U.S. Heat Transfer Fluids Market Size, Share, Trends and Forecast by Type, End User, and Region, 2025-2033

U.S. Heat Transfer Fluids Market Size and Share:

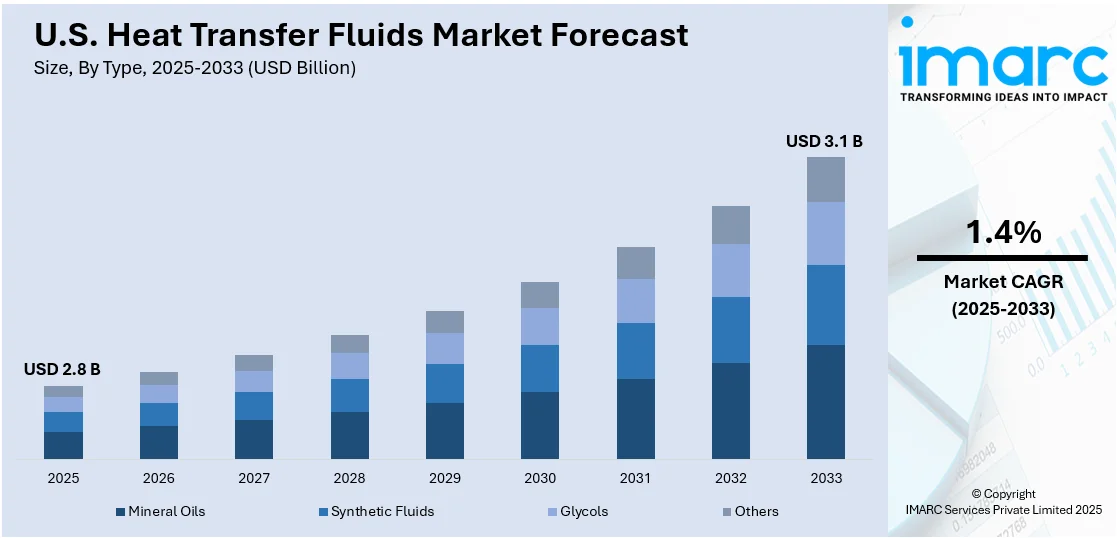

The U.S. heat transfer fluids market size is anticipated to reach USD 2.8 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 3.1 Billion by 2033, exhibiting a CAGR of 1.4% from 2025-2033. The market is experiencing significant growth driven by increasing demand in renewable energy, chemical processing, and HVAC applications, continual advancements in industrial heating systems and stringent energy efficiency regulations, highlighting the need for high-performance, and sustainable thermal management solutions across diverse sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2025

|

USD 2.8 Billion |

|

Market Forecast in 2033

|

USD 3.1 Billion |

| Market Growth Rate (2025-2033) | 1.4% |

The market in the United States is primarily driven by the growing focus on green and biodegradable heat transfer fluids that has fostered innovation and adoption. Moreover, strategic acquisitions in heat transfer fluids markets continue to spur innovation and expansion by enabling companies to acquire necessary specialized expertise and broaden the scope of technological capabilities they can utilize. This should enhance their capacity to better deliver solutions to changing industry expectations for thermal management efficiency. For example, on 12th July 2024, the Nudyne Group LLC announced its acquisition of Howard engineering heat transfer products Corp to expand its expertise in heat transfer fluids and related technologies. This strategic move strengthens Nudyne’s market position, enabling the delivery of innovative solutions in heat transfer and fluid management. The acquisition underscores Nudyne’s commitment to advancing capabilities and meeting growing industry demands for efficient thermal management products.

Furthermore, the U.S. heat transfer fluids market is also driven by the rapid expansion of data centers and digital infrastructure. The growing dependence on cloud computing, artificial intelligence, and big data analytics has forced data centers to maintain optimum operating conditions for servers with efficient thermal management systems. Heat transfer fluids play a critical role in cooling these systems and ensuring performance stability and avoiding overheating. In addition, growth in adoption of electric vehicles is contributing to the United States heat transfer fluids market share due to demand for effective thermal management systems for EV batteries and powertrain systems to improve safety, efficiency, and longevity. Increasing chemical synthesis and pharmaceutical manufacturing industries propel demand for heat transfer fluids, wherein precise temperature control is very critical for product consistency and safety.

U.S. Heat Transfer Fluids Market Trends:

Expanded Collaboration for Heat Transfer Fluids

The increased penetration of the market for heat transfer fluids is driven by the establishment of strategic partnerships between key players in the lubricant and fluid industry. By leveraging expanded distribution networks, this collaboration ensures a broader reach and improved customer accessibility in regions with rising industrial activity, including Europe, the Middle East, and North Africa. The focus on advanced fluid solutions addresses growing demands for high-performance thermal management systems. This initiative signifies the capability of strategic alliances in market competitiveness, with tailored solutions and innovation into the heat transfer fluids sector, thus expanding the United States heat transfer fluids market size. On 29th October 2024, Lubrizol announced its expanded collaboration with oil store to strengthen its finished fluids business across the U.K., Europe, the Middle East, and North Africa. The partnership focuses on heat transfer fluids and lubricants, aiming to enhance market reach and customer solutions. This initiative also aligns with Lubrizol’s growth strategy, leveraging oil store’s distribution capabilities to meet increasing demand in the region.

Advanced Maintenance Solutions Driving Efficiency in Heat Transfer Systems

The innovative maintenance methods introduced for the heat transfer systems continue to revolutionize the concepts of operational efficiency in business sectors requiring continuous thermal management. These solutions deal with typical issues such as thermal cracking and oxidation in heat transfer fluids, enhancing system performance and extending fluid life. As they eliminate the need for shutdowns, these advances reduce downtime and maintenance costs while improving overall reliability. It demonstrates growing concern with the improvement of the productive and sustainable industrial processes to meet the increasingly developing needs for efficient, low-cost, and thermal management in such industries as manufacturing, energy, and infrastructure. On December 19, 2024, precision lubrication reported on a novel maintenance method for heat transfer systems (HTS) that enhances efficiency without necessitating shutdowns. This technique addresses issues like thermal cracking and oxidation in heat transfer fluids, thereby improving system performance and extending fluid lifespan.

Rising Demand from Renewable Energy Applications

As per the United States heat transfer fluids market forecast, the usage of heat transfer fluids is growing due to increasing adoption of renewable energy technologies. Concentrated solar power plants depend significantly on heat transfer fluids for efficient energy collection and storage, hence ensuring continuous power generation. With the U.S. further moving towards clean energy, investments in solar and wind energy projects are growing, thereby increasing the need for advanced thermal management solutions. Heat transfer fluids with a high thermal stability and efficiency are essential in reaching such performance goals, thereby fueling expansion in the market. Renewed efforts at sustainability through energy and lowering carbon footprints also fuel the applications of heat transfer fluids in renewable energy.

U.S. Heat Transfer Fluids Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the U.S. heat transfer fluids market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type and end user.

Analysis by Type:

- Mineral Oils

- Synthetic Fluids

- Glycols

- Others

Mineral oils account for a strong market share in the U.S. market due to their economies of scale and high prevalence in industrial heating and cooling applications. Derived from petroleum, these fluids are used predominantly due to their thermal stability and capability to operate through moderate temperature ranges. Minerals are used by manufacturing and chemical processing industries for efficient thermal management and hence remain the cornerstones of traditional heat transfer solutions.

Synthetic fluids are becoming increasingly popular in the market due to their excellent thermal performance and longer operational life. These fluids, which are usually designed for extreme temperatures, are necessary for applications that demand high thermal stability, such as concentrated solar power plants and advanced manufacturing processes. Their ability to reduce maintenance costs and improve system reliability makes synthetic fluids a crucial choice for industries that emphasize efficiency and durability.

Glycols, especially ethylene and propylene glycols, are highly in demand in the market due to their excellent antifreeze properties and adaptability in low-temperature environments. Being used in HVAC systems, refrigeration, and food processing, glycols provide efficient heat transfer and freeze protection. The non-toxic and biodegradable variants also fit environmental regulations, which further adds importance to these glycols in industries that are more sustainability and eco-friendly in terms of thermal solutions.

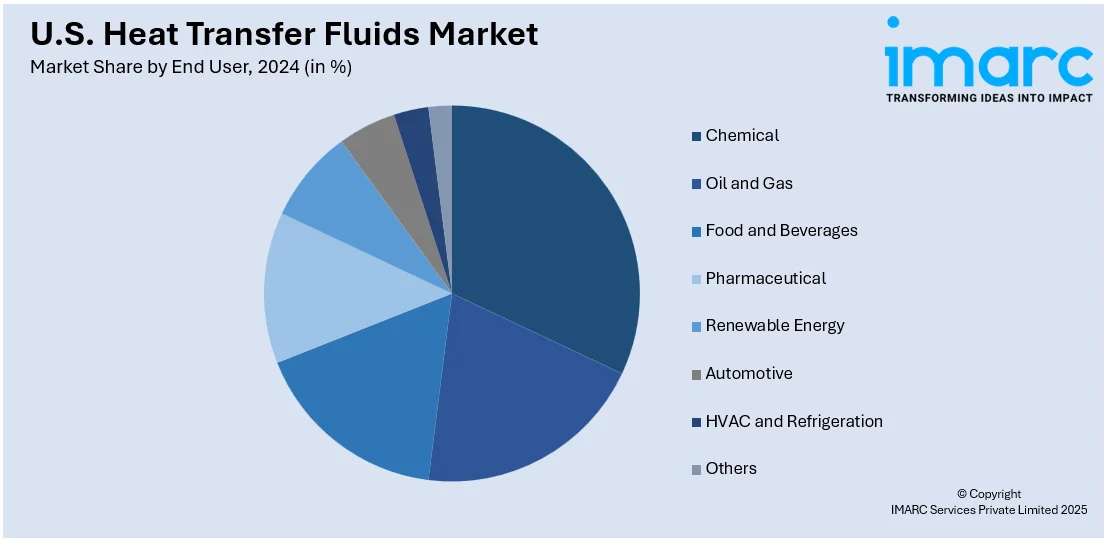

Analysis by End User:

- Chemical

- Oil and Gas

- Food and Beverages

- Pharmaceutical

- Renewable Energy

- Automotive

- HVAC and Refrigeration

- Others

The chemical industry plays a pivotal role in driving the U.S. market, as precise temperature control is essential in processes such as distillation, polymerization, and synthesis. Heat transfer fluids ensure efficiency and product consistency in these critical operations. The demand for high-performance, thermally stable fluids is rising, driven by the industry's growth in specialty chemicals and advancements in production technologies.

The oil and gas sector significantly influences the U.S. heat transfer fluids market through its need for effective thermal management in refining, processing, and pipeline operations. Heat transfer fluids are vital in maintaining operational efficiency and preventing equipment damage under extreme temperatures. With increasing exploration and processing activities, the sector is adopting advanced fluid technologies that enhance safety, efficiency, and sustainability.

The food and beverage industry are a key consumer of heat transfer fluids, relying on them for thermal control in processes like pasteurization, freezing, and cooking. These fluids ensure consistent temperatures, product quality, and energy efficiency. As the demand for processed and packaged foods grows, the need for high-performance, food-grade heat transfer fluids that meet stringent safety and hygiene standards is expanding, driving market growth.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region is crucial in the U.S. market, considering its high concentration of industrial and commercial sectors, including pharmaceuticals and advanced manufacturing. The region's harsh winters increase the demand for efficient heating solutions, which means that high-performance heat transfer fluids are adopted more readily. Moreover, the presence of research institutions fosters innovation, enhancing the region's contribution to advancements in thermal management technologies.

The Midwest sector highly influences the heat transfer fluids market with their significant manufacturing, automotive, and agricultural industries. There also arises a demand for an efficient thermal management system, such as in food processing and biofuel production. The region's aim toward energy recovery and sustainability during industrial processes highlights the heat transfer fluids' role in maximized process efficiency and environmental regulation.

The South is a significant contributor to the heat transfer fluids market due to its fast industrial growth and expanding petrochemical and energy sectors. The region's high temperatures require effective cooling solutions in industries such as oil refining and power generation. In addition, renewable energy projects, especially in solar power, are on the rise, further increasing the demand for advanced thermal management systems and innovative fluid formulations.

The West is also the largest customer of renewable energy sources especially solar and geothermal technologies, hence the biggest buyer of heat transfer fluids used in the sectors. High technology and hubs of data centers also are major users of efficient thermal solutions. Due to stringent environmental regulations the region prefers eco-friendly as well as biodegradable types of heat transfer fluids which makes the region an attractive market for sustainable thermal management innovations.

Competitive Landscape:

The key players of the U.S. market are investing efforts in innovation, strategic partnerships, and capacity building for enhancing their presence in the market. The companies have been developing advanced fluid formulations with improved thermal stability, energy efficiency, and environmental compliance to satisfy the changing needs of various sectors like energy, automobile, and manufacturing. There is a growing trend of strategic partnerships and acquisitions that allows firms to expand their product portfolio and penetrate untapped markets. Collaborations with distributors are enhancing supply chain efficiency and ensuring broader customer reach. Furthermore, major companies are investing significantly in R&D to develop environmentally friendly and biodegradable heat transfer fluids in line with the stringent environmental regulations, increasing consumer preference for green solutions.

The report provides a comprehensive analysis of the competitive landscape in the U.S. heat transfer fluids market with detailed profiles of all major companies.

Latest News and Developments:

- November 2024: Marquardt announced the expansion of its flow sensor portfolio with advanced ultrasonic technology, designed to enhance precision and reliability in managing heat transfer fluids and other applications. The new sensors improve performance across industries by delivering accurate flow measurement and durability. This innovation underscores Marquardt’s dedication to cutting-edge fluid management solutions, addressing the growing demand for high-performance flow sensors in industrial and commercial sectors.

- Nov 29, 2024: ABC Technologies has reached an agreement to acquire TI Fluid Systems, a global manufacturer of thermal and fluid system solutions for vehicles. The deal is valued at approximately £1,831 Million and is expected to be completed in the first half of 2025.

- February 1, 2024: TotalEnergies' Special Fluids division has joined GRC's ElectroSafe Fluid Partner Program to collaborate on advancing the performance and environmental footprint of single-phase immersion cooling fluids for data centers. TotalEnergies will provide its Biosourced BioLife Immersion Cooling Fluids, focusing on environmental friendliness and reduced carbon footprint.

- Jan 02, 2024: Modine, a global leader in thermal management solutions, has acquired the intellectual property and assets of TMG Core, specializing in liquid immersion cooling technology for high-density computing data centers. This is expected to enhance Modine's position in the growing data center market and enables the company to offer advanced solutions for high-density computing applications, such as AI and 5G.

U.S. Heat Transfer Fluids Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Mineral Oils, Synthetic Fluids, Glycols, Others |

| End Users Covered | Chemical, Oil and Gas, Food and Beverages, Pharmaceutical, Renewable Energy, Automotive, HVAC and Refrigeration, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the U.S. heat transfer fluids market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the U.S. heat transfer fluids market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the U.S. heat transfer fluids industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Heat transfer fluids are specialized liquids used to transfer heat in industrial and commercial systems. Their applications include renewable energy, chemical processing, automotive systems, and HVAC operations, where precise thermal management is critical for efficiency, safety, and system longevity.

The U.S. heat transfer fluids market size is anticipated to reach USD 2.8 Billion in 2025.

IMARC estimates the U.S. heat transfer fluids market to exhibit a CAGR of 1.4% during 2025-2033.

The market is driven by rising demand in renewable energy, chemical processing, and HVAC applications, alongside advancements in industrial heating systems, expanding data centers, and growing adoption of electric vehicles, highlighting the need for sustainable and high-performance thermal management solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)