United States Luxury Hotel Market Size, Share, Trends and Forecast by Type, Room Type, Category and Region, 2026-2034

United States Luxury Hotel Market Summary:

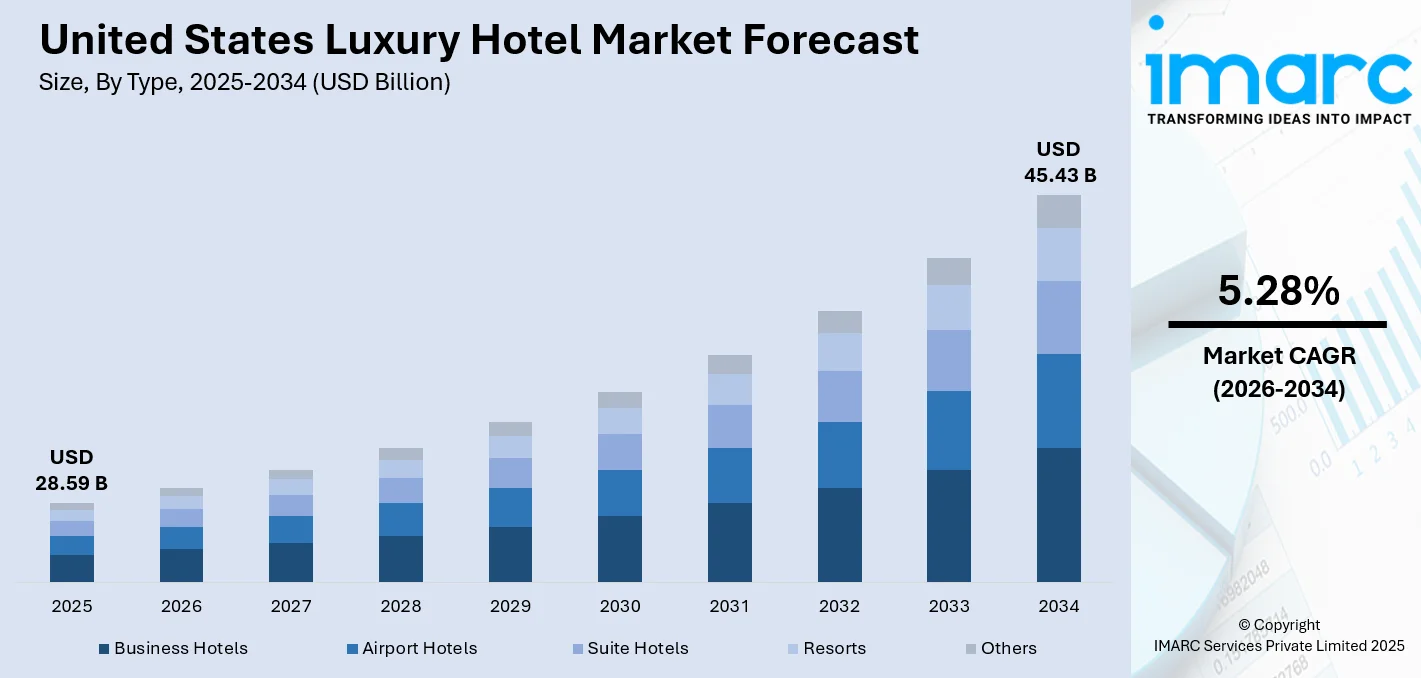

The United States luxury hotel market size was valued at USD 28.59 Billion in 2025 and is projected to reach USD 45.43 Billion by 2034, growing at a compound annual growth rate of 5.28% from 2026-2034.

The current state of the luxury hotel industry in the United States is one that is growing from strength to strength, thanks to an increasing demand for upscale hotel experiences, a rising level of disposable income for affluent customers, and a thriving tourist economy that draws people from all over to experience this great nation. An increasingly savvy customer base is turning to more experiential and personalized luxury as opposed to physical luxury. Technology and a push for sustainable practices are shaping this industry.

Key Takeaways and Insights:

-

By Type: Business hotels dominates the market with a share of 26% in 2025, driven by the strong recovery of corporate travel, increasing demand for premium meeting facilities, and the growing prevalence of bleisure travel combining business and leisure purposes.

-

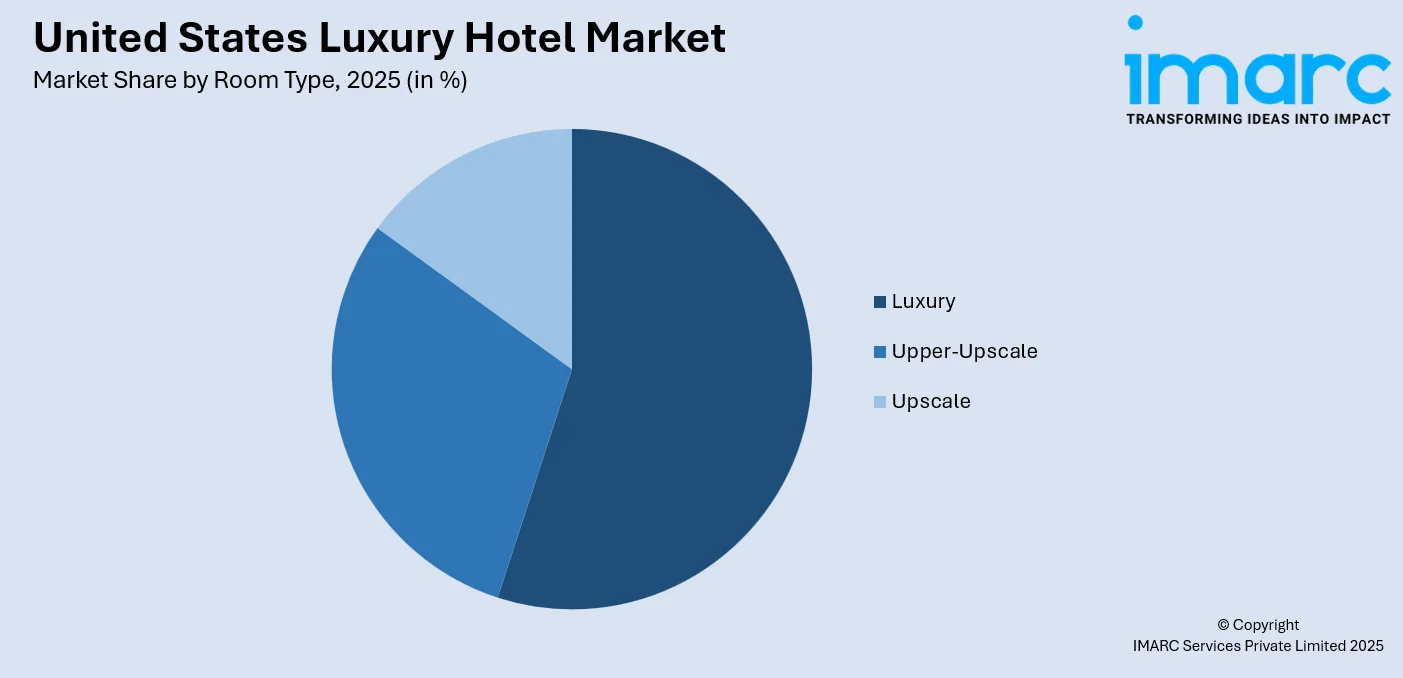

By Room Type: Luxury lead the market with a share of 42% in 2025, reflecting affluent travelers' preferences for exclusive accommodations featuring premium amenities, personalized services, and distinctive design elements.

-

By Category: Chain dominate with a market share of 78% in 2025, attributed to established brand recognition, extensive loyalty programs, consistent service standards, and strategic global distribution networks.

-

By Region: South leads the market with a share of 34% in 2025, driven by strong leisure tourism in Florida and Texas, diverse resort destinations, favorable climate conditions, and expanding business activity across major metropolitan areas.

-

Key Players: The United States luxury hotel market features major global hospitality corporations including established luxury brands and emerging lifestyle hotel concepts. Leading companies focus on portfolio expansion, brand differentiation, technological innovation, and sustainability initiatives to capture market share across diverse traveler segments.

To get more information on this market Request Sample

The United States maintains its position as the world's largest luxury hotel market, benefiting from a diverse landscape of urban destinations, resort locations, and business hubs attracting premium travelers. In November 2025, Marriott International raised its full-year profit forecast for 2025, driven in large part by resilient demand in its upscale and luxury hotel portfolio, reflecting stronger spending on premium stays even as broader travel patterns fluctuate. The market has demonstrated strong recovery from pandemic-era disruptions, with domestic travel exceeding historical volumes and international arrivals approaching pre-pandemic levels. Growing numbers of high-net-worth individuals drive demand for exclusive accommodations delivering customized experiences, while shifting consumer preferences emphasize experiential value over traditional luxury markers. The evolution of hybrid work arrangements has transformed travel patterns, creating new opportunities through extended stays and the integration of business and leisure purposes.

United States Luxury Hotel Market Trends:

Bleisure Travel and Extended Stay Demand

The convergence of business and leisure travel represents a transformative trend reshaping the luxury hotel landscape. According to a 2025 report, U.S. luxury hotel travelers increasingly prefer unique, sustainable stays and bleisure trips, while interest in travel perks and upgrades declines among wealthy visitors. A substantial majority of business travelers now blend work and leisure activities during trips, with many extending corporate visits to incorporate personal vacation time. Luxury hotels are adapting through flexible workspace suites, high-bandwidth connectivity, wellness-oriented amenities, and extended-stay packages that accommodate evolving guest expectations.

Wellness Tourism and Experience-Driven Hospitality

The integration of wellness into luxury hospitality is accelerating as affluent travelers seek holistic health experiences. In July 2025, Marriott International’s Luxury Group launched the “Luxury Wellbeing Series,” with properties like Mandapa, a Ritz‑Carlton Reserve, and The St. Regis Goa offering immersive, tailored wellness journeys encompassing physical, mental, and nutritional wellbeing. Luxury hotels increasingly position spa treatments, fitness programs, and nutritional dining as core offerings, leveraging the growing wellness tourism sector to attract health-conscious guests and differentiate themselves in competitive markets.

Direct Digital Booking and Technology Integration

The shift toward direct digital booking channels is reducing distribution costs while enhancing guest relationship management. In November 2025, Marriott International reported that its Bonvoy loyalty program added 12 million members in the third quarter, bringing total global membership to nearly 260 million. Hotel executives cited this growth as evidence of strong engagement on direct channels, which helps reduce reliance on third-party booking platforms. Luxury hotels are investing in proprietary booking systems, mobile apps, and data analytics to personalize services, improve operational efficiency, and enhance guest satisfaction across all touchpoints.

Market Outlook 2026-2034:

The United States luxury hotel market outlook remains positive, supported by resilient domestic travel demand, recovering international arrivals, and continued expansion of high-net-worth populations. Major hospitality companies maintain robust development pipelines with significant room additions planned across luxury and upper-upscale segments. The emphasis on experiential travel, wellness-centric offerings, and sustainable operations will continue differentiating successful properties in competitive markets. Gateway cities and established resort destinations will maintain strong performance, while emerging destinations in the South and West regions present growth opportunities. The market generated a revenue of USD 28.59 Billion in 2025 and is projected to reach a revenue of USD 45.43 Billion by 2034, growing at a compound annual growth rate of 5.28% from 2026-2034.

United States Luxury Hotel Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Business Hotels | 26% |

| Room Type | Luxury | 42% |

| Category | Chain | 78% |

| Region | South | 34% |

Type Insights:

- Business Hotels

- Airport Hotels

- Suite Hotels

- Resorts

- Others

The business hotels dominates with a market share of 26% of the total United States luxury hotel market in 2025.

Business hotels serve as essential infrastructure for corporate travel, providing executives and professionals with premium accommodations optimized for productivity and networking. In early 2025, Hilton Worldwide reported a more than 3% year‑over‑year increase in business travel revenue per available room (RevPAR), driven by strong demand from large corporate clients and meetings, underscoring the rebound in corporate travel and the value of business‑oriented hotel inventory. These properties feature sophisticated meeting facilities, high-speed connectivity, concierge services, and strategic locations in central business districts of major metropolitan areas.

The development and expansion of business hotels see a growing incorporation of lifestyle components relevant to the interface between business and leisure travel. The integrated experience is offered by providing high-end culinary offerings, wellness facilities, and adaptable space that can be shared by guests. The big players in the hospitality industry remain engaged in developing business hotels in gateway destinations and growing commercial hubs due to the continued interest shown by business travelers.

Room Type Insights:

Access the comprehensive market breakdown Request Sample

- Luxury

- Upper-Upscale

- Upscale

The luxury leads with a share of 42% of the total United States luxury hotel market in 2025.

Luxury accommodations are the epitome of hotel experiences, as they provide exclusive amenities, superior service quality, and distinct interior designs that provide value for money. This segment is targeted at high-net-worth individuals and/or people seeking personalized service, generous space, and upscale amenities such as spa facilities, fine dining, and other related services. This focus on intangible value and less emphasis on materialism are reflective of changing consumer trends.

The luxury market is witnessing increasing differentiation based on unique positioning, in terms of wellness offerings, culinary, cultural, and sustainable elements. The suite accommodations taking up substantial market share are reflecting residential-style elements for convenience of longer-stay and family clientele. The luxury market is recognizing strength in revenue per available room, thereby continuing investments in luxury projects and renovating existing luxury hotels in key markets.

Category Insights:

- Chain

- Independent

The chain dominates with a market share of 78% of the total United States luxury hotel market in 2025.

Chain-operated luxury hotels maintain market leadership through established brand recognition, extensive loyalty programs, and consistent service delivery standards across global portfolios. In 2025, Hyatt Hotels Corporation announced that its World of Hyatt loyalty program surpassed 60 million members and expanded its collaboration with Chase to deepen engagement and rewards for frequent travelers, reinforcing how leading hospitality chains leverage loyalty ecosystems to drive repeat stays and brand preference. Major hospitality corporations leverage sophisticated distribution networks, centralized marketing resources, and operational expertise to optimize revenue performance and guest satisfaction.

Leading hotel chains continue expanding luxury portfolios through strategic acquisitions, new brand introductions, and management agreements with independent properties seeking brand affiliation benefits. The soft brand collection model enables chains to incorporate distinctive independent properties while providing owners with distribution and loyalty program access. This approach supports portfolio diversification while maintaining the authentic character and local relevance increasingly valued by contemporary luxury travelers.

Regional Insights:

- Northeast

- Midwest

- South

- West

South exhibits a clear dominance with a 34% share of the total United States luxury hotel market in 2025.

The South region benefits from diverse hospitality offerings spanning urban business destinations, coastal resort communities, and leisure attractions generating year-round demand. Florida markets including Miami, Orlando, and emerging destinations attract substantial international and domestic visitation, while Texas cities demonstrate strong growth in both corporate and leisure segments. The region's favorable climate conditions support extended tourism seasons and outdoor-oriented resort experiences appealing to luxury travelers.

Major hospitality investments continue flowing into Southern markets through new hotel developments, resort expansions, and comprehensive property renovations. The region demonstrates strong performance metrics including occupancy rates, average daily rates, and revenue per available room growth exceeding national averages. Emerging destinations beyond established markets present opportunities for luxury hotel development addressing underserved demand in growing metropolitan areas and distinctive leisure destinations.

Market Dynamics:

Growth Drivers:

Why is the United States Luxury Hotel Market Growing?

Growing High-Net-Worth Population and Discretionary Spending

The expanding population of high-net-worth individuals drives sustained demand for luxury hotel accommodations delivering exclusivity, premium services, and customized experiences. By mid-2025, about 510,810 ultra-high-net-worth individuals valued over $30 million were reshaping luxury hospitality with personalized, immersive travel preferences. Ultra-high-net-worth travelers controlling substantial wealth demonstrate preferences for experiential luxury, generating demand for distinctive properties offering personalized itineraries and exclusive access. Rising disposable incomes among affluent demographics support increased spending on premium travel experiences, with luxury lodging capturing growing share of consumer discretionary expenditure. This demographic tailwind provides fundamental support for market growth through mid-decade.

Strong Tourism Recovery and International Visitor Growth

The robust recovery of domestic and international travel volumes provides substantial growth momentum for the luxury hotel market. Domestic travel has exceeded historical volumes with Americans demonstrating strong propensity for leisure and business travel, while international arrivals approach pre-pandemic baselines with continued growth projected, with global international tourist arrivals climbing over 1.1 billion between January and September 2025, a rise of roughly 50 million compared with the same period in 2024, underscoring sustained global travel demand. Gateway cities including New York, Los Angeles, and Miami post visitor volumes supporting premium hotel demand and rate growth. The diversification of source markets, with particular strength from emerging economies, supports occupancy performance across luxury hotel portfolios in major destinations.

Consumer Preference Shift Toward Experiential Luxury

Evolving consumer preferences increasingly prioritize unique experiences, personalized services, and authentic cultural connections over traditional luxury markers. In 2025, luxury travelers rejected standardized offerings, favoring heritage-rich, distinctive experiences, with about 89% of affluent respondents seeking hotels that reflect local charm and character, highlighting a major shift toward experiential stays. Travelers across demographic segments, particularly millennials and younger affluent consumers, demonstrate willingness to invest in memorable experiences rather than material possessions. Luxury hotels responding to this shift through curated programming, destination immersion, and wellness-centric offerings capture premium pricing and enhanced guest loyalty. The experiential emphasis drives innovation in service delivery, amenity development, and property design across the luxury hospitality sector.

Market Restraints:

What Challenges the United States Luxury Hotel Market is Facing?

Economic Volatility and Consumer Confidence Sensitivity

Luxury hotel demand is quite sensitive to economic trends. Economic uncertainties, inflationary pressures, as well as recessionary trends, have the potential to affect discretionary spending, especially for purposes of leisure travel. Luxury hotels’ premium price segmentation makes the sector vulnerable to such trends, especially when the economic conditions are recessionary, especially considering that consumers tend to opt for lower-grade hotels.

Alternative Accommodation Competition

The continued growth of alternative accommodation platforms presents competitive pressure on traditional luxury hotels, particularly for leisure travel and extended stays. Premium vacation rental properties offer distinctive experiences, residential amenities, and space configurations appealing to family travelers and groups. Luxury hotels respond through differentiated service delivery, loyalty program value, and experiential programming that alternative accommodations cannot replicate.

Labor Market Challenges and Operating Cost Pressures

Persistent labor market constraints impact luxury hotel operations, particularly for properties dependent on highly trained service personnel delivering exceptional guest experiences. Wage inflation, recruitment difficulties, and retention challenges affect operational efficiency and service quality maintenance. Rising operating costs across categories including labor, energy, and supplies pressure profitability, requiring revenue management discipline and operational innovation.

Competitive Landscape:

The United States luxury hotel market features a competitive landscape dominated by major global hospitality corporations operating extensive portfolios of luxury and upper-upscale brands. Leading companies differentiate through brand positioning, loyalty program ecosystems, and strategic geographic coverage across gateway cities and resort destinations. Competition intensifies as chains race for pipeline dominance through new development agreements, brand acquisitions, and strategic partnerships. Independent luxury hotels maintain meaningful presence through distinctive positioning, authentic character, and local relevance appealing to travelers seeking alternatives to standardized brand experiences. The market supports diverse operating models including traditional ownership, management agreements, and franchise arrangements enabling capital-efficient portfolio expansion.

Recent Developments:

-

In January 2026, Monarch San Antonio, a $185 million luxury hotel development, has announced in San Antonio, Texas. The approximately 200-room upscale property will feature a landmark public sculpture and is scheduled to open on March 3, 2026. The project highlights growing investment in high-end hospitality across major Texas cities.

United States Luxury Hotel Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Business Hotels, Airport Hotels, Suite Hotels, Resorts, Others |

| Room Types Covered | Luxury, Upper-Upscale, Upscale |

| Categories Covered | Chain, Independent |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The United States luxury hotel market size was valued at USD 28.59 Billion in 2025.

The United States luxury hotel market is expected to grow at a compound annual growth rate of 5.28% from 2026-2034 to reach USD 45.43 Billion by 2034.

Business hotels dominate the market with a 26% share, driven by strong corporate travel recovery, increasing demand for premium meeting facilities, and the growing convergence of business and leisure travel purposes among executives and professionals.

Key factors driving the United States luxury hotel market include growing high-net-worth population and discretionary spending, strong tourism recovery and international visitor growth, consumer preference shift toward experiential luxury, increasing adoption of wellness tourism, and technological advancements enhancing guest experiences.

Major challenges include economic volatility and consumer confidence sensitivity affecting discretionary travel spending, competition from alternative accommodation platforms, labor market constraints impacting service delivery, rising operating costs pressuring profitability, and the need for continuous investment in technology and sustainability initiatives.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)