United States Frequency Converter Market Size, Share, Trends and Forecast by Type, End Use Industry, and Region, 2025-2033

United States Frequency Converter Market Size and Share:

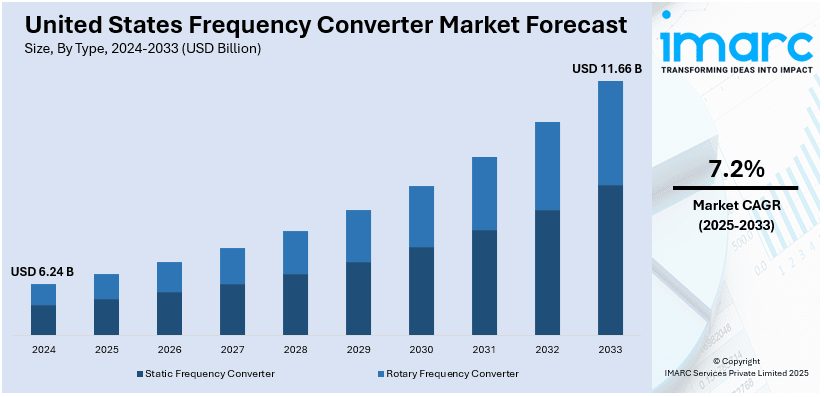

The United States frequency converter market size was valued at USD 6.24 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 11.66 Billion by 2033, exhibiting a CAGR of 7.2% from 2025-2033. The market is propelled by an increasing demand for energy-efficient systems, growing industrial automation, advancements in HVAC systems, and rising renewable energy integration. Additionally, expanding applications in manufacturing, aerospace, and defense sectors, coupled with the need for precise motor control and reduced energy consumption, boost market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.24 Billion |

| Market Forecast in 2033 | USD 11.66 Billion |

| Market Growth Rate (2025-2033) | 7.2% |

The United States frequency converter market is influenced by a blend of technological advancements and rising industry-specific applications. The increasing emphasis on energy efficiency is a key factor, as frequency converters play a crucial role in optimizing power consumption by regulating motor speeds and reducing energy wastage. Industries are adopting these solutions to lower operational costs and comply with strict energy regulations. Industrial automation is another factor contributing substantially to the market growth. Furthermore, in the manufacturing sector, motor control is imperative in the frequency converters to deliver precision and maximize productivity and reliability. In line with this, in August 2024, one of the world's leading industrial automation companies, FANUC, unveiled two new controller technologies at the International Manufacturing Technology Show (IMTS) 2024 in Chicago, in addition to its newest range of cobots, robots, machining solutions, and factory automation products.

The increasing renewable energy industry fuels the growth of the market. Frequency converters are critical in integrating renewable energy sources like solar and wind into the grid with stable and efficient power output. This is well in line with the increasing focus on sustainable energy solutions in the U.S. In the HVAC sector, frequency converters are widely used to control heating, ventilation, and air conditioning systems, enhance energy efficiency, and maintain indoor climate control. The rising need to install state-of-the-art HVAC systems in commercial, industrial, and residential structures supports market growth. For example, the global HVAC control market size stood at USD 17.5 Billion in 2024. Going forward, IMARC Group estimates that the market will reach USD 26.1 Billion by 2033, expanding at a CAGR of 4.6% during 2025-2033. The increasing application of HVAC, especially in smart and automated systems, is likely to facilitate the demand for frequency converters.

United States Frequency Converter Market Trends:

Increasing Industrial Automation

Various industries, especially manufacturing and automotive, typically adopt automated systems on large scales. These devices find application in the controlling of motor speed with energy efficiency, in which optimization of operations and cutting costs for businesses are necessary. As smart factories and Industry 4.0 continue to gain momentum, demand increases, along with the involvement of frequency converters in enhancing process flexibility and precision. For example, in February 2024, the American-Irish multinational intelligent power management company Eaton announced its continued commitment to transforming its manufacturing footprint with smart plants in Changzhou, China and Juarez, Mexico. In this regard, these electrical manufacturing sites, with both new buildings and heritage facilities, have used Industry 4.0 technology and its benefits to digitize their operations. Juarez and Changzhou will serve as a benchmark for other Eaton operations to accelerate the implementation of the latest digital technologies. This increases the need for frequency converters in energy, aerospace, and manufacturing industries that rely on these advanced components for efficient operation.

Rising Renewable Energy Integration

The widespread renewable energy adoption is acting as another major growth-inducing factor. Renewable energy sources, such as solar and wind, need to be integrated into the grid with frequency converters to provide stable and efficient power supply. Government regulations and incentives to promote clean energy also helped push the market's growth, with utilities and businesses investing in advanced technologies to meet sustainability goals. For example, in September 2024, the Interstate Renewable Energy Council (IREC) and the International City/County Management Association (ICMA) launched Energy Ready, a new coordinated initiative, backed by the U.S. Department of Energy (DOE), that recognizes local governments' strides in zoning, planning, and permitting of distributed energy generation while providing free technical assistance. This initiative represents a systemic approach to removing regulatory and technical barriers to the adoption of renewable energy sources, thereby further increasing the demand for technologies such as frequency converters in order to integrate renewable energy smoothly and efficiently.

Infrastructure Development

Ongoing infrastructure development across transportation, healthcare, and construction sectors drives the demand for frequency converters. According to industry reports, in Pullman, Washington, a significant expansion and refurbishment project is scheduled to begin in early 2025. The Pullman Regional Hospital expansion project, which is expected to cost between $45 million and $50 million, intends to put the hospital in a better position to handle a rise in the demand for specialized medical services while upholding high standards of care and efficient operations. This project reflects the broader trend of infrastructure investments in sectors like healthcare, which drives the demand for frequency converters as part of modernizing and enhancing facility operations. These devices are vital for powering equipment like HVAC systems, elevators, and medical machinery. Urbanization and federal investments in modernizing infrastructure further support the market growth, thereby increasing the need for reliable power conversion solutions.

United States Frequency Converter Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States frequency converter market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type and end use industry.

Analysis by Type:

- Static Frequency Converter

- Rotary Frequency Converter

Static frequency converters hold the largest United States frequency converter market share due to their reliability, and efficiency, along with an extensive range of industrial applications. Unlike rotary converters, static converters have no moving parts, resulting in lower maintenance costs and improved durability. They are highly employed in the defense, aerospace, and industrial manufacturing sectors for precise power conversion and stable frequency regulation. Additionally, static converters support renewable energy integration by converting frequencies in solar and wind power systems. Their ability to provide seamless and efficient performance across various applications makes them the preferred choice, driving their dominance in the U.S. market.

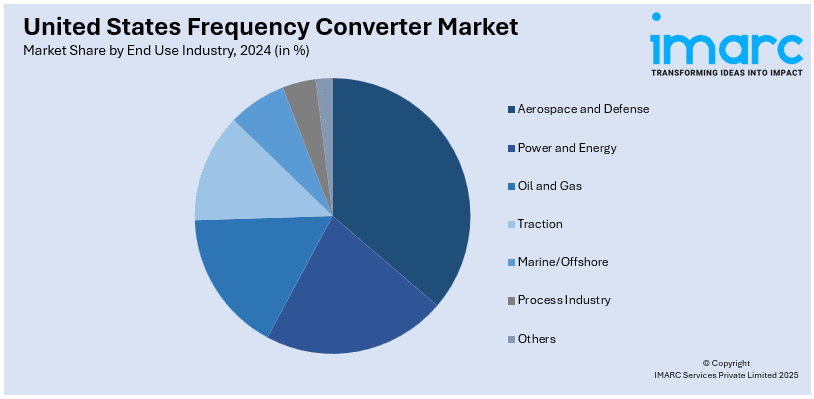

Analysis by End Use Industry:

- Aerospace and Defense

- Power and Energy

- Oil and Gas

- Traction

- Marine/Offshore

- Process Industry

- Others

The aerospace and defense sector holds the largest share of the United States frequency converter market due to its critical need for precise power conversion and reliable frequency regulation in mission-critical applications. Frequency converters are essential for powering aircraft systems, ground support equipment, and advanced radar systems, ensuring seamless operation in varying frequency environments. The widespread adoption of advanced technologies, like electric aircraft and unmanned aerial vehicles (UAVs), further fuels the demand. Additionally, significant government investments in defense infrastructure and aerospace innovation amplify the need for efficient and durable frequency converters, solidifying the sector's dominance in the United States market.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The frequency converter market in the Northeast is driven by the region's strong industrial base, including manufacturing, healthcare, and technology sectors. High energy costs encourage industries to adopt energy-efficient solutions like frequency converters. Additionally, the region's emphasis on renewable energy integration, particularly wind and solar, and its focus on modernizing aging infrastructure boost demand for advanced power conversion systems.

A strong industrial base, comprising manufacturing, healthcare, and technology sectors drives the frequency converter market in the Northeastern region. The high energy costs motivate industries to adopt energy-efficient variants like frequency converters. Moreover, the region’s focus on renewable energy integration, driven by wind and solar, and modernizing aged infrastructure reinforces demand for advanced power conversion systems.

The Midwest market is driven by the region's strong manufacturing and automotive industries, both of which need the ability to control motors with precision as well as industrial automation. The growing existence of renewable energy projects, particularly in wind energy, also increases the need for frequency converters. In addition, investments in modernizing industrial facilities as well as enabling improvements in energy efficiency also play a considerable role in market development across this region.

The frequency converter market in the South is driven by the region's expanding aerospace, oil and gas, and industrial sectors. The rising focus on industrial automation and energy-efficient systems supports the demand for frequency converters. Additionally, the widespread adoption of HVAC systems in commercial and residential projects, along with renewable energy initiatives, fuels market growth in the southern United States.

The West benefits from a strong focus on renewable energy integration, particularly solar and wind projects, driving the need for frequency converters. The region's thriving technology and aerospace sectors also rely on advanced power management solutions. Furthermore, stringent energy efficiency regulations and the adoption of automation in industries such as electronics and manufacturing contribute to market growth.

Competitive Landscape:

The United States frequency converter market is highly competitive, with key players including ABB, Siemens, Schneider Electric, and General Electric dominating the industry. These companies focus on innovation, offering advanced static and rotary frequency converters tailored to industrial, aerospace, and renewable energy applications. Regional manufacturers and smaller players are also gaining traction by providing cost-effective and customized solutions. Mergers, acquisitions, and strategic collaborations are common as companies aim to expand their market presence. The market is further shaped by investments in R&D, regulatory compliance, and the widespread adoption of automation and energy-efficient technologies in several industries.

Latest News and Developments:

- In April 2024, Rockwell Automation expanded device analytics in medium voltage PowerFlex VFDs and broadened application coverage with permanent magnet motors. The PowerFlex® 6000T medium voltage variable frequency drive (VFD) was updated to accommodate effective permanent magnet (PM) motor applications. With PM motor solutions, firms in the oil, gas, HVAC, paper, water, metals, and forestry sectors strive for new energy efficiency and sustainability targets. The PowerFlex VFD manages high-speed applications up to 120 Hz output frequency, from 2.3-11 kV to 680 A.

- In August 2024, True Blue Power announced a Supplemental Type Certificate (STC) for the company’s TFC4000 Frequency Converter on Gulfstream G450, G550, G650 and G650ER aircraft. The product provides up to 4,000 watts of wall outlet power to cabin equipment, and is a direct and more reliable replacement for existing GE Aviation Systems 717220-1, 717220-2, 717220-2R and Avionic Instruments 1-002-0102-2444 and 1-002-0102-2052 frequency converters.

- In March 2023, Siemens announced the launch of Sinamics G220 to its Sinamics portfolio. These frequency converters are equipped with clean power technology, which reduces harmonics by up to 97 percent without the requirement for line harmonic chokes or DC link chokes.

- March 2023: Bourns launched its Model PLN0xx-ED21 Series Planar Transformers, designed for high-frequency, compact DC-DC conversion applications. These transformers offer high power density, low losses, and enhanced efficiency in a low-profile design. Supporting input voltages of 33-57 VDC and output power from 48 to 70 watts, they feature low leakage inductance and a switching frequency of 250 kHz. Ideal for industrial power systems, SMPS, LED lighting, and more, these transformers utilize standard PWB materials for easy assembly and customization options.

United States Frequency Converter Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Static Frequency Converter, Rotary Frequency Converter |

| End Use Industries Covered | Aerospace and Defense, Power and Energy, Oil and Gas, Traction, Marine/Offshore, Process Industry, Others |

| Region Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States frequency converter market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States frequency converter market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States frequency converter industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The frequency converter market in the United States was valued at USD 6.24 Billion in 2024.

The United States frequency converter market growth is driven by rising industrial automation, increasing demand for energy-efficient systems, renewable energy integration, and advancements in HVAC technologies. Expanding applications in aerospace, defense, and manufacturing, along with stringent energy regulations and the push for sustainable power solutions, further boost market expansion.

IMARC estimates the United States frequency converter market to reach USD 11.66 Billion by 2033, exhibiting a CAGR of 7.2% from 2025-2033.

Static frequency converters hold the largest share in the United States market due to their efficiency, reliability, low maintenance, and widespread use in aerospace, defense, and industrial applications.

The aerospace and defense sector holds the largest share of the market due to its critical need for precise power conversion and frequency regulation in mission-critical applications and advanced technologies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)