United States Medical Simulation Market Size, Share, Trends and Forecast by Product and Services, Fidelity, End User, and Region, 2026-2034

United States Medical Simulation Market Summary:

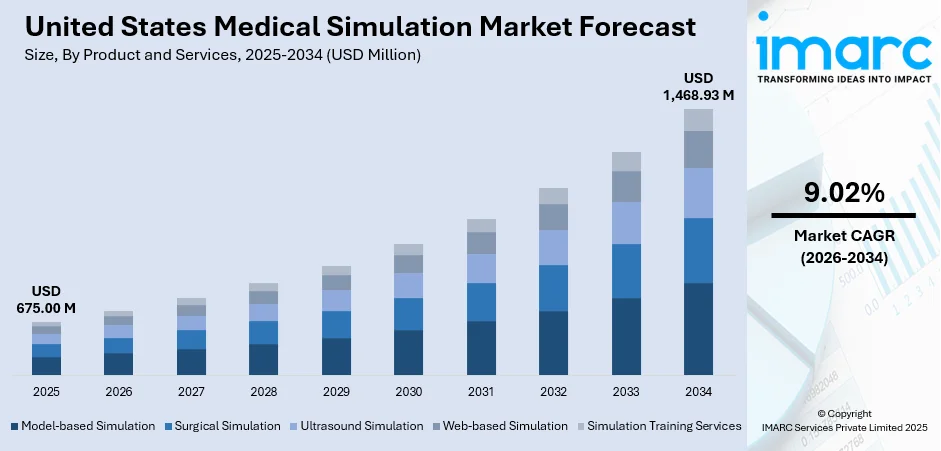

The United States medical simulation market size was valued at USD 675.00 Million in 2025 and is projected to reach USD 1,468.93 Million by 2034, growing at a compound annual growth rate of 9.02% from 2026-2034.

The United States medical simulation market is expanding rapidly because of the emphasis on patient safety and the reduction of healthcare errors through simulation education and training. Further advancements in virtual reality, Augmented Reality, and Artificial Intelligence are providing an immersive and real-world training experience through simulation education and training for healthcare professionals, thus fueling the growth of the healthcare simulation market in the US and across the globe.

Key Takeaways and Insights:

- By Product and Services: Model-based simulation dominates the market with a share of 32% in 2025, driven by the widespread use of physical mannequins and anatomical models that provide hands-on learning experiences for fundamental clinical skills training including physical examinations, cardiopulmonary resuscitation, and procedural practice.

- By Fidelity: Low fidelity leads the market with a share of 40% in 2025, attributed to their cost-effectiveness, accessibility, and suitability for basic skills training and introductory medical education programs where fundamental procedural competencies are developed before advancing to more complex simulations.

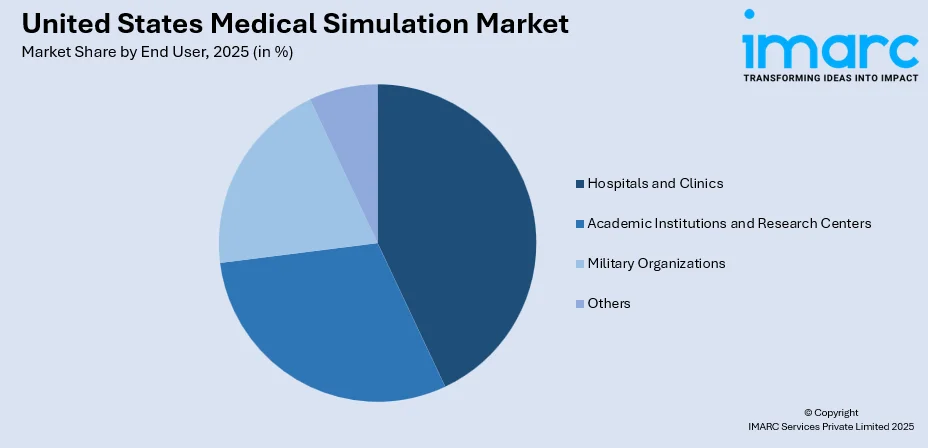

- By End User: Hospitals and clinics dominate the market with a share of 43% in 2025, owing to their need for continuous staff training, competency assessment, procedural skills maintenance, and the growing recognition that simulation-based training improves patient outcomes and reduces medical errors in clinical settings.

- By Region: South leads the market with a share of 30% in 2025, supported by the concentration of major healthcare systems, academic medical centers, and military medical facilities in states including Texas, Florida, and Georgia, along with significant investments in healthcare education infrastructure.

- Key Players: The U.S. medical simulation market is highly competitive, driven by continuous technological innovation, development of specialty-focused solutions, and strategic partnerships. Players differentiate through advanced simulation platforms, immersive training technologies, and cloud-based service offerings.

To get more information on this market Request Sample

The U.S. medical simulation industry is growing as healthcare organizations focus on competency-based education and patient safety. It uses a range of technologies to replicate clinical scenarios, allowing professionals to build skills in controlled, risk-free environments. In 2025, virtual reality provider SimX partnered with Elevate Healthcare to integrate its VR simulation platform with advanced physical simulation tools, enhancing clinical readiness across institutions. Regulatory support and accreditation for simulation hours further drive adoption. Hospitals and academic centers are developing simulation facilities featuring mannequins, VR systems, and standardized patient programs. Increasing procedure complexity, resident work-hour limits, and limited hands-on exposure make simulation vital. Innovations like AI-driven scenarios, haptic feedback, and cloud-based platforms are improving accessibility and learning outcomes, helping healthcare professionals train more effectively.

United States Medical Simulation Market Trends:

Integration of Virtual Reality and Augmented Reality Technologies

Virtual reality and augmented reality are transforming medical simulation by creating immersive training environments that replicate real clinical scenarios. In January 2025, KRN Labs showcased next‑gen VR surgical simulators at ArabHealth, offering high-fidelity laparoscopic and robotic training on consumer VR headsets to make surgical education more accessible. Healthcare institutions are increasingly using VR simulators, anatomy visualization systems, and procedural training platforms to allow repeated practice without patient risk. AR overlays enhance mannequin-based simulations, providing real-time guidance, detailed anatomical visualization, and immediate feedback, improving skill acquisition and retention.

Expansion of Cloud-Based and Remote Simulation Platforms

Cloud-based simulation platforms are reshaping medical education by providing scalable, accessible training beyond traditional simulation centers. In 2025, Body Interact enhanced its virtual patient simulator and engaged global educators at IMSH 2025, demonstrating how web-based simulations support remote learning and cross-institution collaboration. These platforms enable virtual team exercises, asynchronous skill development, and flexible training schedules for healthcare professionals. The rise of hybrid learning models has accelerated adoption of web-based simulations. Cloud infrastructure allows institutions to share content, benchmark performance, and collaborate on curriculum development, improving the efficiency and impact of simulation-based education programs.

Growing Focus on Interprofessional Team Training

Medical simulation is increasingly used for interprofessional team training, bringing together physicians, nurses, pharmacists, and allied health professionals to practice collaborative care. In August 2025, Munson Healthcare expanded its simulation lab to Cadillac Hospital, providing a dedicated space where multidisciplinary teams can rehearse emergency response and teamwork using high-fidelity manikins and scenario drills. Healthcare systems are investing in programs that emphasize team dynamics, crisis management, and coordinated responses. Multi-user simulations enable care teams to practice complex scenarios like trauma, surgical emergencies, and critical care, enhancing communication, situational awareness, and shared mental models for safer, high-performing healthcare teams.

Market Outlook 2026-2034:

The United States healthcare simulation market is expanding rapidly because of the emphasis on patient safety and the reduction of healthcare errors through simulation education and training. Further advancements in virtual reality, Augmented Reality, and Artificial Intelligence are providing an immersive and real-world training experience through simulation education and training for healthcare professionals, thus fueling the growth of the healthcare simulation market in the US and across the globe. The market generated a revenue of USD 675.00 Million in 2025 and is projected to reach a revenue of USD 1,468.93 Million by 2034, growing at a compound annual growth rate of 9.02% from 2026-2034.

United States Medical Simulation Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product and Services | Model-based Simulation | 32% |

| Fidelity | Low Fidelity | 40% |

| End User | Hospitals and Clinics | 43% |

| Region | South | 30% |

Product and Services Insights:

- Model-based Simulation

- Surgical Simulation

- Ultrasound Simulation

- Web-based Simulation

- Simulation Training Services

The model-based simulation dominates with a market share of 32% of the total United States medical simulation market in 2025.

Model-based simulation uses physical mannequins and anatomical models to provide hands-on learning for healthcare professionals across all training levels. In January 2025, Gaumard Scientific showcased PHOEBE, an advanced female polytrauma simulator offering ultra-high-fidelity trauma and emergency response training. These tools range from basic task trainers for specific procedures to full-body mannequins simulating complex physiological responses. Physical interaction with realistic models helps develop muscle memory, spatial awareness, and procedural confidence, complementing digital simulation for comprehensive clinical skills training.

Model simulations find applications in medical education, nursing education, and residency education for training students in skills such as examination techniques, airways management, venipuncture, and cardiac resuscitation. The reusable models ensure cost-effectiveness for high-volume training. The development of technology has made model simulations simulate real tissue as well as physiological responses with enhanced vital signs. Model simulations can also be used along with electronic assessment instruments for performance measurement.

Fidelity Insights:

- Low Fidelity

- Medium Fidelity

- High Fidelity

The low fidelity leads with a share of 40% of the total United States medical simulation market in 2025.

Low-fidelity simulation involves the use of simple tools such as static models, part-task trainers, or simple models that emphasize the skills required in procedures with less attention to physiological reactions. Such models are cost-effective and are best suited for initial process introductions to lay the groundwork for skills development. This is because these models are cost-effective, easy to use, and do not require much time or technical support to be incorporated into the training programs.

Low-fidelity simulations can be utilized for learning procedures, hand and eye coordination, and basic skills training prior to moving towards more complex tasks. The common application of low-fidelity simulations can be seen in training practitioners in the field of providing high volumes for procedures such as suturing, injections, catheterization, and basic life support in healthcare. The rationale behind their efficacy is based on research evidence demonstrating skill mastery being more reliant upon practice time rather than system sophistication.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Hospitals and Clinics

- Academic Institutions and Research Centers

- Military Organizations

- Others

The hospitals and clinics dominate with a market share of 43% of the total United States medical simulation market in 2025.

Hospitals and clinics are the largest end-user segment due to ongoing needs for staff training, competency assessment, and quality improvement. In October 2025, HCA Healthcare’s Mission Health opened the HCA Healthcare Center for Clinical Advancement (HHCCA), providing nurses, residents, and allied health professionals hands-on training in realistic clinical scenarios. Dedicated simulation centers support onboarding, skills maintenance, and preparation for rare high-acuity events, helping standardize care, implement protocols, and improve team coordination while enhancing patient safety and overall care quality.

Healthcare organizations apply simulation for skill training, simulation and response to emergencies, implementing new technologies, and root cause analysis. Simulation programs allow inter-professional teams, consisting of doctors, nurses, and support staff, to simulate patient care delivery and respond to low-frequency events, such as cardiac arrests and trauma situations. Simulation centers are also used for competence validation, faculty/physician credentialing, and continuing education for continued medical education activities.

Regional Insights:

- Northeast

- Midwest

- South

- West

South exhibits a clear dominance with a 30% share of the total United States medical simulation market in 2025.

The South is currently leading the U.S. medical simulation market because of the presence of large-scale healthcare setups in Texas, Florida, Georgia, and North Carolina. This region is home to large simulation facilities, catering to both civilian as well as military requirements. With rapid population expansion and development in the healthcare setup, the South is leading the medical simulation market in the United States.

The healthcare systems within the South are investing in simulation resources to cater to the healthcare workforce requirements within the region that is experiencing fast growth. The academic medical institutions and nursing schools have active simulation programs that support the healthcare learning pipeline. A favorable environment for carrying out business operations, as well as growth within the sector, are factors that encourage simulation technology businesses to invest within the region.

Market Dynamics:

Growth Drivers:

Why is the United States Medical Simulation Market Growing?

Increasing Emphasis on Patient Safety and Medical Error Reduction

Patient safety is a key driver of medical simulation adoption in the U.S. healthcare system. Medical errors remain a leading cause of preventable harm, prompting organizations to use simulation-based training to build skills without risking patient safety. According to reports, an AHRQ-funded project showed that simulation-based handoff training improved the accuracy and completeness of information during emergency department transitions, enhancing continuity of care. Simulation allows practice of high-risk procedures, rare scenarios, and learning from mistakes. Accreditation requirements, performance measurement, and competency documentation further drive investment and support quality improvement and regulatory compliance.

Rapid Technological Advancements in Simulation Technologies

Technological innovation is advancing medical simulation, improving training outcomes and expanding applications. In August 2025, Wolters Kluwer and Laerdal Medical integrated conversational AI into their vrClinicals for Nursing VR platform, allowing deeper interactions with virtual patients and enhancing educational realism. Virtual and augmented reality create immersive clinical environments, while AI enables adaptive scenarios tailored to learner performance. Haptic feedback adds realistic tactile sensations during procedures. Together, these innovations broaden the range of conditions and procedures that can be simulated, enhancing learning efficiency, skill retention, and overall training effectiveness.

Growing Adoption of Simulation-Based Medical Education

Simulation is increasingly central to medical education and competency-based training. Limits on resident duty hours and supervision have reduced traditional apprenticeship opportunities, making simulation essential for skill development. In 2025, the ACGME revised its Common Program Requirements to reinforce competency-based education and expand simulation-enhanced training across U.S. residency programs. Accreditation standards for medical and nursing schools now emphasize simulation for learning and assessment. By improving knowledge retention, procedural skills, and clinical confidence, simulation supports faster skill acquisition, earlier clinical readiness, and more efficient healthcare education amid workforce shortages.

Market Restraints:

What Challenges the United States Medical Simulation Market is Facing?

High Initial Investment and Maintenance Costs

A high capital requirement is a challenge to healthcare organizations and educational facilities as well. This is particularly due to the high cost of high-fidelity mannequins, virtual reality equipment, and simulation center facility installation, making it difficult for small health facilities to gain easy access to advanced simulation equipment. There are also recurrent expenses in terms of maintaining these facilities, as well as software and material usage.

Shortage of Trained Simulation Educators and Operators

A skilled teacher is the hallmark of successful simulation education since they create the simulation scenario, teach during the simulation process, and provide debriefing afterwards. Highly sophisticated simulation equipment also demands specific knowledge for its operation, thus posing an HR issue. Specialized skills provided in limited training for simulation teachers limit the scope of simulation education programs, or the investment made through technological development will be underutilized since the human resources involved will lack the skills needed.

Integration Challenges with Existing Curricula and Workflows

The implementation of simulation technology and programs that integrate these activities within existing learning programs pose a number of challenges. Faculty could be unfamiliar with the use of simulation technology. Resistance to changing instruction and implementation programs could be another problem. The availability of training and the lack of a standardized framework of instruction create challenges to the effectiveness of programs.

Competitive Landscape:

The medical simulation market in the United States is characterized by a competitive landscape that is represented by established medical equipment firms, simulation technology firms, and startups with innovative training tools. Market competitors have strong business setups that include comprehensive ranges of products such as mannequins, virtual reality tools, and surgical simulation tools. Simulation technology providers collaborate with medical facilities and academic bodies to facilitate productions that suit customer needs. The presence of healthy competition in this market forces frequent developments in features that cover reality simulation and use of artificial intelligence and cloud platform technology. Market acquisitions have created consolidation within some sections of this medical technology market. In addition, venture investments have fueled startups that utilize innovative simulation methods. Global expansion and developing products that allow specifications for specialties have been adopted as growth strategies.

Recent Developments:

- In November 2025, Siemens Healthineers has launched a new AI‑enabled radiology services suite that includes advanced simulation tools for complex scenario planning and operational performance, showcased at the RSNA 2025 conference in Chicago. The offering aims to streamline workflows from scheduling to image interpretation and support hospital operations.

United States Medical Simulation Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product and Services Covered | Model-based Simulation, Surgical Simulation, Ultrasound Simulation, Web-based Simulation, Simulation Training Services |

| Fidelities Covered | Low Fidelity, Medium Fidelity, High Fidelity |

| End Users Covered | Hospitals and Clinics, Academic Institutions and Research Centers, Military Organizations, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The United States medical simulation market size was valued at USD 675.00 Million in 2025.

The United States medical simulation market is expected to grow at a compound annual growth rate of 9.02% from 2026-2034 to reach USD 1,468.93 Million by 2034.

Model-based simulation dominated the United States medical simulation market with a share of 32%, driven by the widespread use of physical mannequins and anatomical models that provide essential hands-on learning experiences for developing fundamental clinical skills.

Key factors driving the United States medical simulation market include increasing emphasis on patient safety and medical error reduction, rapid technological advancements including VR and AR integration, growing adoption of simulation-based medical education, expansion of cloud-based simulation platforms, and development of customized specialty-specific simulation solutions.

Major challenges include high initial investment and ongoing maintenance costs, shortage of trained simulation educators and operators, integration difficulties with existing curricula and workflows, resistance to change among traditional educators, and the need for standardized frameworks for curriculum design and competency assessment.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)