United States Fruit Juice Market Size, Share, Trends and Forecast by Product Type, Flavor, Distribution Channel, and Region, 2026-2034

United States Fruit Juice Market Size and Share:

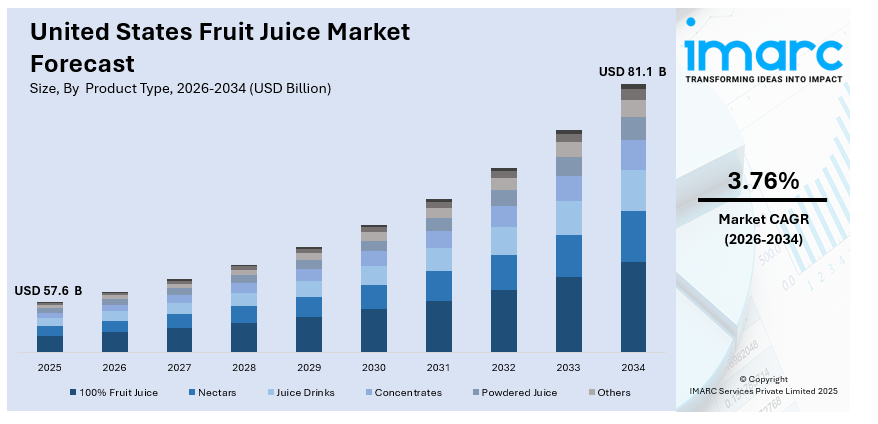

The United States fruit juice market size was valued at USD 57.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 81.1 Billion by 2034, exhibiting a CAGR of 3.76% from 2026-2034. The market is driven by the growing health consciousness, increasing demand for natural and organic beverages, and the popularity of convenient, ready-to-drink (RTD) options. Innovations in flavor combinations and fortified juices are attracting diverse consumer segments. Additionally, the rising interest in sustainable packaging and locally sourced ingredients are bolstering the United States fruit juice market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 57.6 Billion |

| Market Forecast in 2034 | USD 81.1 Billion |

| Market Growth Rate (2026-2034) | 3.76% |

United States Fruit Juice Market Analysis:

- Growth Drivers: Rising health consciousness accelerates the demand for natural, low-calorie, and functional juices. Convenient, ready-to-drink products are favored by consumers. Sustainable packaging and locally grown fruits add even more to the market attractiveness and will fuel United States fruit juice market growth.

- Major Market Trends: Functional ingredients such as probiotics and antioxidants become increasingly popular. Consumers turn to exotic fruit mixtures, organic products, and environmentally friendly packaging. Single-serve, cold-press, and subscription juice formats keep on gaining traction.

- Market Opportunities: Increased demand for digestive health and immunity-boosting juices. Premium organic blends and exotic fruits see increased demand. E-commerce, personalized wellness, and green practices create strong United States fruit juice market demands.

- Market Challenges: Climate change distorts fruit yields, influencing supply. Increasing tariffs interferes with imports. Sugar content is examined by health regulations. Flavored waters, kombucha, and plant-based beverages compete with traditional fruit juice sales.

In the United States, consumers are looking for beverages that fit more healthful lifestyles, favoring natural, organic, and no-added-sugar fruit juices. This movement is driven by a desire to minimize the consumption of artificial ingredients and added sugars. Moreover, brands are adding variety through new flavors, blends, and functional ingredients for appealing to broader consumer tastes and health objectives. This includes the development of cold-pressed juices and fortified varieties, which offer further health advantages. Besides this, the growing interest in transparency regarding ingredients and sourcing, with consumers favoring brands that emphasize sustainability and ethical practices, is offering a favorable market outlook.

To get more information on this market Request Sample

Additionally, considerable reliance on online shopping channels is increasing the accessibility of fruit juice to consumers. The advent of subscription-based juice delivery models and direct-to-consumer (DTC) services are enhancing the purchasing experience, particularly for niches and premium brands. Furthermore, the growing popularity of seasonal and limited-edition flavors is

creating excitement among consumers and fostering brand loyalty. These offerings often tie into holidays or seasonal trends, attracting attention and driving sales. Apart from this, strategic partnerships between juice manufacturers and wellness companies like fitness studio are assisting brands to reach health-conscious individuals through co-branded products and promotions. Moreover, the rising incorporation of fruit juices as a base in alcoholic cocktails and non-alcoholic mocktails is expanding applications beyond traditional consumption, especially in social and recreational settings.

United States Fruit Juice Market Trends:

Health and Wellness Trends

The rising emphasis on health and wellness among consumers represents one of the major factors impelling the market growth in the United States. Individuals are prioritizing products with natural ingredients, no added sugar, and functional benefits like immunity-boosting properties or digestive health support. This trend is driving the demand for organic and non-genetically modified organism (GMO) juices, and encouraging innovations in cold-pressed and freshly squeezed options. Additionally, consumers are actively seeking alternatives to sugary beverages, making low-calorie and fortified fruit juices more appealing. These preferences align with broader lifestyle shifts toward healthier eating habits and a focus on preventive health. Following this trend, Welch’s launched its new line of zero sugar juices in 2024. The new line comprises two new flavors comprising passion fruit and grape along with other tropical flavors. These are available on juice aisles and refrigerated sections at retailers nationwide.

Technological Advancements in Production

Advancements in fruit juice processing like high-pressure processing (HPP) and cold pasteurization are improving product quality while preserving the natural taste, color, and nutritional value of fruit. These methods allow producers to create novel blends and functional juices enriched with probiotics, vitamins, and antioxidants, offering tailored solutions for particular health advantages, including improving immunity and enhancing digestion. By maintaining the freshness of natural ingredients, these advanced production methods help brands differentiate themselves in an increasingly competitive market. Better Juice collaborated with Ingredion in 2024 to bring its enzymatic sugar reduction technology to the US juice market. This development eliminates basic sugars but retains nutrients, meeting the increasing interest of consumers in healthier drink choices. The partnership aims to expand Better Juice's reach and production capabilities.

Increasing Focus on Branding

Health-conscious buyers are prioritizing beverages made with natural ingredients, free from artificial additives or preservatives. This trend aligns with the growing preference for clean-label products, where the simplicity and clarity of ingredient lists play a pivotal role in purchase decisions. Brands that emphasize their commitment to natural and minimally processed products stand out in a competitive market. Marketing campaigns that reinforce authenticity and highlight the natural origins of juices resonate strongly with consumers, fostering trust and loyalty. By aligning their branding with the values of health and transparency, companies effectively cater to evolving consumer expectations. For instance, in 2024, Tropicana unveiled special "Tropcn" packaging at CES 2024 in Las Vegas, dropping "AI" from its name to highlight the naturalness of its orange juice. The campaign emphasizes Tropicana Pure Premium's dedication to using only natural ingredients without any artificial additives. The promotion involves giving away items nationwide at Kroger stores that are participating.

United States Fruit Juice Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States fruit juice market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product type, flavor, and distribution channel.

Analysis by Product Type:

- 100% Fruit Juice

- Nectars

- Juice Drinks

- Concentrates

- Powdered Juice

- Others

100% fruit juice includes beverages made entirely from fruit without added sugars, artificial flavors, or preservatives. It is the most sought-after category by health-conscious consumers prioritizing natural and wholesome options. The demand for 100% fruit juice is driven by its perceived nutritional benefits and the increasing popularity of organic and cold-pressed variants.

Nectars, which are made from fruit puree blended with water and sweeteners, cater to consumers seeking a balance between taste and affordability. This segment enjoys significant traction in family households, as it offers a cost-effective alternative to 100% fruit juice while maintaining a fruity flavor profile.

Juice drinks, which often contain a mix of fruit juice, water, and added flavors, represent a large share of the market due to their affordability and variety. This segment is popular among younger consumers and children, driven by vibrant packaging and diverse flavor offerings.

Concentrates, which are made by mixing water, serve as a practical option for budget-conscious individuals and bulk buyers. Their extended shelf life and easy storage make them a popular option in both retail and food service industries.

Powdered juice segment is growing, driven by its convenience and affordability. This format is particularly attractive to people in regions where it might be difficult to find fresh juice readily. Advancements in freeze-drying and sourcing ingredients are improving the taste and nutritional value of powdered juices, making them a good alternative to liquid choices.

Others consist of innovative formats like juice shots, kombucha-based juices, and hybrid blends with vegetables and herbs. These products cater to niche markets focused on functionality, detoxification, or unique taste profiles.

Analysis by Flavor:

- Orange

- Apple

- Mango

- Mixed Fruit

- Others

Orange holds a notable market share due to its widespread popularity and association with breakfast consumption. Famous for its abundant vitamin C levels, it attracts health-conscious individuals. Different types like pulp-free, high-pulp, and enriched with calcium or antioxidants are available to suit a range of tastes.

Apple is a widely consumed flavor, appreciated for its mild taste and versatility. It is particularly popular among children and families. The section benefits from being naturally sweet and easy to combine with other ingredients, making it suitable for inclusion in both individual and mixed product options.

Mango holds a notable market share owing to its high content of vitamins A and C, appealing to health-conscious consumers. Its rich taste and association with exotic fruit blends make it a key choice for premium and tropical juice offerings. The segment also benefits from its versatility in mixed-fruit formulations.

Mixed fruit offers a diverse array of flavors, combining multiple fruits to create unique and innovative blends. These items attract individuals who are looking for different options and novelty in their drinks. This segment is a key area for manufacturers exploring unusual fruits, beneficial components, and exclusive products.

Others include less common flavors, such as cranberry, pomegranate, and tropical blends. Others include less common flavors, such as cranberry, pomegranate, and tropical blends. These juices are frequently marketed as high-end products with distinct health advantages, such as their rich antioxidant levels. Niche flavors are becoming popular with health-conscious and adventurous consumers who are looking for options other than regular fruit juices.

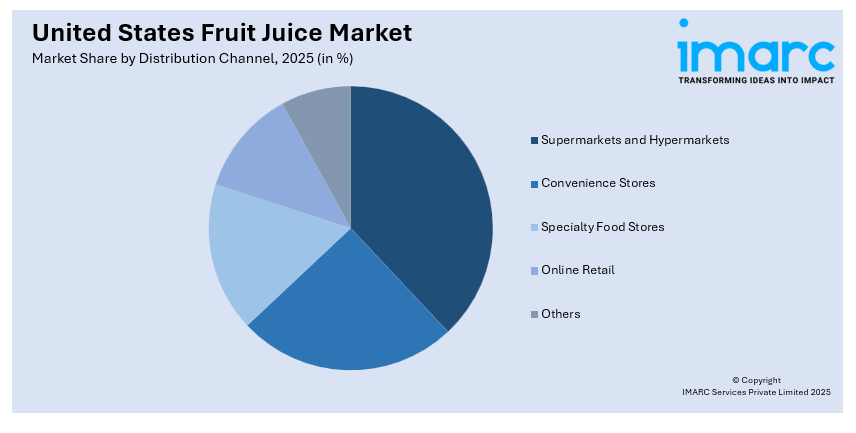

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Food Stores

- Online Retail

- Others

Supermarkets and hypermarkets hold a notable market share, offering consumers the convenience of one-stop shopping. These distribution channels offer a diverse range of products, including affordable options and high-end brands. Promotions, in-store samplings, and prominent shelf placements play a vital role in driving sales in this segment.

Convenience stores are popular for on-the-go purchases, making them a key channel for single-serve and RTD fruit juice products. Their strategic locations and extended operating hours attract consumers seeking quick and accessible options.

Specialty food stores attract health-conscious and premium-seeking consumers with their selection of organic, cold-pressed, and exotic fruit juices. These stores focus on quality, sourcing, and sustainability, attracting specific consumer groups. Their carefully chosen products and well-informed employees improve the shopping experience, creating brand loyalty with buyers.

Online retail is a vital segment in the market attributed to its convenience of doorstep delivery and the rising number of e-commerce platforms. Individuals benefit from the ability to easily compare prices, select subscription options, and enjoy access to unique and high-end brands that may not be available in brick-and-mortar shops.

Others include distribution through vending machines, institutional sales to schools and offices, and direct sales at farmers markets or juice bars. These channels cater to specific consumer segments, such as students or wellness enthusiasts, and offer opportunities for brands to establish a localized presence. They also serve as platforms for introducing innovative or limited-edition products.

Regional Analysis:

- Northeast

- Midwest

- South

- West

Northeast represents a significant market for fruit juice, driven by its health-conscious population. Consumers in this region prefer premium and organic options, reflecting the growing demand for cold-pressed and fortified juices. The region's affluent demographic supports strong sales of niche and specialty juice products available through specialty food stores and online retail.

In the Midwest, affordability and family-oriented consumption are driving the demand for fruit juice. This region shows a preference for bulk purchases and mainstream flavors like orange and apple juice, primarily through supermarkets and hypermarkets.

South is an essential segment in the market attributed to its diverse and increasing population and rising popularity of tropical and mixed-fruit flavors. Convenience shops are crucial for swift product distribution in order to satisfy the fast-paced lifestyle and preference for single-serve options in the region

West is a hub for innovation in the fruit juice market, driven by its health-conscious and environmentally aware population. Consumers here show a strong preference for plant-based, sustainable, and functional beverages. The region leads in sales of exotic blends, kombucha-infused juices, and cold-pressed options, with online retail and specialty stores being key distribution channels.

Competitive Landscape:

Leading companies in the industry are focusing on product innovation, introducing health-oriented options with decreased sugar and added functional benefits, catering to the changing user preferences. They are expanding their portfolios, including organic and non-GMO offerings, aligning with the rising consumer demand for natural drinks. Key players are also employing online channels to improve individual engagement and streamline distribution through e-commerce platforms. Additionally, collaborations and acquisitions are pursued to enhance market presence and diversify product offerings, ensuring competitiveness in a dynamic market landscape. In 2024, Brix Holdings completed its purchase of Clean Juice, the organic juice bar franchise with 75 units that is USDA-certified. The company aims to launch 10 additional sites in 2024 and 15-20 more in 2025, all while revamping operations and store layout. Key employees from Clean Juice have joined Brix Holdings to support these initiatives.

The report provides a comprehensive analysis of the competitive landscape in the United States fruit juice market with detailed profiles of all major companies.

Latest News and Developments:

- In January 2025, Backed by Grupo Jumex, Odwalla® launches a fresh lineup featuring smoothies (Mango, Strawberry-Banana, Berries) and juices (Orange-Guava-Ginger, Green Juice, and pure Orange Juice). Available in glass bottles and Tetra Prisma® cartons, these beverages are made with real fruit, no added sugar, and natural ingredients—offering quality, freshness, and health-conscious convenience for today’s consumers.

- In January 2024, Suja Organic, known for cold-pressed juices, debuts Suja Organic Protein Shakes—ready-to-drink beverages combining plant-based protein (pea, rice, hemp), essential vitamins (A–E), minerals, and Acacia fiber. Each 200-calorie shake delivers 16g of protein and features almond milk and coconut cream for a rich, smooth texture. The launch expands Suja’s health-focused offerings into the growing functional and protein beverage category.

United States Fruit Juice Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | 100% Fruit Juice, Nectars, Juice Drinks, Concentrates, Powdered Juice, Others |

| Flavors Covered | Orange, Apple, Mango, Mixed Fruit, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Food Stores, Online Retail, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States fruit juice market from 2026-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States fruit juice market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States fruit juice industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Fruit juice is a liquid extracted from fresh fruits, typically by pressing or crushing the pulp of the fruit. It is consumed as a beverage and valued for its natural flavor, nutrients, and refreshing qualities. It can be sweet, tangy, or a combination of both depending on the type of fruit.

The United States fruit juice market was valued at USD 57.6 Billion in 2025.

The United States fruit juice market is projected to exhibit a CAGR of 3.76% during 2026-2034, reaching a value of USD 81.1 Billion by 2034.

Key factors driving the U.S. fruit juice market include growing health consciousness, demand for natural and organic products, preference for functional beverages with added nutrients, rising interest in immunity-boosting ingredients, and innovations in packaging. Convenience, sustainability, and clean-label formulations also influence consumer purchasing decisions and market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)