United States Online Grocery Market Size, Share, Trends and Forecast by Product Type, Business Model, Platform, Purchase Type, and Region, 2026-2034

United States Online Grocery Market Size and Share:

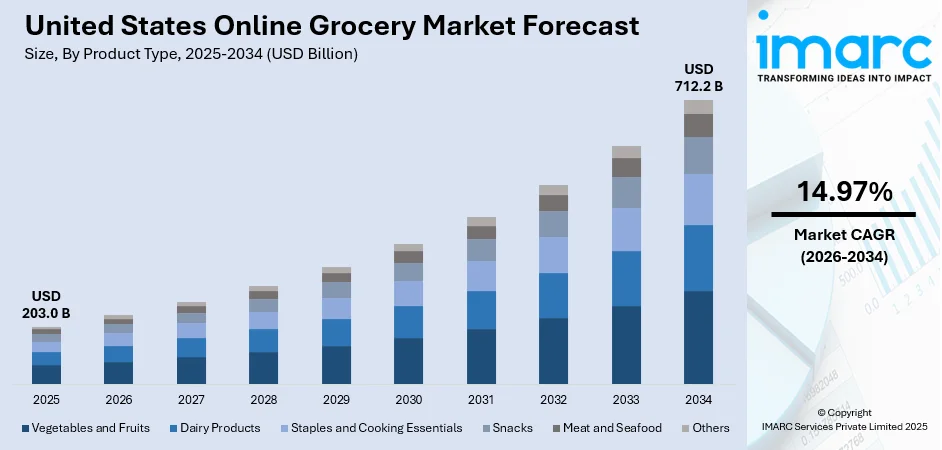

The United States online grocery market size was valued at USD 203.0 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 712.2 Billion by 2034, exhibiting a CAGR of 14.97% from 2026-2034. The market share is propelled by the increasing demand for convenient and time-saving shopping solutions, expansion of same-day and rapid delivery services by major retailers, growing adoption of mobile apps and digital payment solutions, rising demand for subscription-based grocery delivery services, and integration of AI, data analytics, and personalized recommendations in online grocery platforms.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 203.0 Billion |

|

Market Forecast in 2034

|

USD 712.2 Billion |

| Market Growth Rate (2026-2034) | 14.97% |

Access the full market insights report Request Sample

The United States online grocery market is mainly driven by the growing consumer requirements for convenience and ubiquitous acceptance of digital shopping solutions. Busy lifestyles, long working hours, and urbanization have led consumers to prefer online grocery shopping over in-store visits. As per the World Bank, 83% of the total population of the United States was living in urban areas in 2023. In addition, rapid growth in same-day and express delivery is also boosting convenience and contributing to the United States online grocery market growth. Consumers can now enjoy fresh produce, dairy, and frozen foods within hours, reducing their dependency on shopping in-store and driving the grocery delivery market in the United States.

To get more information on this market Request Sample

Besides this, mobile payment features, contactless transactions, and personalized promotions have increased consumer engagement, driving the expansion of the online grocery market in the US. According to the IMARC Group, the United States mobile payment market is expected to grow at a CAGR of 22.2% during 2024-2032. Moreover, mobile apps using AI-driven recommendations and subscription-based models improve the online grocery experience. Ordering is a seamless process, made easy and efficient by scheduling recurring deliveries, along with receiving real-time inventory updates. Additionally, retailers are also strengthening fulfillment networks through strategic alliances to ensure broader market reach and efficiently meet the United States online grocery market demand.

United States Online Grocery Market Trends:

Increasing demand for personalized shopping experiences

Personalization is one of the fast-emerging United States online grocery market trends, where consumers seek tailored recommendations and customized shopping lists. Retailers are employing machine learning (ML) and artificial intelligence (AI) to analyze the patterns of purchases so that they can suggest the appropriate related product with respect to diet preferences, previous purchasing history, and seasonality. Features embedded in subscription models through AI-driven meal planning are helping consumers make better food choices while also eliminating wasted materials. Personalized offers and discounts are also creating higher consumer engagement, thus increasing repeat purchases. In addition, voice-assisted shopping through smart speakers is making grocery ordering more convenient, improving user retention in the online grocery space.

Rising popularity of direct-to-consumer (DTC) grocery brands

More DTC grocery brands are coming up across the United States in response to increasing consumer demands for high-quality specialty and organic goods that are not easily found in conventional retail shops. Many health-centric brands, as well as food manufacturers, are bypassing third parties and now are available through self-owned websites, building direct relations with consumers. DTC brands also give exclusive subscription services, bundled meal kits, and grocery boxes tailored according to individual preferences. The rising interest in sustainability also drives demand for DTC brands, particularly those that focus on sustainable sourcing, using eco-friendly materials for packaging, and ensuring their supply chains maintain farm-to-table standards.

Growing demand for sustainable and ethical grocery options

Sustainability concerns are significantly influencing the United States online grocery market outlook. Consumers need grocery options that are more ecological, ethically sourced, and generate less waste. Retailers have responded through carbon-neutral deliveries, biodegradable packaging, and increased plant-based and organic goods. More and more grocery stores are promoting green brands and choices, making eco-friendly choices possible for consumers in one click. Additionally, there is increasing focus on reducing food waste, with AI-based inventory management and redistribution of surplus food gaining prominence. Subscription services focused on groceries sourced sustainably are also experiencing growth. Since sustainability is driving purchasing decisions, online grocery retailers are increasingly embracing more eco-conscious solutions in their operations.

United States Online Grocery Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States online grocery market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product type, business model, platform, and purchase type.

Analysis by Product Type:

- Vegetables and Fruits

- Dairy Products

- Staples and Cooking Essentials

- Snacks

- Meat and Seafood

- Others

Staples and cooking essentials represent the leading segment in the market in 2025. Staples and kitchen tools make up the majority of the US online market because of continuous demand and convenience-led purchasing behavior. Consumers regularly buy numerous pantry staples, including grains, flour, oil, and dairy products, to ensure the availability of staple ingredients. Mass purchasing, subscriptions, and discounts on regular orders have made these purchases affordable for numerous households. Busy lifestyles and meal planning also make consumers turn to online shopping for everyday grocery purchases. Stronger inventory management, fast delivery options, and personalized recommendations help solidify staples and cooking essentials as the best in the online grocery segment.

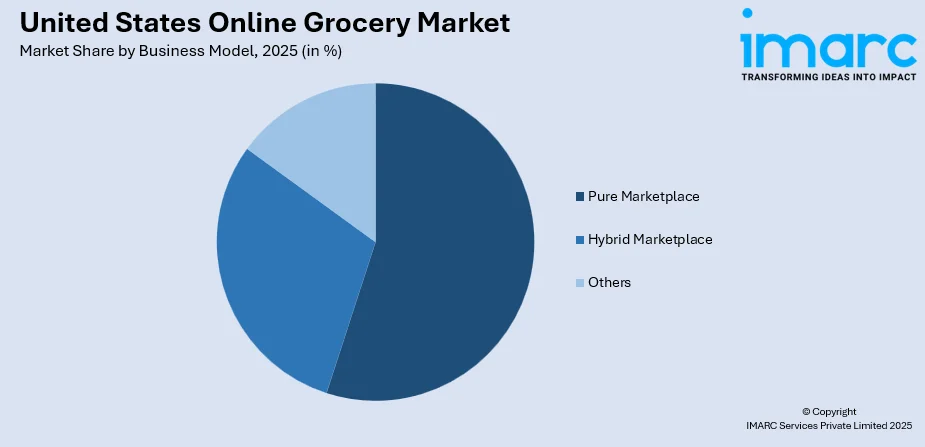

Analysis by Business Model:

To get detailed segment analysis of this market Request Sample

- Pure Marketplace

- Hybrid Marketplace

- Others

Pure marketplace exhibits a clear dominance in the market in 2025. Pure marketplace models are dominant in the United States online grocery market due to their vast product offerings, competitive pricing, and efficient logistics. These platforms connect multiple grocery retailers and suppliers, giving consumers access to diverse brands and specialty items in one place. Pure marketplaces do not maintain physical inventory and focus instead on optimizing fulfillment through third-party sellers and delivery services, thus ensuring cost efficiency and scalability. Consumers benefit from price comparisons, subscription discounts, and personalized promotions, increasing engagement. Furthermore, pure marketplace platforms are also the preferred choice for online grocery shopping due to advancements in AI-driven recommendations, flexible payment options, and fast delivery services.

Analysis by Platform:

- Web-Based

- App-Based

App-based holds the largest market share in 2025. App-based services are the US market leaders in online groceries primarily due to convenience, smooth, user-friendly experience, and on-time delivery. The main reasons why consumers prefer mobile applications for grocery shopping are personalized suggestions, order tracking, and quick reordering. Most retailers and third-party delivery companies have developed their apps by using AI-driven search functions, secure payment options, and loyalty rewards to attract customers. The integration of same-day and express delivery further boosts adoption, particularly among busy households. The app-based platforms also allow contactless transactions and voice-assisted shopping, which makes it popular among modern consumers seeking efficiency and flexibility in grocery shopping.

Analysis by Purchase Type:

- One-Time

- Subscription

Subscription leads the market in 2025. Subscription services dominate the US online grocery market due to their convenience, cost savings, and tailored shopping experiences. Consumers are seeking regular deliveries of essentials, thus reducing the rate of frequent orders and making sure there is always a good stock of products. Leading retailers also provide offers, free shipping, and club deals in exchange for long-term subscriptions, which retain customers. AI-based recommendations and customizable subscription models further increase user engagement by targeting individual dietary and lifestyle needs. Busy households and professionals also like the convenience of automated replenishment in grocery shopping. The growth of subscription services by major grocery retailers and meal kit providers also strengthens this market segment.

Regional Analysis:

- Northeast

- Midwest

- South

- West

In 2025, South accounted for the largest United States online grocery market share. This is largely due to its enormous and rapidly growing population, particularly in metropolitan and suburban areas, where the demand for convenient shopping solutions is high. The region has also experienced substantial investment in fulfillment centers, thus enhancing fast delivery services and efficient last-mile logistics. Leading grocery retailers and e-commerce companies also have well-established distribution networks that guarantee availability and competitive pricing. In addition, the South boasts high mobile grocery shopping app adoption, largely fueled by the region's tech-savvy consumers and the seamless integration of digital payments. Favorable demographics, increased urbanization, and extending infrastructures add to the dominance of the region in the market.

Competitive Landscape:

Key players in the United States online grocery market are driving growth by expanding their delivery infrastructure through automated fulfillment centers and last-mile logistics. Retailers are strengthening partnerships with third-party delivery services to provide more efficient services. This enables grocery shoppers to experience same-day or express grocery delivery services. More firms are incorporating AI-driven inventory management systems and personalized experiences to make sure the shopper feels satisfied with what is bought and how it is sold. New subscription-based models and loyalty programs are being introduced to boost customer retention and engagement. Private-label product lines from leading retailers are also being extended to accommodate price-sensitive consumers. Moreover, contactless payment solutions and easy mobile application experiences further contribute to market growth through the improvement of convenience and access for consumers.

The report provides a comprehensive analysis of the competitive landscape in the United States online grocery market with detailed profiles of all major companies, including:

- Albertsons Companies Inc.

- Amazon.com Inc.

- Costco Wholesale Corporation

- H-E-B

- Instacart

- Publix

- Target Brands Inc.

- The Kroger Co.

- Walgreen Co.

- Walmart

Latest News and Developments:

- 21 November 2024: Instacart, a premier provider of online grocery delivery services headquartered in San Francisco, has introduced a Supplemental Nutrition Access Program (SNAP) qualification screener on their platform. With this feature, consumers around the country can quickly and anonymously find out if they might qualify for SNAP benefits and also find appropriate government resources to expedite their process of enrollment. This initiative is the very first time an assessment service for SNAP has been provided to consumers by an online grocery platform.

- 7 August 2024: Good Eggs, a well-known online grocery solutions provider based in California, has been acquired by GrubMarket, a renowned food e-commerce business and a prominent provider of Enterprise AI services for the United States food supply network industry. This acquisition is a significant turning point for GrubMarket, bolstering its e-commerce services across its major service locations in Los Angeles and San Francisco.

- 21 February 2024: Thrive Market, an online grocery platform providing sustainable and health-conscious options, has announced that it now accepts SNAP EBT, which has made it the first online-only business to be granted USDA approval. This is a significant turning point in the brand's aspirations to enhance accessibility to healthy and sustainable groceries and make them more affordable for consumers.

- 8 November 2023: FreshDirect, an online grocery services provider in New York City, has been successfully acquired by Turkey-based Getir, a leading provider of lightning-fast grocery deliveries. This acquisition furthers Getir's expansion plans in the United States. Moreover, now FreshDirect will be able to utilize the numerous technologies and advanced logistical infrastructure of Getir to provide its consumers with faster support and improved services.

United States Online Grocery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Vegetables and Fruits, Dairy Products, Staples and Cooking Essentials, Snacks, Meat and Seafood, Others |

| Business Models Covered | Pure Marketplace, Hybrid Marketplace, Others |

| Platforms Covered | Web-Based, App-Based |

| Purchase Types Covered | One-Time, Subscription |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States online grocery market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States online grocery market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States online grocery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States online grocery market was valued at USD 203.0 Billion in 2025.

The rising adoption of e-commerce and digital shopping habits, expanding product assortments and availability of fresh groceries online, increased investment in warehouse automation and fulfillment centers, growing partnerships between grocery retailers and third-party delivery services, and enhanced customer experience through AI-driven inventory management and predictive ordering are the primary factors driving the United States online grocery market.

IMARC estimates the United States online grocery market to exhibit a CAGR of 14.97% during 2026-2034.

South currently dominates the market due to its large population, high suburban growth, and strong demand for home delivery services.

Some of the major players in the United States online grocery market include Albertsons Companies Inc., Amazon.com Inc., Costco Wholesale Corporation, H-E-B, Instacart, Publix, Target Brands Inc., The Kroger Co., Walgreen Co., Walmart, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)