United States Infection Control Market Size, Share, Trends and Forecast by Type, End User, and Region, 2025-2033

United States Infection Control Market Size and Share:

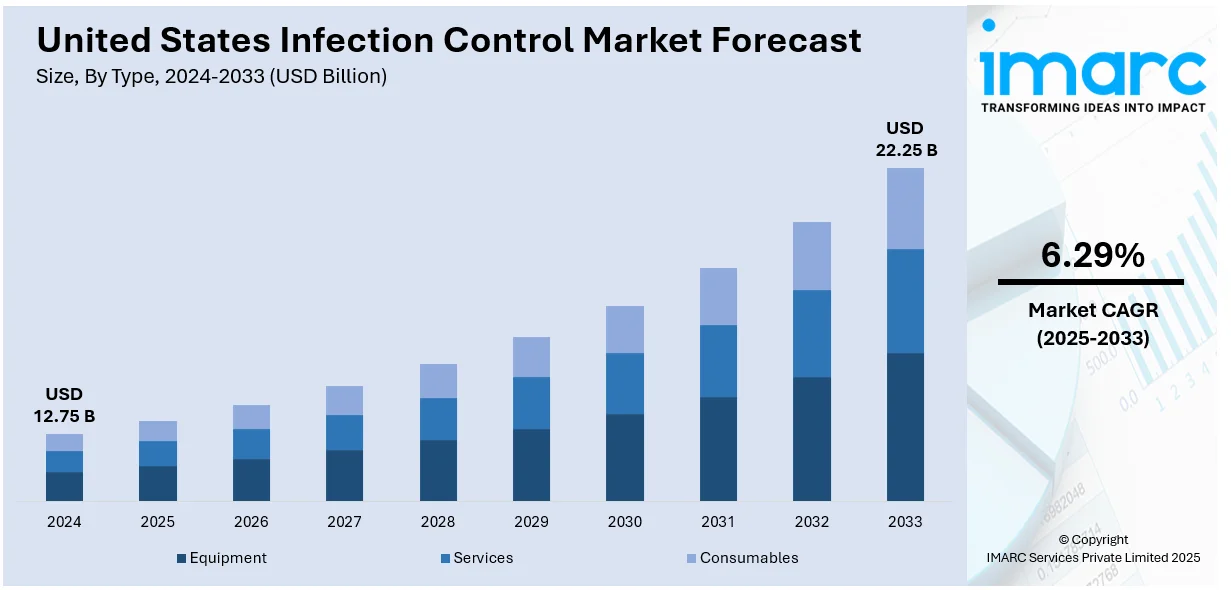

The United States infection control market size was valued at USD 12.75 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 22.25 Billion by 2033, exhibiting a CAGR of 6.29% from 2025-2033. The market is expanding due to rising hospital-acquired infections (HAIs), stringent regulatory standards, and advancements in sterilization technologies. Additionally, increasing healthcare investments, adoption of single-use medical products, and demand for automated disinfection solutions are driving market growth across hospitals, laboratories, and pharmaceutical industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 12.75 Billion |

| Market Forecast in 2033 | USD 22.25 Billion |

| Market Growth Rate (2025-2033) | 6.29% |

The infection control market in the United States is growing because of strict regulatory requirements, growing HAIs, and a greater number of surgical procedures. The strict sterilization and disinfection standards by the Centers for Disease Control and Prevention (CDC), Food and Drug Administration (FDA), and other private entities have boosted this demand for innovative infection control solutions. For instance, in October 2023, the CDC issued a draft guideline to prevent pathogen transmission in healthcare settings. It recommends infection control measures, including NIOSH-approved respirators, eye protection, and risk assessments to determine appropriate precautions for different pathogens. Moreover, an aging population and chronic disease prevalence are adding to the reasons for hospitalizations, which are further requiring powerful infection prevention technologies. Furthermore, the growth in outpatient surgical facilities and the utilization of single-use medical devices also strengthen the necessity for effective sterilization technologies.

Technological advancements and the rise of antimicrobial resistance are revolutionizing infection control practices. New developments in the form of UV disinfection, hydrogen peroxide vapor sterilization, ethylene oxide (EtO), and antimicrobial coatings have streamlined hygiene issues in healthcare setups. For instance, according to industry reports, ethylene oxide (EtO) is the most used sterilization method for medical devices. In the U.S., it sterilizes nearly half of the 20 billion sterile devices sold each year. In addition, hospitals and pharmaceutical companies are investing in automated sterilization equipment to avoid contamination risks and make operations more efficient. The increasing incidence of MDROs is forcing health care providers to be more stringent with their infection control measures. Furthermore, the government, through various innovations aimed at upgrading sanitation systems in public healthcare settings, is also driving market growth, thereby maintaining the requirement for progressive decontamination and sterilization solutions.

United States Infection Control Market Trends:

Advancements in Sterilization and Disinfection Technologies

The infection control in the United States experiences fast paced market growth in sterilization and disinfection technology development. Hospital facilities and healthcare centers are adopting cutting-edge sterilization methods to minimize infections, such as hydrogen peroxide vapor, UV-C light systems, and plasma sterilization systems. Additionally, multidrug-resistant pathogens are gaining traction among healthcare service providers as they are searching for immensely impactful sterilization methods. For instance, in January 2024, the FDA announced an official designation of vaporized hydrogen peroxide (VHP) as a standardized sterilization method for medical devices, promoting its broader use while advancing alternatives to ethylene oxide (EtO) to strengthen supply chain resilience and reduce emissions. Automatic touch-free disinfecting systems also have increasing importance to enhance the compliance with the infection control practice. Additionally, the regulatory authority is tightening rules, compelling the manufacturers to manufacture safer and more efficient methods to sterilize equipment in medical units and hospital facilities.

Increasing Outsourcing of Infection Control Services

Healthcare facilities within the United States are increasingly finding it essential to outsource services related to infection control to specific third-party organizations. The current trend is precipitated by complexity in sterilization standards and more stringent requirements necessary for compliance purposes. Several hospital facilities are thus adopting centralized CSPDs operated externally by experienced companies, with some benefits such as cost savings while improving operational performance. Another increasing demand are contracting cleaning and disinfection services by long-term care facilities and even outpatient clinics. For instance, in 2023, Cameron Memorial Community Hospital, a U.S. based hospital, saved USD 38,000 by outsourcing laundry to a local vendor, reducing costs, optimizing space, and ensuring high-quality linens that help maintain infection control and enhance patient comfort. This change enables the healthcare provider to pay more attention on patient care while ensuring the infection control protocols are consistently met.

Growth in Demand for Personal Protective Equipment (PPE)

United States' healthcare sector is witnessing surging demand for personal protective equipment (PPE) to control infection. Even post-pandemic, hospitals, laboratories, and pharmaceutical companies continue to enforce stringent PPE policies to protect health care workers and patients from cross-contamination. For instance, in October 2024, six U.S. companies invested USD 350 million to produce medical gowns for the Strategic National Stockpile. This initiative aims to replenish personal protective equipment supplies following shortages experienced during the pandemic. New PPE innovations, including antimicrobial-treated fabrics and reusable high-filtration masks, are also emerging. The significant rise in demand for gloves, masks, and gowns also results from the constantly growing numbers of home-based healthcare services. Furthermore, contingency supply strategies add to this trend by ensuring that future public health emergencies are better prepared for.

United States Infection Control Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States infection control market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type and end user.

Analysis by Type:

- Equipment

- Disinfectors

- Washers

- Flushers

- Ultrasonic Cleaners

- Sterilization Equipment

- Heat Sterilization

- Low Temperature Sterilization

- Radiation Sterilization

- Filtration-Based Sterilization

- Others

- Disinfectors

- Services

- Contract Sterilization

- ETO Sterilization

- Gamma Sterilization

- E-Beam Sterilization

- Steam Sterilization

- Infectious Waste Disposal

- Contract Sterilization

- Consumables

- Disinfectants

- Sterilization Consumables

- Personal Protective Equipment

- Others

The infection control equipment segment includes sterilizers, disinfection systems, air filtration units, and UV-C disinfection devices, essential for maintaining sterile environments in hospitals, laboratories, and pharmaceutical facilities. Autoclaves, vaporized hydrogen peroxide (VHP) sterilizers, and ultrasonic cleaning systems play a critical role in eliminating pathogens from medical instruments and surfaces. The demand for automated and AI-driven disinfection technologies is rising, driven by regulatory requirements, hospital-acquired infection (HAI) prevention efforts, and increasing surgical procedures across healthcare facilities, contributing to the growth of the U.S. infection control market share.

Infection control services include decontamination, sterilization validation, on-site equipment maintenance, and waste management solutions. Healthcare facilities, medical device manufacturers, and pharmaceutical companies rely on professional infection prevention consulting and outsourced sterilization services to comply with FDA, CDC, and Joint Commission regulations. Increasing adoption of contract sterilization services, particularly for single-use medical devices and biopharmaceuticals, is driving market growth. Additionally, environmental disinfection services using hydrogen peroxide vapor, UV sterilization, and chemical fogging are gaining prominence in healthcare and public spaces.

The infection control consumables segment includes disinfectants, sterilization wraps, gloves, masks, gowns, and single-use medical supplies essential for preventing cross-contamination. Hospitals and laboratories regularly replenish these products to ensure compliance with infection prevention protocols. The demand for alcohol-based sanitizers, antimicrobial coatings, and high-level disinfectants continues to rise due to increasing infection risks and stringent regulatory standards. Single-use consumables, such as surgical drapes and PPE kits, are widely adopted to minimize contamination risks in hospitals, outpatient clinics, and diagnostic laboratories.

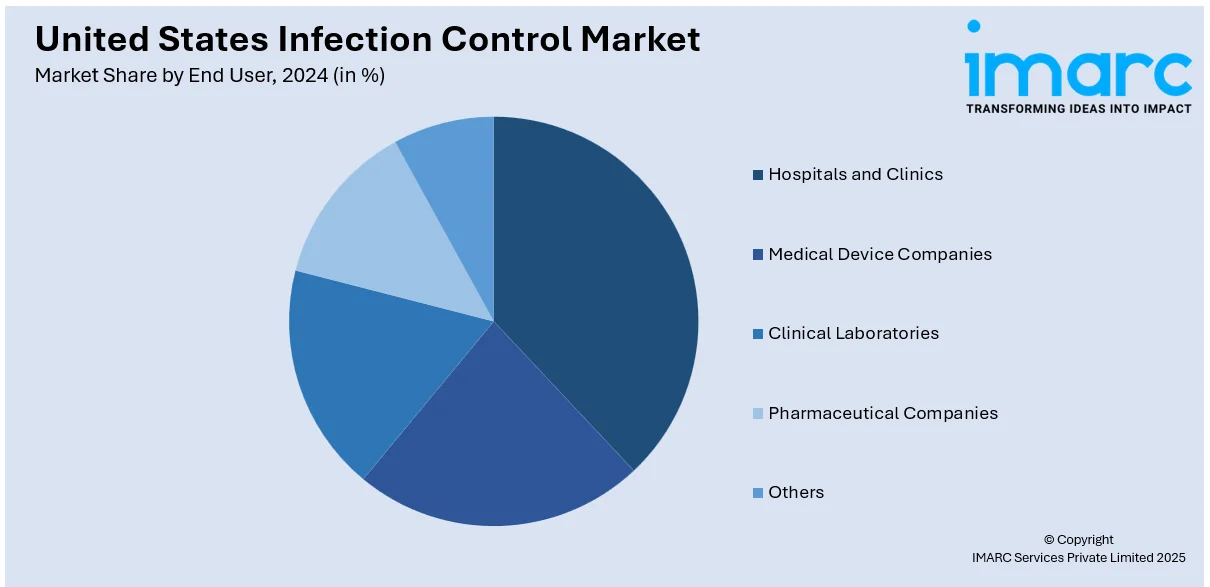

Analysis by End User:

- Hospitals and Clinics

- Medical Device Companies

- Clinical Laboratories

- Pharmaceutical Companies

- Others

Hospitals and clinics are the prominent end-users in the United States infection control market, requiring strict sterilization protocols, disinfection systems, and personal protective equipment (PPE) to prevent hospital-acquired infections (HAIs). The demand for advanced sterilization technologies, antimicrobial coatings, and UV disinfection systems continues to rise due to high patient volumes and complex surgical procedures. Regulatory bodies such as the CDC and The Joint Commission enforce strict infection prevention guidelines, driving continuous investments in infection control solutions for patient safety and compliance.

Medical device companies rely on stringent sterilization and contamination control measures to ensure product safety and regulatory compliance. Infection control plays a critical role in the manufacturing, packaging, and distribution of sterile medical devices, including surgical instruments, implants, and catheters. Companies use ethylene oxide (EtO) sterilization, gamma radiation, and hydrogen peroxide vapor methods to meet FDA and ISO standards. The increasing adoption of single-use medical devices is further driving demand for infection prevention solutions in production and quality control environments.

Clinical laboratories require rigorous infection control measures to maintain biosafety standards and prevent cross-contamination in diagnostic testing. Infection control solutions such as biosafety cabinets, automated sterilization systems, and high-level disinfectants are essential in handling pathogens, bloodborne viruses, and infectious samples. The growing demand for rapid diagnostic tests and molecular testing has increased the need for effective decontamination protocols. Regulatory agencies such as the FDA and CDC enforce compliance with biosafety level (BSL) guidelines, ensuring laboratory safety and infection risk mitigation.

Pharmaceutical companies rely on strict contamination control to ensure the safety and efficacy of drugs, vaccines, and biologics. Infection control measures include cleanroom sterilization, air filtration systems, and chemical disinfectants to prevent microbial contamination in drug manufacturing and packaging. With the rise in biopharmaceutical production and sterile injectables, the industry is investing in automated sterilization technologies and antimicrobial coatings. Regulatory bodies such as the FDA and USP enforce Good Manufacturing Practices (GMP), driving demand for advanced infection prevention solutions in pharmaceutical production.

Regional Analysis:

- Northeast

- Midwest

- South

- West

According to the United States infection control market forecast, the Northeast region plays a significant role in the infection control market, driven by a high concentration of hospitals, research institutions, and pharmaceutical companies. States like New York, Massachusetts, and Pennsylvania have stringent infection prevention regulations, increasing demand for advanced disinfection solutions, sterilization equipment, and antimicrobial coatings. The aging population and high healthcare expenditure further contribute to market expansion. Additionally, urban density and frequent travel increase infection risks, prompting greater investment in preventive healthcare measures and hospital-acquired infection (HAI) control programs.

The Midwest region's infection control market is expanding due to rising healthcare infrastructure, increasing surgical procedures, and growing awareness of hospital-acquired infections. States such as Illinois, Ohio, and Minnesota have large healthcare systems and medical manufacturing hubs, driving demand for sterilization technologies and personal protective equipment (PPE). The presence of leading medical device companies further supports market growth. Rural hospitals and long-term care facilities are also investing in infection control strategies to comply with regulatory guidelines, ensuring safer healthcare environments.

The South has a rapidly growing infection control market due to large healthcare networks, an increasing elderly population, and a high prevalence of chronic diseases. States like Texas, Florida, and Georgia are investing in infection prevention technologies, hospital disinfection systems, and antimicrobial coatings. The region’s warm climate can contribute to higher pathogen survival rates, increasing the need for enhanced infection control measures. Additionally, strong government initiatives and healthcare investments support the adoption of advanced sterilization methods in hospitals, outpatient clinics, and long-term care facilities.

The infection control market in the South is steadily growing because of giant healthcare networks, a rising elder population, and a significant proportion of chronic diseases. Texas, Florida, and Georgia are also expanding their infection prevention technologies, hospital disinfection systems, and antimicrobial coatings. Its warm climate means survival for more pathogens, which is why this region needs enhanced infection control. Another factor that supplements the adoption of advanced sterilization methods in hospitals, outpatient clinics, and long-term care facilities is good government initiatives and healthcare investment.

The western states are the hub for control of infection as they are home to good infrastructure in health services and biotechnological research with the state being California, Washington, and Oregon. High tech medical industries that encourage automated sterilization systems and UV disinfecting technology also AI-based solutions for controlling infection. Infection prevention and control is an added emphasis due to the densely populated areas and increasing patient influx within the region's hospitals. Additionally, regulatory framework and public health campaigns facilitate the use of infection control products in hospitals, hospitality, and other related public facilities.

Competitive Landscape:

The US infection control market is very competitive and driven by strict healthcare regulations, the growing hospital-acquired infections (HAIs), and advanced sterilization technologies. The company’s focus on automated disinfection systems, antimicrobial coatings, and advanced PPE solutions for better infection prevention. Increased demand for single-use medical devices, sterilization services, and innovative barrier protection products has heightened the competition. Moreover, strategic partnerships among hospitals, pharmaceutical companies, and technology vendors are broadening the scope of the market. Growth in outpatient facilities and home health care services drives adoption. For instance, in February 2024, APIC announced its 2024 Strategic Partners to advance infection prevention. It supports education and infection control efforts in healthcare and other sectors with 15,000 members. Furthermore, the demand for regulation, technological innovation, and AI-based monitoring system integration is one of the primary determinants for this market dynamics and competitiveness.

The report provides a comprehensive analysis of the competitive landscape in the United States infection control market with detailed profiles of all major companies.

Latest News and Developments:

- In January 2024, ICP Medical, a division of TEAM Technologies, launched a new website to enhance user experience and streamline product access. It integrates infection control solutions, e-commerce capabilities, instructional resources, and industry-specific offerings for healthcare, industrial, and government markets.

- In July 2024, BioVigil, a U.S. based company, reengineered its user badges with enhanced sensing technology, durability, and battery life to improve hand hygiene monitoring. The system tracks compliance, reduces HAIs, supports contact tracing, and ensures effective infection prevention in healthcare settings.

- In November 2024, Ondine Biomedical announced its preparations for a U.S. Phase 3 trial in Q4 2024 after raising C$16 Million. The trial, in collaboration with HCA Healthcare, will assess Steriwave® nasal photodisinfection to reduce hospital-associated infections, antimicrobial resistance, and surgical site infections across 14 hospitals.

United States Infection Control Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| End Users Covered | Hospitals and Clinics, Medical Device Companies, Clinical Laboratories, Pharmaceutical Companies, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States infection control market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States infection control market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States infection control industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States infection control market was valued at USD 12.75 Billion in 2024.

The market is driven by rising hospital-acquired infections (HAIs), stringent regulatory policies, advanced sterilization technologies, and increasing healthcare expenditures. Growing demand for single-use medical supplies, automated disinfection systems, and antimicrobial coatings further accelerates market expansion across healthcare and pharmaceutical sectors.

IMARC estimates the global United States infection control market to reach USD 22.25 Billion in 2033, exhibiting a CAGR of 6.29% during 2025-2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)