U.S. Legionella Testing Market Size, Share, Trends and Forecast by Application, End User, and Region, 2025-2033

U.S. Legionella Testing Market Size, Share & Analysis:

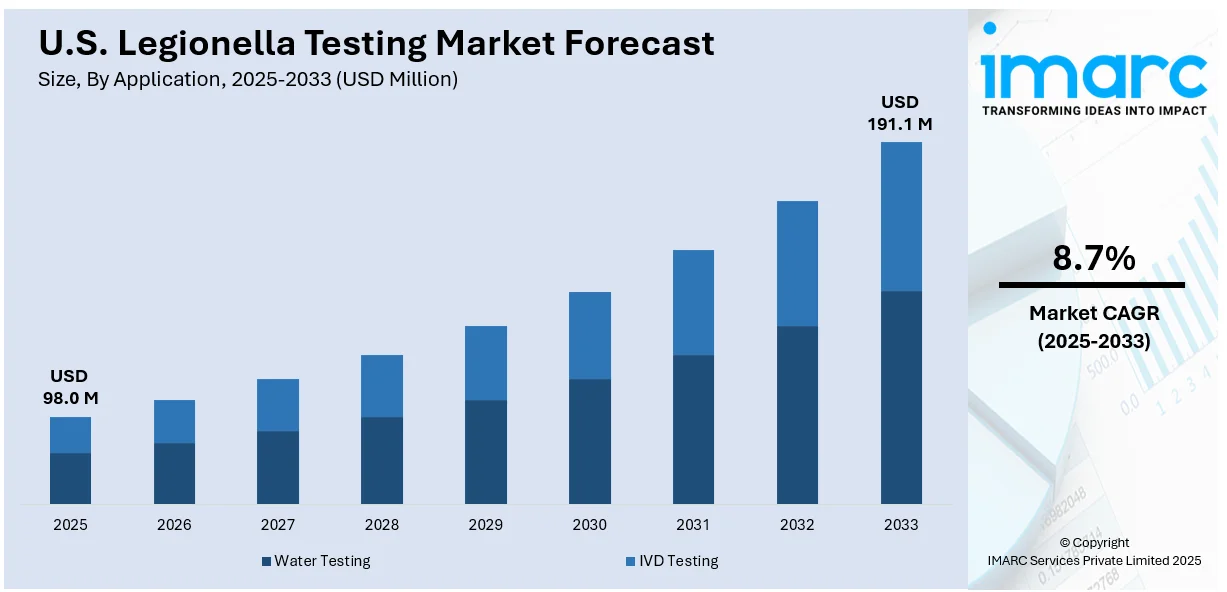

The U.S. legionella testing market size is anticipated to reach USD 98.0 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 191.1 Million by 2033, exhibiting a CAGR of 8.7% from 2025-2033. The market is primarily driven by regulatory compliance demands, heightened public health concerns, technological advancements in molecular diagnostics, expanding urban populations, improved water management strategies, and increased investment in research and development (R&D) activities for innovative testing solutions catering to diverse infrastructure and environmental challenges thus strengthening the U.S. legionella testing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2025

|

USD 98.0 Million |

|

Market Forecast in 2033

|

USD 191.1 Million |

| Market Growth Rate (2025-2033) | 8.7% |

The market in the United States is majorly influenced by the increasing awareness of Legionnaires' disease, and its potential risks. Also, healthcare providers and public health authorities are keen on early detection and prevention. Further, the rising prevalence of Legionella outbreaks, especially in urban areas and with old infrastructure, also fuels the need for such advanced testing solutions. For example, On September 8, 2024, a Legionnaires' disease outbreak at Peregrine Senior Living in Albany, New York, resulted in three fatalities and over 20 hospitalizations. The Albany County Department of Health identified Legionella bacteria in the facility's water system, leading to the installation of advanced water filtration systems and enhanced safety measures.

To get more information on this market, Request Sample

Moreover, the increasing healthcare and hospitality industries, which demand high safety standards for water, are also driving the market. In addition to this, the trend of Legionella testing is also increasing with the innovation of portable and user-friendly sampling kits, which allow on-site collection and preliminary analysis. For instance, Normec MTS developed advanced water sampling kits that maritime crews can use to collect water samples for Legionella testing independently. These kits make it easier to comply with international water safety regulations as they allow for accurate, on-site sampling that can be sent to certified laboratories for analysis. This innovation is promoting proactive water quality monitoring and reducing the risks of waterborne pathogens on vessels. Also, increased public and private funding for waterborne disease research is driving innovation in testing methods, which strengthens the U.S. legionella testing market growth.

U.S. Legionella Testing Market Trends:

Adoption of Advanced Molecular Diagnostics

The U.S. legionella testing market is witnessing increased adoption of molecular diagnostic technologies, such as next-generation sequencing (NGS) and polymerase chain reaction (PCR). These applications contribute to faster and more accurate detection of the Legionella species. Compared with the usual culture’s method for detection, PCR-based detection and identification procedures take far shorter periods in laboratories. Hospitals and laboratories have shifted preferences towards PCR due to the identification capability of several legionella types. Advances in multiplex assays have made it possible to detect other waterborne pathogens simultaneously. These advancements have increased the efficiency and appeal of molecular diagnostics to deal with public health issues. For instance, an article published on November 13, 2024, in The Journal of Clinical Microbiology reported a fatal case of pneumonia due to Legionella pneumophila in an elderly patient. Rapid urine antigen testing initially confirmed serogroup 1 Legionella pneumophila. The case study emphasizes urine antigen testing is not able to reliably detect the different species of Legionella and highlights the growing role of molecular diagnostics in Legionella detection, highlighting their high sensitivity and specificity compared to traditional methods.

Integration of Internet of Things (IoT) and Smart Water Management Systems

The integration of internet of things (IoT) into water management systems is another key U.S. legionella testing market trends. Real-time data can be generated from IoT-enabled sensors, which is also helpful in measuring temperature, pH, chlorine level, and other determinants. This trend benefits large facilities, mostly hotels and hospitals, where automated systems are replacing manual monitoring processes. These systems provide predictive analytics and provide timely interventions that can prevent Legionella outbreaks. These advancements are increasingly preferred as they can optimize water safety and regulatory compliance. The article by Smart City Works on March 21, 2024, details how smart water management technologies are transforming U.S. cities. Through internet of things (IoT), artificial intelligence (AI), and smart sensors, municipalities enhance water distribution, detect leaks, and optimize consumption. For example, New York has an automated water usage monitoring system. Missouri recently implemented a smart sewage and stormwater management system at a cost of USD 1.2 Million.

Regulatory Emphasis on Preventive Testing

Strengthened regulations and guidelines for Legionella control in water systems are profoundly shaping U.S. legionella testing market outlook. The CDC, EPA, and state-level agencies have implemented strict protocols that require periodic testing of water in risk settings, such as healthcare facilities, cooling towers, and commercial buildings. For instance, The CDC's "Routine Testing Module," published on March 15, 2024, outlines guidelines on the testing of water systems for Legionella to prevent Legionnaires' disease. It prescribes collection protocols of samples, frequency of testing, and testing in a laboratory for proper detection and tracking the U.S. legionella testing market demands. In the module, routine testing is indicated as a crucial feature of any water management program to prevent such outbreaks in healthcare environments, hotels, and other environments. Besides this, the penalties for non-compliance are motivating organizations to implement stringent testing schedules. Regulatory developments are encouraging innovation as manufacturers are now focusing on providing faster, user-friendly, and compliant testing solutions that meet the growing needs of regulated industries.

U.S. Legionella Testing Market Opportunities:

Increasing Focus on Public Health, Building Safety, and Water Monitoring System

The U.S. Legionella testing industry has high growth prospects as a result of greater emphasis on public health, building safety, and monitoring of water systems. Hospitals, nursing homes, hotels, and offices are giving priority to periodic testing to avoid outbreaks of Legionnaires' disease. Government regulation and guidelines are driving more aggressive water management strategies, which generate a consistent demand for testing services. Rapid diagnostic technological advancements are facilitating quicker and better detection, making them a point of attraction for both public and private sector capital inflow. Ramping up green buildings and green infrastructure is also propelling the embedding of water quality management solutions. Facility managers are adopting preventive measures, such as regular Legionella testing, in increasing numbers to prevent shutdowns at a high cost, as well as litigation. As people become more aware and testing becomes integral to regular safety procedures, companies with complete solutions—from detection to continuous monitoring—are poised to reap long-term value in this emerging market.

U.S. Legionella Testing Market Challenges:

Complexity and Cost of Advanced Testing Technologies

The sophistication and expense of new testing technologies may provide a barrier for small facilities, unevenly contributing to wide-scale adoption. Some of these potential testing methodologies necessitate the presence of trained staff and equipment, which may make them inaccessible to underserved populations. The lack of uniform testing standards and differences in state-level regulation may also lead to confusion, complicating compliance and implementation for organizations. Furthermore, logistical problems in collecting and shipping water samples from large or distant facilities can impact test accuracy and reliability. False positives or false negatives can erode confidence in the findings and make decision-making more difficult. Moreover, numerous organizations continue to approach testing as a reactive process, waiting for outbreaks to occur before responding. These regulatory and operational issues hinder progress and can potentially keep the industry from achieving its full potential, even as public recognition and health issues continue to grow.

U.S. Legionella Testing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the U.S. legionella testing market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on application and end user.

Analysis by Application:

- Water Testing

- Microbial Culture

- DFA Stain

- PCR

- Others

- IVD Testing

- Blood Culture

- Urine Antigen Test

- DFA Stain

- PCR

- Others

According to the U.S. legionella testing market analysis, the water testing plays an important role since it addresses regulatory compliance and public health safety. This testing finds the presence of Legionella contamination in water systems, such as cooling towers, plumbing networks, and potable water sources. The growing awareness of water-borne diseases and stricter governmental regulations have increased demand for more sophisticated solutions to water testing, like rapid PCR and culture-based methods.

In vitro diagnostic (IVD) testing is critical in identifying Legionnaires' disease in the clinical setting to make an accurate and timely diagnosis. A growing number of legionella infections has increased the uptake of sophisticated diagnostic tools such as antigen tests and nucleic acid amplification methods. IVD testing allows hospitals, clinics, and diagnostic laboratories to improve patient outcomes, hence propelling market growth and innovation in legionella diagnostics.

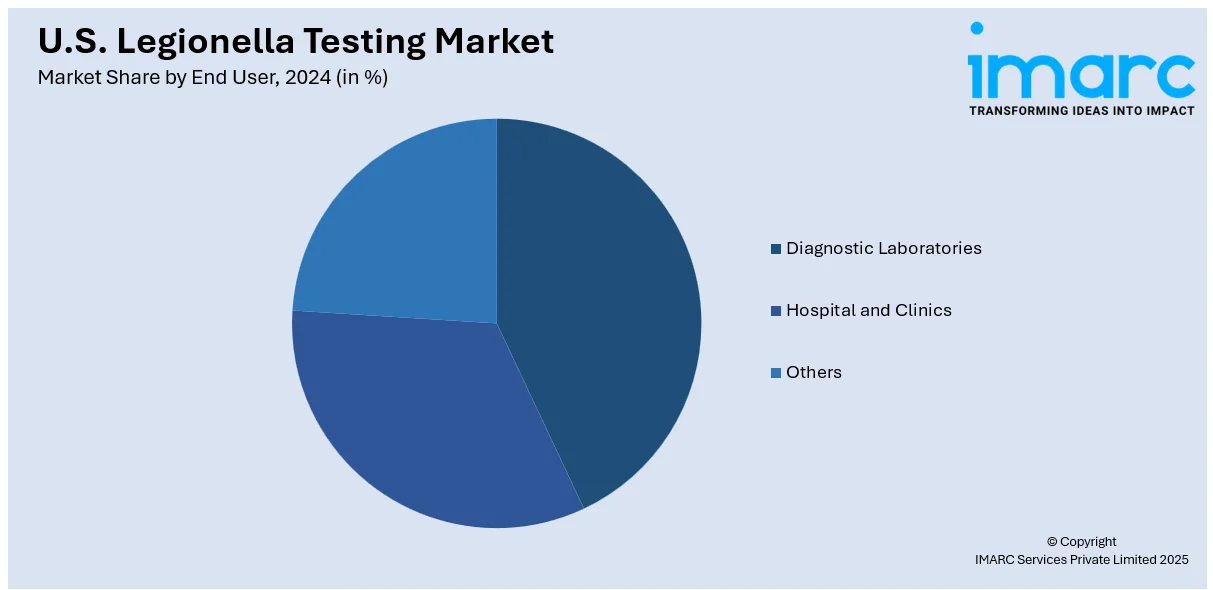

Analysis by End User:

- Diagnostic Laboratories

- Hospital and Clinics

- Others

Based on the U.S. legionella testing market forecast, the diagnostic laboratories play an important role in the market, as they are well-equipped to provide modern testing solutions- thereby providing accurate and precise monitoring and detection of Legionella bacteria. By incorporating advanced technology, such as PCR and antigen-based methodologies, it can serve clinical as well as regulatory demands. Laboratory-based diagnostics is majorly driving market growth due to their rising demand amid increasing levels of Legionella outbreaks.

Hospitals and clinics are a key part of the Legionella testing market as they integrate diagnostic services into routine healthcare. They allow for timely testing for patients presenting symptoms of Legionnaires' disease, aiding early intervention and treatment. The increasing health infrastructure and awareness among healthcare providers about waterborne diseases contribute significantly to the demand for Legionella testing solutions, thereby accelerating market growth, and improving public health outcomes.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region plays an important part in the market due to its dense urban settings, aging infrastructure, and water quality regulatory framework. A significant population with large hospitals, labs, and commercial properties supports the steady demand for the testing solution. Furthermore, seasonal temperature changes and very humid conditions raise the Legionnaires' disease outbreak risk, further making proactive monitoring critical to the region.

The Midwest is a critical region for the Legionella testing market. The strong industrial sector and large water systems. Cooling towers, manufacturing plants, and agricultural facilities all contribute to potential exposure risks. Increasing awareness of public health safety and stricter regulations on water testing are driving the growth of the market. Investments in diagnostic laboratories and public health initiatives enhance the Midwest's capacity to detect and manage Legionella effectively.

The South region has a warm climate, and most buildings use HVAC systems, which creates an ideal environment for Legionella growth. Rapid urbanization and the growth of healthcare infrastructure in this region drive demand for Legionella diagnostic solutions. Regulatory compliance and public health campaigns also increased awareness about Legionella risks, thereby increasing the adoption of advanced testing methods in hospitals, clinics, and commercial establishments.

The West region focuses mainly on environmental sustainability and water conservation, aligning with the need for Legionella testing in water systems. Urban centers, with a critical presence of healthcare facilities, are driving both preventive and clinical diagnostic requirements. A proactive regulatory environment with innovative technologies in adoption is adding to the growth of the Legionella testing market in the region by ensuring effective management of public health risks associated with Legionella outbreaks.

Competitive Landscape:

The competitive landscape of the market is characterized by continuous innovation of diagnostic technologies and increased applications of rapid testing solutions. Companies are focusing on research efforts to improve test sensitivity and accuracy in relation to high regulatory standards and the increasing demand for effective water quality monitoring. Another factor supporting growth is innovation in culture-based and molecular diagnostic methods that focus on precision and efficiency. This regulatory push further intensifies market competition as companies strive to develop cost-effective, compliant solutions and establish strategic partnerships to address emerging demands.

The report provides a comprehensive analysis of the competitive landscape in the U.S. legionella testing market with detailed profiles of all major companies.

Latest News and Developments:

- In September 2024, LuminUltra acquired Genomadix’s Legionella testing business and secured licensing rights to expand qPCR assays across water, energy, and food sectors using the Genomadix Cube™ platform. This move enhances LuminUltra’s rapid, in-field testing capabilities, delivering lab-grade Legionella detection in under an hour. The deal strengthens LuminUltra’s portfolio, enabling real-time decision-making and reinforces its leadership in molecular diagnostics for critical infrastructure and environmental safety.

- September 25, 2024, Water Engineering Inc. announced its acquisition of Gotham Refining Chemical Corp., headquartered in New York provides water treatment services that likely include systems for controlling waterborne pathogens like Legionella, which is common in industrial and commercial water systems. The acquisition will strengthen Water Engineering’s national footprint and enhance its service capabilities in the Northeast, with Gotham’s founder, Andrew Lewin, remaining to support the transition.

- January 31, 2024: The U.S. General Services Administration (GSA) introduced enhanced water quality initiatives to federal buildings across the country to reduce the risk of contaminants like Legionella. These measures encompass proactive testing protocols, improved water management strategies, and the integration of advanced treatment technologies, underscoring the commitment to health and safety in federally managed facilities.

U.S. Legionella Testing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered |

|

| End Users Covered | Diagnostic Laboratories, Hospital and Clinics, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the U.S. legionella testing market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the U.S. legionella testing market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the U.S. legionella testing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Legionella testing involves detecting Legionella bacteria in water systems to prevent Legionnaires' disease outbreaks. Common applications include testing in cooling towers, healthcare facilities, hotels, and industrial water systems. These tests ensure compliance with health regulations and safeguard public health by monitoring and mitigating contamination risk.

The U.S. legionella testing market size is anticipated to reach USD 98.0 Million in 2025.

IMARC estimates the U.S. legionella testing market to exhibit a CAGR of 8.7% during 2025-2033.

The key factors driving the U.S. Legionella testing market include stringent health and safety regulations, increasing awareness of waterborne diseases, and advancements in rapid diagnostic technologies. The growing emphasis on proactive water quality management in commercial and public infrastructure further fuels market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)