United States Halal Food Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region, 2026-2034

United States Halal Food Market Size and Share:

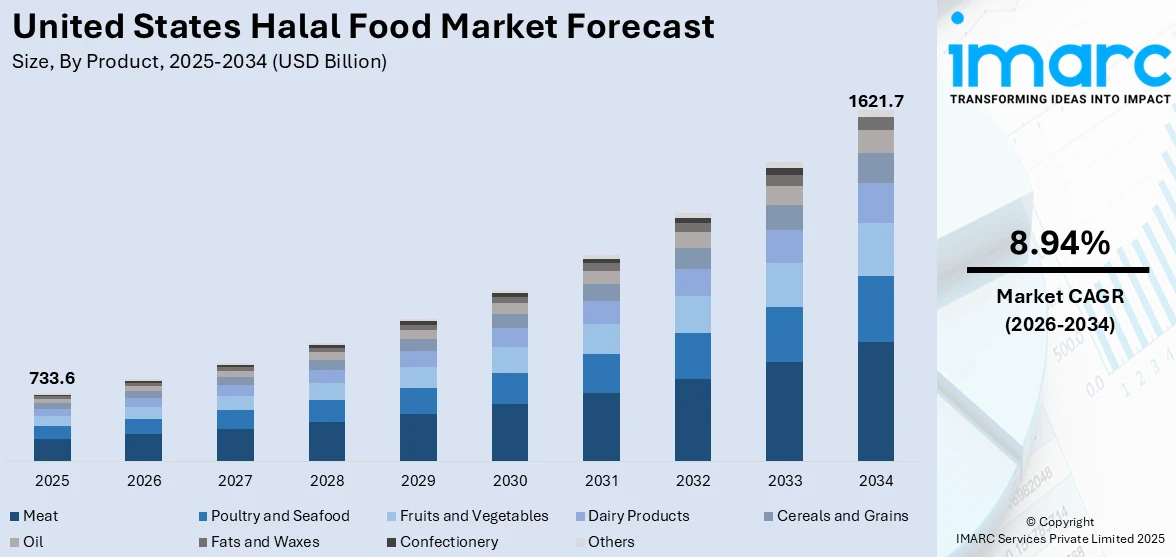

The United States halal food market size was valued at USD 733.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 1,621.7 Billion by 2034, exhibiting a CAGR of 8.94% from 2026-2034. The market is witnessing significant growth due to the escalating Muslim population and the increasing demand for ethically sourced and culturally inclusive food options. Moreover, the rise in demand for convenience-driven halal products, growth of online halal food retailing, and increasing diversification of halal food offerings are expanding the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 733.6 Billion |

| Market Forecast in 2034 | USD 1,621.7 Billion |

| Market Growth Rate (2026-2034) | 8.94% |

The rising Muslim population in the U.S. is a key factor driving the demand for halal food. With steady growth over the years, projections indicate further increases in the coming decades. For instance, in 2024, approximately 3.5 million Muslims reside in the United States, making Muslim Americans one of the fastest-growing demographic groups nationally. This shift has put forth a considerable demand for high-standard food as these food articles should be halal according to the Islamic standard for diet intake. The rising Muslim consumer base, in terms of population as well as purchasing power, will demand more and more halal-certified products in supermarkets, restaurants, and online platforms. This is going to force food manufacturers and retailers to expand their offerings to reach this growing segment.

To get more information on this market Request Sample

Consumer demand is rising for more ethically sourced and culturally inclusive food. This isn't limited to Muslim consumers but non-Muslims are also increasing their interest in halal food for ethical standards such as humane animal slaughtering practices and transparent source practices. Besides that, most people view the quality of Halal food with regard to a better safety profile than its alternative counterparts, especially in health-oriented consumers. These factors, cumulatively, have accelerated the growth of the halal market in the U.S. For example, in April 2023, Crescent Foods introduced Individually Frozen Halal Hand-Cut Boneless Skinless Chicken Thighs, expanding its successful frozen chicken line. The product meets Halal standards, featuring humanely raised, antibiotic-free chickens fed a vegetarian diet.

United States Halal Food Market Trends:

Rise in Demand for Convenience-Driven Halal Products

The convenience-driven halal product is gaining momentum recently. Its demand includes ready-to-eat meals, pre-packaged snacks, and frozen foods. For example, in 2024, Saffron Road launched four new gluten-free, halal frozen meals, including Korean Fire-Roasted Chicken, Vegetable Bibimbap, Drunken Noodles, and Fire-Roasted Adobo Chicken, which reflect authentic global flavors. With busy lifestyles becoming more prevalent among U.S. consumers, especially in urban settings, halal food manufacturers are focusing more on producing products that provide convenience with adherence to the standards of the halal diet. Ready-to-eat meals and other quick-preparation options enable Muslim consumers as well as health-conscious non-Muslim consumers to enjoy halal food without requiring much preparation. This trend reflects greater consumer preference for convenience and implies a move to faster, easy-to-access food solutions that may not even have to compromise on quality or ethical contentions.

Growth of Online Halal Food Retailing

Online retailing is the new growing trend in the halal food market. E-commerce and grocery delivery services have been made easy, allowing consumers access to halal products, even in regions where stores offering such products may be scant. For example, in 2024, Behalaal App was launched in the USA and offers a premium marketplace for halal products. The platform directly connects buyers to sellers, with ease of access to these essentials. Accelerated by the pandemic, consumers became more reliant on online shopping, including grocery items and specialty foodstuffs. This shift enables halal food brands to adapt and improve digital reach, with options for delivery direct to customers' doors as well as establishing relationships with massive online grocery stores for wider halal product distribution.

Increasing Diversification of Halal Food Offerings

There is a considerable diversification of halal food offerings to appeal to a wider market. Traditional halal foods, such as meat and poultry, remain the backbone, but more and more products are coming with halal certifications like Islamic Services of America (ISA) into the dairy, beverage, snack, and even plant-based food sectors. For example, in 2024, Beyond Meat introduced an extended line of Beyond Crumbles with 12g protein, low saturated fat, and no cholesterol, now certified by the American Heart Association and American Diabetes Association. As consumers become more aware of the ethical considerations surrounding food choices, there is a rising demand for halal-certified products beyond traditional categories, driven by both Muslim and non-Muslim consumers seeking ethically sourced and inclusive food options. This diversification is enabling the halal food market to expand beyond its traditional consumer base, fostering growth in new product segments.

United States Halal Food Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States halal food market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product and distribution channel.

Analysis by Product:

- Meat, Poultry and Seafood

- Fruits and Vegetables

- Dairy Products

- Cereals and Grains

- Oil, Fats and Waxes

- Confectionery

- Others

The Muslim population is rising in the United States, and there is an ever-increasing demand for ethically sourced, halal-certified products. Under Islamic law, halal-certified meats of beef, chicken, lamb, and seafood are slaughtered for quality, cleanliness, and safety. Suppliers accommodate this demand, and options including beef, chicken, lamb, and seafood, of course, are readily found at supermarkets and restaurants.

Halal certification is crucial in the U.S. fruit and vegetable market, ensuring that products are free from harmful additives and contaminants. Fruits and vegetables are naturally halal, but certification ensures they meet Islamic dietary laws and are handled in accordance with halal standards. This segment sees growing demand from Muslim consumers seeking certified produce for healthy and ethical eating.

There is a huge demand for halal-certified dairy products, including milk, cheese, and yogurt, in the U.S. market because Muslim consumers want to find a dairy product that fits within the parameters of Islamic dietary laws. Such products are prepared using halal ingredients and processes, including rennet-free cheeses. Dairy companies are focusing on providing diverse, high-quality halal dairy options to meet the needs of Muslim families and health-conscious individuals.

The U.S. halal food market also encompasses cereals and grains, with most of the brands holding a halal certification, providing mass-produced rice, wheat, and oats. Of course, these items are halal but require such certification to ensure they are free of contamination from non-halal sources. The need for halal grains arises with the preparation of healthy, compliant meals for Muslim families and health-conscious consumers.

Halal-certified oils, fats, and waxes are considered important in the U.S. food market due to a high demand from Muslim consumers. Halal vegetable oils such as olive, canola, and palm oils are used for cooking, baking, and food processing. Increasingly, companies are offering halal-certified cooking oils and fats to adhere to Islamic dietary laws and cater to consumer preference for purity and ethical sourcing.

The U.S. halal confectionery market is observed to be highly booming with a very wide variety of halal-certified candies, chocolates, and snacks available for Muslim consumers. These products are manufactured and produced using halal ingredients and processes, ensuring that there are no non-halal additives, gelatin, or alcohol in them. Therefore, the variety of sweets recognized as halal caters to the different tastes of Muslim communities and encourages diversity within the snack industry.

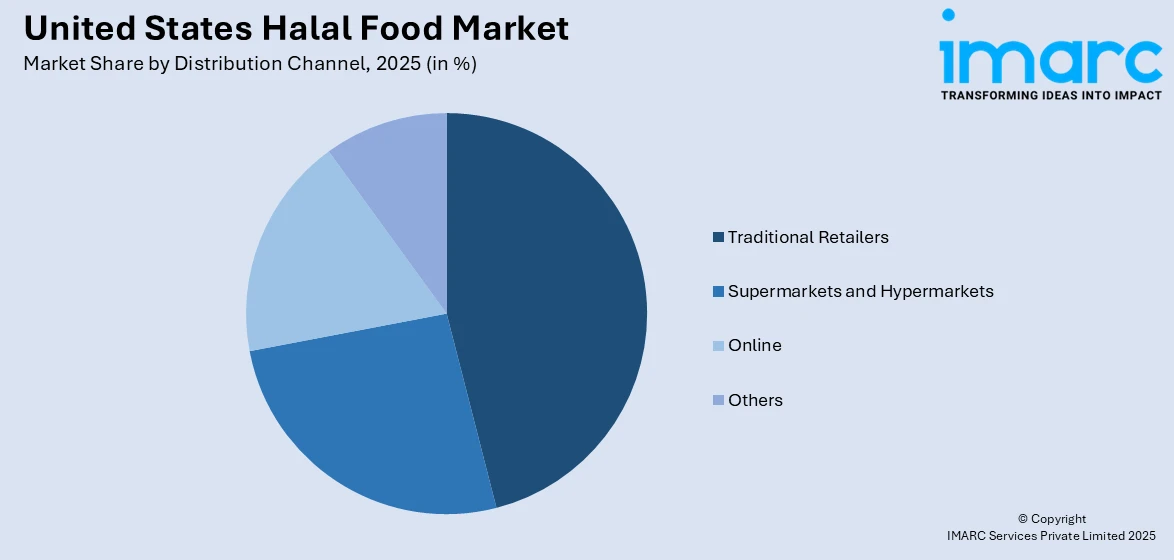

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Traditional Retailers

- Supermarkets and Hypermarkets

- Online

- Others

Traditional retailers across the U.S. are helping to provide these communities with proper halal food products, mostly in areas inhabited by a more significant number of Muslims. Through these stores, consumers can avail themselves of multiple halal products, such as meat, dairy, and snack items, according to their desires for convenience as well as consumption of culturally desirable foods. Accessibility to these products is also assured, thus becoming inclusive.

Supermarkets and hypermarkets in the U.S. are increasing their halal food offerings to cater to the demand of Muslim consumers. Major chains like Walmart and Kroger have separate sections for halal products that offer a variety of certified products, including meat, beverages, and packaged foods. These retailers make halal food accessible to a broader customer base, thus promoting convenience and trust.

Online platforms are a revolution within the U.S. market, offering consumers halal food options with convenience and diversification at one's fingertips. Using an e-commerce website like Amazon, HalalGuys, and specialty websites, consumers gain access to a range of food, rare and hard-to-find foods as well, as this is delivered to their homes, ensuring broader distribution.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast U.S. is home to diverse, large Muslim populations, particularly in cities like New York and New Jersey. This region has a high demand for halal food, with many local supermarkets, ethnic grocery stores, and restaurants offering a wide variety of halal-certified products. The presence of halal butchers and growing awareness support a thriving halal market, catering to both traditional and modern needs.

Availability of halal food has been rising in the Midwest U.S., mainly driven by the increasing number of Muslim communities in cities like Chicago and Detroit. There is a growth of halal food being sold in mainstream grocery stores, ethnic markets, and restaurants. Additionally, online retailers have met this demand, reaching halal products in the suburban and rural areas, which were otherwise difficult to access.

The South U.S. cities of Houston and Atlanta have emerged as prime hubs for halal food because of growing populations and increased cultural diversity. Supermarkets, ethnic stores, and fast-food chains carry a range of halal products to cater to Muslim customers. Halal-certified meat, snacks, and frozen foods are in high demand and are growing locally and regionally.

The West U.S., especially California, has one of the largest markets for halal food due to its highly diverse and multicultural population. Large cities like Los Angeles and San Francisco provide many halal grocery stores, restaurants, and suppliers. Plant-based and ethical food demand is strong in the West, thus driving the demand for organic and clean-label halal foods.

Competitive Landscape:

The United States halal food market is very competitive, and it hosts both traditional halal food manufacturers and large multinational companies. For instance, key players market halal meats, ready-to-eat meals, and snacks catering to Muslim consumers with health-conscious non-Muslims in mind as well. Large food companies are entering the market with acquisitions and partnerships, taking advantage of large distribution networks and resources. Online platforms are also expanding for direct-to-consumer delivery in response to growth in e-commerce. For example, in November 2024, Crescent Foods updated its packaging and expanded distribution nationwide to Costco, Walmart, H-E-B, and Kroger. Known for its halal hand-cut meats, the new design makes it easier, clearer, and more convenient. dynamic market is constantly innovating in terms of product offerings, pricing strategies, and distribution channels, reflecting an increasing demand for ethical, sustainable, and convenient halal food solutions.

The report provides a comprehensive analysis of the competitive landscape in the United States halal food market with detailed profiles of all major companies, including:

- Nestle S.A.

- Saffron Road

- American Foods Group, LLC

- BRF SA

- Cargill Inc.

- Crescent Foods

- Wellmune (Kerry Group PLC)

- Harris Ranch Beef Company

- Midamar Corporation

- Al Safa Foods

Latest News and Developments:

- In January 2025, Shah’s Halal Food, a family-owned chain, is expanding beyond New York’s five boroughs with a new location in Dupont Circle, Washington, D.C. This expansion introduces Shah’s unique Middle Eastern flavors and New York-style service to a vibrant new market, marking a significant milestone for the growing brand.

- In December 2024, Halal Boyz opened in Olive Branch, Mississippi, bringing New York-style Mediterranean street food to the South. The restaurant offers halal-certified dishes like gyro, chicken shawarma, and falafel, introducing the local community to vibrant Mediterranean flavors.

- In January 2024, HAQQ, an ethical blockchain ecosystem based on Islamic values, partnered with GoMeat, a leader in decentralized home delivery. This collaboration aims to improve access to halal meat and food across the U.S., enhancing the GoMeat app’s services for a wider audience.

United States Halal Food Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Meat, Poultry and Seafood, Fruits and Vegetables, Dairy Products, Cereals and Grains, Oil, Fats and Waxes, Confectionery, Others |

| Distribution Channels Covered | Traditional Retailers, Supermarkets and Hypermarkets, Online, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States halal food market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States halal food market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States halal food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States halal food market in the region was valued at USD 733.6 Billion in 2025.

The growth of the U.S. halal food market is driven by an increasing Muslim population, rising awareness of halal dietary preferences, growing diversity in the food industry, and expanding demand for ethical, clean-label products. Additionally, the popularity of ethnic cuisines and the convenience of halal options contribute to market expansion.

The United States halal food market is projected to exhibit a CAGR of 8.94% during 2026-2034, reaching a value of USD 1,621.7 Billion by 2034.

Some of the major players in the United States halal food market include Nestle S.A., Saffron Road, American Foods Group, LLC, BRF SA, Cargill Inc., Crescent Foods, Wellmune (Kerry Group PLC), Harris Ranch Beef Company, Midamar Corporation, Al Safa Foods, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)