United States Golf Cart Market Size, Share, Trends and Forecast by Product Type, Seating Capacity, Application, and Region, 2025-2033

United States Golf Cart Market Size and Share:

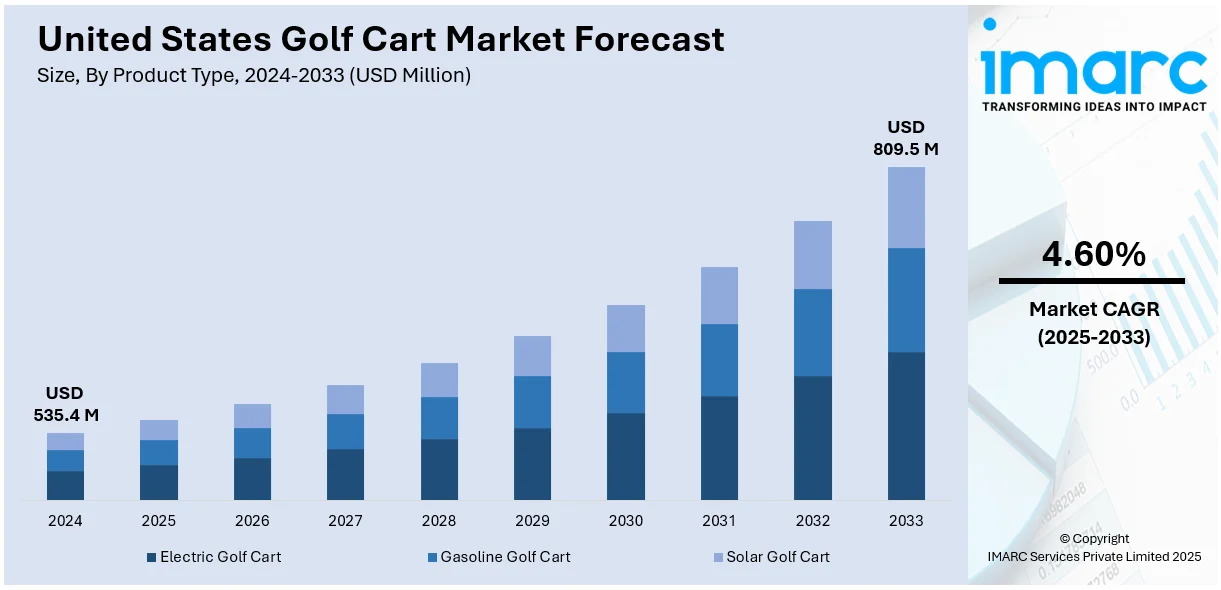

The United States golf cart market size was valued at USD 535.4 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 809.5 Million by 2033, exhibiting a CAGR of 4.60% from 2025-2033. The U.S. golf cart market is fueled by growing interest in environmentally friendly transportation, the increasing adoption of electric vehicles (EVs), and their expanding applications in leisure activities, tourism, and residential communities. Additionally, advancements in battery technology, along with growing adoption of golf carts in non-golf-related activities, fuel the United States golf cart market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 535.4 Million |

| Market Forecast in 2033 | USD 809.5 Million |

| Market Growth Rate (2025-2033) | 4.60% |

United States Golf Cart Market Analsyis:

- Key Market Trends: The market is moving toward electric and solar-powered carts with smart features. Growing interest in sustainable transport and multifunctional use is reshaping demand beyond traditional golf course applications.

- Major Drivers: Demand is driven by environmental awareness, urban mobility needs, and broader adoption in hospitality, residential, and commercial sectors. Golf communities and aging populations also contribute to rising usage of golf carts.

- Market Opportunities: Expanding use in campuses, resorts, gated communities, and airports presents growth opportunities. Customization, connectivity, and low-emission models offer manufacturers and service providers new ways to attract lifestyle and commercial buyers.

- Market Challenges: High purchase costs, fragmented regulations, limited charging infrastructure, and maintenance issues challenge growth. Additionally, consumer hesitation toward new technologies and competition from traditional or refurbished models may slow United States golf cart market growth.

To get more information on this market, Request Sample

The increasing focus on sustainability and minimizing carbon footprints is a major factor driving the U.S. golf cart market. As environmental concerns increase, both consumers and businesses are opting for electric-powered golf carts over traditional gas-powered models. These environmentally friendly vehicles provide reduced emissions, lower operating costs, and a quieter driving experience. Additionally, governments are promoting green initiatives, with the Inflation Reduction Act of 2022 providing tax credits of up to $7,500 for eligible electric vehicle (EV) purchases starting January 1, 2023. This surge in government support has further boosted the appeal of electric golf carts as a sustainable transportation option, especially in golf courses, residential communities, and tourist areas, where efficient, eco-conscious solutions are in high demand in U.S.

Besides this, the U.S. golf carts are no longer limited to golf courses; they have found increasing utility in residential communities, resorts, and tourist destinations. Many residential areas, especially those with sprawling estates, gated communities, and retirement villages, use golf carts for short-distance travel within the neighborhood in U.S. With their compact design, easy maneuverability, and low operating costs, these vehicles present an appealing alternative to cars for both daily tasks and recreational pursuits. Moreover, resorts, amusement parks, and other leisure centers rely on golf carts to transport guests. This broader application across sectors beyond golf courses drives the growth of the market in the U.S.

United States Golf Cart Market Trends:

Growing Popularity of Electric Golf Carts

The shift from gas-powered to electric golf carts is one of the most prominent United States golf cart market trends. Electric golf carts in the U.S. provide an eco-friendlier and energy-efficient option, in line with the growing demand for sustainable solutions. These vehicles are quieter, have lower maintenance costs, and are favored for their reduced environmental impact due to fewer emissions. Advancements in battery technology, such as lithium-ion batteries, have significantly enhanced the performance and range of electric golf carts, making them more viable for both recreational and residential use. Government initiatives and incentives aimed at encouraging the adoption of electric vehicles are reinforcing this trend, accelerating the shift towards electric-powered golf carts in the U.S.

Integration of Smart Technology and IoT Features

Another major U.S golf carts trend is the rapid integration of smart technologies and the Internet of Things (IoT). Among them are features that enhance fleet management, Global Positioning System or GPS navigation system, Bluetooth connection, advanced driver assists systems for improving overall comfort of operation and much more convenience, safety and efficiency in a better manner that could suit bigger resorts, retirement communities and large golf courses in managing and overseeing golf cart activity. For instance, real-time fleet tracking allows better management and schedules of maintenance while GPS and automatic course mapping enable navigation and optimize routes. With this advancement in smart technology becoming affordable and accessible, demand for high-tech golf carts is expected to rise in the commercial and private sectors of the U.S.

Increasing Adoption of Golf Carts in Non-Golf Activities

With golf carts increasingly being applied for activities unrelated to golf, this industry is sweeping across the U.S. residential communities, resorts, and tourist destinations very fast. Historically related to golf courses, these multipurpose vehicles are now gaining more popularity for short-distance transport within gated communities, airports, theme parks, and resorts. Around 60,000 inhabitants in retirement communities like The Villages in Florida use golf carts for grocery shopping or visiting friends while living in such residential areas; this is assisted by specific infrastructures. Widespread utilization of U.S. golf carts in various communities is now stretching the market way beyond the realm of golf courses, creating vast growth prospects while turning them into multi-purpose machines for recreation, transportation, and daily uses.

United States Golf Cart Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States golf cart market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type, seating capacity, and application.

Analysis by Product Type:

- Electric Golf Cart

- Gasoline Golf Cart

- Solar Golf Cart

Based on the United States golf cart market analysis, the U.S. market is divided into product types, including electric, gasoline, and solar golf carts, with each type addressing distinct consumer preferences. Electric golf carts make up the bulk due to their eco-friendliness, quiet operation, and the reduced maintenance costs. Evolutionary battery technology like lithium-ion has enhanced performance and increased its range to a level that widely prefers it at golf courses, residential estates, and resorts in U.S. Gasoline-powered golf carts are still more preferred because of their high power and durability in rough terrains or industrial applications. Solar golf carts are emerging as the sustainable option, utilizing renewable energy to decrease operational costs and carbon footprints and gaining popularity with environmentally conscious users and in sunny areas thereby positively impacting the U.S. gold cart market outlook.

Analysis by Seating Capacity:

- Small (2 - 4 Seater)

- Medium (6 - 8 Seater)

- Large (Above 8 Seats)

The U.S. golf cart market is categorized by seating capacity into small, medium, and large configurations, catering to diverse applications. Small golf carts (2-4 seater) are expected to dominate due to their widespread use in golf courses, residential communities, and personal transport, offering compactness, affordability, and maneuverability. These are perfect for individuals or small groups. However, the medium golf carts (6-8 seater) are increasingly popular in U.S. resorts, amusement parks, and corporate campuses, where they efficiently transport groups while maintaining a balance between capacity and size. Apart from this, the large golf carts (above 8 seats) in U.S. are specialized for high-capacity needs, such as airport shuttles, large industrial sites, or event venues. Their robust design and utility make them suitable for transporting larger groups or heavy loads efficiently thus aiding the U.S. gold cart market growth.

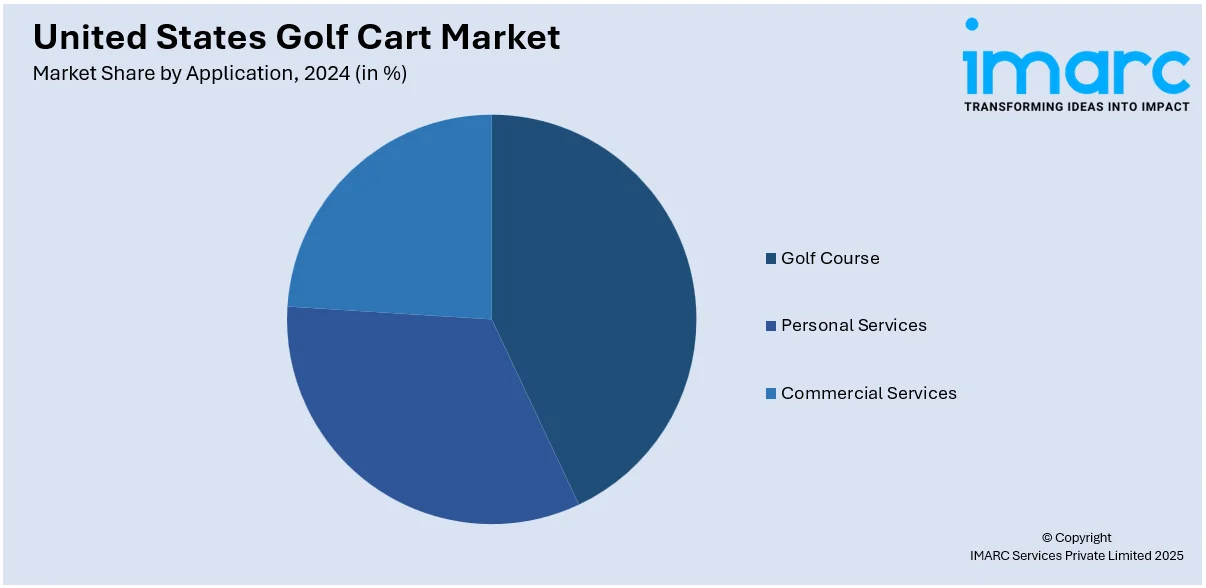

Analysis by Application:

- Golf Course

- Personal Services

- Commercial Services

The application of products and services across golf courses, personal services, and commercial services varies significantly, catering to distinct needs in U.S. Golf courses prioritize maintenance solutions such as irrigation systems, turf care, and landscaping products to ensure optimal playing conditions. In personal services, the focus shifts to individual-oriented offerings like grooming products, fitness equipment, or wellness solutions tailored for convenience and personalization. Meanwhile, commercial services in U.S. encompass a broad range of applications, including hospitality, cleaning, and professional tools, emphasizing efficiency and scalability to serve businesses effectively. These application types reflect diverse demands, with customization, quality, and functionality driving product choices and innovations in each sector. This segmentation allows manufacturers and service providers to implement targeted strategies, ensuring they stay relevant and foster growth in the U.S. market.

Regional Analysis:

- Northeast

- Midwest

- South

- West

Regional analysis highlights distinct market dynamics in U.S. across the Midwest, Northeast, West, and South. The Northeast is characterized by its urbanization, driving demand for high-end, eco-friendly products and services tailored for densely populated areas. The Midwest, with its agricultural and manufacturing backbone, focuses on industrial solutions, equipment, and tools that support farming and production. In the South, a combination of warm climate and growing populations fosters demand for residential and commercial services, particularly in heating, ventilation, and air conditioning (HVAC) systems, landscaping, and leisure products. The West, driven by technology and sustainability trends, emphasizes innovative and energy-efficient solutions across industries. Each region's economic activities, climate, and cultural preferences shape its unique consumption patterns and opportunities for United States market growth.

Competitive Landscape:

United States golf cart market competitive landscape comprises diverse players including the well-established manufacturers and newer start-ups. In the United States, leading players are majorly focused on launching new-age electric models with higher focus on longer battery life, improved performance, and efficiency of charging. Other than this, ongoing technological changes such as GPS navigation, Bluetooth connectivity, and smart features also are boosting the differentiation in products of U.S. Manufacturers in the United States are increasingly engaging in collaborations inside residential communities, resorts, and golf courses so as to make solutions tailored according to the level of convenience needed and the required efficiency in handling the operations. Intense price wars are therefore experienced in both after-sales and customer support approaches to market penetration. Regulatory competitive factors include factors such as U.S. standard emissions and benefits from electric cars.

The report provides a comprehensive analysis of the competitive landscape in the U.S. golf cart market with detailed profiles of all major companies including:

- Club Car, LLC

- E-Z-GO

- Yamaha Motor Corporation

- Polaris Industries

- Textron Inc

- Garia Golf Carts

- Cruise Car Inc

- STAR EV Corporation

- Tomberlin U.S.A

- Spartan-EV

- ICON Electric Vehicles

- HDk Golf Carts

Latest News and Developments:

- In November 2024, Massimo Group introduced the MVR Series electric carts, which include the MVR 2X Golf Cart and MVR Cargo Max Utility Cart, responding to the increasing demand for versatile low-speed electric vehicles (LSVs). Designed for recreational and professional use, these eco-friendly vehicles offer advanced features and high performance. With a strong network of over 2,800 partners, Massimo is well-positioned to secure a substantial share of the growing LSV market.

- In August 2024, LOBO EV Technologies Ltd. launched its solar-powered golf cart, with an initial production of 33 units already sold to U.S. customers. This marks LOBO’s third successful golf cart export to the U.S., highlighting its growing market presence. CEO Huajian Xu emphasized the cart’s alignment with LOBO’s green travel philosophy, meeting the rising demand for eco-friendly transportation in the U.S. market while showcasing the company’s commitment to innovation and sustainability.

- In January 2024, WiTricity and ICON EV have announced the launch of the 2024 ICON Low-Speed Vehicles (LSVs), which will feature an industry-first wireless charging option. The LSVs will be unveiled at the Las Vegas CES and are set to be available for purchase in Summer 2024. WiTricity's CEO, Alex Gruzen, highlighted the growing demand for wireless charging, offering ICON EV customers a hassle-free solution to charge their vehicles by simply parking them.

- In January 2024, Yamaha Golf-Car Company (YGC), a subsidiary of Yamaha Motor Corporation, revealed its DRIVE H2, a hydrogen-powered engine golf cart concept, at the PGA Show in Orlando, Florida. Based on the DRIVE2 CONCIERGE4, the four-seater cart features two 25-liter high-pressure hydrogen tanks positioned under the driver’s seat and rear seat. This innovative model marks a first in the industry, showcasing Yamaha’s commitment to sustainable transportation solutions for the global market.

- In March 2023, Club Car launched its latest street-legal electric vehicle, the Urban LSV and XR, available through its North American commercial distributor network. Designed for large campuses, last-mile delivery, and hospitality, the Urban features automotive styling, a 25 mph top speed, and customizable options. Powered by lithium-ion batteries for fast charging and low costs, it offers enhanced safety with rollover protection and 3-point belts, making it an ideal solution for eco-friendly, on-road transportation.

United States Golf Cart Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Electric Golf Cart, Gasoline Golf Cart, Solar Golf Cart |

| Seating Capacities Covered | Small (2 - 4 Seater), Medium (6 - 8 Seater), Large (Above 8 Seats) |

| Applications Covered | Golf Course, Personal Services, Commercial Services |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States golf cart market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States golf cart market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States golf cart industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States golf cart market was valued at USD 535.4 Million in 2024.

Key factors in the U.S. golf cart market include rising demand for eco-friendly electric models, technological advancements like smart features, and increased usage in residential, leisure, and commercial sectors. Regulatory support for green transportation and evolving consumer preferences for sustainable, versatile vehicles further drive the U.S. the market expansion and innovation.

IMARC estimates the United States golf cart market to exhibit a CAGR of 4.60% during 2025-2033.

Some of the major players in the U.S. market include Club Car, LLC, E-Z-GO, Yamaha Motor Corporation, Polaris Industries, Textron Inc, Garia Golf Carts, Cruise Car Inc, STAR EV Corporation, Tomberlin U.S.A, Spartan-EV, ICON Electric Vehicles, HDk Golf Carts, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)