United States Health and Wellness Market Size, Share, Trends and Forecast by Product Type, Functionality, and Region, 2025-2033

United States Health and Wellness Market Size and Share:

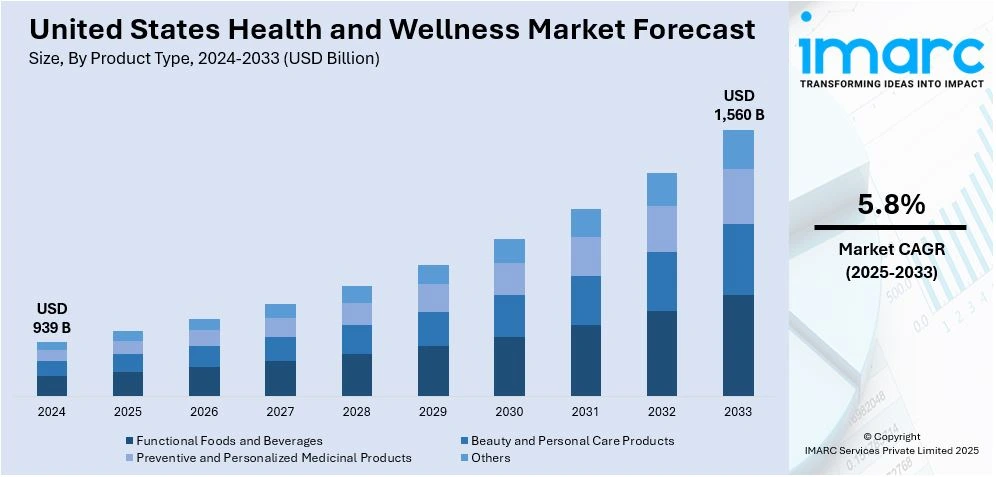

The United States health and wellness market size was valued at USD 939 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,560 Billion by 2033, exhibiting a CAGR of 5.8% from 2025-2033. The market is propelled by the rising personal demand for healthier living, heightened awareness regarding preventive healthcare, and the popularity of fitness and nutrition initiatives. Technological progress, an increase in organic and natural product options, and tailored wellness solutions also contribute to the market growth. Furthermore, corporate wellness programs and the growing awareness about mental health are influencing the health and wellness market in the United States.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 939 Billion |

|

Market Forecast in 2033

|

USD 1,560 Billion |

| Market Growth Rate 2025-2033 | 5.8% |

Individuals are becoming proactive about their health, trying to prevent chronic diseases by changing their lifestyles. There is a rise in demand for nutritional supplements, fitness programs, and functional foods as people take wellness over-reactive medical care. This shift is driving the demand for wellness services, personalized nutrition plans, and fitness solutions that cater to individual needs. Additionally, the growing awareness about stress management, mindfulness, and therapy is catalyzing the demand for services like meditation apps, counseling, and wellness retreats. Apart from this, people are adopting holistic practices such as yoga, meditation, acupuncture, and alternative therapies to get their bodies, minds, and souls in balance. This movement is increasing the need for wellness retreats, holistic healthcare, and integrative practitioners.

Moreover, technology is revolutionizing wellness by offering access to telehealth services, online fitness programs, and wearable health monitors. Digital platforms assist in tracking fitness, sleep, and nutrition, encouraging lasting behavioral changes. The appeal of wellness apps and devices available on demand is drawing in tech-oriented people. In addition to this, health-oriented wearable gadgets, such as fitness bands and smartwatches, are enabling people to track essential health indicators like heart rate, activity intensity, and sleep quality. The insights derived from these devices encourage responsibility and sustainable wellness practices. Furthermore, the rise of chronic conditions such as obesity, diabetes, and heart-related problems is encouraging people to embrace healthier habits. This change is creating a demand for weight control solutions, fitness items, and wellness initiatives that encourage improved health results.

United States Health and Wellness Market Trends:

Rising Focus on Preventative Healthcare

People are focusing on preventive healthcare to ensure lasting wellness and lower healthcare costs. This change arises from an increasing awareness about chronic illnesses like obesity, diabetes, and heart disease, which are frequently associated with unhealthy eating, inactive habits, and stress. Availability of online resources, health-focused applications, and wearable fitness gadgets is enabling people to manage their health more effectively through improved nutrition, physical activity, and stress reduction. Companies are offering products and services that encourage healthier lifestyles, such as functional foods, natural supplements, and wellness initiatives. This evolving user attitude is driving the need for products and services that focus on disease prevention and overall wellness. In 2024, Cleveland Clinic partnered with FitNow, Inc. to launch the Cleveland Clinic Diet app, which offers research-based dietary guidance, exercise tracking, and professionally guided workout plans. The app features AI-driven tools like voice, photo, and barcode food tracking to help users achieve sustainable health goals. Two customized programs, BodyGuard and HeartSmart, encourage nutritious eating and cardiovascular wellness.

Growing Popularity of Digital Health Apps and Wearables

People are leveraging health apps for fitness tracking, nutrition planning, and habit formation, while wearables like smartwatches monitor physical activity, heart rate, and sleep quality. These tools provide real-time feedback, helping individuals adopt healthier lifestyles and set measurable wellness goals. Integration of artificial intelligence (AI) enhances these technologies, offering personalized insights and predictive analytics for fitness, stress management, and chronic disease prevention. The data-driven nature of these tools encourages accountability and enables users to monitor progress effectively. Additionally, partnerships between wellness companies and tech firms are creating integrated ecosystems where digital platforms connect individuals to nutritionists, trainers, and wellness experts. This growing reliance on technology highlights its role as a driver of accessible, customizable wellness solutions in daily life. In 2024, Abbott launched Lingo™, its first continuous glucose monitor (CGM) for health and wellness, which is currently available in the US without a prescription. Designed to provide real-time glucose tracking and personalized coaching, Lingo helps users improve metabolism, manage weight, and optimize overall well-being. It includes tailored insights, activity logging, and flexible purchase options.

Rise of E-Commerce Platforms for Health and Wellness Products

Businesses are creating specialized online marketplaces aimed at health-focused consumers by providing an extensive selection of wellness products, such as organic food, dietary supplements, natural personal care products, and fitness gear. These platforms prioritize ease of use, guaranteeing smooth nationwide shipping, and improving access to specialized health-oriented products. Leveraging advanced technology, data analytics, and AI, businesses are attracting a growing number of individuals searching for healthier alternatives online. Partnerships between wellness brands and technology providers further boost visibility and sales. Individuals are prioritizing convenience and transparency in their purchasing decisions, which is making e-commerce platforms a vital channel for meeting the rising demand for health and wellness solutions while reshaping how people shop for healthier lifestyles. In 2024, Jiva Technologies, in partnership with We Got Groceries, launched wegotgroceries.com, an online platform specializing in health and wellness products. The platform ensures seamless delivery across the US and aims to capture a share of the growing health-focused food market. The joint venture leverages JIVA's technology and SEO expertise to drive traffic and sales.

United States Health and Wellness Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States health and wellness market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type and functionality

Analysis by Product Type:

- Functional Foods and Beverages

- Beauty and Personal Care Products

- Preventive and Personalized Medicinal Products

- Others

Functional foods and beverages are a crucial segment in the market, as individuals prioritize nutrition to enhance overall well-being. Products such as fortified foods, probiotics, and energy-boosting beverages are gaining traction for their health benefits like improved immunity, digestion, and energy levels. Increased awareness about natural ingredients and demand for clean-label options are shaping this segment, with people seeking convenient and nutrient-dense choices.

Beauty and personal care are driven by a growing demand for natural, chemical-free, and sustainable products. People are concentrating on products for skin, hair, and wellness that enhance general health and provide lasting outcomes. Trends in clean beauty are inspiring brands to create products using transparent ingredients and environmentally sustainable methods. Furthermore, incorporating wellness principles like anti-stress and anti-aging benefits into personal care items is synchronizing beauty practices with overall health objectives.

Preventive and personalized medicinal products are gaining momentum as people seek targeted solutions to prevent chronic illnesses and enhance quality of life. Businesses are utilizing progress in genomics and biotechnology to develop personalized supplements, vitamins, and wellness treatments suited to specific health needs.

Others encompass wellness tourism, fitness gear, and alternative therapies, addressing varied user requirements. Comprehensive health approaches such as yoga, meditation, and integrative therapies are gaining popularity as people emphasize mental and physical wellness.

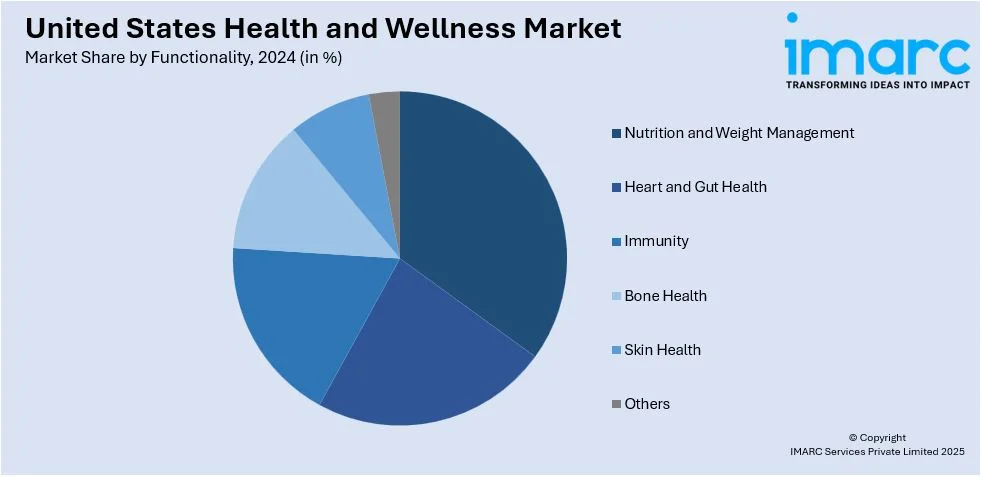

Analysis by Functionality:

- Nutrition and Weight Management

- Heart and Gut Health

- Immunity

- Bone Health

- Skin Health

- Others

Nutrition and weight management segment is growing as people prioritize a healthy lifestyle through balanced eating and active habits. People are looking for items like meal replacements, protein supplements, and low-calorie functional foods to control their weight and meet fitness objectives. This segment is supported by a growing emphasis on portion management, conscious eating, and tracking nutrition, enhanced by digital resources and customized meal strategies.

Heart and gut health promoting products are gaining traction due to their role in supporting essential bodily functions. Omega-3-rich foods, probiotics, and fiber-enriched products are in demand for improving cardiovascular performance and digestive balance. Consumers are recognizing the link between gut health and overall well-being, leading to higher adoption of prebiotic and probiotic supplements.

The immunity segment is propelled by growing awareness regarding preventive healthcare. Individuals are seeking vitamins, minerals, and functional foods that boost immune function and safeguard against diseases. Items that include antioxidants, plant extracts, and immune-enhancing nutrients such as vitamin C and zinc are experiencing considerable growth. Companies are focusing on introducing natural and plant-based immunity products, as individuals seek holistic solutions to improve resilience and overall health.

The bone health segment is growing as consumers emphasize products that enhance mobility, joint resilience, and bone density. Calcium, vitamin D, and collagen-rich products are highly desired to avert bone issues and improve musculoskeletal well-being. Functional drinks, supplements, and enhanced foods aimed at improving bone strength are experiencing consistent demand.

Skin health is becoming central to wellness practices, supported by the rising need for products that improve skin look and performance. Collagen supplements, hyaluronic acid, and formulations rich in antioxidants are being utilized to aid hydration, elasticity, and anti-aging requirements.

Others include offerings and services that promote overall wellness, such as sleep health, mental well-being, and energy management. Options like adaptogens, herbal infusions, and calming supplements are tackling stress and exhaustion, whereas sleep-oriented items such as melatonin-based products aid people in obtaining restorative sleep.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast is witnessing steady expansion in the health and wellness industry, supported by strong individual interest in natural, organic, and functional products. The emphasis on fitness trends, healthy eating, and preventive health practices in the area is resulting in an increase in wellness offerings like boutique fitness studios, holistic therapies, and mental health initiatives. Individuals are embracing personalized nutrition, plant-based eating, and digital fitness options, fostering innovation and the acceptance of wellness products that match their health goals.

In the Midwest, the market for health and wellness is growing as awareness about preventive healthcare and balanced living increases. People are adopting functional foods, weight control options, and exercise programs to tackle health issues and ensure overall wellness. The growing appeal of alternative treatments, including yoga and meditation, is additionally boosting the demand for wellness services.

The South is becoming a significant player in the health and wellness sector, driven by a rising demand for functional foods, fitness services, and wellness initiatives. Individuals are focusing on heart wellness, weight control, and products that enhance immunity, resulting in increased use of nutritional supplements and fitness technologies. Comprehensive wellness approaches such as integrative therapies and mental health services are becoming increasingly popular.

The West is an essential part of the market, propelled by robust user demand for comprehensive health approaches, cutting-edge wellness offerings, and transparent-label items. Functional foods, plant-centered diets, and fitness innovations are commonly embraced as people prioritize their overall wellness. The need for mental health services, tailored nutrition, and sustainable products is driving growth in this area.

Competitive Landscape:

Key players in the market are focusing on expanding product portfolios, enhancing digital capabilities, and adopting innovative technologies to meet the growing user demand. They are investing in research operations to deliver personalized wellness solutions, such as tailored nutrition, fitness, and mental health services. Companies are forming strategic partnerships to increase market reach and improve service accessibility. Emphasis on sustainability and clean-label products is driving innovation in organic and natural offerings. Additionally, digital platforms and wearable technology integration are being prioritized to provide real-time health insights, fostering client engagement and long-term loyalty. In 2024, Zepp Health announced the US launch of the Amazfit Helio Ring, offering advanced athletic performance and recovery monitoring. The intelligent ring works perfectly with Amazfit smartwatches and the Zepp App, providing cohesive insights into health, sleep, and recovery data.

The report provides a comprehensive analysis of the competitive landscape in the United States health and wellness market with detailed profiles of all major companies, including:

- Nestlé SA

- Procter & Gamble

- Unilever PLC

- Bayer AG

- L’Oréal SA

- Danone S.A.

- Amway Corp.

- Herbalife Nutrition Ltd.

- David Lloyd Leisure Ltd.

- Holland & Barrett Retail Limited

Latest News and Developments:

- July 2024: Nutritional Growth Solutions (NGS) partnered with The Healthy Chef® to exclusively produce and distribute its wellness products in the US and Canada. This contract utilizes NGS’s current infrastructure, focusing on high-demand areas such as weight loss, gut health, and immunity, with projected revenue surpassing $1.5 million in the initial year.

- February 2024: The U.S. Department of Health and Human Services (HHS) held its inaugural Food is Medicine summit, revealing collaborations with Instacart, Feeding America, and the Rockefeller Foundation. These collaborations aim to integrate nutrition into healthcare to address chronic diseases and improve access to healthy food. HHS also introduced five guiding principles to support its broader Food is Medicine initiative.

United States Health and Wellness Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Functional Foods and Beverages, Beauty and Personal Care Products, Preventive and Personalized Medicinal Products, Others |

| Functionalities Covered | Nutrition and Weight Management, Heart and Gut Health, Immunity, Bone Health, Skin Health, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Companies Covered | Nestlé SA, Procter & Gamble, Unilever PLC, Bayer AG, L’Oréal SA, Danone S.A., Amway Corp., Herbalife Nutrition Ltd., David Lloyd Leisure Ltd., Holland & Barrett Retail Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States health and wellness market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States health and wellness market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States health and wellness industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Health is a state of physical, mental, and social well-being, free from illness, while wellness focuses on actively pursuing habits that enhance overall quality of life. It includes balanced nutrition, regular exercise, emotional resilience, and mental clarity. Together, health and wellness ensure individuals thrive by maintaining harmony in body, mind, and daily lifestyle choices.

The United States health and wellness market was valued at USD 939 Billion in 2024.

IMARC estimates the United States health and wellness market to exhibit a CAGR of 5.8% during 2025-2033.

The United States health and wellness market is driven by the growing individual awareness about preventive healthcare, increasing demand for organic and natural products, and a focus on fitness and mental well-being. Advancements in technology, rising popularity of personalized nutrition, and corporate wellness initiatives further contribute to market growth as individuals prioritize healthier lifestyles and sustainable wellness solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)