking, which optimizes space utilization in storage facilities. This versatility is crucial for businesses aiming to maximize storage density and reduce operational costs. Furthermore, block pallets are often manufactured from high-quality materials, which adds to their durability and makes them more reusable and sustainable, aligning with growing environmental concerns.

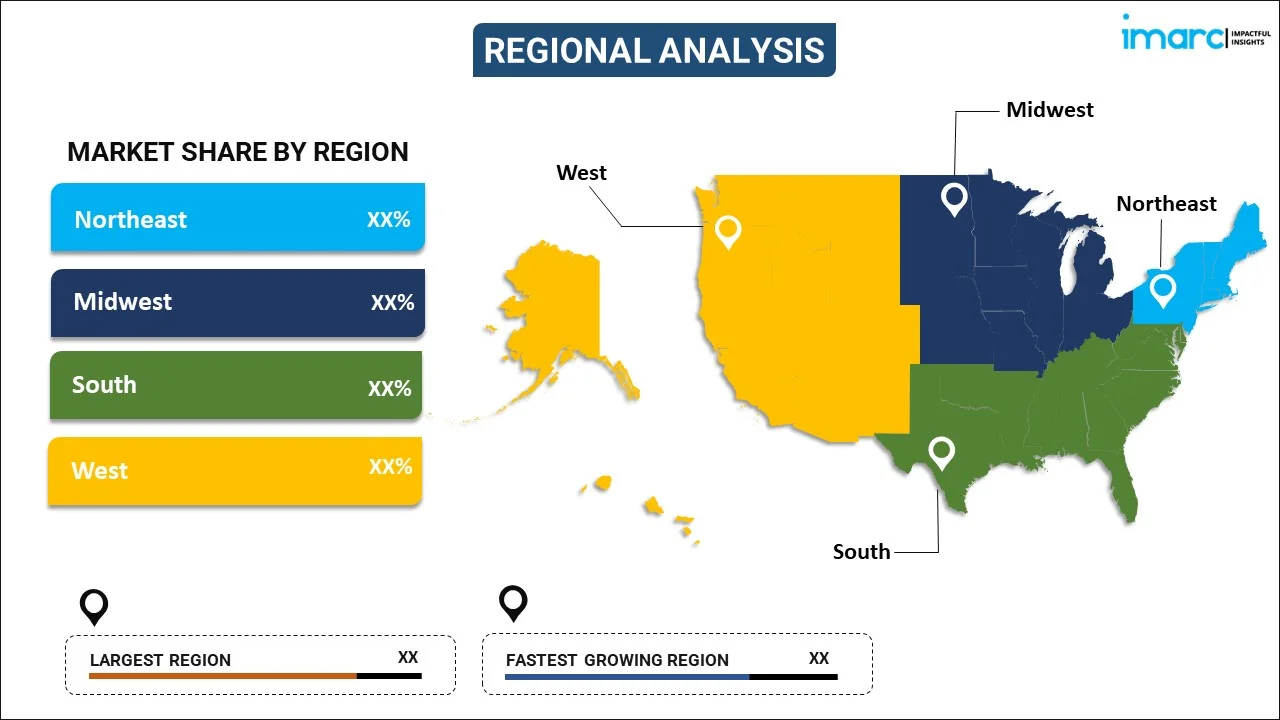

Breakup by Region:

- Northeast

- Midwest

- South

- West

South exhibits a clear dominance, accounting for the largest United States pallet market share

The report has also provided a comprehensive analysis of all the major regional markets, which include the Northeast, Midwest, South, and West. According to the report, the South represented the largest segment.

The pallet industry in the South United States is experiencing growth driven by the region's strong manufacturing base, particularly in sectors, such as automotive, aerospace, and petrochemicals, which rely heavily on efficient logistics and storage solutions that pallets provide. Additionally, the South has multiple bustling ports such as those in Houston, Miami, and New Orleans, facilitating both international and domestic trade. The transport of goods to and from these ports often necessitates the use of pallets for efficient handling and storage. Furthermore, the South is a significant hub for the agriculture industry, including livestock, poultry, and crop farming. The growing need for safe and hygienic transport of these goods also contributes to the demand for specialized pallets.

Apart from this, the region is also experiencing a rise in e-commerce activities, which inherently require robust logistical capabilities, another area where pallets play a critical role. Moreover, the South's growing focus on sustainability is driving demand for eco-friendly pallet options, such as those made from recycled materials or sustainably harvested wood.

Competitive Landscape:

The key players in the market are actively engaged in manufacturing, distributing, and supplying a wide range of pallets to support various industries. These pallets serve as essential tools for the efficient storage, transportation, and handling of goods. Along with this, manufacturers in the U.S. pallet market are focused on producing pallets using diverse materials, such as wood, plastic, and metal, to meet the specific needs of their clients. They prioritize quality and durability to ensure safe and secure product handling. Additionally, sustainability has become a key consideration, with companies incorporating eco-friendly practices in pallet production. In addition, distribution companies within the U.S. pallet market play a crucial role in connecting manufacturers with businesses in need of pallets. These distributors streamline the supply chain by ensuring timely and efficient delivery of pallets to various industries, including retail, logistics, and manufacturing. Furthermore, companies operating in the U.S. pallet market are also exploring technological advancements. Key players are implementing tracking and monitoring solutions to enhance visibility throughout the supply chain. This technology enables better management of pallet inventories and contributes to improved logistics efficiency. Thus, it is contributing to the market.

The report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

United States Pallet Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion Units |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Wood, Plastic, Metal, Corrugated Paper |

| Applications Covered | Food and Beverages, Chemicals and Pharmaceuticals, Machinery and Metal, Construction, Others |

| Structural Designs Covered | Block, Stringer, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the United States pallet market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the United States pallet market?

- What is the impact of each driver, restraint, and opportunity on the United States pallet market?

- What is the breakup of the market based on the type?

- Which is the most attractive type in the United States pallet market?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the United States pallet market?

- What is the breakup of the market based on the structural design?

- Which is the most attractive structural design in the United States pallet market?

- What is the breakup of the market based on imports and domestic manufacturing?

- What is the competitive structure of the United States pallet market?

- Who are the key players/companies in the United States pallet market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States pallet market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States pallet market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States pallet industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)