United States HIV Drugs Market Size, Share, Trends and Forecast by Drug Class, Distribution Channel, and Region, 2025-2033

United States HIV Drugs Market Size and Share:

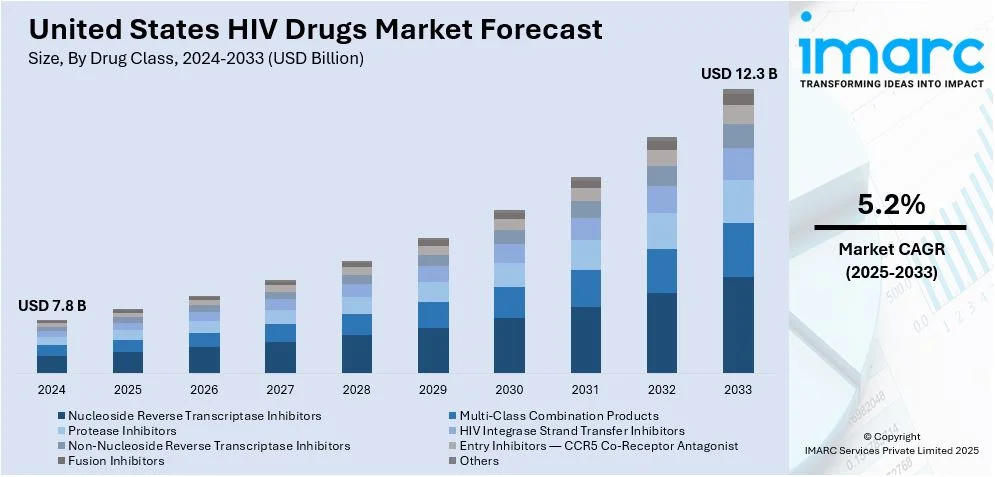

The United States HIV drugs market size was valued at USD 7.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 12.3 Billion by 2033, exhibiting a CAGR of 5.2% from 2025-2033. The market is driven by advancements in antiretroviral therapy, increasing HIV prevalence, heightened awareness, early diagnosis initiatives, and government programs supporting treatment access. Innovations in long-acting formulations and combination therapies improve adherence, while ongoing research and the rising demand for preventive measures like PrEP further boost market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7.8 Billion |

| Market Forecast in 2033 | USD 12.3 Billion |

| Market Growth Rate (2025-2033) | 5.2% |

The market in the United States is primarily driven by the increasing prevalence of HIV, which sustains the demand for effective treatment options. According to industry reports, in the United States, over 1.1 million Americans are living with HIV in the current period of 2024. After years of stagnation in the annual infection rate, which hovered at around 50,000 new infections per year, the rate has begun to steadily drop in recent years due to newer preventive strategies like PrEP (pre-exposure prophylaxis) and HIV treatment as prevention, the latter of which can reduce the risk of HIV transmission to zero. In line with this, the widespread adoption of antiretroviral therapy (ART) has revolutionized HIV management, enabling patients to achieve undetectable viral loads and live healthier, longer lives. Continuous advancements in drug formulations, such as fixed-dose combinations and long-acting injectable therapies, enhance treatment adherence and patient convenience, further fueling market growth.

Government initiatives and programs, including the Ryan White HIV/AIDS Program and Medicaid expansion under the Affordable Care Act, ensure broader access to HIV medications. These programs, coupled with increased funding for HIV treatment and prevention, play a critical role in market development. According to the Centers for Disease Control and Prevention, The National HIV/AIDS Strategy for the United States (NHAS) sets bold targets for ending HIV in the United States by 2030, including a 75% reduction in new HIV infections by 2025 and a 90% reduction by 2030. The Strategy focuses on four goals including preventing new HIV infections, improving HIV-related health outcomes of people with HIV, reducing HIV-related disparities and health inequities, and achieving integrated, coordinated efforts that address HIV among all partners and stakeholders. Public health campaigns emphasizing early diagnosis through routine testing have led to more individuals seeking timely treatment, boosting demand for HIV drugs.

United States HIV Drugs Market Trends:

Advancements in Antiretroviral Therapy (ART)

Innovations in ART, such as fixed-dose combinations and long-acting injectables, improve treatment efficacy and adherence. These developments enhance patient convenience, reduce side effects, and help achieve viral suppression, increasing their adoption. Continuous research drives the creation of safer, more effective drugs, expanding treatment options and supporting the market's growth. For instance, in June 2024, two clinical studies were initiated to investigate a new long-lasting version of HIV pre-exposure prophylaxis (PrEP) among cisgender women and individuals who use injectable drugs. The mid-stage trials will evaluate the safety, acceptability, and pharmacokinetics of lenacapavir, an injectable antiretroviral medication given every six months. Lenacapavir has received approval from the Food and Drug Administration for the treatment of HIV, used alongside other antiretroviral therapies, specifically for individuals who have undergone extensive treatment and cannot effectively manage their HIV infections with existing options due to resistance, intolerance, or safety issues related to other medications, and who have developed multidrug resistance.

Government Programs and Policies

Programs like the Ryan White HIV/AIDS Program and Medicaid aid in improving the access to HIV drugs for uninsured and underserved populations. Federal funding and initiatives promoting early diagnosis and routine testing ensure timely treatment, boosting drug demand and expanding the patient base. For instance, in August 2024, the Health Resources and Services Administration (HRSA) of the U.S. Department of Health and Human Services (HHS), announced more than $1.4 billion in Ryan White HIV/AIDS Program funding for the HRSA AIDS Drug Assistance Program and related awards. This HRSA funding ensures that individuals with HIV who have low incomes receive lifesaving medication, quality HIV health care, and essential support services. This announcement supports and advances the Biden-Harris Administration’s National HIV/AIDS Strategy.

Rising Awareness and Prevention Strategies

The growing awareness through public health campaigns has increased HIV testing and early diagnosis rates, prompting timely treatment initiation. According to the Centers for Disease Control and Prevention (CDC) reports published in 2023, studies on PrEP effectiveness have shown that consistent use of PrEP reduces the risk of getting HIV from sex by about 99% and from injection drug use by at least 74%. Preventive measures like pre-exposure prophylaxis (PrEP) are also gaining traction, contributing to market growth as more individuals adopt these medications to reduce transmission risks. For instance, in June 2024, Gilead Sciences, Inc. revealed topline findings from an interim analysis of its crucial Phase 3 PURPOSE 1 trial, showing that the company's biannual injectable HIV-1 capsid inhibitor, lenacapavir, exhibited 100% effectiveness for the experimental application of HIV prevention in cisgender women.

United States HIV Drugs Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States HIV drugs market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on drug class and distribution channel.

Analysis by Drug Class:

- Nucleoside Reverse Transcriptase Inhibitors

- Multi-Class Combination Products

- Protease Inhibitors

- HIV Integrase Strand Transfer Inhibitors

- Non-Nucleoside Reverse Transcriptase Inhibitors

- Entry Inhibitors — CCR5 Co-Receptor Antagonist

- Fusion Inhibitors

- Others

Nucleoside reverse transcriptase inhibitors (NRTIs) form the backbone of most antiretroviral therapies due to their effectiveness in halting viral replication. Their use in combination therapies and minimal resistance issues ensure consistent demand. Additionally, their inclusion in fixed-dose regimens improves patient adherence, solidifying their market share.

Combination therapies simplify treatment by including multiple drug classes in a single regimen. These reduce pill burden, enhance adherence, and improve treatment outcomes, making them highly preferred by patients and healthcare providers, thus dominating the market.

Protease inhibitors are critical for suppressing viral replication in resistant cases. Their durability against resistance and inclusion in salvage therapies maintain their relevance, especially for patients requiring advanced treatment options, ensuring significant market share.

HIV integrase strand transfer inhibitors are highly effective and well-tolerated, with fast viral load reduction. Their pivotal role in first-line treatment regimens and inclusion in fixed-dose combinations make them a cornerstone of modern HIV therapy, driving strong market demand.

Non-nucleoside reverse transcriptase inhibitors (NNRTIs) provide potent viral suppression and are widely used in combination therapies. Their cost-effectiveness and availability in low-dose formulations make them essential for comprehensive treatment options, sustaining their large market presence.

CCR5 antagonists block HIV entry into cells and are essential for patients with specific resistance profiles. Their role in targeted therapy options ensures continued relevance in specialized treatment regimens, driving demand.

Fusion inhibitors prevent HIV from fusing with host cells, offering a unique mechanism for resistant cases. Though used less frequently, their importance in salvage therapy for heavily treatment-experienced patients secures a stable market niche.

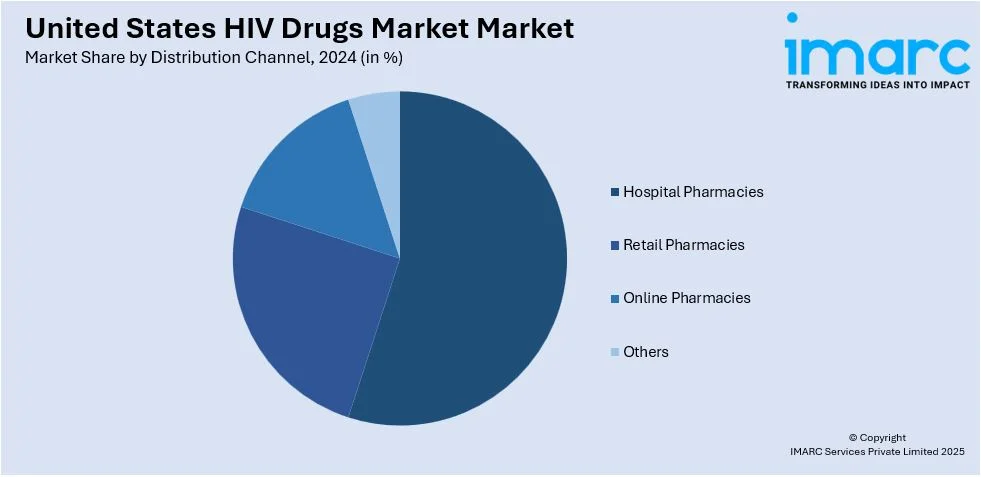

Analysis by Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others

In hospital pharmacies, dispensing anti-HIV drugs to newly diagnosed and hospitalized patients is a vital service. With this integration, the patient can receive counseling and adherence support, making these pharmacies a reliable source for complex therapies, including antiretrovirals, securing their significant market share.

Retail pharmacies are expected to lead the market share owing to their large availability and access to patients to refill their prescriptions. Their partnerships with HIV programs and insurance providers ensure steady drug availability and affordability. These make the pharmacies a major distribution channel within the market.

Online pharmacies are gaining traction due to their convenience, home delivery options, and discreet services, which appeal to patients seeking privacy in their HIV treatment. The rise of telemedicine and increasing internet penetration further drive the adoption of online platforms, boosting their market share.

Regional Analysis:

- Northeast

- Midwest

- South

- West

In the Northeast, high HIV awareness, extensive access to healthcare facilities, and robust government-funded programs drive the HIV drugs market. The region’s emphasis on routine testing, urban population density, and widespread availability of specialized clinics contribute to higher diagnosis rates and treatment uptake.

The Midwest benefits from increasing awareness campaigns and expanding access to affordable healthcare through Medicaid. Efforts to reduce stigma and improve rural healthcare infrastructure also play a crucial role in driving HIV drug adoption in the region.

The South, with a higher HIV prevalence, sees market growth driven by federal and state initiatives aimed at improving access to care. Programs targeting underserved communities, coupled with the growing adoption of preventive therapies like PrEP, are key factors supporting the demand for HIV drugs.

In the West, strong public health initiatives, progressive healthcare policies, and urban centers with advanced medical facilities fuel the HIV drugs market. The region also leads in adopting innovative therapies and preventive strategies, further boosting market growth.

Competitive Landscape:

The market is highly competitive, dominated by key players such as Gilead Sciences, ViiV Healthcare, Merck & Co., and Janssen Pharmaceuticals, especially due to the increasing development of new antiretrovirals, such as long-acting injectables and fixed-dose combinations aimed at improving treatment efficacy and adherence. PrEP is increasing competition further in preventive treatments. Strategic alliances, strong research pipelines, and government collaborations further cement their market presence and advantages while even; small biotech firms have their rounds with niche and next-generation therapies. For instance, in November 2024, Gilead Sciences unveiled the initial comprehensive overview of complete results from its critical Phase 3 PURPOSE 2 trial (NCT04925752), which examines biannual lenacapavir, the firm's injectable HIV-1 capsid inhibitor, for the exploratory application of HIV prevention among a wide and geographically varied group of cisgender men and gender-diverse individuals. Recently disclosed findings encompass information regarding the adherence to and pharmacokinetics of lenacapavir in trial participants.

Latest News and Developments:

- In August 2024, The U.S. Food and Drug Administration (FDA) has approved Dovato (dolutegravir/lamivudine) for the treatment of HIV-1 infection in adolescents aged 12 and older who weigh at least 25 kg and have never received antiretroviral therapy (ARV) or to replace the current ARV regimen in those who are virologically suppressed (HIV-1 RNA less than 50 copies/mL) on a stable ARV regimen with no history of treatment failure and no substitutions linked to resistance to the individual components of Dovato. ViiV Healthcare is a global specialist HIV company that is primarily owned by GSK, with Pfizer and Shionogi as shareholders.

- Gilead Sciences, Inc. and Merck, referred to as MSD outside the U.S. and Canada, revealed new findings from a Phase 2 clinical trial assessing the experimental combination of islatravir, an investigational nucleoside reverse transcriptase translocation inhibitor, and lenacapavir, a pioneering HIV-1 capsid inhibitor.

United States HIV Drugs Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Drug Classes Covered | Nucleoside Reverse Transcriptase Inhibitors, Multi-Class Combination Products, Protease Inhibitors, HIV Integrase Strand Transfer Inhibitors, Non-Nucleoside Reverse Transcriptase Inhibitors, Entry Inhibitors — CCR5 Co-Receptor Antagonist, Fusion Inhibitors, Others |

| Distribution Channels Covered | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States HIV drugs market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States HIV drugs market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States HIV drugs industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

HIV drugs are medications used to treat Human Immunodeficiency Virus (HIV) by suppressing the virus's replication, slowing disease progression, and improving immune function. These drugs, typically combined with antiretroviral therapy (ART), help manage the infection, reduce transmission risk, and enable individuals to live longer, healthier lives when taken consistently.

The United States HIV drugs market was valued at USD 7.8 Billion in 2024.

IMARC estimates the United States HIV drugs market to exhibit a CAGR of 5.2% during 2025-2033.

The key factors driving the market are advancements in antiretroviral therapy, increasing HIV prevalence, heightened awareness, early diagnosis initiatives, and government programs supporting treatment access. Innovations in long-acting formulations and combination therapies improve adherence, while ongoing research and rising demand for preventive measures like PrEP further boost market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)