United States Online Food Delivery Market Size, Share, Trends and Forecast by Platform Type, Business Model, Payment Method, and Region, 2026-2034

United States Online Food Delivery Market Size, Share & Analysis

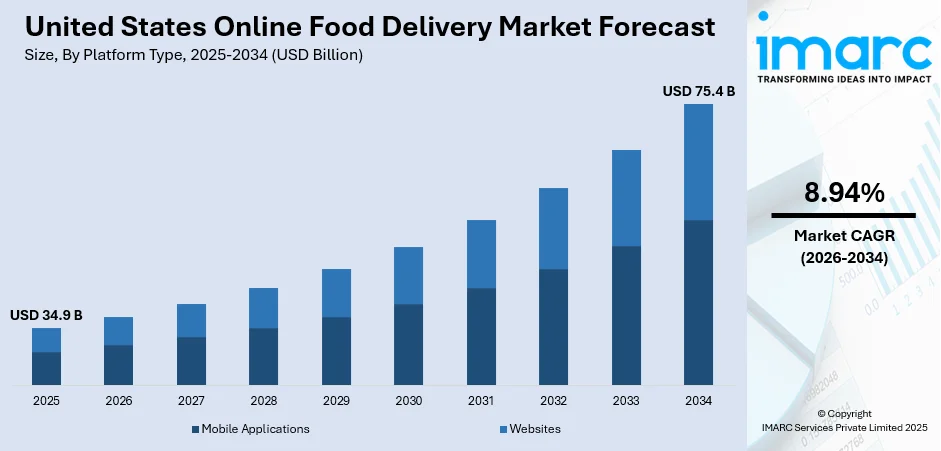

The United States online food delivery market size was valued at USD 34.9 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 75.4 Billion by 2034, exhibiting a CAGR of 8.94% during 2026-2034. South dominates the market, holding 28.7% of the market share in 2025. The growing preference for convenient and fast service among consumers, rising reliance on smartphones and high internet penetration, and increasing adoption of advanced technologies to enhance user service are some of the factors impelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 34.9 Billion |

|

Market Forecast in 2034

|

USD 75.4 Billion |

| Market Growth Rate 2026-2034 | 8.94% |

Access the full market insights report Request Sample

The widespread adoption of smartphones and high-speed internet has made online ordering more accessible. According to industry reports, at the beginning of 2024, the United States had 331.1 million internet users, with internet penetration reaching 97.1 percent. In early 2024, there were 396.0 million active cellular mobile connections in the United States, representing 116.2 percent of the entire population. Innovations such as AI-driven logistics and autonomous delivery vehicles are enhancing operational efficiency and customer satisfaction and fueling the United States online food delivery market share. The COVID-19 pandemic accelerated the adoption of online food delivery services. Consumers now expect quick, convenient, and contactless delivery options, leading to sustained demand for these services.

To get more information on this market Request Sample

Delivery services are diversifying beyond traditional restaurant meals to include groceries, alcohol, and even prescriptions, broadening their appeal. Collaborations between delivery platforms and major retailers, such as Amazon's partnership with Grubhub, are increasing accessibility and attracting a larger customer base. The increasing urban population, particularly among younger, tech-savvy consumers, is driving demand for food delivery services. These consumers prioritize convenience and are more likely to use digital platforms for ordering food. For instance, in April 2025, Presto Phoenix, Inc., the top provider of drive-thru Voice AI for the quick-service restaurant (QSR) sector in America, unveiled its phone-ordering division at the beginning of the Restaurant Leadership Conference (RLC) in Phoenix.

United States Online Food Delivery Market Trends

Technological Advancements

The rise in sales of smartphones and fast internet connections are simplifying the process for individuals to purchase meals from their preferred eateries by simply tapping a few times. According to researchs, 91% of American citizens own a smartphone. The ordering process is becoming easier for people due to mobile applications and user-friendly interfaces, offering a smooth experience. Additionally, the industry is being transformed by the incorporation of AI and ML, which streamlines delivery routes, forecasts demand, and tailors suggestions to user preferences. Novel ways of delivering products, like contactless deliveries and the possible use of drones, are improving efficiency and safety. For instance, in August 2021, Grubhub and Yandex SDG introduced robotic food delivery at Ohio State University, enhancing campus dining with 50 autonomous rovers delivering food orders seamlessly to the doorsteps of the students. This innovative collaboration offers a convenient and efficient dining experience, revolutionizing campus food delivery with cutting-edge technology.

Strategic Partnerships and Acquisitions

The increasing focus on forming strategic partnerships and making acquisitions plays a crucial role in propelling the United States online food delivery market growth. Top companies are seeking to increase their market share and improve their service offerings by forming partnerships with restaurant chains, grocery stores, and other food service providers. These collaborations enable food delivery applications to expand their range of food choices, serving a larger audience. In June 2023, Grubhub and Homewood Suites by Hilton partnered to offer dining options to guests at approximately 500 sites across the United States. Through the use of geolocation and quick response (QR) codes within the Grubhub app, tourists could easily order from local restaurants, enhancing their experience with a variety of dining choices. Furthermore, the buying of smaller delivery services and technology companies allows leading businesses to strengthen their position, improve efficiency, and smoothly incorporate new technologies. Besides this, collaborations with big supermarket companies result in the introduction of grocery delivery services, adding value to customers and generating fresh sources of income. These tactical decisions enhance the competitive advantage of important participants and foster innovation and productivity, leading to overall market growth.

Marketing and Promotional Campaigns

Aggressive marketing and promotional campaigns are essential drivers of the online food delivery market. According to the United States online food delivery market outlook, companies are investing heavily in advertising across various platforms, like television (TV), social media, and online channels, to increase brand awareness and attract new users. Promotional offers, such as discounts, free deliveries, and loyalty programs, play a crucial role in retaining existing users and encouraging frequent usage of the service. For example, in June 2023, Grubhub and Amazon renewed their free Grubhub+ promotion for another year for American Prime members, offering no delivery fees and special discounts on restaurant purchases. This partnership increased the value of Prime by offering members exclusive discounts and special dining opportunities through Grubhub's platform.

Furthermore, collaborating with popular events or influencers during specific times of the year increases brand exposure and interaction with people. According to a survey, 41% of respondents under the age of 30 years reported making a purchase due to an influencer’s endorsement. These marketing strategies are especially successful in transitioning traditional in-person diners to online delivery users. Through the use of inventive marketing tactics, delivery platforms can consistently connect with their audience, giving them a competitive advantage, increasing user acquisition, and fostering continuous market growth.

United States Online Food Delivery Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States online food delivery market, along with forecasts at the regional levels from 2026-2034. The market has been categorized based on platform type, business model, and payment method.

Analysis by Platform Type:

- Mobile Applications

- Websites

Mobile application leads the market with around 72.3% of market share in 2025. Mobile applications hold the biggest share of the market due to their simplicity, availability, and improved user satisfaction. These applications have user-friendly interfaces, tailored suggestions, and smooth ordering systems, leading to a notable rise in their appeal to users. Many users prefer mobile apps due to the ability to order from anywhere at any time, along with features like real-time tracking, push notifications for deals, promotions, and secure payment options. Furthermore, incorporating loyalty programs and special discounts within apps also encourages their utilization. As smartphone penetration continues to rise and technological advancements improve app functionalities, the dominance of mobile applications in the market is expected to grow even stronger. As per the IMARC Group, the US smartphone market is projected to grow at a CAGR of 2.07% between 2024 and 2032.

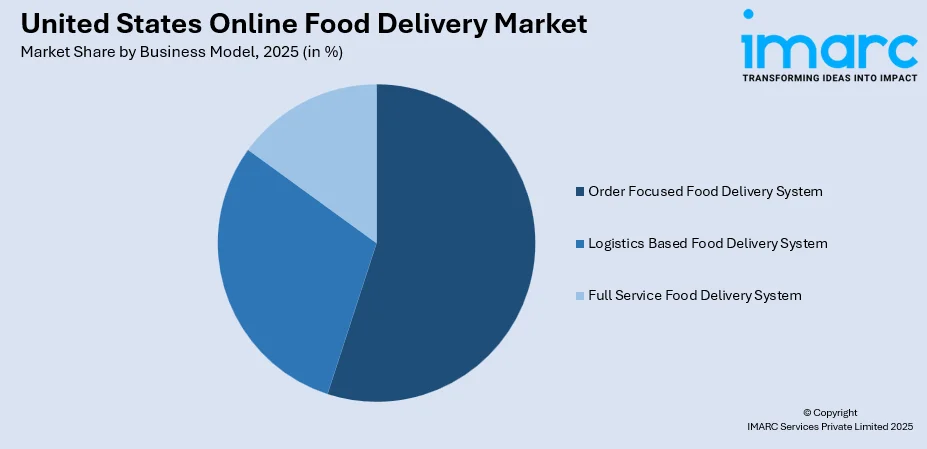

Analysis by Business Model:

To get detailed segment analysis of this market Request Sample

- Order Focused Food Delivery System

- Logistics Based Food Delivery System

- Full Service Food Delivery System

Order focused food delivery system leads the market with around 55.8% of market share in 2025. Order focused food delivery system represents the biggest segment as per the industry overview due to its efficient and direct connection between users and restaurants. In this model, platforms concentrate on making the ordering process easier without handling the delivery logistics directly. This enables restaurants to manage deliveries themselves or utilize third-party delivery services. The model centered on orders receives advantages from reduced operational complexities and costs, allowing these platforms to quickly expand and provide individuals with a diverse selection of restaurant options. Focusing on order processing, user service, and payment handling allows these platforms to offer a smooth user experience, while also enabling restaurants to retain control over their delivery operations. The appeal of this model to provide flexibility and simplicity to consumers and restaurant partners, ensures that it remains dominant in the market.

Analysis by Payment Method:

- Online

- Cash on Delivery

Online leads the market with around 81.6% of market share in 2025. Online payments are the most vital part of online food delivery, driven by their convenience, speed, and security measures. The user experience is greatly improved due to the growing use of digital payment options like credit and debit cards, digital wallets, and mobile payment apps, which allow for fast and convenient transactions. In 2023, the US mobile payment market was valued at US$ 612.6 billion and is projected to reach US$ 3,901.8 Billion by 2032, according to the IMARC Group. Consumers opt for online payments due to the convenience of avoiding cash handling and the option to quickly place orders with just a few clicks, often being seamlessly integrated into mobile apps for smooth transactions. Moreover, online payments provide extra security measures with encryption and fraud detection technologies, improving consumer trust.

Regional Analysis:

- Northeast

- Midwest

- South

- West

In 2025, South accounted for the largest market share of over 28.7%. The South represents the largest segment in the market, driven by its expansive population, diverse urban centers, and rapidly growing suburban areas. Major cities serve as vital hubs for food delivery services, with a dense array of restaurants and a high demand for convenient dining options. Moreover, in December 2021, DoorDash extended grocery delivery through a partnership with Southeastern Grocers, benefiting customers in the Southeastern U.S., including Florida, Georgia, Alabama, Mississippi, and Louisiana, offering same-day delivery from over 400 stores in the region. This move aligned with consumer demand for convenience and speed in grocery delivery services, particularly in Southern states.

Furthermore, the region's demographic trends, including a younger, tech-savvy population, are driving the United States online food delivery market demand. Additionally, the South is experiencing a rise in economic growth and urbanization, contributing to an increase in disposable incomes and a preference for dining convenience. The prevalence of busy lifestyles and the popularity of Southern cuisine, which includes a wide range of food preferences from traditional to innovative, is supporting the growth of the market.

Competitive Landscape:

The United States online food delivery market is highly competitive, with key players like DoorDash, Uber Eats, and Grubhub. DoorDash leads by expanding its delivery infrastructure, including autonomous robots and partnerships with local businesses. Uber Eats focuses on innovation through robotic deliveries and integration with various services. Grubhub, now owned by Wonder Group, faces challenges in maintaining its market share but benefits from its partnership with Amazon, offering exclusive deals to Prime members. Smaller players and new entrants are also capitalizing on niche markets, emphasizing speed, variety, and customer loyalty to differentiate themselves in this evolving market.

The report provides a comprehensive analysis of the competitive landscape in the United States online food delivery market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: DoorDash, a leading online food delivery platform headquartered in California, launched a suite of AI-driven solutions on its application aimed at assisting restaurants in improving their online menus, increasing consumer satisfaction, and boosting revenue. These novel AI-driven services highlight the continued dedication of DoorDash to supporting merchant success and providing them with the resources and capabilities they require.

- April 2025: Serve Robotics Inc., a renowned provider of autonomous sidewalk deliveries, launched its services in the metro area of Dallas-Fort Worth in collaboration with Uber Eats, a leading online food delivery platform in the United States. This launch marks a significant step in Serve’s goal of deploying 2,000 AI-driven delivery robots nationwide by the end of 2025.

- April 2025: Domino’s Pizza Inc., the leading pizza company globally, established a partnership with California-based DoorDash, a popular online food delivery service in the U.S., to expand its consumer base via DoorDash Marketplace. While the initial trial for this service is already underway in a few areas, a countrywide rollout is scheduled to get started in May 2025 across the United States.

- November 2024: Wonder, an online food delivery platform based in New York, announced the acquisition of Chicago-based Grubhub, the leading online food ordering and delivery service in the U.S., from Just Eat Takeaway. The acquisition deal was finalized at an enterprise value of USD 650 Million and is expected to be completed by Q1 2025.

- June 2024: Starbucks entered into a partnership with Grubhub to offer consumers the convenience of doorstep delivery for their favorite Starbucks orders. Starbucks Delivery with Grubhub is scheduled to debut in certain regions in Colorado, Illinois, and Pennsylvania in June. By August 2024, the service is expected to be available nationwide in all 50 states.

- May 2024: Uber Eats announced that it is teaming up with Instacart to offer food delivery services in the United States, allowing customers to order from hundreds of thousands of restaurants through the Instacart app. Through this cooperation, users will benefit from a handy option that streamlines grocery shopping and meal delivery.

United States Online Food Delivery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Platform Types Covered | Mobile Applications, Websites |

| Business Models Covered | Order Focused Food Delivery System, Logistics Based Food Delivery System, Full Service Food Delivery System |

| Payment Methods Covered | Online, Cash on Delivery |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States online food delivery market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States online food delivery market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States online food delivery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States online food delivery market was valued at USD 34.9 Billion in 2025.

The United States online food delivery market is projected to exhibit a CAGR of 8.94% during 2026-2034, reaching a value of USD 75.4 Billion by 2034.

The United States online food delivery market is driven by rising demand for convenience, widespread smartphone usage, and user-friendly apps. Strategic partnerships, digital payment adoption, and a growing preference for diverse cuisines also contribute. Efficient logistics and targeted promotions further accelerate market expansion across urban and suburban areas.

South currently dominates the United States online food delivery market due to urban growth, smartphone adoption, and diverse culinary demand.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)