United States Industrial Gases Market Size, Share, Trends and Forecast by Type, Application, Supply Mode, and Region, 2025-2033

United States Industrial Gases Market Size and Share:

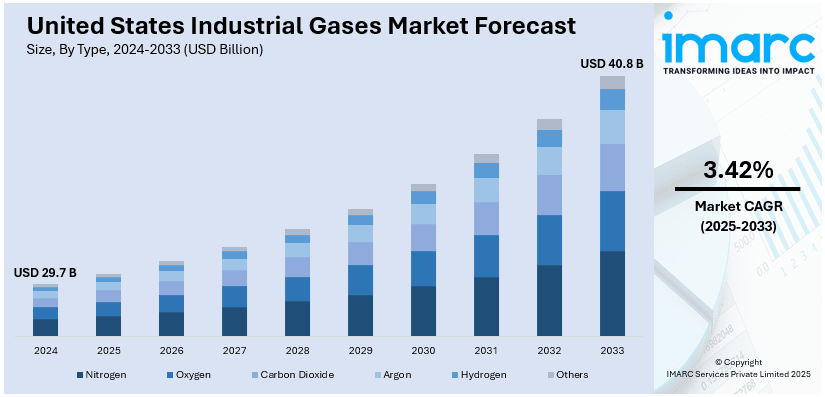

The United States industrial gases market size was valued at USD 29.7 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 40.8 Billion by 2033, exhibiting a CAGR of 3.42% during 2025-2033. The market is fueled by heightened demand across all industries like manufacturing, healthcare, food and beverages, and electronics. Improvements in technology for production and distribution of gases, coupled with heavy use in welding, cooling, and chemical processing, also propels growth in the market. Also fueling clean technologies' adoption is regulation and the demand for cleaner gas technology, thereby boosting the United States industrial gases market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 29.7 Billion |

|

Market Forecast in 2033

|

USD 40.8 Billion |

| Market Growth Rate (2025-2033) | 3.42% |

United States industrial gases market is expanding with the increasing demand in various industries like manufacturing, healthcare, food and beverages, and electronics. Automotive, steel, and chemicals industries require the use of industrial gases like oxygen, nitrogen, and hydrogen in welding, metal fabrication, and chemical production. Additionally, mounting focus on cleaner production and renewable energy is propelling the consumption of specialty gases, which play a very important role in markets like fuel cell production and exhaust gas after-treatment. Technological development in gas production and distribution also spurs market growth through increasing efficiency and lowering costs and thereby making gases increasingly suitable for industrial use. For instance, in February 2025, Air Products showcased its industrial gases, particularly hydrogen, at POWERGEN International in Dallas, Texas. The company will present its hydrogen boiler trials and discuss hydrogen's role in microgrid resilience, emphasizing its contribution to the decarbonization of the power industry. Air Products aims to help power generators reduce carbon emissions and meet sustainability goals. It also discussed hydrogen's integration into renewable energy systems and its benefits for microgrids.

Furthermore, the health sector is growing significantly, propelling the usage of medical gases, such as oxygen and nitrous oxide, in respiratory care, anesthesia, and critical care. The food and beverage sector also plays an important role in the United States industrial gases market growth with its requirement for gases in food preservation, packaging, and carbonation. Additionally, robust environmental standards are forcing industry toward cleaner, greener options like hydrogen fuel cells and carbon capture technologies. It is inspiring investment in creative industrial gas solutions and developing new uses in fast-growing industries like electronics, where gases are paramount in making semiconductors.

United States Industrial Gases Market Trends:

Ongoing Technological Advancements

The advancements in technology in producing, storing, and distributing industrial gases are fueling the United States industrial gases market share. Several advancements in cryogenic and non-cryogenic air separation technologies increase operating efficiency, decrease separation costs, and improve the quality of the resultant gases. For instance, progress in hydrogen generation by electrolysis and sequestration ability technology substantially affects the market. Supporting this trend, the U.S. Department of Energy states that in March 2024, USD 750 Million was awarded to 52 clean hydrogen projects across 24 states, aimed at reducing the cost of clean hydrogen and bolstering the U.S.’s leadership in the sector. The United States Energy Information Administration (EIA) reported that those are vital in harnessing change in the energy sector. Advancements in and those that underpin the production of these specialized products support the growing requirement for specialty gases used in industries such as semiconductors and renewable energy.

Rapid Growth in the Healthcare Sector

The United States industrial gases market growth is significantly driven by the increasing requisites of the healthcare industry to a larger extent for medical gases such as oxygen, nitrogen, and nitrous oxide. Further, the development of healthcare centers, improved techniques in the treatment of disorders, and progressively focused treatment of the patients’ needs help in creating this demand. The COVID-19 pandemic has stressed the importance of medical gas management in healthcare even more, which proves that it is essential to have a robust and efficient gas supply system.

Stringent Environmental Regulations

Environmental standards are a key factor in the United States industrial gases market data, as the industry must adhere to very high standards, especially in developed countries. The U.S. Environmental Protection Agency (EPA) has made policies that encourage the use of lean industrial gases by cutting down emissions of greenhouse gases. Rules such as those governing hydrofluorocarbons (HFCs), for instance, propose the use of environmentally friendly gases such as CO2 and NH3 used in refrigeration and air conditioning. In alignment with the American Innovation and Manufacturing (AIM) Act, the EPA has mandated that by September 2025, annual U.S. HFC consumption must be reduced by 40% below the baseline of 302.5 million metric tons of CO₂ equivalent (MMTCO₂e). Along with this, processes to limit industrial emissions and improve energy intensity stimulate the use of gases applied in CCS technologies. These regulations integrate with the overarching national energy and climate change plan to mitigate change and enhance air quality.

United States Industrial Gases Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States industrial gases market, along with forecast at the country and regional levels from 2025-2033. The market has been categorized based on type, application, and supply mode.

Analysis by Type:

- Nitrogen

- Oxygen

- Carbon Dioxide

- Argon

- Hydrogen

- Others

Nitrogen stands as the largest component in 2024, holding around 28.6% of the market. As per the United States industrial gases market analysis, nitrogen dominates the United States industrial gases market requirements due to its applicability in numerous industries. According to the U.S. Geological Survey (USGS), nitrogen is primarily used in the production of ammonia, which is vital for fertilizers in agriculture, with the U.S. producing 14 million metric tons of ammonia in 2023. The United States industrial gases market forecast notes that nitrogen will continuously experience growth in the future due to extensive application in manufacturing and food processing industries such as inserting, blanketing, and preservation of foodstuffs. Moreover, an increased number of applications demands in the oil and gas sector such as EOR and pipeline purging of nitrogen provide another robust pillar to the nitrogen market. EIA coincides with the above applications stating that their demand and production contribute to the consistently changing nitrogen demand and production, which cements its position in the industrial gases market.

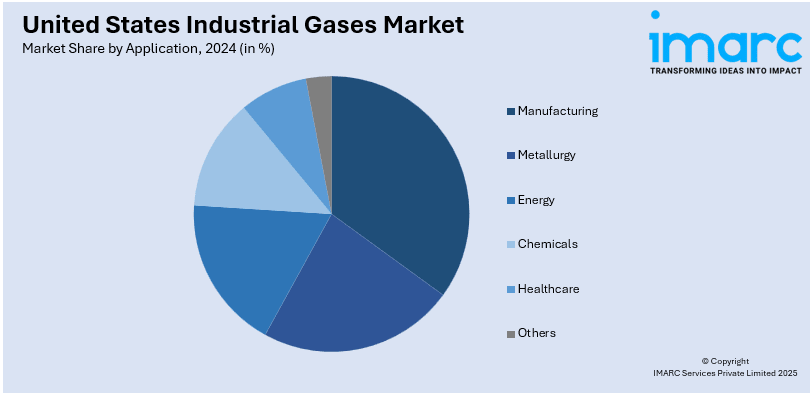

Analysis by Application:

- Manufacturing

- Metallurgy

- Energy

- Chemicals

- Healthcare

- Others

Manufacturing leads the market with around 27.5% of market share in 2024. Manufacturing industries remain the dominant consumer of industrial gases in the United States. This is mainly because oxygen, nitrogen, and argon, which are the most popular industrial gases, are used in many industries such as manufacturing and fabrication of metals, chemicals, and electronics. According to the National Institute of Standards and Technology (NIST), the manufacturing sector contributes significantly to the U.S. economy, with over 11.4 million jobs and substantial energy consumption (NIST). The expectation of improved efficiency and next-generation material use in the sector has ensured the relevance of industrial gases. Moreover, the Department of Energy emphasized the decarbonization of manufacturing, in which the utilization of industrial gases enhances effective and efficient processes (Energy. gov). These constant requirements for production and carbon reduction aim to further guarantee that the sector will continue to be a crucial player in the industrial gases industry.

Analysis by Supply Mode:

- Packaged

- Bulk

- On-Site

Packaged leads the market with around 45.7% of market share in 2024. Packaged dominates the US industrial gases market through its extensive infrastructure, comprehensive product range, and strategic market positioning. According to recent data from the US Bureau of Economic Analysis, Packaged holds a significant 28% market share, making it a key player in the industry. The company's success is bolstered by its robust distribution network, which ensures timely delivery of compressed and specialty gases to diverse sectors including manufacturing, healthcare, and electronics. Packaged emphasis on innovation and stringent quality standards further enhances its competitive edge, allowing it to meet the precise needs of its customers reliably. By continuously investing in technology and customer service, packaged maintains its leadership position and also sets benchmarks for excellence in the industrial gases sector nationwide.

Regional Analysis:

- Northeast

- Midwest

- South

- West

In the Northeast, the manufacturing sector is well-developed with strong additional bases in the pharmaceuticals and research segments and, therefore, the demand for industrial gases is due to the manufacturing industry. This region that specializes in large industries and farming uses more gases for construction, food processing, and power. In the South, intense industrialization particularly in Texas and Florida means that there is sufficient demand from manufacturing segments for things such as petrochemicals, autos, and aerospace. However, in this regard, the West is privileged to possess various technology-savvy industries out of California and relevant semiconductor manufacturing states such as Arizona.

Competitive Landscape:

United States industrial gases market largest companies are concentrating on business sustainability and diversification. They are also making a lot of efforts to cut their emissions and improve the efficiency of their operations. For instance, Air Products has planned to spend more than USD 4 Billion on a new net-zero hydrogen energy processing facility in Texas, where low-carbon hydrogen will be generated in the industrial and transportation segments. Along with this, Linde is enhancing the development of carbon capture and storage techniques to reach emission decrease goals. As per the US Department of Energy the key role of industrial decarbonization, such as low carbon fuels, advanced reactors, and other avenues of industrial energy efficiency for achieving the net zero emissions targets. These companies including the companies in New York State are supported by the DOE where they provided funding for applied research and development projects.

The report provides a comprehensive analysis of the competitive landscape in the United States industrial gases market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: ExxonMobil and Calpine signed an agreement for ExxonMobil to transport and store up to 2 million metric tons of CO₂ annually from Calpine’s Baytown Energy Center. The project aimed to produce 500 megawatts of low-carbon electricity.

- January 2025: Chart Industries signed a global master goods and services agreement with ExxonMobil to supply LNG equipment, technology, and services for ExxonMobil’s global projects. The deal included Chart’s cold boxes and IPSMR® process technology, aiming to optimize LNG project efficiency, cost, and quality worldwide, strengthening their longstanding collaboration.

- September 2024: ADNOC acquired a 35% stake in ExxonMobil’s proposed low-carbon hydrogen and ammonia facility in Baytown, Texas. The project, expected to start in 2029, aims to produce 1 bcf/day of low-carbon hydrogen and over 1 million tons of ammonia annually, removing 98% of CO₂ emissions to support global decarbonization goals.

- July 2024: ExxonMobil signed a second carbon capture agreement with CF Industries to capture up to 500,000 tons per year of CO2 from CF's Yazoo City facility. CF planned a USD 100 million investment, with operations starting in 2028.

- June 2024: Air Liquide announced that it would invest over USD 250 million to build a new industrial gas facility in Idaho to supply Micron Technology and others. The plant, expected to be operational by the end of 2025, supported memory chip production with ultra-pure gases, enhancing efficiency and sustainability in semiconductor manufacturing.

- May 2024: Linde doubled the capacity at its La Porte facility to meet the rising demand for industrial gases in the US Gulf Coast. This expansion supported increased industrial gas supply for the manufacturing, healthcare, and energy sectors.

United States Industrial Gases Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Nitrogen, Oxygen, Carbon Dioxide, Argon, Hydrogen, Others |

| Applications Covered | Manufacturing, Metallurgy, Energy, Chemicals, Healthcare, Others |

| Supply Modes Covered | Packaged, Bulk, On-Site |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States industrial gases market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States industrial gases market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States industrial gases industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India bancassurance market was valued at USD 29.7 Billion in 2024.

The India bancassurance market is projected to exhibit a CAGR of 3.42% during 2025-2033, reaching a value of USD 40.8 Billion by 2033.

Key factors driving the United States industrial gases market include increasing demand across sectors like manufacturing, healthcare, and food processing, technological advancements in gas production, rising environmental regulations pushing for cleaner energy solutions, and the growing adoption of specialty gases in industries such as electronics, renewable energy, and decarbonization.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)