United States Heparin Market Size, Share, Trends and Forecast by Product, Source, Mode of Administration, Application, End-User, Distribution Channel, and Region, 2025-2033

United States Heparin Market Size and Share:

The United States heparin market size was valued at USD 2.4 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 3.9 Billion by 2033, exhibiting a CAGR of 5.42% from 2025-2033. The market is driven by the rising prevalence of cardiovascular diseases, increased surgical procedures, continual advancements in drug delivery systems, growing focus on biosimilar development, and robust government and private sector investments, and escalating demand for advanced anticoagulant solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.4 Billion |

| Market Forecast in 2033 | USD 3.9 Billion |

| Market Growth Rate (2025-2033) | 5.42% |

United States heparin market Analysis:

- Major Market Drivers: The market growth is propelled by increasing cardiovascular disease prevalence, aging demographics requiring long-term anticoagulation therapy, surgical procedure volumes, and regulatory support for advanced anticoagulant formulations. Rising healthcare investments and personalized medicine adoption further accelerate market expansion across diverse clinical applications.

- Key Market Trends: Advanced drug delivery systems, biosimilar development, and prefilled syringe adoption characterize current market share trends. Digital health integration, outpatient care emphasis, and infection prevention focus drive innovation. Low molecular weight heparins gain prominence over traditional formulations in clinical practice.

- Competitive Landscape: Leading pharmaceutical companies dominate the United States heparin market demand through strategic partnerships, research investments, and manufacturing capacity expansion. Companies focus on quality assurance, regulatory compliance, and product differentiation. Market consolidation occurs through acquisitions and collaborative agreements among key players.

- Challenges and Opportunities: Supply chain vulnerabilities and regulatory complexities present market challenges. Growing emphasis on infection prevention and catheter-related solutions creates significant opportunities. United States heparin market analysis indicates potential for diversified sourcing strategies and advanced delivery systems. Emerging applications in personalized medicine offer substantial growth prospects for industry participants.

The market in the United States is primarily driven by the increasing prevalence of chronic diseases, where long-term anticoagulant therapies are required for management, such as atrial fibrillation and venous thromboembolism. Moreover, the growing demand for specialized anticoagulants in cardiovascular care is driving the United States heparin market growth. On 29th January 2024, Avenacy announced the U.S. launch of Bivalirudin for Injection, an anticoagulant indicated for use in patients undergoing percutaneous coronary interventions and those with heparin-induced thrombocytopenia. The introduction of this critical therapy reinforces Avenacy's commitment to expanding access to high-quality pharmaceutical solutions and addressing essential needs in cardiovascular and hematologic care within the U.S. healthcare system.

.webp)

To get more information on this market, Request Sample

The market is further driven by the increased interest in personalized medicine, where specific anticoagulation products are developed for a patient's individual profile, further accelerating research in new heparin formulations and uses. Strict regulatory monitoring and the industry's interest in maintaining high-quality standards for anticoagulant production are the major drivers of United States heparin market share expansion. The growing geriatric population in the United States is contributing significantly to the demand for anticoagulant therapies, as older adults are at a higher risk of developing conditions such as deep vein thrombosis, pulmonary embolism, and stroke. This demographic shift is leading to an increased focus on preventive and long-term therapeutic solutions.

United States Heparin Market Trends:

Escalating Demand for Advanced Anticoagulant Solutions

The healthcare sector is experiencing growing demand for innovative anticoagulant treatments that can prevent clots in the blood during medical procedures. For instance, B. Braun Medical Inc. announced the launch of heparin sodium 2,000 units in 0.9% sodium chloride injection (1,000 mL, 2 units/mL) in the United States in February 2024. This anticoagulant is designed for intravenous infusion, enhancing blood clot prevention during medical procedures. The product aligns with B. Braun's commitment to advancing patient care and increasing access to critical medical therapies. Advanced heparin sodium formulations help meet the increasing demand for effective and reliable intravenous solutions in hospitals and clinics. Such products improve patient care by guaranteeing accurate dosing and compatibility with modern infusion equipment.

Rising Emphasis on Infection Prevention in Healthcare

Increased awareness on the need to avoid catheter-related bloodstream infections through more advanced catheter lock solutions is fuelling the market demand. Effective catheter-related bloodstream infection-reducing innovative products are thus fast becoming essential in healthcare for better patient safety and conformance with regulations. Partnerships and agreements among the service providers and the suppliers create strategic benefits to ensure easy access to these solutions. For instance, in September 2024, CorMedix Inc. announced a new commercial agreement with a leading group purchasing organization (GPO), strengthening the availability of DefenCath, its taurolidine and heparin catheter lock solution. This collaboration aims to enhance market access for DefenCath in healthcare facilities, supporting improved patient safety and reducing catheter-related bloodstream infections. The agreement underscores CorMedix's commitment to delivering innovative infection prevention solutions.

Rising Government and Private Sector Investments

Government and private investments are contributing to the rapid growth of the market in the United States. Public health initiatives focused on expanding access to anticoagulants and reducing the cost are also increasing the demand for heparin products. Private pharmaceutical firms are also investing in research and development of new formulations with enhanced efficacy and better safety profile compared to the existing heparin products. These investments enhance the scaling up of manufacturing capacities to ensure a consistent supply of high-quality anticoagulants. Also, collaborations between healthcare institutions and manufacturers are helping to adapt heparin in various clinical applications from surgical interventions to dialysis.

United States Heparin Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States heparin market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product, source, mode of administration, application, end-user, and distribution channel.

Analysis by Product:

- Unfractionated Heparin

- Low Molecular Weight Heparin (LMWH)

- Ultra-Low Molecular Weight Heparin (ULMWH)

Unfractionated heparin (UFH) has been used in hospitals as a rapid anticoagulant. Its short half-life and reversibility make it ideal for acute care settings, especially during surgeries and dialysis. The intravenous or subcutaneous administration of UFH offers flexibility in treatment, ensuring effective management of thrombosis and related conditions in critically ill patients.

Low molecular weight heparin (LMWH) has a greater half-life than UFH, thus it can only be administered once a day thereby reducing the workload on physicians and patients. It's used for outpatient treatment on cases of deep vein thrombosis and pulmonary embolism due to its wide use with less monitoring requirements for LMWH.

Ultra-low molecular weight heparin represents an emerging segment within the U.S. heparin market, as it exhibits a targeted mechanism of action and reduced risk of bleeding. Heparins are designed for high efficacy in thromboembolic prevention with minimal side effects. ULMWH is gaining traction in specific areas of care, including cancer-associated thrombosis and long-term anticoagulation management, reflecting advancements in precision medicine, and expanding its role in modern healthcare.

Analysis by Source:

- Bovine

- Porcine

Bovine heparin is known as an alternative strategic alternative to a porcine-based approach, mitigating supply chain vulnerabilities and possible shortages in the future. Regulatory entities encourage the re-entry to establish diversified sources that can impact market stability. Bovine heparin meets the high-quality and stringent safety standards that can efficiently suffice against the growing needs for anticoagulants applied in various clinical settings through the U.S. health care system.

Porcine-source heparin dominates in the United States heparin market, accounting for the majority of production due to its established safety and efficacy. It is widely utilized in conditions such as thrombosis and surgical procedures. Easy accessibility of porcine sources, therefore, ensures steady availability to ensure that the health delivery system can maintain the continuous anticoagulant supply in place.

Analysis by Mode of Administration:

- Oral

- Parenteral

Oral anticoagulants are gaining popularity in the US heparin market as a convenient alternative to traditional parenteral formulations. These drugs, which are used for long-term management of thromboembolic disorders, increase patient compliance due to their ease of administration. Oral heparin derivatives have been developed to meet specific needs, and the demand for patient-centered anticoagulant solutions is increasing in outpatient and home care settings.

Parenteral heparin is still an essential drug in acute care settings, especially for the emergency management of thromboembolic events and during surgical interventions. Its rapid onset of action makes it an indispensable drug in critical care, providing accurate control over anticoagulation levels. The injectable form is widely used in hospitals for conditions requiring immediate therapeutic intervention, thereby underlining its irreplaceable role in managing coagulation disorders and preventing complications in high-risk patients.

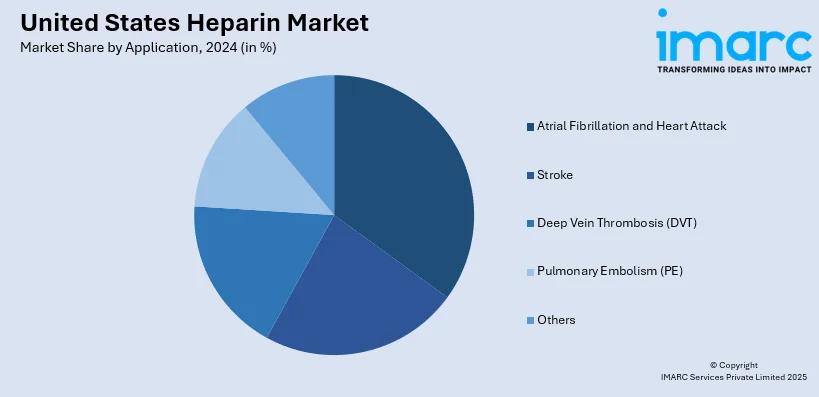

Analysis by Application:

- Atrial Fibrillation and Heart Attack

- Stroke

- Deep Vein Thrombosis (DVT)

- Pulmonary Embolism (PE)

- Others

Atrial fibrillation (AFib) has a huge impact on the U.S. heparin market due to its prevalence and the resulting risk of blood clots and severe complications. AFib patients usually need anticoagulant therapies, such as heparin, to prevent stroke and systemic embolism. The rise in diagnosis rates and incorporation of advanced monitoring technologies underline the importance of heparin in managing this condition safely and effectively.

Stroke is an important medical condition in the United States, accounting for a significant portion of the anticoagulant therapies that are heparin. Since it is the leading cause of long-term disability and mortality, preventing and treating stroke remains one of the priorities in healthcare. Ensuring less clot formation during ischemic strokes through the use of heparin, the importance of the product in treatment protocols ensures its continued market growth and development in this domain.

Another major driver in the U.S. heparin market is deep vein thrombosis (DVT), commonly linked to post-stroke immobility. Prophylactic and therapeutic use of heparin helps in minimizing clot risks, thereby preventing pulmonary embolism complications. The two significant uses of heparin for stroke related DVT prevention and acute stroke management point to its vital position in tackling these interrelated health issues, further supported the market supremacy and demand.

Analysis by End-User:

- Hospitals

- Clinics

- Homecare Settings

- Ambulatory Surgical Centers

- Others

Hospitals form a huge part of the United States heparin market as they provide critical care and surgery management services. Heparin is used in the majority of hospitals for anticoagulation purposes in surgeries, intensive care, and emergency interventions. Its speed of action and effectiveness make it a vital component of operating rooms and ICUs. The central procurement mechanisms in hospitals also guarantee uninterrupted supplies of high-quality heparin for different medical purposes.

Clinics play a significant role in dealing with outpatient anticoagulation needs. Chronic situations of deep vein thrombosis and atrial fibrillation continue to require long-term administration of heparin. Easy accessibility coupled with patient-centric care allows demand for prefilled syringes and low molecular weight heparins through this space.

Homecare settings are gaining importance in the heparin market with an increased trend for outpatient care and self-administration of anticoagulants. Drug delivery systems like prefilled syringes allow safe and convenient use of heparin at home. This is significant especially for elderly and chronically ill patients requiring long-term anticoagulation therapy. The shift towards home-based healthcare reduces hospitalization rates but increases demand for heparin products.

Analysis by Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Drug Stores

- Online Stores

- Others

Hospital pharmacies are one of the primary suppliers in the United States heparin market due to their role in providing the needed anticoagulant supplies for inpatient care. They provide heparin for surgery, emergency treatment, and in intensive care units. Maintaining quality control and offering customizable dosing solutions, the hospital pharmacy supports the safe and effective administration of heparin to address immediate medical needs and improve patient outcomes in the clinical setting.

Retail pharmacies play an important role in the dispensing of heparin in outpatient settings and home care therapies. Such outlets serve as a middle link between the producers and consumers to provide accessible essential anticoagulants. Retail pharmacies are essential in the management of chronic diseases such as deep vein thrombosis and atrial fibrillation. By offering counseling, they help ensure medication compliance and safety outside the hospital settings.

Drug stores cater to patients with a need for over the counter or prescription-based anticoagulants. The stores are often sited in residential neighborhoods so that heparin products are available when needed, whether as a preventive or maintenance treatment. Drug stores are vital for rural and underserved populations, providing access points to critical medications and adding to the overall network of distribution within the heparin market.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast area is one of the more important regions in the market based on its well-developed healthcare infrastructure and a heavy concentration of leading medical organizations. This region has strong demand for anticoagulant therapies due to cardiovascular diseases as well as surgical interventions. In addition, the region has a well-established pharmaceutical production base and active research. This improves the availability and discovery of heparin products in the region.

The heparin market is expanding in the Midwest due to the high number of hospitals and clinics that have spread throughout the region, both urban and rural. Chronic diseases, such as deep vein thrombosis, are common and require long-term anticoagulation therapy, thus driving demand. Furthermore, the Midwest is a hub for pharmaceutical production and distribution, ensuring that there is always a steady supply of quality heparin products available to meet healthcare needs.

The South is considered a substantial portion of the heparin market mainly due to its large diverse population with a high aging population who are prone to coagulation disorders. The growing healthcare infrastructure combined with an increase in surgeries has further increased the use of anticoagulants in the South. Additionally, public health initiatives and private investments in the healthcare sector have increased access to heparin for the urban as well as the underserved areas.

The Western United States is an important region in the heparin market, led by its innovative healthcare practices and high adoption of advanced medical technologies. This region focuses highly on outpatient care, which involves home healthcare solutions that raise the demand for prefilled syringes and other delivery systems for heparin. The presence of major biotechnology firms and research institutions further supports the ongoing developments of anticoagulant therapies.

Competitive Landscape:

The key players in the US heparin market are focusing on strategic initiatives for stronger market presence and cater to the changing needs of the healthcare sector. Rising investments in research and development leads to innovation of safer and more effective formulations for heparin, such as biosimilars and combination therapies. They focus on collaboration with the distribution networks and healthcare providers for improving product access and enhancing the supply chain. Quality assurance continues to be a significant area of focus as companies take safety and compliance measures to meet regulatory requirements. Also, substantial efforts are being made towards increasing production capacities to ensure the steady supply of heparin, which is witnessing increased demand. Market leaders are also focused on patient-centric solutions, such as prefilled syringes and advanced delivery systems to increase convenience and adherence in a variety of clinical applications.

The report provides a comprehensive analysis of the competitive landscape in the United States heparin market with detailed profiles of all major companies.

Latest News and Developments:

- In April 2024, CorMedix Inc. announced the U.S. inpatient commercial availability of DefenCath® (taurolidine and heparin) catheter lock solution. Approved by the FDA, the product is designed to reduce catheter-related bloodstream infections in adult hemodialysis patients, marking a significant advancement in patient safety and therapeutic care.

- In February 2024, B. Braun Medical Inc. formally launched Heparin Sodium 2,000 units in 0.9% Sodium Chloride Injection, 1,000 mL (2 units/mL) in the United States. Manufactured in Irvine, California, the product supports catheter patency while reinforcing patient safety, environmental responsibility, and the company’s commitment to a secure domestic pharmaceutical supply.

- On 16th September 2024, Techdow USA launched the Enoxaparin Sodium Injection, expanding its anticoagulant portfolio alongside heparin injection. This low-molecular-weight heparin is indicated for preventing and treating thromboembolic disorders. The launch underscores Techdow's commitment to enhancing access to high-quality, cost-effective anticoagulant therapies in the U.S. healthcare market, supporting improved patient care and addressing critical needs in thrombosis management.

United States Heparin Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Unfractionated Heparin, Low Molecular Weight Heparin (LMWH), Ultra-Low Molecular Weight Heparin (ULMWH) |

| Sources Covered | Bovine, Porcine |

| Mode of Administrations Covered | Oral, Parenteral |

| Applications Covered | Atrial Fibrillation and Heart Attack, Stroke, Deep Vein Thrombosis (DVT), Pulmonary Embolism (PE), Others |

| End-Users Covered | Hospitals, Clinics, Homecare Settings, Ambulatory Surgical Centers, Others |

| Distribution Channels Covered | Hospital Pharmacies, Retail Pharmacies, Drug Stores, Online Stores, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States heparin market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States heparin market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States heparin industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Heparin in the United States is an anticoagulant drug used to prevent and treat blood clots, including DVT, PE, and stroke. It exists as unfractionated heparin and low molecular weight heparins like enoxaparin. Primarily sourced from pig intestines, it is FDA-regulated and widely used in hospitals and surgical procedures.

The United States heparin market was valued at USD 2.4 Billion in 2024.

The United States heparin market is projected to exhibit a CAGR of 5.42% during 2025-2033, reaching a value of USD 3.9 Billion by 2033, supported by demographic trends and healthcare infrastructure developments.

Rising cardiovascular disease prevalence, geriatric population demographics, increased surgical procedures, advancements in drug delivery systems, and growing focus on personalized medicine approaches drive market expansion. Government healthcare initiatives and private sector investments further accelerate growth across therapeutic applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)