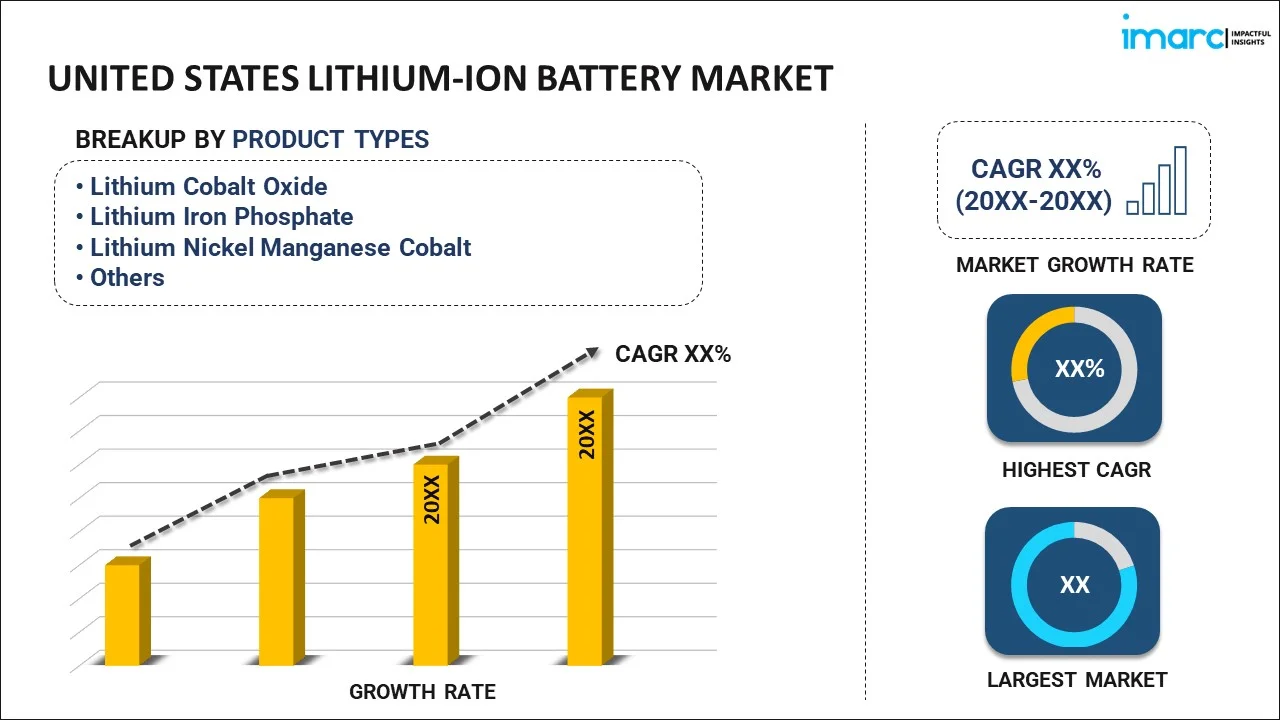

United States Lithium-Ion Battery Market Report by Product Type (Lithium Cobalt Oxide, Lithium Iron Phosphate, Lithium Nickel Manganese Cobalt, Lithium Manganese Oxide, and Others), Power Capacity (0 to 3000mAH, 3000mAH to 10000mAH, 10000mAH to 60000mAH, More than 60000mAH), Application (Consumer Electronics, Electric Vehicles, Energy Storage, and Others), and Region 2026-2034

United States Lithium-Ion Battery Market Size:

The United States lithium-ion battery market size reached USD 15.6 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 38.3 Billion by 2034, exhibiting a growth rate (CAGR) of 10.55% during 2026-2034. The rising focus of key players on using cleaner energy solutions and the shifting consumer preferences towards sustainable modes of transportation and power production are primarily driving the market growth across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 15.6 Billion |

| Market Forecast in 2034 | USD 38.3 Billion |

| Market Growth Rate (2026-2034) | 10.55% |

Access the full market insights report Request Sample

United States Lithium-Ion Battery Market Analysis:

- Major Market Drivers: In the United States, the growing popularity of electric vehicles (EVs) is propelling the demand for lithium-ion batteries, as they have the capacity to store and release energy optimally. Additionally, the inflating adoption of several consumer electronic products, such as smartphones, laptops, tablets, etc., is also stimulating the need for high-capacity and compact batteries with extended lifespans. This, in turn, is acting as a significant growth-inducing factor.

- Key Market Trends: Continuous innovations in battery designs by key players are also positively impacting the market growth across the country. Apart from this, numerous state and federal incentives, such as subsidies and tax credits for the purchases of electric vehicles and renewable energy installations, offered by government bodies are further stimulating the market growth in the United States. Moreover, the rising number of domestic manufacturing activities is also catalyzing the lithium-ion battery market across the country.

- Challenges and Opportunities: Some of the supply chain vulnerabilities, including dependence on important raw materials, can negatively impact production capabilities, thereby disrupting the market growth in the United States. However, government bodies in the country are introducing favorable initiatives to expand domestic production capacities, which will present significant growth opportunities for the market players in the coming years.

United States Lithium-Ion Battery Market Trends:

Increase in Electric Vehicle Production

Continuous innovations in the United States automotive industry are elevating the sales of electric vehicles, that utilize lithium-ion batteries. For example, according to the International Energy Agency, the electric vehicle sales in the country were around 990,000 compared to 630,000, registering a growth rate of more than 57% between 2022 and 2021. As such, these batteries are extensively used to provide a source of power to these automobiles, thereby bolstering their demand in the country. In addition, major companies in the United States, including General Motors and Ford, are developing their targeted strategy to increase the manufacturing capacities of EVs, which, in turn, will continue to augment the market for lithium-ion batteries in the country. Moreover, in 2022, General Motors & Ford, and American companies announced their targeted strategy to manufacture and sell electric vehicles. As such, General Motors set its target to produce 30 EV models and set up a Battery Electric Vehicle (BEV) production capacity of 1 million units in North America by 2025.

The Expansion of Advanced Manufacturing Infrastructures

Novel infrastructures in the United States aid in the innovations and production of lithium-ion batteries. This is further fueled by the wide presence of key manufacturers and research and development (R&D) activities for improving battery technology. Moreover, these infrastructures will provide a competitive edge in the United States. Many companies are further planning to manufacture these batteries, thereby contributing to the market growth. For instance, in October 2022, Honda, a major company, announced its plans to manufacture lithium-ion batteries in the United States. It was planned in 2023 to achieve mass production of advanced lithium-ion battery cells by the end of 2025.

Favorable Policies by the Government Bodies to Support Lithium-Ion Battery Technology

Regulatory bodies in the United States are introducing initiatives and policies to manufacture their products within the country. These include incentives, such as the US$ 17 Billion issued by the lending authority under DOE's Advanced Technology Vehicles Manufacturing Loan. Furthermore, EV manufacturers are taking measures to cater to the escalating demand across the country. For example, thirteen new battery cell giga-factories are expected to come online in the United States by 2025. Numerous automobile manufacturers, including General Motors Company and Ford Motor Company, offer support for their electric vehicle manufacturing and sales.

Strategic collaborations among Leading Players and Research Institutions

The market across the country is also fueled by partnerships that will help to share information and assets, enhance production capacities and methods, increase profitability, etc. Samsung SDI participated in InterBattery 2023. It showcased advanced battery technologies, such as high-efficiency fast charging and all-solid-state batteries. In line with this, these collaborations are aiding the companies to improve their market presence and gain a competitive edge in the market.

The Integration of Renewable Energy Sources

Various producers and large utility plants, such as NextEra, AES, and Invenergy are emphasizing on integration of renewable energy sources, which will bolster the demand for these batteries as efficient energy storage solutions. Renewable solutions are also gaining extensive traction, as they manage intermittent power generation and address several issues, including the increasing consumer consciousness towards environmental sustainability and cost-reduction. To illustrate, the Federal Energy Regulatory Commission (FERC) approved the Order 841 compliance plans, which have created new growth opportunities for the market across the country.

United States Lithium-Ion Battery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type, power capacity, and application.

Product Type Insights:

To get detailed segment analysis of this market Request Sample

- Lithium Cobalt Oxide

- Lithium Iron Phosphate

- Lithium Nickel Manganese Cobalt

- Lithium Manganese Oxide

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes lithium cobalt oxide, lithium iron phosphate, lithium nickel manganese cobalt, lithium manganese oxide, and others.

Power Capacity Insights:

- 0 to 3000mAH

- 3000mAH to 10000mAH

- 10000mAH to 60000mAH

- More than 60000mAH

The report has also provided a detailed breakup and analysis of the market based on the power capacity. This includes 0 to 3000mAH, 3000mAH to 10000mAH, 10000mAH to 60000mAH, and more than 60000mAH.

Application Insights:

- Consumer Electronics

- Electric Vehicles

- Energy Storage

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes consumer electronics, electric vehicles, energy storage, and others.

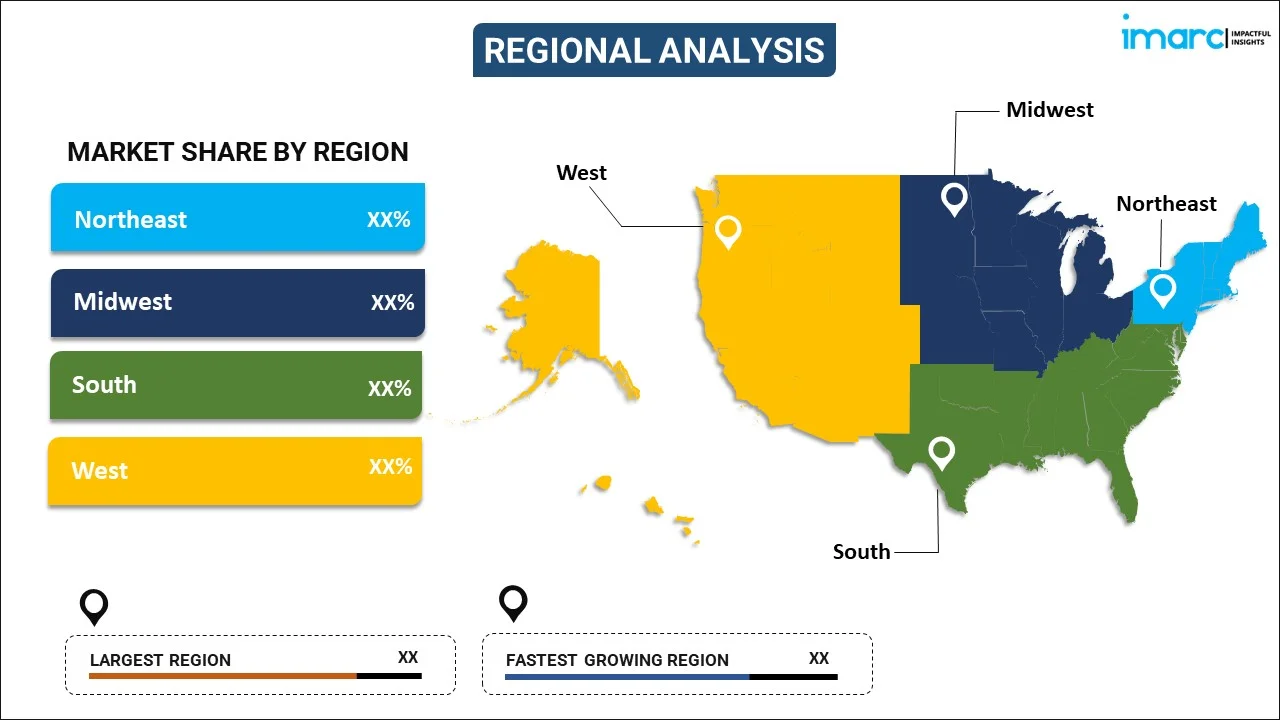

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Northeast

- Midwest

- South

- West

The report has also provided a comprehensive analysis of all the major regional markets, which include the Northeast, Midwest, South, and West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

United States Lithium-Ion Battery Market News:

- January 2023: The United States battery manufacturer Yoshino Technology is developing solid-state lithium-ion batteries with outputs ranging from 330 W to 4,000 W. They are specifically designed for wide-ranging off-grid applications, home backup, and powering small industrial machinery. The system can also be used in combination with solar panels. The 4,000 W power station has a peak power of 6000 W and 2,611 Wh capacity. A 600 W solar panel can fully recharge in 5.5 hours.

- February 2023: A United States-based battery recycling and engineered materials company called Ascend Elements announced a basic agreement with Honda Motor Co. Ltd to collaborate on stable procurement of recycled lithium-ion battery materials for Honda electric vehicles in North America. This was done to minimize the carbon footprint of electric vehicles.

- February 2024: American Battery Technology Company (ABTC), an integrated critical battery materials company that is commercializing its first-of-kind technologies for both secondary minerals lithium-ion battery recycling and primary battery minerals manufacturing announced its second quarter fiscal year (FY) 2024 financial results, for the period ending December 31, 2023.

United States Lithium-Ion Battery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Lithium Cobalt Oxide, Lithium Iron Phosphate, Lithium Nickel Manganese Cobalt, Lithium Manganese Oxide, Others |

| Power Capacities Covered | 0 to 3000mAH, 3000mAH to 10000mAH, 10000mAH to 60000mAH, More than 60000mAH |

| Applications Covered | Consumer Electronics, Electric Vehicles, Energy Storage, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the United States lithium-ion battery market performed so far, and how will it perform in the coming years?

- What has been the impact of COVID-19 on the United States lithium-ion battery market?

- What is the breakup of the United States lithium-ion battery market on the basis of product type?

- What is the breakup of the United States lithium-ion battery market on the basis of power capacity?

- What is the breakup of the United States lithium-ion battery market on the basis of application?

- What are the various stages in the value chain of the United States lithium-ion battery market?

- What are the key driving factors and challenges in the United States lithium-ion battery market?

- What is the structure of the United States lithium-ion battery market, and who are the key players?

- What is the degree of competition in the United States lithium-ion battery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States lithium-ion battery market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States lithium-ion battery market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States lithium-ion battery industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)