United States IoT Security Market Size, Share, Trends and Forecast by Component, Security Type, Vertical, and Region, 2025-2033

United States IoT Security Market Size and Share:

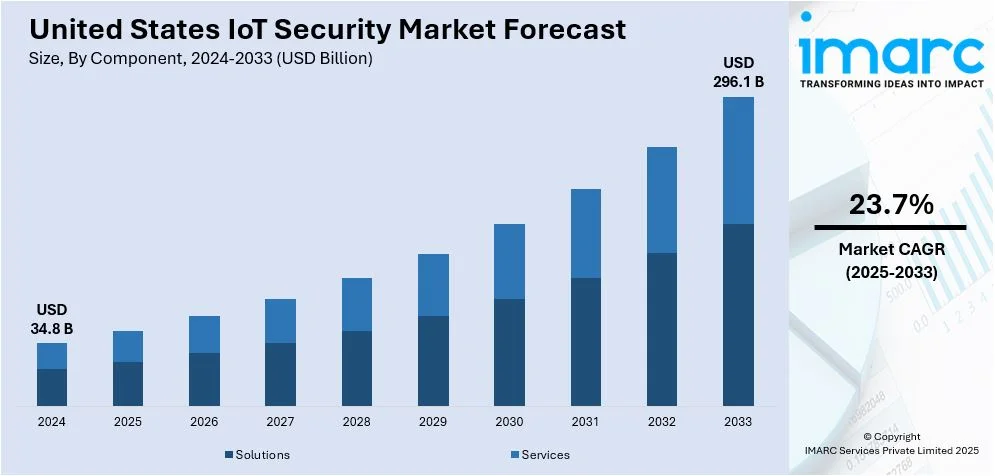

The United States IoT security market size was valued at USD 34.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 296.1 Billion by 2033, exhibiting a CAGR of 23.7% from 2025-2033. The widespread adoption of IoT devices across industries, rising cybersecurity threats, stringent regulatory compliance, the advent of fifth-generation (5G) technology, integration of artificial intelligence (AI) and machine learning (ML) in security solutions, increased awareness about data privacy, and a growing emphasis on secure IoT products are stimulating the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 34.8 Billion |

| Market Forecast in 2033 | USD 296.1 Billion |

| Market Growth Rate (2025-2033) | 23.7% |

At present, the extensive usage of Internet of Things (IoT) devices in various sectors is offering a favorable market outlook in the United States. Rising concerns about data privacy, network vulnerabilities, and cyber security threats are stemming from the heightened use of interconnected devices in sectors like healthcare, manufacturing, smart homes, and transportation. Businesses and governments are increasingly recognizing the importance of robust IoT security solutions in safeguarding sensitive data and critical infrastructure. Besides this, the market is driven by the increased utilization of connected devices. The extensive use of smart devices is also resulting in the formation of an intricate ecosystem, requiring advanced security protocols.

Organizations are encouraged to invest in security solutions like endpoint security, encryption protocols, and intrusion detection systems since the increasing number of endpoints in IoT networks expands the attack surface for hackers. The IoT security environment in the United States is also significantly shaped by government rules and compliance requirements. Baseline security requirements are set by policies for federal agencies' use of IoT devices. The market demand for secure IoT solutions is being driven by these laws, which encourage manufacturers and service providers to include security measures during the design and implementation phases.

United States IoT Security Market Trends:

Increased Cybersecurity Threats and Advanced Persistent Threats (APTs) Targeting IoT Ecosystems

There is currently a notable rise in the complexity and occurrence of cyberattacks directed at IoT devices and networks. Businesses are increasingly worried about Advanced Persistent Threats (APTs) as cybercriminals exploit weaknesses in IoT ecosystems. In May 2024, the FBI San Francisco division cautioned people and groups about the increasing dangers from cyber criminals using AI for advanced phishing attacks and scams involving voice and video cloning. In addition, there is an increase in ransomware attacks targeting interconnected healthcare devices like pacemakers and infusion pumps. This concerning pattern is motivating companies to focus on investing in IoT security, incorporating measures such as encryption, network segmentation, and AI-based intrusion detection systems.

Regulatory Mandates and Industry Standards for IoT Security

Stringent government regulations and industry-specific standards are emerging as other major factors propelling the growth of the market in the US. The Internet of Things Cybersecurity Improvement Act underwent significant updates to include stricter compliance requirements for IoT device manufacturers. These amendments mandate the inclusion of secure-by-design principles, such as mandatory device authentication and automatic software updates, in all IoT products sold to federal agencies. The adoption of similar requirements by private sectors has further reinforced demand for compliant IoT solutions. Moreover, various companies are now adhering to the new security guidelines. This trend is motivating companies to launch security-focused IoT solutions. In 2024, President Joseph Biden signed Executive Order 14117 called "Preventing Access to Americans' Bulk Sensitive Personal Data by Countries of Concern," to limit specific transfers of US data to countries of concern to reduce the threat of harmful exploitation.

Proliferation of Smart Devices and the Expansion of IoT Applications

The rapid growth of IoT applications across diverse industries, including healthcare, smart cities, manufacturing, and agriculture, is bolstering the market growth. This massive expansion is increasing the attack surface for cyber threats, compelling businesses to invest in comprehensive IoT security solutions. The growing adoption of these solutions aligns with the increasing number of IoT deployments, particularly in smart home systems and connected vehicles. For example, connected car adoption in the US is increasing further driving the demand for security technologies that protect vehicle-to-infrastructure communication and personal data. As per the predictions made by the IMARC Group, the Unites States connected car market is expected to exhibit a growth rate (CAGR) of 21.00% during 2024-2032.

United States IoT Security Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States IoT security market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on component, security type, and vertical.

Analysis by Component:

- Solutions

- Services

The market is dominated by the solutions segment, which includes a variety of hardware and software products made to secure IoT networks and devices. Intrusion detection systems, network security, data encryption, and device authentication and control are essential elements. As linked devices spread throughout sectors including manufacturing, healthcare, and smart cities, these solutions are essential for mitigating the vulnerabilities associated with IoT ecosystems. Furthermore, notable developments in AI-powered security solutions are noted, with top firms launching integrated platforms that provide predictive analytics and real-time threat detection.

The services segment concentrates on executing, overseeing, and upkeeping IoT security structures. This involves advising, security services management, and maintenance and support services. With IoT ecosystems growing increasingly intricate, numerous organizations are seeking out third-party providers for their specialized knowledge in creating and implementing secure IoT networks, particularly in industries like utilities and transportation which rely on critical infrastructure. Furthermore, managed security services are becoming a rapidly growing subcategory in the services sector, with more businesses opting to outsource their security requirements.

Analysis by Security Type:

- Network Security

- Endpoint Security

- Application Security

- Cloud Security

- Others

The market is dominated by the network security segment, which deals with safeguarding devices and data linked to IoT networks. Virtual private networks (VPNs), firewalls, intrusion detection and prevention systems (IDPS), and secure access controls are all included in this section. Protecting data in transit is becoming more important as IoT networks get bigger and more sophisticated, particularly in sectors like smart cities, transportation, and telecoms.

Endpoint security mainly focuses on protecting IoT devices including sensors, cameras, and linked medical equipment. Because of the widespread use of connected endpoints across industries ransomware and malware assaults are increasingly targeting these devices. Antivirus software, endpoint detection and response systems, and device authentications are some of the examples of endpoint security solutions. Apart from this, a major development in this segment is the adoption of zero trust security models which ensure that IoT devices are constantly checked before being granted access to networks or various types of data.

The application security segment prioritizes securing IoT applications and software against security breaches, vulnerabilities, and malicious attacks. As IoT applications manage sensitive data and facilitate critical operations like smart home automation or industrial machinery controls, ensuring their integrity is becoming increasingly important. Application security solutions include secure coding practices, vulnerability scanning, and application testing tools which are all important for managing critical operations.

Cloud security is becoming an essential segment in the market, driven by the rapid adoption of cloud-based IoT deployments. This segment encompasses solutions that protect data storage, processing, and transmission in cloud environments, including encryption, secure access controls, and security posture management. Besides this, the rise of hybrid cloud models and edge computing is driving the demand for robust cloud security measures, as organizations sought to secure IoT workloads across distributed environments.

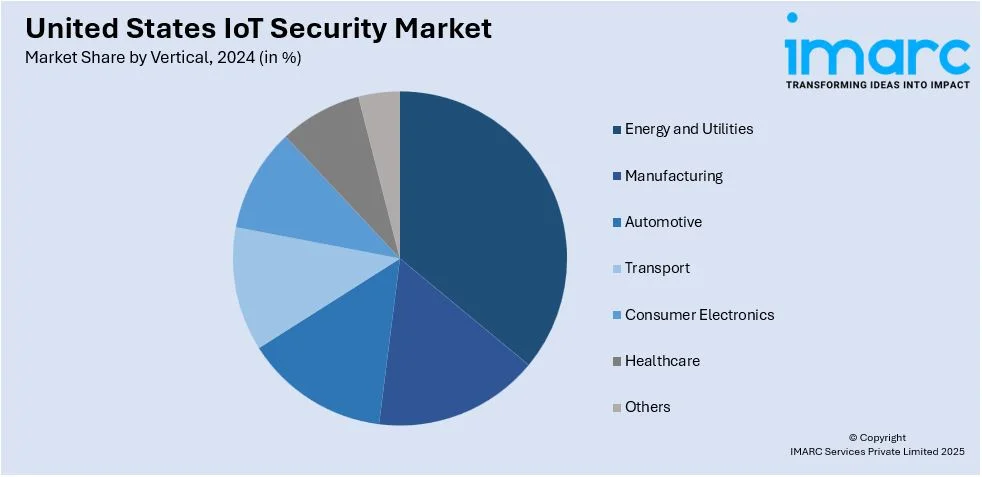

Analysis by Vertical:

- Energy and Utilities

- Manufacturing

- Automotive

- Transport

- Consumer Electronics

- Healthcare

- Others

The energy and utilities segment is becoming a key vertical in the market as smart grids, connected meters, and IoT-enabled energy management systems grow in adoption. These systems, while improving efficiency, expose critical infrastructure to cyberattacks, including threats to energy distribution networks and power grids. Moreover, investments in IoT security for this vertical increased significantly, with utilities deploying advanced intrusion detection systems and endpoint protection tools to safeguard against ransomware attacks and operational disruptions.

Manufacturing is another dominant vertical in the IoT security market, driven by the widespread adoption of Industrial IoT (IIoT) systems, such as connected machinery, robotics, and supply chain tracking tools. At present, manufacturers are facing growing cyber risks, including attacks on operational technology (OT) systems that could lead to production halts and intellectual property theft. As a result, demand is increasing for network security solutions, endpoint protection, and secure IIoT platforms.

The automotive and transport vertical witnessed rapid growth in IoT security adoption, driven by advancements in connected vehicle technologies, smart transportation systems, and autonomous driving. Vehicles equipped with IoT devices, such as GPS trackers and vehicle-to-everything (V2X) communication systems, are increasingly targeted by cyberattacks aimed at compromising user data or disrupting transportation networks. Security measures, including encryption, secure over-the-air (OTA) updates, and intrusion prevention systems, have become critical in this space.

The consumer electronics vertical, encompassing devices like smart home systems, wearables, and connected appliances, remains one of the fastest-growing segments in the market. Moreover, the rapid proliferation of smart home devices, including voice assistants and IoT-enabled cameras, raised concerns over data privacy and device vulnerabilities.

The healthcare vertical is emerging as a critical area for IoT security investment due to the widespread use of connected medical devices, such as remote monitoring systems, infusion pumps, and wearable health trackers. Moreover, the healthcare sector faced increasing ransomware attacks and data breaches targeting sensitive patient information and life-saving devices.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region of the United States, which includes major metropolitan areas such as New York City, Boston, and Philadelphia, is a significant market for IoT security due to the high concentration of financial institutions, healthcare providers, and government agencies. Moreover, the demand for IoT security solutions in this region surged, driven by the rapid adoption of connected technologies in smart city projects, healthcare systems, and banking services. The prevalence of sensitive data in these industries has made network security, endpoint protection, and data encryption solutions a priority.

The Midwest region, often regarded as the industrial heartland of the United States, is experiencing significant growth in IoT security demand due to the widespread adoption of Industrial IoT (IIoT) in manufacturing, agriculture, and logistics. States like Michigan, Ohio, and Illinois have seen a surge in connected devices within factories, warehouses, and agricultural operations, necessitating robust IoT security solutions.

The Southern region, including states such as Texas, Florida, and Georgia, is emerging as a leading market for IoT security, driven by its growing energy sector, smart city initiatives, and healthcare advancements. Moreover, Texas, with its vast energy infrastructure, invested heavily in IoT security solutions to protect critical infrastructure like smart grids and oil refineries from cyberattacks. Meanwhile, cities such as Atlanta and Miami advanced their smart city deployments, including connected traffic systems and IoT-enabled public safety solutions.

The West region, which includes technology hubs like California, Washington, and Oregon, is leading the market due to its strong concentration of tech companies, startups, and innovation centers. Silicon Valley remains at the forefront of IoT security innovation, with major technology firms launching cutting-edge security solutions.

Competitive Landscape:

Key players are investing significantly in research and development (R&D) to create advanced security solutions that leverage cutting-edge technologies such as artificial intelligence (AI), machine learning (ML), and blockchain. AI and ML are being incorporated into security platforms to enhance real-time threat detection, predictive analytics, and automated response mechanisms. Blockchain technology is being utilized to provide decentralized security frameworks, ensuring data integrity and secure device-to-device communication in IoT networks. Moreover, companies are focusing on developing tailored security solutions for specific industries, such as healthcare, manufacturing, smart homes, and automotive, where unique IoT challenges and risks exist. Collaborations and partnerships are central to the business strategies of key IoT security market players. Recognizing the complexity of the IoT ecosystem, companies are forming alliances with technology providers, cloud service companies, hardware manufacturers, and IoT platform developers to offer comprehensive security solutions. In 2024, Oracle Communications announced its plan of infusing AT&T IoT connectivity into its Enterprise Communications Platform (ECP). This will also include support from public-safety focused FirstNet service that runs on AT&T.

The report provides a comprehensive analysis of the competitive landscape in the United States IoT security market with detailed profiles of all major companies.

Latest News and Developments:

- March 2024: The Connectivity Standards Alliance announced the launch of their IoT Device Security Specification 1.0, with the accompanying certification program, and Product Security Verified Mark. The Product Security Working Group aims to meet security challenges by consolidating requirements from the three most popular IoT cybersecurity baselines from the United States, Singapore, and Europe into a single specification and certification program.

- March 2024: The US Federal Communications Commission voted to design a voluntary cybersecurity labelling program for wireless consumer Internet of Things (IoT) products.

United States IoT Security Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered | Solutions, Services |

| Security Types Covered | Network Security, Endpoint Security, Application Security, Cloud Security, Others |

| Verticals Covered | Energy and Utilities, Manufacturing, Automotive, Transport, Consumer Electronics, Healthcare, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States IoT security market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States IoT security market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States IoT security industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

IoT security solutions encompass technologies, strategies, and practices designed to protect internet-connected devices and networks from vulnerabilities, cyber threats, and unauthorized access. These solutions safeguard sensitive data, ensure secure communication, and protect critical infrastructures across industries.

The United States IoT security market was valued at USD 34.8 Billion in 2024.

IMARC estimates the United States IoT security market to exhibit a CAGR of 23.7% during 2025-2033.

The increasing integration of connected devices in industries, growing concerns about cyber threats, and regulatory mandates emphasizing secure IoT solutions are propelling market growth.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and the Middle East and Africa, wherein North America currently dominates the global market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)