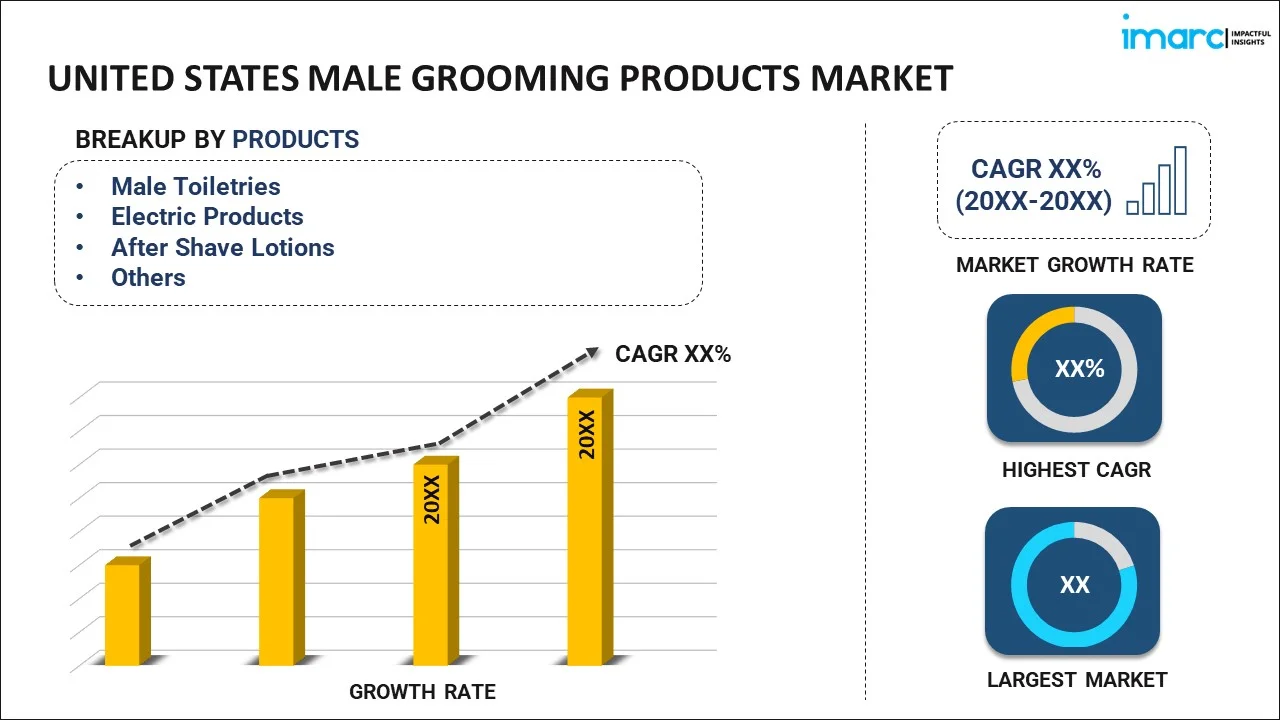

United States Male Grooming Products Market Size, Share, Trends and Forecast by Product, Price Range, Distribution Channel, and Region, 2026-2034

United States Male Grooming Products Market Summary:

The United States male grooming products market size was valued at USD 19,172 Million in 2025 and is projected to reach USD 28,781.48 Million by 2034, growing at a compound annual growth rate of 4.62% from 2026-2034.

The United States male grooming products market is experiencing robust expansion driven by evolving perceptions of masculinity and increasing emphasis on personal wellness among male consumers. Growing awareness about skincare benefits, rising demand for specialized grooming solutions, and the proliferation of accessible product offerings across retail channels are collectively strengthening the United States male grooming products market share.

Key Takeaways and Insights:

- By Product: Male toiletries dominate the market with a share of 49% in 2025, driven by the universal necessity of daily hygiene products including deodorants, shampoos, and body washes across diverse demographic groups and age brackets.

- By Price Range: Mass products lead the market with a share of 72% in 2025, owing to their affordability and widespread availability across retail chains, enabling accessibility for budget-conscious consumers seeking effective grooming solutions.

- By Distribution Channel: Supermarkets and hypermarkets represent the largest segment with a share of 46% in 2025, reflecting consumer preference for one-stop shopping convenience and the ability to physically examine products before purchase.

- By Region: Midwest leads the market with a share of 29% in 2025, supported by the abundance of supermarkets, hypermarkets, and established retail infrastructure facilitating product accessibility across urban and suburban areas.

- Key Players: Leading manufacturers are driving market growth by expanding product portfolios, investing in innovative formulations, enhancing digital engagement strategies, and forming strategic partnerships with retailers and celebrity endorsers to strengthen brand recognition and consumer loyalty.

The United States market for male grooming products is undergoing revolutionary growth due to increasingly shifting societal views about masculinity, resulting in enhanced engagement in overall personal self-grooming practices. The rising wave of engagement in grooming practices has been particularly driven by Generation Z and millennial generations in the United States. Social media platforms have resulted in dramatic shifts in consumer engagement with product knowledge and awareness. Online engagement platforms have created communities for open discussions about grooming practices and product recommendations. The emergence of celebrity-endorsed grooming product brands has normalized personal grooming practices for males in overall mainstream retail channels. Males have come to realize for themselves that investing in high-quality grooming brands has a direct impact on their overall professional look and confidence in addition to overall health and well-being. Overall wellness trends have brought grooming practices firmly into sectors related to overall health and well-being, rather than practices exclusive to females in search of grooming.

United States Male Grooming Products Market Trends:

Increased Skin Care Adoption Amongst Younger Male Populations

The male skincare segment is still growing at a record rate in the US market, driven by Gen Z and millennial customers who consider grooming as part of general well-being. This is demographically changing how companies approach marketing and product development. Younger males, in particular, are joining moisturizers, cleansers, and targeted treatments in their daily routines-forcing companies to create formulas targeting concerns specific to male skin, including hydration, anti-aging properties, and acne prevention-already influenced by social media and shifting ideas of what manicuring means for men.

E-Commerce Channel Expansion and Digital Shopping Preferences

Digital commerce is rapidly emerging as a preferred purchasing channel for male grooming products, offering convenience, diverse product selection, and personalized shopping experiences. Online platforms enable consumers to research ingredients, compare products, and access subscription-based services from home. Research from e-commerce analytics indicates that male shoppers in the United States are spending approximately four times more of their skincare and grooming budgets on Amazon compared to specialty beauty retailers, reflecting the growing importance of digital channels in consumer purchasing decisions.

Celebrity-Driven Brand Innovation and Market Expansion

High-profile celebrity entrepreneurs are entering the male grooming space, leveraging their influence to normalize self-care practices and expand product accessibility. These ventures combine authentic brand messaging with affordable pricing strategies targeting mainstream consumers. In March 2024, Dwayne Johnson launched Papatui, a comprehensive men's personal care line featuring face care, body care, hair care, and tattoo care products priced under $10, exclusively available at Target stores nationwide, demonstrating celebrity-backed innovation driving category expansion.

Market Outlook 2026-2034:

The United States male grooming products market outlook remains positive as manufacturers continue introducing innovative formulations addressing specific consumer concerns including anti-aging, moisturization, and natural ingredients. Growing emphasis on personalized grooming solutions and multi-functional products is reshaping product development priorities across the industry. Expanding retail partnerships, digital marketing sophistication, premiumization strategies, and enhanced e-commerce capabilities will continue supporting sustained market expansion throughout the forecast period as male consumers increasingly embrace comprehensive self-care routines. The market generated a revenue of USD 19,172 Million in 2025 and is projected to reach a revenue of USD 28,781.48 Million by 2034, growing at a compound annual growth rate of 4.62% from 2026-2034.

United States Male Grooming Products Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product |

Male Toiletries |

49% |

|

Price Range |

Mass Products |

72% |

|

Distribution Channel |

Supermarkets and Hypermarkets |

46% |

|

Region |

Midwest |

29% |

Product Insights:

To get detailed segment analysis of this market, Request Sample

- Male Toiletries

- Electric Products

- After Shave Lotions

- Others

Male toiletries dominate with a market share of 49% of the total United States male grooming products market in 2025.

Male toiletries encompassing deodorants, shampoos, body washes, and basic shaving supplies represent essential daily hygiene products with universal consumer demand across all demographic segments. The category benefits from high product turnover rates requiring regular replenishment, ensuring consistent revenue generation and sustained market presence. Digital commerce platforms have expanded product accessibility, enabling convenient purchasing and subscription-based replenishment services that further strengthen consumer engagement with essential toiletry categories. According to the Census Bureau, United States retail e-commerce sales reached approximately $289.2 Billion in the first quarter of 2024, supporting expanded digital availability of toiletry products.

The segment's dominance reflects fundamental consumer needs for personal hygiene maintenance across professional, social, and recreational contexts. Mass-market toiletry brands continue strengthening their positions through accessible pricing strategies, widespread retail distribution, and product innovation addressing specific concerns including sensitive skin formulations, natural ingredient compositions, and enhanced fragrance profiles. Manufacturers are continuously refining formulations to meet evolving consumer preferences while maintaining competitive price points that ensure broad market accessibility.

Price Range Insights:

- Mass Products

- Premium Products

Mass products lead with a share of 72% of the total United States male grooming products market in 2025.

Mass-market grooming products maintain dominant market positioning through competitive pricing strategies enabling broad consumer accessibility across diverse income levels. These products leverage established distribution networks spanning supermarkets, hypermarkets, drugstores, and convenience retailers, maximizing consumer touchpoints and purchase convenience. In April 2024, LeBron James and Maverick Carter launched The Shop Men's Grooming Line exclusively at over 1,600 Walmart stores, with all products priced under ten dollars to ensure accessibility.

The segment's strength derives from value-conscious purchasing behavior among mainstream consumers seeking effective grooming solutions without premium pricing. Major manufacturers continue investing in mass-market product innovation, improving formulations and packaging while maintaining affordable price points that attract budget-minded shoppers seeking quality-to-price optimization across their personal care purchases. Retailers support this segment through promotional strategies, bulk offerings, and loyalty programs that encourage repeat purchases and brand engagement among cost-sensitive consumers prioritizing functional performance over luxury positioning.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Pharmacy Stores

- Online Stores

- Others

Supermarkets and hypermarkets exhibit a clear dominance with a 46% share of the total United States male grooming products market in 2025.

Supermarkets and hypermarkets act as key places of retail purchase for male grooming products due to one-stop shopping convenience along with purchases of essential household products. Large-format retailers offer a wide range of product SKUs, competitive pricing, and allow physical examination of products, which appeals to a consumer who would prefer to shop in-store. The channel draws on established consumer trust, strategic location of stores, and is often able to embed grooming purchases into routine shopping trips, which minimizes friction and allows impulse purchases among male consumers who are less familiar with the category.

The dominance of this channel reflects entrenched consumer shopping patterns toward consolidated purchasing trips and a desire for product availability. Meanwhile, retailers have continued to develop dedicated grooming sections, exclusive brand partnerships, and improved in-store merchandising in an effort to capture growing interest among male consumers and as a reliable counter to the increasingly viable digital commerce alternatives. Strategic shelf placement, promotional displays, and knowledgeable staff recommendations further support the in-store experience, driving discovery and conversion among consumers who need guidance in navigating expanding product selections.

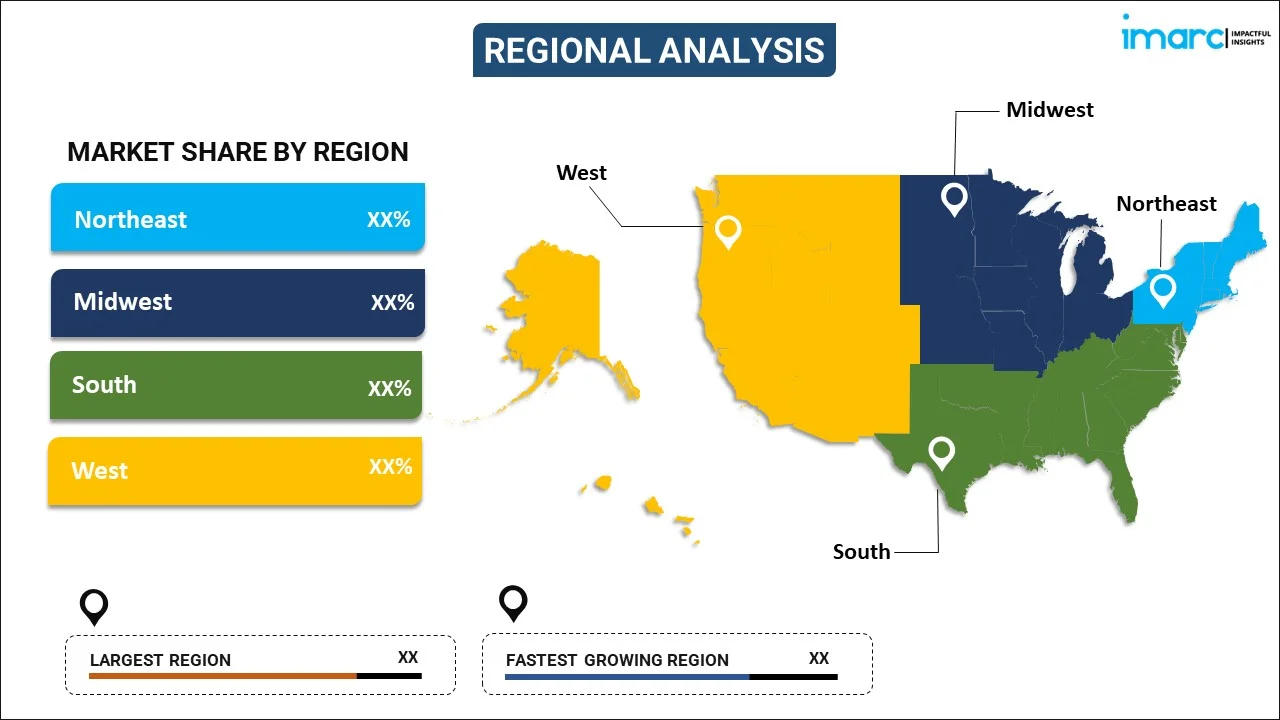

Regional Insights:

To get detailed regional analysis of this market, Request Sample

- Northeast

- Midwest

- South

- West

Midwest represents the leading segment with a 29% share of the total United States male grooming products market in 2025.

The Midwest region maintains market leadership supported by extensive retail infrastructure including numerous supermarkets, hypermarkets, and established retail chains facilitating convenient product accessibility. The region's demographic composition featuring significant middle-income populations creates favorable demand conditions for mass-market grooming products. Strong brand presence across major metropolitan areas combined with competitive retail environments encourages product availability and promotional activities that drive consumer engagement and repeat purchasing behavior among value-conscious male shoppers seeking quality grooming solutions.

Regional market strength reflects robust retail penetration, competitive pricing environments, and growing consumer awareness regarding personal grooming benefits. Urban centers throughout the Midwest continue demonstrating strong demand for both essential toiletries and emerging skincare categories as male consumers increasingly prioritize appearance and self-care practices across professional and social contexts. Suburban expansion and evolving lifestyle preferences further support market growth as grooming routines become integrated into daily wellness practices among diverse consumer segments throughout the region.

Market Dynamics:

Growth Drivers:

Why is the United States Male Grooming Products Market Growing?

Shifting Perceptions of Masculinity and Self-Care Normalization

Cultural attitudes toward male grooming have undergone fundamental transformation, with self-care practices increasingly viewed as essential components of overall health and professional presentation rather than vanity-driven behaviors. Social media platforms and digital influencers have played instrumental roles in normalizing comprehensive grooming routines among male consumers, particularly younger demographics who view personal care as integral to wellness and confidence. Generation Z and millennial male personal care users indicate that social media has influenced them to prioritize grooming, demonstrating digital platforms' powerful impact on consumer behavior. This cultural shift enables brands to expand product offerings and marketing strategies targeting male audiences increasingly receptive to skincare, haircare, and specialized grooming solutions.

Rising Health and Wellness Consciousness Among Male Consumers

A growing number of male consumers are embracing holistic approaches to personal wellbeing that take into account not only fitness and nutrition but also physical attractiveness. Demand for specialist grooming products that address particular issues has increased due to growing understanding of the benefits of skincare, such as managing acne, preventing dryness, and preventing aging. Customers are looking for formulations devoid of potentially hazardous chemicals, which is reflected in the growing emphasis on natural and organic ingredients. Men are realizing that grooming products assist long-term category growth by maintaining skin health and general wellbeing. Because consumers invest in higher-quality items that are thought to provide superior efficacy and ingredient safety, this health-oriented attitude promotes premiumization.

Expanding Retail Accessibility and Digital Commerce Growth

The proliferation of male grooming products across diverse retail channels has significantly enhanced consumer accessibility and purchase convenience. Supermarkets, hypermarkets, drugstores, and specialty retailers have expanded dedicated grooming sections featuring comprehensive product assortments targeting male consumers. Simultaneously, e-commerce platforms offer extensive product selections, competitive pricing, and subscription-based services enabling convenient replenishment. According to industry analysis, male shoppers are spending approximately 54% of their skincare and grooming budgets on Amazon, compared to only 14% at specialty beauty retailers, highlighting digital commerce's growing importance. This multi-channel accessibility enables consumers to discover, compare, and purchase grooming products through their preferred shopping modalities, supporting overall market expansion.

Market Restraints:

What Challenges the United States Male Grooming Products Market is Facing?

Severe Competitive Forces and Market Fragmentation

The market has intense competitive challenges from existing brands, new direct-to-consumer companies emerging in the market, as well as celebrities who invest in companies. In a market where people are becoming increasingly health-conscious due to a focus on fitness and well-being, conventional brands will face intense competition from new companies emerging as a result of celebrities or being new direct-to-consumer startups.

Ingredient Sensitivity & Product Safety Concerns

With heightened awareness of potentially dangerous ingredients in grooming products that might cause skin problems, the formulations used in these products have gained significant attention. Skin allergies, irritation, and sensitivities are factors that influence purchasing decisions, requiring manufacturers to prioritize cleaner ingredient compositions and transparent labeling to address growing consumer concerns effectively.

Regulatory Scrutiny and Marketing Compliance Requirements

Government authorities and relevant regulations maintain strict guidelines on product claims and marketing practices. This has posed challenges for manufacturers seeking to incorporate compliance within captivating product messaging. Limitations on unsubstantiated claims regarding natural and organic products have created obstacles for marketing strategies, requiring careful documentation and verification of all promotional content.

Competitive Landscape:

The competitive dynamics of the male grooming products market in the United States can be described as dynamic, with established multinational companies competing with newer direct-to-consumer brands as well as celebrity-championed brands. The key players are innovating in terms of product offerings, portfolio, and retail collaborations to improve their market performance. They are investing in building effective digital engagement capabilities, influencer programs, and sustainable practices to differentiate themselves in the market. The mergers and acquisitions in the industry function as a result of strategic moves to target the growth opportunities in the high-end/natural segments.

Recent Developments:

- In June 2025, Unilever announced the acquisition of Dr. Squatch, a natural men's personal care brand, from Summit Partners. The acquisition marks Unilever's strategic expansion into the premium men's grooming segment, with plans to scale the direct-to-consumer brand internationally while maintaining its distinctive natural product positioning and viral social media marketing approach.

United States Male Grooming Products Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Male Toiletries, Electric Products, After Shave Lotions, Others |

| Price Ranges Covered | Mass Products, Premium Products |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Pharmacy Stores, Online Stores, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The United States male grooming products market size was valued at USD 19,172 Million in 2025.

The United States male grooming products market is expected to grow at a compound annual growth rate of 4.62% from 2026-2034 to reach USD 28,781.48 Million by 2034.

Male toiletries dominated the market with a share of 49%, driven by universal consumer demand for essential hygiene products including deodorants, shampoos, and body washes across diverse demographic groups.

Key factors driving the United States male grooming products market include evolving perceptions of masculinity, rising health and wellness consciousness, expanding retail accessibility, digital commerce growth, and celebrity-driven brand innovation.

Major challenges include intense competitive pressure among brands, ingredient sensitivity and product safety concerns, regulatory compliance requirements, and the need to navigate evolving consumer preferences across demographic segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)