United States Lactic Acid Market Report by Raw Material (Corn, Sugarcane, Cassava, and Others), Form (Liquid, Solid), Application (Industrial, Food and Beverages, Pharmaceuticals, Personal Care, Polylactic Acid (PLA), and Others), and Region 2026-2034

Market Overview:

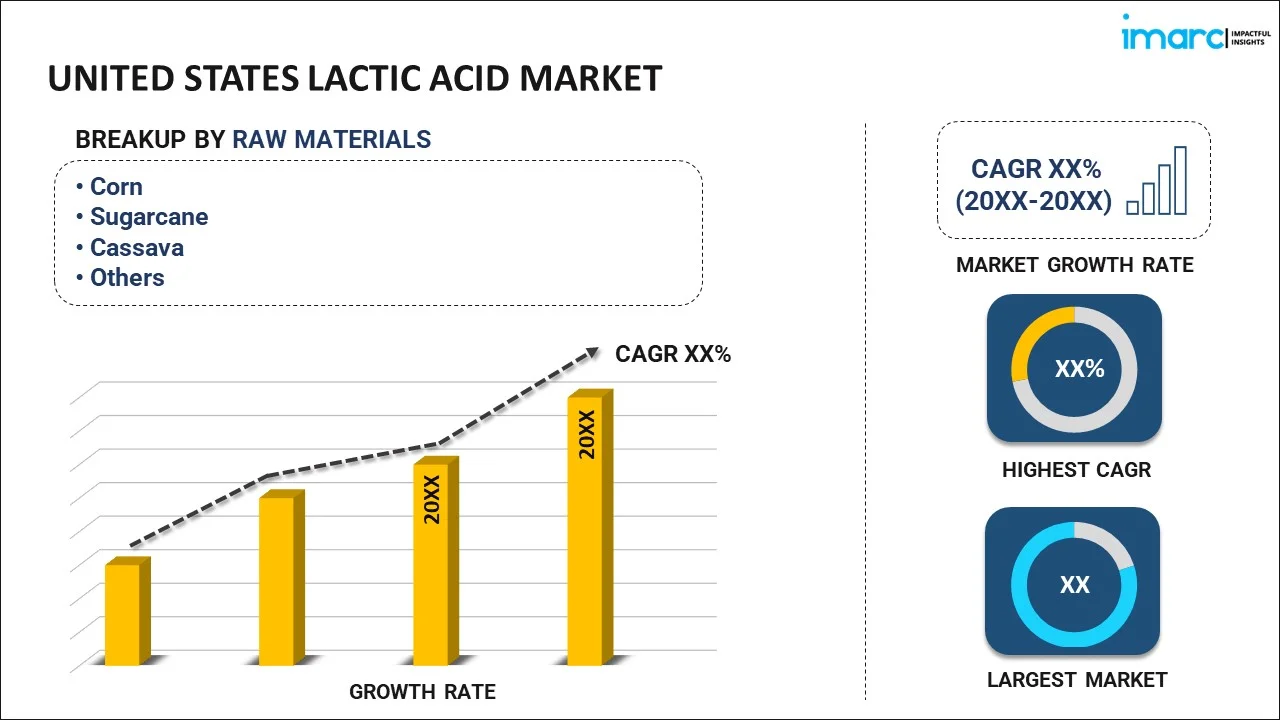

The United States lactic acid market size reached USD 1,130.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,992.3 Million by 2034, exhibiting a growth rate (CAGR) of 6.50% during 2026-2034. The increasing consumption of lactic acid in the production of PLA-based products, continuous growth of the food and beverage sector, and the rising product adoption in various pharmaceutical and medical applications represent some of the key factors driving the United States lactic acid market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,130.4 Million |

| Market Forecast in 2034 | USD 1,992.3 Million |

| Market Growth Rate (2026-2034) | 6.50% |

Access the full market insights report Request Sample

Lactic acid is a type of organic acid that plays a crucial role in various biological processes and industrial applications. It is classified as a carboxylic acid and is characterized by its chemical structure, which consists of a carboxyl group (COOH) attached to a carbon atom that is also bonded to a hydroxyl group (OH). This chemical structure is responsible for the acid's unique properties. Lactic acid has applications in the food and beverage industry as an additive and preservative. It is used to adjust acidity levels, control pH, and enhance the flavor and texture of various food products. Lactic acid also contributes to the production of fermented foods. It is also used in cosmetic and personal care products, such as skin creams and exfoliants. It is known for its exfoliating properties and ability to promote skin renewal. In these products, it is often used as an alpha hydroxy acid (AHA). In addition, it is utilized in industrial cleaning products as an effective acid cleaner. Its ability to dissolve mineral deposits and scale makes it suitable for cleaning applications in industries such as dairy processing and descaling of industrial equipment.

United States Lactic Acid Market Growth Drivers:

The United States lactic acid market growth is primarily driven by the rising demand for biodegradable plastics and sustainable packaging solutions. With increasing environmental concerns and government initiatives promoting eco-friendly materials, lactic acid, particularly used in producing polylactic acid (PLA), is gaining significant traction as a renewable alternative to petrochemical-based plastics. Additionally, its expanding application in the food and beverage industry as a preservative, flavoring agent, and pH regulator supports market expansion. The pharmaceutical and cosmetic sectors are also witnessing increased adoption due to lactic acid’s biocompatibility and use in formulations for controlled drug delivery and skincare products. Moreover, advancements in fermentation technology and the growing preference for bio-based chemicals are reducing production costs and improving product yield. The robust industrial ecosystem, along with strategic investments in bioplastic manufacturing and sustainable chemistry, further propels the market’s steady growth trajectory across the United States.

United States Lactic Acid Market Trends:

Rising Adoption of Biodegradable and Bio-Based Plastics

The United States lactic acid market outlook is witnessing robust growth due to the increasing shift toward biodegradable and bio-based plastics. Consumers and industries are prioritizing environmentally friendly materials to reduce dependence on fossil fuels and minimize plastic pollution. Lactic acid, as a primary feedstock for polylactic acid (PLA), plays a vital role in producing sustainable packaging and disposable products used in food service, consumer goods, and agriculture. The federal and state governments’ emphasis on reducing carbon footprints and promoting circular economy initiatives is further accelerating PLA demand. Technological advancements in polymerization and fermentation processes are also enhancing material performance, making bio-based plastics more competitive with traditional alternatives. The strong focus on sustainability across industries and continued innovation in biopolymer production are solidifying lactic acid’s position as a cornerstone material in the transition toward greener industrial practices in the United States.

Expanding Applications in the Food and Beverage Sector

The food and beverage industry in the United States is emerging as a major consumer of lactic acid due to its multifunctional properties. Lactic acid is widely used as a natural preservative, flavoring agent, and pH regulator, contributing to enhanced food safety and extended shelf life. The growing consumer preference for clean-label, minimally processed, and naturally derived ingredients has further boosted its adoption across dairy, meat, beverage, and bakery products. Additionally, lactic acid’s antimicrobial properties make it an effective solution for maintaining freshness and quality in packaged foods. The steady demand for fortified and functional foods, coupled with regulatory support for natural additives, continues to strengthen its use. As manufacturers pursue healthier formulations and transparent ingredient labeling, lactic acid is positioned as an essential component driving innovation and quality improvement in the evolving U.S. food and beverage market.

Growing Utilization in Pharmaceuticals and Personal Care Products

The United States lactic acid market demand is experiencing steady expansion in the pharmaceutical and personal care sectors due to its biocompatibility and versatile chemical properties. In pharmaceuticals, lactic acid is used in drug formulation, controlled-release systems, and as a pH adjuster in various medical applications. Its safe, non-toxic nature makes it ideal for biologically sensitive uses. In the personal care industry, lactic acid serves as a key ingredient in skincare and cosmetic formulations, particularly in exfoliants, moisturizers, and anti-aging products, due to its gentle effectiveness in promoting skin renewal and hydration. The increasing awareness of sustainable and bio-based ingredients in health and beauty products is further supporting market adoption. Continuous innovation in lactic acid derivatives and polymer-grade applications is also fostering its integration into advanced formulations, underscoring its critical role in enhancing performance and sustainability across the U.S. pharmaceutical and personal care industries.

United States Lactic Acid Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on raw material, form, and application.

Raw Material Insights:

To get detailed segment analysis of this market Request Sample

- Corn

- Sugarcane

- Cassava

- Others

The report has provided a detailed breakup and analysis of the market based on the raw material. This includes corn, sugarcane, cassava, and others.

Form Insights:

- Liquid

- Solid

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes liquid and solid.

Application Insights:

- Industrial

- Food and Beverages

- Pharmaceuticals

- Personal Care

- Polylactic Acid (PLA)

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes industrial, food and beverages, pharmaceuticals, personal care, polylactic acid (PLA), and others.

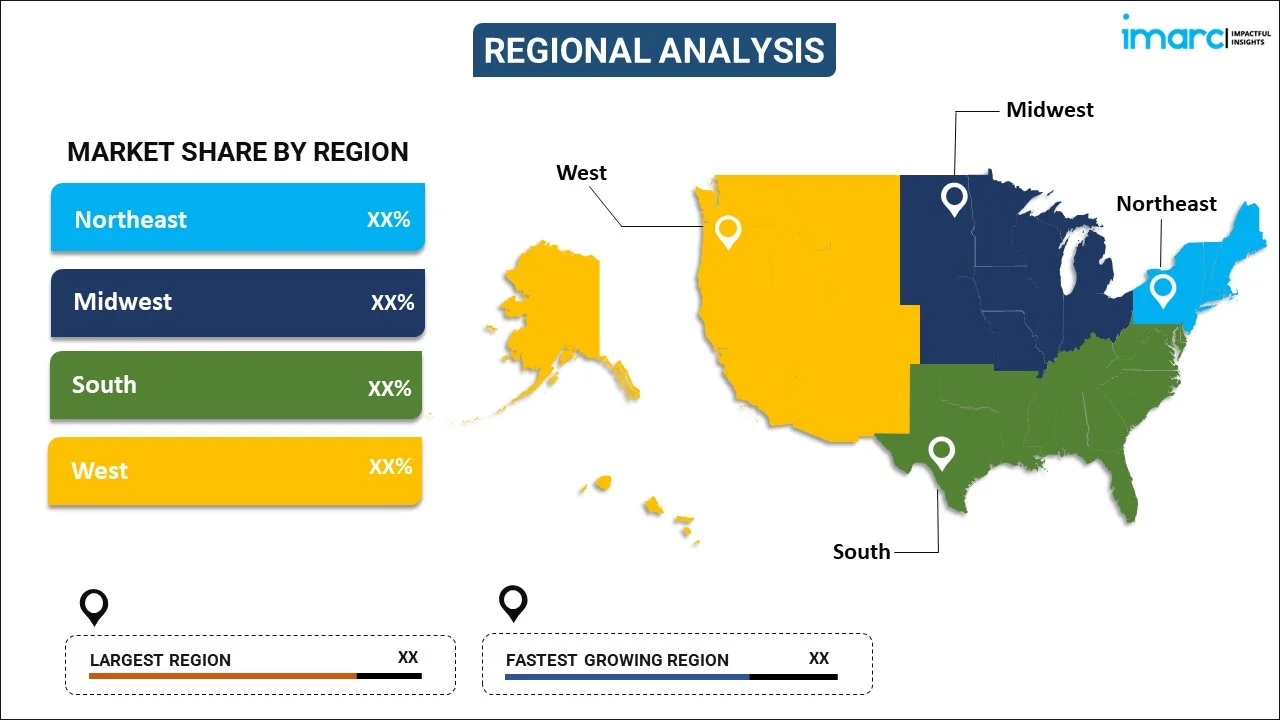

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Northeast

- Midwest

- South

- West

The report has also provided a comprehensive analysis of all the major regional markets, which include Northeast, Midwest, South, and West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

United States Lactic Acid Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Corn, Sugarcane, Cassava, Others |

| Forms Covered | Liquid, Solid |

| Applications Covered | Industrial, Food and Beverages, Pharmaceuticals, Personal Care, Polylactic Acid (PLA), Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States lactic acid market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States lactic acid market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States lactic acid industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The lactic acid market in the United States was valued at USD 1,130.4 Million in 2025.

The lactic acid market in the United States is projected to exhibit a CAGR of 6.50% during 2026-2034, reaching a value of USD 1,992.3 Million by 2034.

Key factors driving the United States lactic acid market include rising demand for clean-label and naturally derived ingredients, increased adoption in the food and beverage, pharmaceutical, and personal care sectors, and growing focus on functional and fortified products. Regulatory support for safe, non-toxic additives further fuels market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)