United States Lawn Care Market Size, Share, Trends and Forecast by Products and Services, Application, and Region, 2026-2034

United States Lawn Care Market Summary:

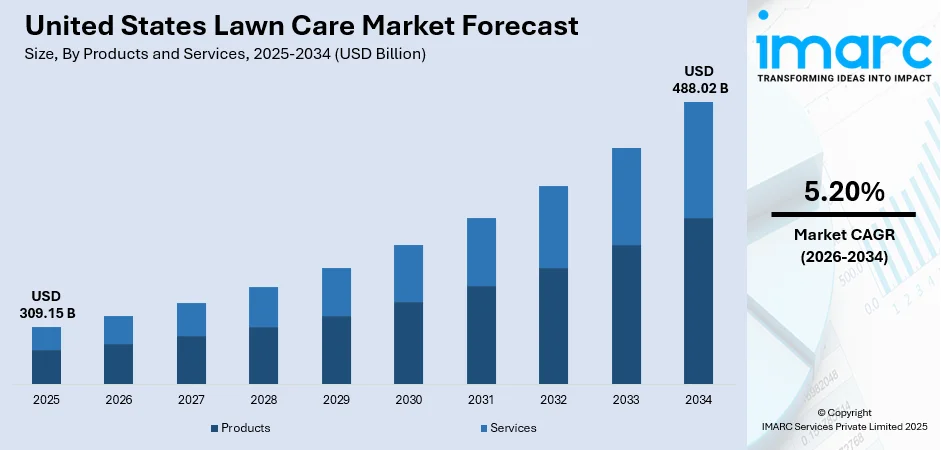

The United States lawn care market size was valued at USD 309.15 Billion in 2025 and is projected to reach USD 488.02 Billion by 2034, growing at a compound annual growth rate of 5.20% from 2026-2034.

The United States lawn care market is experiencing robust expansion driven by increasing residential landscaping demand, rising disposable incomes, and growing suburban development across the country. The market benefits from strong consumer awareness about outdoor aesthetics and property value enhancement, with homeowners and commercial establishments investing substantially in lawn maintenance services. Technological advancements in equipment, the proliferation of eco-friendly products, and the cultural emphasis on well-manicured outdoor spaces continue to strengthen the United States lawn care market share.

Key Takeaways and Insights:

-

By Products and Services: Services dominate the market with a share of 64% in 2025, driven by growing preference for professional lawn maintenance among homeowners and commercial establishments.

-

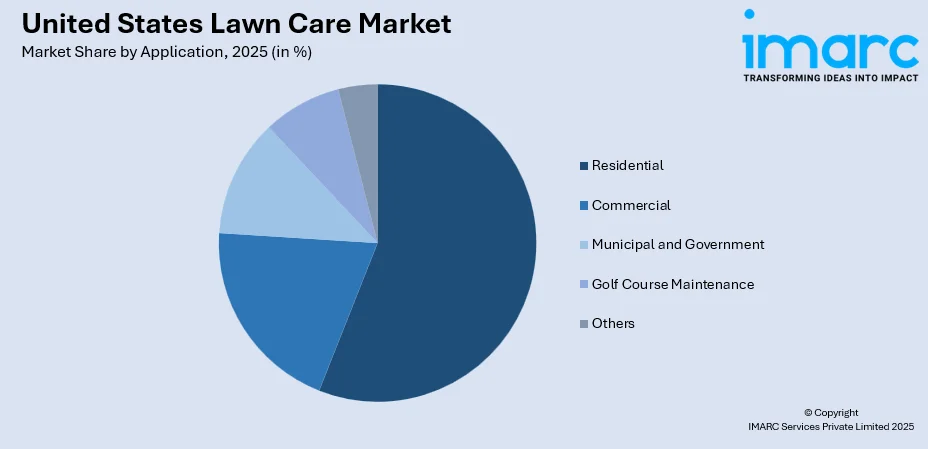

By Application: Residential segment leads the market with a share of 56% in 2025, reflecting strong homeowner investment in outdoor aesthetics and property value enhancement.

-

By Region: South represents the largest segment with a market share of 39% in 2025, supported by year-round favorable climate and high demand for professional landscaping services.

-

Key Players: The United States lawn care market exhibits a fragmented yet competitive structure, with major national players competing alongside regional service providers. Leading companies are focusing on service diversification, technological innovation, strategic acquisitions, and geographic expansion to strengthen their market positioning and capture growing demand across residential and commercial segments.

To get more information on this market Request Sample

The United States lawn care industry is experiencing robust growth as outdoor areas are increasingly treated as essential lifestyle investments and extensions of the home. This cultural shift has moved routine maintenance from a chore to a priority for both residential and commercial properties. The market is diversifying through specialized services, including fertilization, pest control, and landscape design while subscription-based models gain popularity among busy consumers. Demand for professional landscaping is surging, particularly among aging homeowners and dual-income households seeking convenience. Furthermore, the integration of smart technologies and sustainable, eco-friendly practices is modernizing service delivery. These trends, combined with a focus on efficiency, ensure a strong growth trajectory for the US market as professional care becomes a standard for maintaining modern living spaces.

United States Lawn Care Market Trends:

Rapid Adoption of Robotic Mowers and Smart Technologies

The integration of advanced automation technologies is revolutionizing lawn maintenance practices across the United States. Robotic lawn mowers equipped with GPS navigation, AI-powered obstacle detection, and smartphone connectivity are gaining substantial consumer acceptance. In January 2025, John Deere unveiled its fully electric autonomous commercial mower at CES 2025, featuring eight cameras for comprehensive coverage and incorporating the same autonomous technology used in agricultural tractors. This technological shift is particularly attractive to time-constrained homeowners seeking efficient, hands-free lawn maintenance solutions while reducing manual labor requirements.

Growing Demand for Organic and Eco-Friendly Solutions

Environmental consciousness is reshaping consumer preferences toward sustainable lawn care alternatives. The demand for organic fertilizers, natural weed control products, and water-efficient irrigation systems continues to escalate. In 2023, the United States government demonstrated its commitment to sustainable landscaping by investing $1 Billion in increasing access to trees and greenery in urban and community forests where over 84% of Americans reside. This governmental support, combined with consumer environmental awareness, is accelerating the transition toward eco-certified lawn care products and services nationwide.

Expansion of Digital Platforms and On-Demand Services

Digital transformation is reshaping how consumers access and engage with lawn care services. Mobile applications and online marketplaces are connecting homeowners with vetted service professionals, enabling transparent pricing and convenient scheduling. In June 2024, LawnStarter expanded its reach by adding 198 new markets and 440 cities, bringing its total service coverage to over 2,572 cities nationwide. This expansion enabled 16 million additional homeowners to access professional lawn care services while creating job opportunities for local providers, demonstrating the accelerating digitalization of service delivery.

Market Outlook 2026-2034:

The United States lawn care market outlook remains highly favorable as continued suburban development, rising homeownership rates, and evolving consumer preferences drive sustained demand expansion. The proliferation of smart home integration, where lawn care systems seamlessly connect with broader household automation platforms, represents a significant growth catalyst. In April 2025, Irrigreen secured approximately $19 Million in Series A funding to advance its precision irrigation technology serving over 80 million domestic lawns nationwide. The market generated a revenue of USD 309.15 Billion in 2025 and is projected to reach a revenue of USD 488.02 Billion by 2034, growing at a compound annual growth rate of 5.20% from 2026-2034.

United States Lawn Care Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Products and Services |

Services |

64% |

|

Application |

Residential |

56% |

|

Region |

South |

39% |

Products and Services Insights:

- Products

- Lawn Mowers

- Fertilizers

- Grass Seed

- Weed Killers and Herbicides

- Lawn Irrigation Systems

- Others

- Services

- Basic Lawn Maintenance

- Fertilization and Weed Control

- Aeration and Overseeding

- Pest Control and Disease Management

- Lawn Renovation and Landscaping

- Others

The services dominate with a market share of 64% of the total United States lawn care market in 2025.

The services segment maintains commanding market leadership driven by the growing preference among homeowners and commercial establishments to outsource lawn maintenance activities. Subscription-based service packages combining mowing, fertilization, weed control, aeration, and irrigation maintenance have gained substantial traction, offering convenience and predictable monthly costs. In February 2025, LawnStarter achieved $100 Million in bookings and attained profitability for the second consecutive year, implementing artificial intelligence and machine learning solutions to optimize service operations and enhance customer experience.

The shift toward professional services reflects demographic changes including aging homeowners seeking assistance and dual-income households with limited time for lawn maintenance. The services segment benefits from specialized expertise in chemical application, integrated pest management, and advanced turf care that requires professional licensing and training. Companies are diversifying service portfolios to include ancillary offerings such as landscape lighting, fire pit installations, and pollinator garden design, helping reduce seasonal revenue fluctuations while meeting evolving consumer preferences for comprehensive outdoor living solutions.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

- Municipal and Government

- Golf Course Maintenance

- Others

The residential segment leads with a share of 56% of the total United States lawn care market in 2025.

The residential segment maintains market dominance fueled by single-family homeowners and master-planned community residents prioritizing lawn aesthetics and property value enhancement. According to the United States Census Bureau, the country comprises 145.3 Million housing units in 2023, creating substantial demand for landscaping services across suburban lawns, community gardens, and private outdoor spaces. Homeowners increasingly view well-maintained lawns as reflections of property quality and neighborhood standards, driving consistent investment in routine maintenance services.

Consumer behavior patterns reveal strong preference for bundled service packages offered by national and regional lawn care companies, while do-it-yourself activities are declining due to convenience considerations and lifestyle constraints. The residential segment provides the majority of product sales covering equipment, seeds, and chemical treatments, while professional service adoption continues rising. Social media platforms showcasing attractive outdoor spaces have amplified consumer aspirations for well-manicured lawns, motivating homeowners to invest in improved grass varieties, professional edging, weed suppression, and fertilization programs.

Regional Insights:

- Northeast

- Midwest

- South

- West

The South region exhibits a clear dominance with a 39% share of the total United States lawn care market in 2025.

The South region dominates the United States lawn care market, commanding market leadership. This leadership stems from favorable climatic conditions that facilitate year-round grass growth and persistent demand for professional maintenance. In states like Florida, Texas, and Georgia, extended growing seasons require frequent mowing, fertilization, and irrigation. Consequently, the region’s environment creates a market landscape where lawn care is a perpetual necessity rather than a seasonal task.

High humidity and consistent rainfall across the South drive significant demand for herbicides and integrated pest management to combat weeds and local pests. Furthermore, the concentration of large residential properties within suburban master-planned communities necessitates comprehensive landscaping services. From routine maintenance to specialized turf treatments, the region’s demand remains sustained. This combination of ecological challenges and vast suburban expansion ensures the South remains a primary driver of national market growth.

Market Dynamics:

Growth Drivers:

Why is the United States Lawn Care Market Growing?

Rising Homeownership and Suburban Development

The United States continues experiencing steady growth in homeownership rates and suburban development, generating expanded lawn areas requiring ongoing maintenance. New residential construction consistently incorporates landscaped lawns, creating long-term demand for maintenance services, equipment, and lawn care products. Homeowners invest in attractive lawns for aesthetic appeal and social standing, stimulating demand for professional services, quality mowers, premium seeds, fertilizers, and maintenance supplies. As suburban expansion extends into previously undeveloped areas, demand for both do-it-yourself products and professional services continues rising steadily.

Growing Outdoor Living Culture and Curb Appeal Emphasis

Modern lifestyle trends prioritizing outdoor leisure and patio entertainment are driving significant investment in lawn maintenance. Homeowners increasingly view well-manicured yards as vital extensions of their living space that enhance property values and aesthetic appeal. This motivates upgrades such as professional edging and premium weed control. Furthermore, social media platforms showcase aspirational landscapes, inspiring homeowners to emulate these designs through professional services and high-quality maintenance. Consequently, the desire for "picture-perfect" environments continues to boost the demand for expert landscaping and comprehensive turf management across the country.

Technological Advancements in Equipment and Service Delivery

Innovation in equipment and service delivery is significantly expanding market adoption. Smart irrigation, robotic mowers, and IoT sensors appeal to tech-savvy homeowners desiring automated, efficient maintenance solutions. Simultaneously, battery-powered tools are outpacing gasoline alternatives due to environmental concerns and stricter emission regulations. Furthermore, digital platforms bridge the gap between consumers and providers, simplifying scheduling and ensuring transparent pricing. These advancements enhance service accessibility across urban and suburban markets, effectively reshaping the modern American lawn care industry into a much more sustainable, tech-driven, and user-friendly landscape.

Market Restraints:

What Challenges the United States Lawn Care Market is Facing?

Persistent Labor Shortages and Rising Operational Costs

The lawn care industry faces significant workforce challenges as companies struggle to recruit and retain skilled workers. Labor shortages create project backlogs, increase wage pressures, and limit service capacity expansion. Rising fuel costs, elevated material prices, and increasing insurance expenses compress profit margins, forcing service providers to implement price increases that may affect customer retention.

Water Restrictions and Drought Conditions

Frequent droughts and mandated watering restrictions limit traditional lawn maintenance. Regulatory bodies increasingly enforce conservation measures, restricting irrigation schedules to manage scarcity. These environmental pressures necessitate the adoption of drought-resistant grass, xeriscaping, and water-efficient technologies. Such constraints reshape consumer demand and require providers to pivot toward sustainable, water-conscious landscaping solutions.

Regulatory and Environmental Compliance Requirements

Stringent regulations on fertilizers, pesticides, and equipment emissions create significant compliance hurdles. Regional legal discrepancies force service providers to manage diverse product portfolios and adjust operations based on local requirements. This regulatory fragmentation increases operational complexity and costs, pressuring profit margins while demanding constant adaptation to evolving federal, state, and municipal environmental standards.

Competitive Landscape:

The United States lawn care market exhibits a fragmented competitive structure characterized by major national service providers competing alongside regional operators and local businesses. Leading companies are pursuing growth through strategic acquisitions, service portfolio diversification, and technological innovation to strengthen market positioning. Competition intensifies as players invest in digital platforms, customer relationship management systems, and operational efficiency improvements. Market consolidation through mergers and acquisitions remains a prominent strategy, with well-capitalized companies acquiring regional operators to expand geographic coverage and service capabilities. Competitive differentiation increasingly centers on service quality, environmental sustainability credentials, and technological sophistication in service delivery.

Recent Developments:

-

December 2024: LawnPRO Partners announced the acquisition of Meehan's Lawn Service, marking its ninth acquisition and strengthening its presence in Northeast Ohio. Meehan's, founded in 1993, provides lawn fertilization, tree and shrub care, mulch bed weed control, and perimeter pest control services to residential customers.

-

August 2024: The Davey Tree Expert Company acquired VanCurren Service and Midwest Land Clearing, broadening service scope across the Great Lakes region and enhancing capabilities in land management and vegetation control services.

United States Lawn Care Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products and Services Covered |

|

| Applications Covered | Residential, Commercial, Municipal and Government, Golf Course Maintenance, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The United States lawn care market size was valued at USD 309.15 Billion in 2025.

The United States lawn care market is expected to grow at a compound annual growth rate of 5.20% from 2026-2034 to reach USD 488.02 Billion by 2034.

Services hold the largest revenue share of 64% in 2025, driven by growing homeowner preference for professional lawn maintenance, subscription-based service packages, and the convenience of outsourcing routine landscaping activities.

Key factors driving the United States lawn care market include rising homeownership and suburban development, growing emphasis on outdoor living and curb appeal, technological advancements in equipment, and increasing adoption of professional landscaping services.

Major challenges include persistent labor shortages and rising operational costs, water restrictions and drought conditions affecting lawn maintenance, and increasingly stringent regulatory and environmental compliance requirements.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)