United States Industrial Insulation Market Size, Share, Trends and Forecast by Product, Insulation Material, End Use Industry, and Region, 2025-2033

United States Industrial Insulation Market Size and Share:

The United States industrial insulation market size was valued at USD 2.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 3.45 Billion by 2033, exhibiting a CAGR of 3.60% from 2025-2033. The market is driven by the increasing need for efficient cold chain logistics, which aids in preserving the temperature of products across the supply chain, and the heightened demand for insulation technology in the oil and gas industry, where it helps regulate the elevated temperatures and pressures in pipelines and refineries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.5 Billion |

|

Market Forecast in 2033

|

USD 3.45 Billion |

| Market Growth Rate (2025-2033) | 3.60% |

As sectors seek to enhance outdated infrastructure to boost energy efficiency and adhere to strict regulations, the need for industrial insulation is increasing. With the aging of facilities in the chemical, power generation, and manufacturing industries, there is a growing necessity to refresh insulation materials to maintain operational efficiency. In numerous industrial facilities, current insulation systems frequently deteriorate over time because of wear and exposure to the environment. Consequently, businesses are putting money into retrofit insulation initiatives to enhance thermal control and decrease energy use.

.webp)

The data published on the website of the IMARC Group’s shows that the United States green technology and sustainability market reached USD 6.5 Billion in 2024. Industrial insulation is essential for reducing energy use, decreasing carbon emissions, and lessening dependence on non-renewable energy sources. Insulating equipment and buildings is necessary for preserving ideal temperature. It also stops energy waste due to heat loss or gain, which is especially crucial in industries such as manufacturing and power generation. With sustainability objectives taking precedence in corporate strategies, sectors are embracing high-performance, environment friendly insulation materials. These materials offer excellent thermal insulation and also comply with environmental regulations. Furthermore, sectors are implementing advanced insulation technologies that enhance operational performance while minimizing environmental effects.

United States industrial insulation Market Trends:

Rising demand in the oil and gas sector

As per information released on the website of the IMARC Group, the oil and gas market in the United States reached USD 252.6 Billion in 2024. As the industry continues to expand oil and gas exploration and extraction, the need for insulation is increasing to improve operational efficiency and ensure safety. Insulation is essential for managing the high temperatures and pressures typically present in pipelines and refineries. Substances like calcium silicate and mineral wool are frequently used for thermal insulation and to minimize heat loss. The oil and gas sector are highly energy-consuming and the demand for insulation to reduce energy consumption and lower costs is driving market expansion. Proper insulation helps to conserve energy in refinery, leading to significant savings in operational costs. Insulation plays a vital role in preventing the freezing of liquids, ensuring smooth operations throughout the year.

Increasing power generation

The rising energy needs in the US are catalyzing the demand for industrial insulation within the power generation industry. Power plants and renewable energy production sources need proper insulation to improve thermal management and enhance energy efficiency. Insulation methods also guarantee the safety of high-temperature devices, such as boilers and heat exchangers. Insulation materials play a crucial role in these applications for reducing heat loss and enhancing overall plant efficiency. Solar thermal facilities need specific insulation to ensure steady energy production and safeguard delicate equipment from temperature variations. Insulating power generation facilities improves energy conservation alongside enhancing lifespan by protecting equipment from wear and tear. The growing emphasis on energy-efficient and sustainable power production is driving the need for high-performance industrial insulation throughout the industry. The IMARC Group's report forecasted that the renewable energy market in the United States will show a growth rate (CAGR) of 10.31% from 2024 to 2032.

Expanding of cold chain logistics

Cold chain logistics needs a continuous low temperature across the supply chain to maintain the integrity of perishable items. As a result, there is an increased need for insulation materials that can efficiently regulate temperature throughout the supply chain. Insulation aids in lowering energy usage by decreasing heat exchange between cooled spaces and outside surroundings. Substances such as polyurethane foam and fiberglass are utilized for insulating cold storage facilities and refrigerated containers. These substances not only uphold steady temperatures but also enhance energy efficiency by reducing the burden on refrigeration systems. The increasing need for fresh produce and temperature-sensitive medicines and biotechnologies is propelling the market growth. The report from IMARC Group indicates that the refrigerated transport market in the United States is expected to attain US$ 6.7 Billion by 2032.

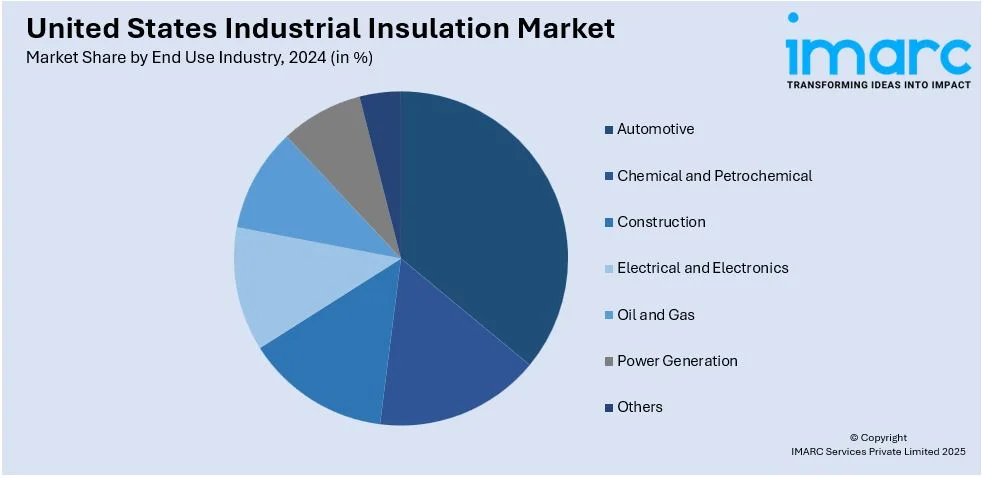

United States Industrial Insulation Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States industrial insulation market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product, insulation material, and end use industry.

Analysis by Product:

- Blanket

- Board

- Pipe

- Others

Blanket insulation is widely used in the industrial sector due to its flexibility and ease of application. Due to which it is employed in covering large areas with complex shape like tanks, vessels, and pipes. Its ability to fit irregular surfaces and complex shapes makes it suitable for diverse industrial applications.

Board insulating is primarily used in industries where very high strength and thermal resistance are required. It is made from materials like fiberglass, polyisocyanurate, and phenolic foam. It offers better structural support, making it ideal to be employed in power plants and chemical industries.

Pipe insulation is critical in industrial applications to maintain temperature control and prevent heat loss or gain in pipelines. Materials like fiberglass and calcium silicate are used in pipe insulation providing safety and efficiency, coupled with less energy consumption. The widespread usage of pipe insulation in various sectors, solidifies its position in the market.

Analysis by Insulation Material:

- Mineral Wool

- Fiber Glass

- Foamed Plastics

- Calcium Silicate

- Others

Mineral wool is used in industrial insulation because to its excellent thermal and fire resistance. It is made from natural minerals like basalt or diabase, providing high durability and stability under high temperatures. Its effectiveness in reducing heat loss and preventing fire hazards, is driving its demand.

Fiberglass insulation is gaining traction due to its versatility and high thermal resistance. Besides being lightweight and moisture resistant, it is easy to install compared to other types of insulation. Its non-combustible characteristic as well as energy savings feature makes it widely employed in industries like automotive manufacturing and aerospace.

Foamed plastics including polyurethane and polystyrene, are used in industrial insulation for their lightweight and high insulating properties. Their superior thermal performance and flexibility, makes them suitable for insulation in both high and low-temperature environments.

Calcium silica insulation is highly valuable in high-heat industrial applications as it can withstand extreme temperature. It is commonly employed in the power generation and oil and gas industries to insulate high-temperature equipment like boilers and steam pipes.

Analysis by End Use Industry:

- Automotive

- Chemical and Petrochemical

- Construction

- Electrical and Electronics

- Oil and Gas

- Power Generation

- Others

Industrial insulation in the automotive sector is crucial for controlling heat within engines, exhaust systems, and HVAC systems. Fiberglass and ceramic fibers are used to reduce heat transfer and improve energy efficiency, alongside enhancing comfort in vehicles. As the demand for fuel-efficient vehicles grows, the automotive sector is driving the demand for high-performance insulation.

The chemical and petrochemical industries require industrial insulation to manage high temperatures and pressures in pipelines and storage tanks. Insulation materials like mineral wool and calcium silicate help reduce energy consumption and prevent heat loss. The expansion of refineries and chemical plants around the world is one of the major contributors impelling the market growth.

The construction industry is a major user of industrial insulation products for both residential and commercial buildings. Insulation helps in temperature regulation and reducing heating and cooling costs, alongside enhancing building energy efficiency. With increasing awareness about energy conservation and green building standards, the demand for insulation materials is on the rise.

In the electronics sector, insulation plays a vital role in ensuring the safety and performance of electrical components. Fiberglass and foamed plastics are being used for insulating wire, transformer, and circuit boards shielding against electrical interferences and moisture. The growing demand for electronic devices and advancements in renewable energy technologies are catalyzing the need for industrial insulation.

Insulation materials like calcium silicate and mineral wool are used in high-temperature applications like reactors and boilers. The continued exploration and extraction activities in oil and gas reserves are strengthening the market for advanced insulation solutions.

Industrial insulation improves energy efficiency and reduce operating costs, along with ensuring the safe operation of boilers and turbines. Materials like mineral wool and calcium silicate, along with foamed plastics insulate high-temperature systems and reduce heat loss. Growing renewable energy sector, requiring energy-efficient solutions, is contributing to the rising demand for industrial insulation.

Regional Analysis:

- Northeast

- Midwest

- South

- West

Due to its established infrastructure and high demand for energy efficiency, the Northeast region occupies a significant portion of the market. Stringent environmental regulations in states like New York and Massachusetts are encouraging industries to adopt high-performance insulation materials.

The Midwest with its strong industrial base is driving the demand for industrial insulation in numerous industries. The demand for materials like fiberglass and mineral wool is driven by the increased focus on energy efficiency and affordable insulation materials. The presence of large manufacturing plants and refineries in states like Ohio and Michigan, further contributes to the market growth.

The South has a large concentration of petrochemical plants and power generation facilities. States like Texas and Louisiana are key energy hubs and insulation is critical in maintaining efficient and safe operations in these industries. The region’s warm climate increases the need for insulation in HVAC systems and thermal management, which further strengthens the market growth.

In the West California, is known for its strong focus on sustainability and energy efficiency. Industries including technology manufacturing and aerospace in states like California are contributing to a steady demand for insulation to meet high-performance standards. The increased demand for industrial insulation solutions that support the efficient operation of green buildings, is bolstering the market growth.

Competitive Landscape:

The US is home to key players who are innovating through the advancement of newer materials and solutions. To meet the diverse needs from various industries, major manufacturers are producing high-performance insulation products. They are focusing on improving energy efficiency while reducing operational costs and enhancing safety in industrial facilities. This has resulted in insulation solutions that can optimize temperature control, alongside reducing energy consumption and preventing heat loss. For instance, in 2024, Holcim US signed an agreement to acquire advanced insulation systems manufacturer Ox Engineered Products for US$ 136m. This agreement will help offer the full suite of building envelope systems to North American buyers, ranging from commercial to residential applications. Besides this, key players are considerably financing research and development (R&D) activities to launch eco-friendly insulation materials, which comply with environmental regulations.

The report provides a comprehensive analysis of the competitive landscape in the United States industrial insulation market with detailed profiles of all major companies, including:

- Al-Futtaim Logistics

- Agility Logistics

- Emirates SkyCargo

- Aramex

- Global Shipping and Logistics LLC

- Mohebi Logistics

- Hellman Worldwide Logistics

- DHL Supply Chain

Latest News and Developments:

- December 2024: ROCKWOOL invested in a new production line in Mississippi to increase its US manufacturing capacity for stone wool insulation. The expansion aimed to meet rising demand for energy-efficient insulation in industrial and commercial sectors.

- November 2024: Hempitecture was awarded $8.42 million by the U.S. Department of Energy (DOE) under the Biden-Harris Administration’s Investing in America agenda to improve the production of industrial fiber hemp processing and manufacturing facility in northeast Tennessee. The company focuses on making sustainable solutions for insulation, packaging, and building materials sectors.

United States Industrial Insulation Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Blanket, Board, Pipe, Others |

| Insulation Materials Covered | Mineral Wool, Fiber Glass, Foamed Plastics, Calcium Silicate, Others |

| End Use Industries Covered | Automotive, Chemical and Petrochemical, Construction, Electrical and Electronics, Oil and Gas, Power Generation, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States industrial insulation market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States industrial insulation market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States industrial insulation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Industrial insulation is used to reduce heat transfer and improve energy efficiency, along with assuring safety in industrial facilities. It is applied to equipment and structures to maintain optimal temperatures, prevent heat loss, and minimize energy consumption. Industrial insulation also facilitates fire resistance and protects personnel from extreme temperatures, alongside soundproofing industrial environments.

The United States industrial insulation market was valued at USD 2.5 Billion in 2024.

IMARC estimates the United States industrial insulation market to exhibit a CAGR of 3.60% during 2025-2033.

The increased adoption of insulation solutions by industries for reducing energy consumption, is driving the market growth. The oil & gas, and power generation sectors require insulation to maintain temperature and ensure safety. The expansion of cold chain logistics is fueling the demand for temperature-controlled insulation. Sustainability efforts are further contributing to the adoption of eco-friendly insulation materials.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)