United States Mattress Market Size, Share, Trends and Forecast by Product, Distribution Channel, Size, Application, and Region, 2026-2034

United States Mattress Market Size and Share:

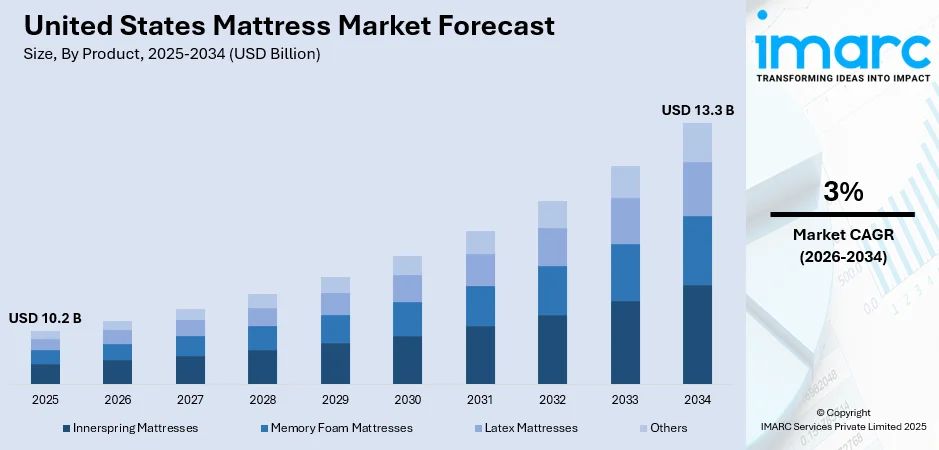

The United States mattress market size was valued at USD 10.2 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 13.3 Billion by 2034, exhibiting a CAGR of 3% from 2026-2034. The rising demand for premium and customizable products that cater to consumer health and comfort needs has significantly contributed to the U.S. mattress market share, reflecting consumers' growing preference for high-quality and personalized sleep solutions. Moreover, technological innovations, expanding online retail channels, and evolving lifestyle preferences are key factors shaping the industry.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 10.2 Billion |

| Market Forecast in 2034 | USD 13.3 Billion |

| Market Growth Rate (2026-2034) | 3% |

Access the full market insights report Request Sample

Rising consumer awareness of the importance of good quality sleep for overall health and well-being is driving the United States mattress market. Consumers are inclining towards high-quality mattresses with features like temperature control and changeable support systems that grow the overall demand. For instance, in August 2024, Brooklyn Bedding launched the Titan Plus Elite, a luxury mattress that offers heavy-duty support, advanced cooling features, and premium comfort while supporting weights of up to 1,000 pounds. Additionally, the growth of e-commerce platforms has simplified mattress purchases, offering consumers a variety of choices and convenience, thereby boosting market penetration. The U.S. mattress industry has also been influenced by the increasing adoption of online reviews and virtual trials, which shape consumer preferences and drive sales.

To get more information on this market Request Sample

Moreover, the expanding real estate sector, coupled with a growing trend toward home renovations, has contributed to the rising demand for mattresses in the U.S. The surge in disposable income and shifting lifestyles have prompted consumers to prioritize comfort and invest in high-quality sleep solutions. Moreover, innovations in environmentally sustainable and eco-conscious mattress materials are appealing to green-minded consumers, significantly driving the expansion of the market. For instance, in 2025, Bedding Industries of America (BIA) is re-launching its Harvest Green mattress collection in the Las Vegas Market, featuring enhanced organic materials, updated designs, and a streamlined three-model lineup. As consumer preferences shift, producers are consistently developing new solutions to address the growing need for resilient, personalized, and wellness-focused offerings.

United States Mattress Market Trends:

Increasing Popularity of Smart Mattresses

Technological advancements are driving the adoption of smart mattresses, offering features such as sleep tracking, temperature control, and adjustable firmness. These innovations cater to health-conscious consumers seeking improved sleep quality and personalized comfort. Smart mattresses often integrate IoT technology, providing real-time data to enhance well-being and convenience. The growing focus on the connection between sleep and overall health is encouraging manufacturers and consumers to invest in advanced designs and features. For instance, in July 2024, Prisma Health unveiled smart mattresses with Hercules Patient Repositioning Technology, as part of a USD 41 Million investment. This enables a single nurse to reposition patients quickly, improving safety, reducing staff injuries, and enhancing overall patient care efficiency. With increasing awareness of the importance of restorative sleep, U.S. mattress market growth is projected to rise, propelled by consumer preferences for premium, tech-enabled products that seamlessly combine luxury with functionality.

Emphasis on Sustainable Manufacturing

Sustainability is emerging as a defining factor in the U.S. mattress market, with consumers favoring products made from eco-friendly materials like organic cotton, natural latex, and recycled fibers. Brands are adopting sustainable practices, including the use of renewable resources and recyclable packaging, to meet the rising demand for environmentally conscious options. In addition, certifications enhance consumer trust by verifying the quality and sustainability of products, hence further supporting the market. For instance, in September 2024, Avocado Green Mattress, based in Los Angeles, earned the EWG Verified mark for its full range of adult, kids', and crib mattresses, ensuring transparency and safety by avoiding harmful chemicals. This trend reflects a broader shift toward responsible consumption, as consumers increasingly prioritize the environmental impact of their purchases. Furthermore, businesses are responding with innovations to align with evolving expectations, ensuring competitive positioning in a sustainability-driven market.

Expanding Online Sales Channels

E-commerce is reshaping consumer behavior in the mattresses market in the United States, with online platforms offering convenience and competitive pricing. Direct-to-consumer brands have gained traction by simplifying the purchasing process through bed-in-a-box models, free trials, and easy returns. For instance, in January 2025, Amerisleep, a U.S based online retailer brand, launched the AS6 Black Series, a luxury mattress tailored for hot sleepers. The brand is recognized for its quality offerings, including the AS3 for side sleepers. These features resonate with modern buyers who value efficiency and transparency. The pandemic accelerated the shift to digital shopping, highlighting the importance of virtual consultations, detailed product descriptions, and customer reviews in decision-making. The online channel’s rapid growth is redefining traditional retail models, compelling manufacturers and sellers to optimize digital strategies to capitalize on this evolving trend.

United States Mattress Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States mattress market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product, distribution channel, size, and application.

Analysis by Product:

- Innerspring Mattresses

- Memory Foam Mattresses

- Latex Mattresses

- Others

Innerspring mattresses dominate the U.S. mattress market due to their widespread availability, affordability, and proven comfort. Known for their durability and support, they feature a coil-based support system that offers enhanced airflow and a responsive sleeping surface. These mattresses appeal to a wide range of customer needs, positioning them as a favored option for households and those mindful of spending. Advancements in hybrid designs, combining innerspring systems with memory foam or latex layers, have further bolstered their appeal. For instance, in January 2024, Englander expanded its Everest luxury innerspring mattress lineup with a new model featuring a cooling cover, 3-degree cooling coils, Englander Edge technology, and copper-infused materials, Talalay latex and copper memory foam for enhanced comfort. Furthermore, their strong market presence reflects their ability to meet both traditional and modern sleep demands effectively.

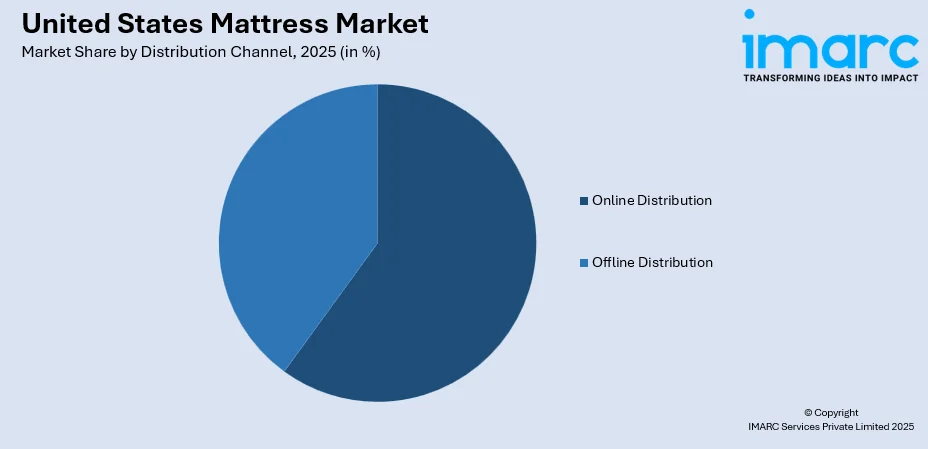

Analysis by Distribution Channel:

To get detailed segment analysis of this market Request Sample

- Online Distribution

- Offline Distribution

Offline channels lead the U.S. mattress market as consumers prefer the tactile experience of testing products in physical stores. Retail outlets, including specialty stores and department chains, allow customers to evaluate mattress quality, comfort, and features before purchasing. For instance, in December 2024, Denver Mattress announced the opening of its new store in Garden City, Kansas, offering high-quality, factory-direct mattresses and exclusive discounts during the grand opening event. Personalized assistance from sales representatives enhances the decision-making process, fostering trust and satisfaction. Additionally, brick-and-mortar stores offer attractive financing options, same-day delivery, and promotional deals, strengthening their appeal. Despite the growth of e-commerce, offline channels remain integral, serving as a trusted medium for purchasing high-value, comfort-driven products like mattresses.

Analysis by Size:

- Twin or Single Size

- Twin XL Size

- Full or Double Size

- Queen Size

- King Size Mattress

- Others

The queen-size mattress dominates the U.S. mattress market demand, as it offers the ideal balance of comfort and practicality for a wide range of consumers. Its dimensions provide ample sleeping space for couples while fitting seamlessly into standard bedrooms, making it a versatile choice for a wide consumer base. The rising preference for spacious yet cost-effective options has driven demand for this segment. For instance, in August 2024, Ikea U.S. announced a new mattress line, including queen-sized options under USD 600, with comfort zones, a 90-day trial, and a 10-year warranty. Additionally, its compatibility with various bed frames and accessories enhances its appeal. As consumer lifestyles evolve, the queen-size mattress remains the preferred option for its practicality, affordability, and adaptability to diverse needs.

Analysis by Application:

- Domestic

- Commercial

The domestic segment leads the U.S. mattress market, driven by consistent demand from households seeking improved sleep quality and comfort. With rising consumer awareness of the health benefits of quality sleep, homeowners increasingly prioritize investing in premium mattresses tailored to personal needs. Additionally, the U.S. mattress market outlook remains strong, supported by factors such as growing homeownership, evolving interior design trends, and the integration of innovative mattress technologies, which further bolster this segment's dominance. Furthermore, the domestic application benefits from heightened online and offline accessibility, ensuring that consumers can select products aligned with their comfort, style, and budget preferences. For instance, as of 2024, Tempur Sealy generates the highest revenue among publicly traded mattress companies online, with USD 4.89 Billion in revenue.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Midwest emerges as the leading regional segment in the U.S. mattress market, driven by its substantial population and rising consumer spending on home furnishings. This region benefits from a strong presence of manufacturing facilities and well-established distribution networks, ensuring widespread product availability. For instance, in June 2024, Sleep Number, a Minneapolis based sleep technology company, launched the c1 queen size smart bed. It features adjustable firmness, breathable comfort, and personalized sleep insights as part of the brand’s Classic Series. Additionally, consumers in the Midwest demonstrate a growing preference for innovative mattress technologies, reflecting increasing awareness of sleep health. Besides this, the affordability of living and consistent housing market growth in the region supports steady demand, positioning the Midwest as a key contributor to the market’s expansion.

Competitive Landscape:

The market is witnessing intense industry competition as companies are creating better products at top quality levels for their customers. Leading companies compete to reach U.S. market dominance by creating innovative sleep technology and bringing diverse mattress choices at competitive prices. For instance, in August 2024, Mattress Firm offered nearly 600 U.S. athletes returning from Paris a premium Sleepy’s by Sealy mattress. The mattress aims to provide optimal comfort and recovery, supporting athletes in improving their sleep quality as they rest and celebrate their achievements. Moreover, increasing demand for eco-friendly materials and customizable options has prompted manufacturers to adopt sustainable practices and cater to evolving consumer preferences. The rise of e-commerce platforms has further intensified competition, enabling brands to reach broader audiences while offering convenience and affordability. Furthermore, this competitive landscape motivates market players to continuously enhance product performance, refine marketing strategies, and expand distribution channels to maintain their foothold in the industry.

The report provides a comprehensive analysis of the competitive landscape in the United States mattress market with detailed profiles of all major companies, including:

- Serta Simmons Bedding LLC

- Tempur Sealy International Inc.

- Casper Inc.

- Saatva Inc.

- Purple Innovations Inc.

- Spring Air International

- Sleep Number Corporation

- Tuft & Needle LLC

- Kingsdown Mattress

- Corsicana Mattress Company

Latest News and Developments:

- In January 2024, Serta Simmons Bedding announced seven new collections for Serta and Beautyrest. These innovative products, offering clear value and retail opportunities, will debut at Winter Las Vegas Market for preview and advance ordering.

- In April 2024, Brooklyn Bedding launched its first kids' mattress, BB Kids, starting at USD 265. It is designed in the U.S. to prioritize safety, comfort, and durability, featuring certified foams and a stain-resistant, environmentally friendly cover.

- In September 2024, BASF partnered with Future Foam, a U.S. based foam company, to produce flexible foam for bedding using 100% U.S.-made BMB Lupranate T 80 TDI. This partnership emphasizes sustainability, reducing environmental impact, and advancing renewable raw materials in the bedding industry.

- In December 2024, Avocado Green Mattress partnered with Sika Health to enable customers to use HSA/FSA funds for organic sleep products. This partnership simplifies health-related purchases, promoting wellness through certified non-toxic materials and sustainable sleep solutions.

United States Mattress Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | Innerspring Mattresses, Memory Foam Mattresses, Latex Mattresses, Others |

| Distribution Channels Covered | Online Distribution, Offline Distribution |

| Sizes Covered | Twin or Single Size, Twin XL Size, Full or Double Size, Queen Size, King Size Mattress, Others |

| Applications Covered | Domestic, Commercial |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States mattress market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States mattress market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States mattress industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States mattress market was valued at USD 10.2 Billion in 2025.

The market is driven by rising awareness of quality sleep's health benefits, demand for innovative and customizable products, advancements in materials and technologies, and the growth of online retail channels enhancing accessibility and convenience for consumers.

IMARC estimates the United States mattress market to reach USD 13.3 Billion by 2034, exhibiting a CAGR of 3% during 2026-2034.

Midwest leads the United States mattress market by region, driven by its strong manufacturing base, affordable housing trends, and high population density in urban areas. Additionally, the region's preference for value-driven purchases aligns with competitive pricing strategies, fostering demand across both traditional retail outlets and e-commerce platforms.

Some of the major players in the United States mattress market include Serta Simmons Bedding LLC, Tempur Sealy International Inc., Casper Inc., Saatva Inc., Purple Innovations Inc., Spring Air International, Sleep Number Corporation, Tuft & Needle LLC, Kingsdown Mattress, Corsicana Mattress Company, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)