U.S. Menswear Market Size, Share, Trends and Forecast by Product Type, Season, Distribution Channel, and Region, 2025-2033

U.S. Menswear Market Size and Share:

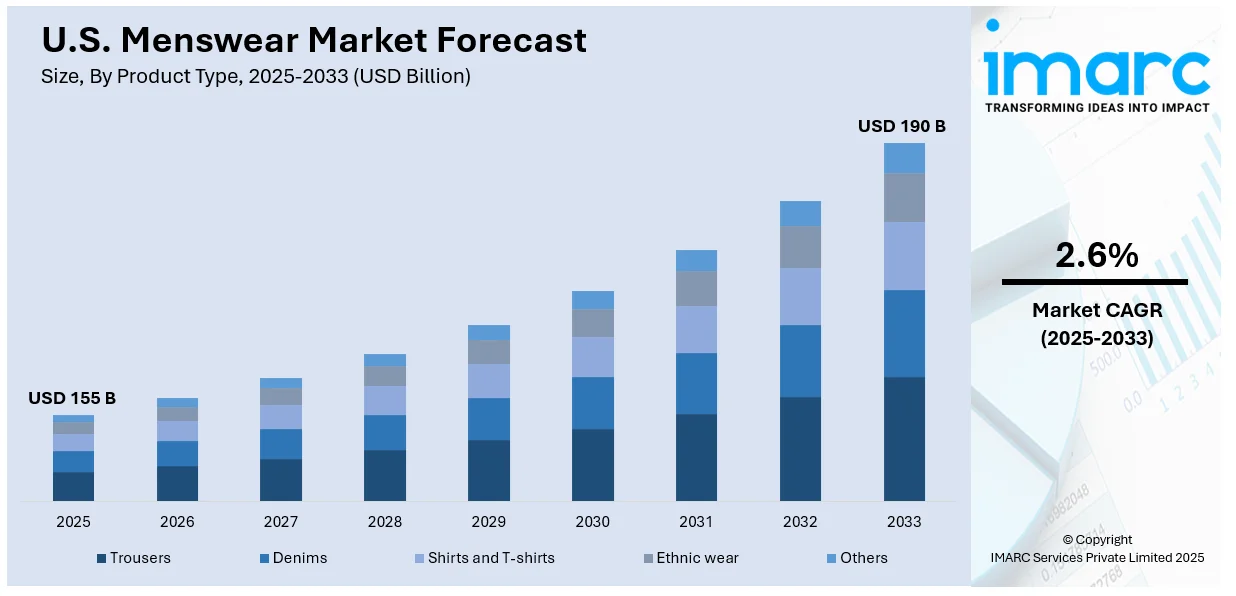

The U.S. menswear market size is anticipated to reach USD 155 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 190 Billion by 2033, exhibiting a CAGR of 2.6% from 2025-2033. Some of the primary factors influencing the U.S. menswear market include the changing fashion trends, greater emphasis on comfort and athleisure, and growing demand for custom and sustainable clothing choices.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2025 | USD 155 Billion |

| Market Forecast in 2033 | USD 190 Billion |

| Market Growth Rate (2025-2033) | 2.6% |

A major factor influencing the U.S. menswear market is the rising demand for athleisure and comfort-focused apparel. As per the IMARC Group the United States athleisure market is expected to reach US$ 175.4 Billion by 2032 and is exhibiting a CAGR of 7.56% during 2024-2032. As consumer habits change, numerous men emphasize comfort and functionality while maintaining a sense of style. This trend has sped up, particularly with the growth of remote jobs and dynamic lifestyles, where flexible apparel can shift from exercise to informal gatherings. Athleisure, combining sportswear with casual clothing, has gained immense popularity on account of its comfort, adaptability, and suitability for various occasions.

Another significant driver for the menswear market in the United States is the growing interest of consumers in sustainability and ethical fashion. As awareness about the environmental and social concerns has been rising, many consumers are now choosing brands which emphasize sustainable materials, responsible manufacturing practices, and transparent supply chains. Boys these days are becoming conscious regarding products purchase; they opt for some alternative sustainable products such as cotton-based clothing or secondhand recycled materials, under conditions of fair labor during manufacture. This shift forced all well-established and emerging companies to adapt by creating and emphasizing sustainable lines while developing longer-lasting products.

U.S. Menswear Market Trends:

Increasing influence of social media and digital platforms

The emergence of social media platforms such as Instagram, TikTok, and YouTube has greatly impacted fashion trends, particularly in menswear. As per Data Reportal, 239.0 million individuals across the USA used various types of social media platforms, in January 2024. These platforms enable brands and influencers to showcase new styles, outfits, and partnerships straight to consumers. Men are progressively turning to these platforms for fashion inspiration, resulting in heightened awareness about international fashion trends and labels. Digital influencers and celebrities significantly influence the buying habits of men, boosting the desire for trendy fashion pieces and inspiring consumers to try out different styles. Consequently, the swift spread of fashion trends, rising impact of online shopping, and enhanced adoption of digital marketing tactics by brands are contributing to the U.S. menswear market growth.

Customization and personalization

In the U.S. menswear industry, customization and personalization have gained significance as shoppers look for distinct and customized apparel. The fashion labels of men are addressing this demand by providing items that allow customization regarding color, fit, material, or style. Due to technological advancements, online brands and retailers utilize data to deliver more tailored shopping experiences, providing suggestions based on previous purchases or individual preferences. This movement enables shoppers to refine their wardrobe more accurately, cultivating a feeling of uniqueness and distinctiveness. The rise in availability of custom and tailored choices, particularly for products such as suits and shirts, is attracting men who appreciate quality craftsmanship and distinctive design.

Growing Popularity of Streetwear and Casual Wear

Streetwear, merging casual urban attire with high fashion, remains a key influence on trends in the United States menswear sector. Originating from skateboarding, hip-hop, and youth subcultures, streetwear has transformed into a prominent fashion category, significantly shaped by partnerships between high-end brands and well-known streetwear labels. The cozy feel, adaptability, and striking designs of streetwear have drawn a diverse array of consumers, especially younger audiences. The increasing popularity of casual attire in different environments, such as offices and social gatherings, has significantly boosted the demand for streetwear, featuring hoodies, graphic t-shirts, sneakers, and baggy jackets. This trend has rendered casual, comfortable fashion socially acceptable across various settings, broadening the definition of appropriate menswear in the United States.

U.S. Menswear Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the U.S. menswear market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type, season, and distribution channel.

Analysis by Product Type:

- Trousers

- Denims

- Shirts and T-shirts

- Ethnic wear

- Others

Pants remain crucial in the men’s apparel market of the United States, catering to both casual and formal occasions. Dress trousers, such as tailored slacks and chinos, are crucial for workplace clothing and business outfits, shaped by corporate culture and professional attire norms. In contrast, comfortable options like joggers and cargo pants have gained popularity because of the rising desire for comfort and functionality.

Denim is a crucial element of men's fashion, combining durability, style, and adaptability. In the United States, denim is a popular option for informal and semi-formal events. There has been an increase in the U.S. menswear market share with the addition of diverse styles, such as skinny, straight-leg, relaxed-fit, and distressed jeans, accommodating varying tastes. Eco-friendly denim, crafted from sustainable materials and utilizing water-efficient manufacturing processes, has become increasingly popular with environmentally aware shoppers.

Shirts and T-shirts are essential in the menswear market due to their adaptability in casual, formal, and athleisure styles. T-shirts dominate the casual segment, often featuring graphic designs, logos, or basic patterns that appeal to younger crowds. Polo shirts and button-down shirts fulfill semi-formal and formal roles, with their popularity shaped by their adaptability and ease of layering. Performance shirts, including moisture-wicking and wrinkle-free options, are gaining popularity among active and professional men.

Analysis by Season:

- Summer wear

- Winter wear

- All-season wear

The summer wear category within the U.S. menswear market is fueled by the need for lightweight, breathable, and moisture-wicking materials intended for hotter regions. Main items consist of cotton shirts, linen pants, shorts, and polo shirts, ensuring comfort during warm weather. Activewear and swimwear experience a rise in demand in summer, particularly due to outdoor activities and vacations. The hues and designs in summer clothing typically showcase seasonal trends, featuring vibrant, pastel colors and floral patterns as favorites.

In the U.S. menswear market, winter clothing prioritizes practicality, warmth, and longevity, all while ensuring a fashionable look. This category comprises coats, jackets, thermal clothing, sweaters, and items such as gloves, scarves, and hats. Fabrics such as wool, fleece, and down are highly desired for their coziness and insulation. Moreover, progress in performance fabrics, including materials that are water-resistant and windproof, is spurring innovations in winter apparel.

All-season wear is an expanding market, targeting consumers who seek adaptable clothing appropriate for diverse weather conditions. This encompasses pieces such as light jackets, cardigans, chinos, and versatile layers suitable for various weather scenarios. The attraction of all-season clothing stems from its functionality and affordability, as buyers aim to enhance the usefulness of their wardrobe. Materials such as blended fabrics, which provide a balance of breathability and insulation, are often utilized.

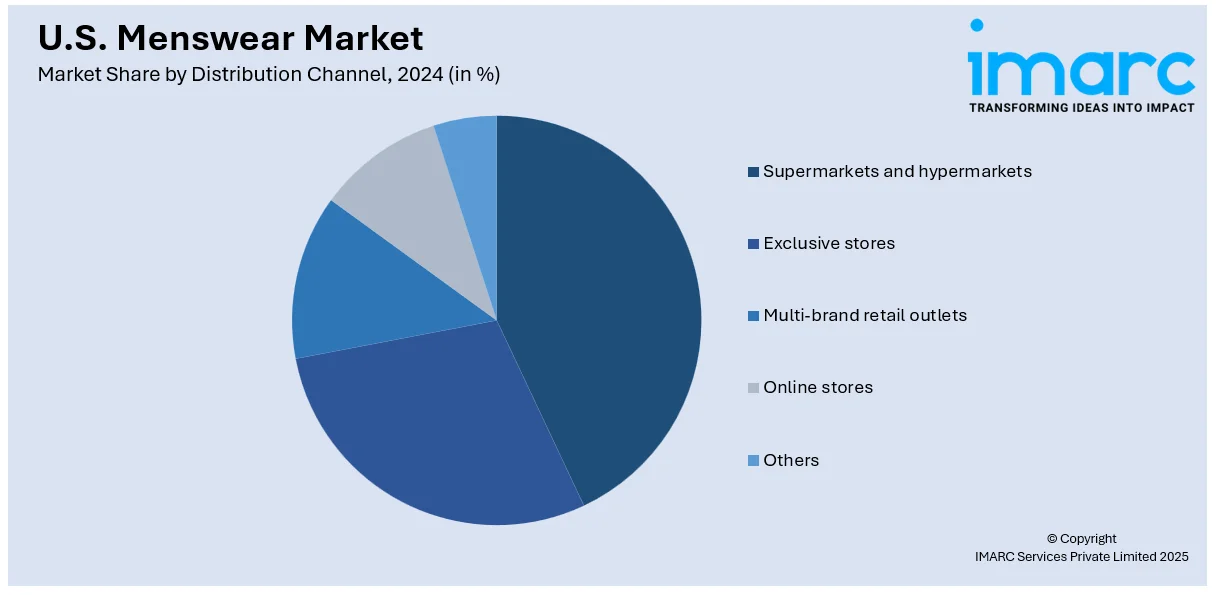

Analysis by Distribution Channel:

- Supermarkets and hypermarkets

- Exclusive stores

- Multi-brand retail outlets

- Online stores

- Others

Supermarkets and hypermarkets significantly influence the U.S. menswear market by providing convenience and cost-effectiveness. These expansive retail areas frequently include specific sections for clothing of the men, offering a diverse selection ranging from informal outfits to dressy apparel. They attract budget-minded shoppers who appreciate a convenient place to buy clothing along with other home necessities. Moreover, supermarkets and hypermarkets frequently offer private-label menswear brands that are affordably priced and appeal to shoppers seeking value while maintaining style.

Exclusive retail locations, such as brand-owned shops, offer a high-end shopping experience aligned with the identity and quality linked to particular menswear brands. These shops concentrate on providing premium products and customized services such as styling guidance or tailored choices. Exclusive retailers play a crucial role in fostering brand loyalty and displaying a brand's complete range, frequently acting as the main point of contact for new product launches and partnerships.

Multi-brand retail stores function as a center for diversity and convenience, providing menswear items from various brands in a single location. These shops serve a wide range of consumers, from cost-sensitive shoppers to individuals looking for high-end choices. They offer a wide array of styles, sizes, and price ranges, attracting men with different preferences and budgets. Multi-brand retailers utilize their capacity to provide competitive pricing and promotions to draw in consumers. In addition, they frequently include in-store specialists who offer styling tips, improving the overall shopping experience.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast, which includes cities such as New York, Boston, and Philadelphia, plays a vital role in shaping fashion trends within the U.S. menswear industry. This area is marked by a significant presence of urban professionals who favor formal and business-casual clothing due to the prominence of corporate employment. Furthermore, the area's chillier weather increases the need for seasonal men's clothing such as tailored jackets, wool suits, and essential layering pieces. The Northeast serves as a center for upscale and luxury menswear brands, attracting wealthy consumers who appreciate top-notch craftsmanship.

The menswear market in the Midwest is influenced by a combination of urban and rural lifestyles, affecting the need for both functional and fashionable apparel. Cities such as Chicago and Detroit lead the market for business clothing and casual wear, while the area's robust agricultural and industrial foundation creates a need for sturdy workwear. Consumers in the Midwest typically prioritize cost-effectiveness and practicality, establishing it as an important market for mid-range and value-focused brands.

The Southern United States, featuring states such as Texas, Florida, and Georgia, boasts a unique menswear market influenced by its hotter climate and varied cultural demographics. Lightweight materials such as cotton and linen are highly adopted on account of the heat and humidity of the area. The South also showcases lively, striking colors and designs, representing its cultural legacy. Business casual and resort attire are trendy, especially in urban centers and seaside locations.

Competitive Landscape:

Major participants in the U.S. menswear market are proactively adopting creative tactics to attract and maintain consumer engagement. Top brands are adopting digital transformation by utilizing e-commerce platforms, customized marketing, and virtual fitting technologies to improve the shopping experience. Collaborations and partnerships with designers, influencers, and celebrities are being utilized more frequently to enhance brand visibility and attract younger audiences. Moreover, businesses are broadening their product ranges to feature sustainable and ethically produced clothing, responding to the increasing demand for eco-conscious fashion. Numerous brands are prioritizing inclusivity by providing a variety of size options and gender-neutral styles. Funding for research and development is driving progress in functional textiles, such as moisture-wicking or wrinkle-free fabrics, meeting consumer demands for practicality and aesthetics.

The report provides a comprehensive analysis of the competitive landscape in the U.S. menswear market with detailed profiles of all major companies.

Latest News and Developments:

- July 2024: Pacsun has entered the men's sportswear market in the United States, with the launch of its adaptable A.R.C. (active. recreation. comfort) collection.

- June 2024: The "Metamorphose" project, a collaborative effort aimed at advancing sustainable fashion, was started by the U.S. Embassy Public Affairs.

- May 2024: Macy's introduced an exclusive and versatile menswear collection in the U.S. that includes blazers, polos, cardigans, accessories, and more.

U.S. Menswear Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Trousers, Denims, Shirts and T-Shirts, Ethnic Wear, Others |

| Seasons Covered | Summer Wear, Winter Wear, All-Season Wear |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Exclusive Stores, Multi-Brand Retail Outlets, Online Stores, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the U.S. menswear market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the U.S. menswear market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the U.S. menswear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Menswear refers to clothing, footwear, and accessories specifically designed and tailored for men, encompassing a variety of styles from formal and business attire to casual and sportswear.

The U.S. menswear market size is anticipated to reach USD 155 Billion in 2025.

IMARC estimates the U.S. menswear market to exhibit a CAGR of 2.6% during 2025-2033.

Key factors driving the U.S. menswear market include evolving fashion trends, increased focus on comfort and athleisure, and rising demand for personalized and sustainable clothing options.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)