United States Forage Market Size, Share, Trends and Forecast by Crop Type, Product Type, Animal Type, and Region, 2026-2034

United States Forage Market Size and Share:

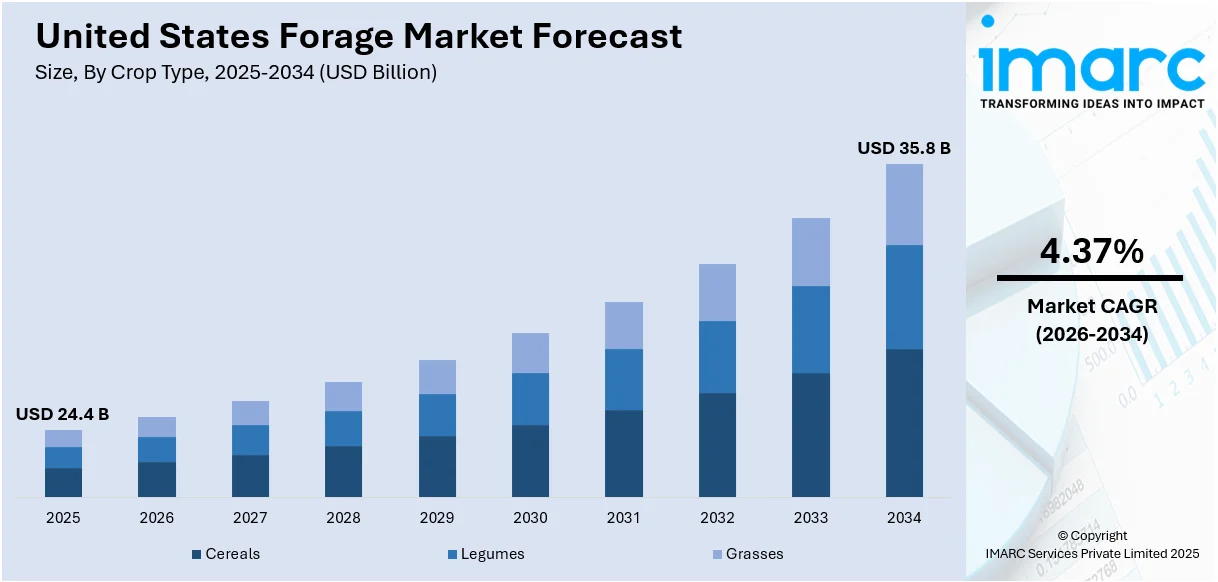

The United States forage market size was valued at USD 24.4 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 35.8 Billion by 2034, exhibiting a CAGR of 4.37% from 2026-2034. The market is driven by growing livestock demand, rising meat and dairy consumption, and sustainable farming practices like rotational grazing. Technological advancements in forage genetics and preservation boost productivity, while regional adaptability and strong export opportunities, especially for high-quality hay, further contribute to increasing the United States forage market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 24.4 Billion |

| Market Forecast in 2034 | USD 35.8 Billion |

| Market Growth Rate (2026-2034) | 4.37% |

The increased demand for animal products, including meat and dairy due to population expansion and changing eating habits, remains a key factor driving the growth of the US forage industry. Grasses, legumes, and silages are among forages that constitute important components in livestock feed as they provide the nutritional needs for greater animal health and productivity. Advancements in forage crop genetics and harvesting technologies have increased yield and quality to meet the demand. For example, in May 2024, a global agricultural technology company S&W Seed Company announced the commercial launch of Double Team Forage Sorghum, which has been added to its portfolio of unique and exclusive sorghum trait technologies. Double Team Forage Sorghum offers growers of forage sorghum a wild, non-GMO, grassy weed control alternative. Furthermore, the use of forages as an economical and ecologically friendly feed source has increased due to the increasing inclination toward sustainable farming methods like organic farming and rotational grazing, which, in turn, represents one of the key United States forage market trends.

To get more information on this market Request Sample

Regional differences also influence the market, with certain crops and farming methods adapted to regional climates and industries. For instance, the dairy and beef industries in the Midwest rely on corn silage and alfalfa, while the cattle farming in the South relies on warm-season grasses such as Bermuda grass. Government support for sustainable agriculture through subsidies and research funding is also expanding the market. For example, in June 2024, nematologist Amanda Pominville, Ph.D., was appointed to the research team at Forage Genetics International (FGI). This significant recruitment shows FGI's commitment to providing alfalfa growers solutions through scientific discoveries and research, as the company is one of the few in the world solely focused on alfalfa progress. Another factor contributing to the United States forage market growth is the possibility of exporting, especially premium hay to Asia, which makes the forage market an essential component of the American agricultural economy.

United States Forage Market Trends:

Rising Livestock Demand

The increasing demand for meat, dairy, and other animal-based products in the U.S. directly drives the forage market. As the population grows and dietary preferences shift, there is heightened pressure on livestock producers to maintain efficient feeding practices. Forages like alfalfa, grass, and silage are essential for animal nutrition, supporting the productivity and health of cattle, poultry, and swine. According to USDA, more than 700,000 acres of dried hay made from alfalfa and alfalfa mixture are expected to be harvested this year by Colorado farmers and ranchers, an increase of 50,000 acres from 2023. 2.80 million tons of alfalfa hay are anticipated to be produced, which is 29% more than the August 1 forecast and 27% more than the 2.21 million tons produced the year before. It is anticipated that the average amount of alfalfa hay produced will be 4.00 tons per acre, which is 0.9 tons more than the August 1 estimate and 0.6 tons more than the 2023 final yield. This demand for quality forage is crucial to meet the nutritional needs of livestock and ensure steady output in the agricultural sector, which, in turn, is creating a positive United States forage market outlook.

Growing Sustainable Farming Practices

Sustainability is a key driver of the U.S. forage market, as practices like rotational grazing, cover cropping, and reduced synthetic input reliance are becoming more widespread. These practices promote soil health, reduce erosion, and enhance pasture productivity, aligning with environmental goals. Forage crops, due to their role in improving soil fertility through nitrogen fixation, are a preferred choice in sustainable farming systems. For instance, in July 2024, DLF introduced 4Most Seed Enhancement by DLF, a new seed enhancement solution designed with environmental sustainability at its core, tailored specifically for turf and forage applications. As farmers seek cost-effective and eco-friendly solutions, the United States forage market demand for high-quality forages that support these practices continues to grow.

Significant Technological Advancements

Innovations in forage crop genetics, harvesting techniques, and preservation methods are transforming the U.S. forage market. Advances in seed genetics allow for the development of high-yielding, disease-resistant, and climate-resilient forage varieties. Additionally, improved methods for forage storage, such as baling and silage fermentation, have helped reduce wastage and preserve nutritional value. These technological developments enhance the efficiency of forage production and ensure year-round supply, improving both profitability and sustainability in livestock farming. For instance, in February 2024, New Holland unveiled bold yellow styling for its commercial hay and forage equipment, marking the next phase in its ongoing restyling initiative. This update, starting with the late model year 2024 equipment, ushers in a new era for New Holland North America's iconic hay and forage lineup.

United States Forage Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States forage market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on crop type, product type, and animal type.

- Cereals

- Legumes

- Grasses

Cereals like corn and oats dominate the market due to their high nutritional value and widespread use in silage and hay production. Corn silage is preferred due to its high energy density, and energizing element, significant for dairy and beef cattle. These crops are easy to grow as they can adapt to different climates as well as ensure efficient yields, making them an ideal choice for a forage crop. Also, their characteristics that qualify them as both grains and forages increase their efficiency in the commercial sense hence tapping their popularity among the livestock producers.

Legumes, such as alfalfa and clover, hold a significant market share due to their exceptional protein content and nitrogen-fixing properties, which enrich soil fertility. Alfalfa is another highly preferred forage for making hay, it is highly digestible and is rich in all essential nutrients for animals. Since legumes replace synthetic fertilizers, they are fitting in support of sustainable farming. They are well suited to various climatic conditions, hence increasing their accessibility, and greatly needed in feeding livestock as well as organic farming.

Grasses like Bermuda grass and ryegrass are widely cultivated due to their versatility, resilience, and ability to thrive in diverse environments. They are rich in fiber and energy for continuous grazing animals and commonly grown for pastures, hay, and silage. They can be easily grown with simple management requirements and are productive throughout the year. Their uses for soil erosion control and carbon capture also increase their demand, supporting sustainability strategies in American farming.

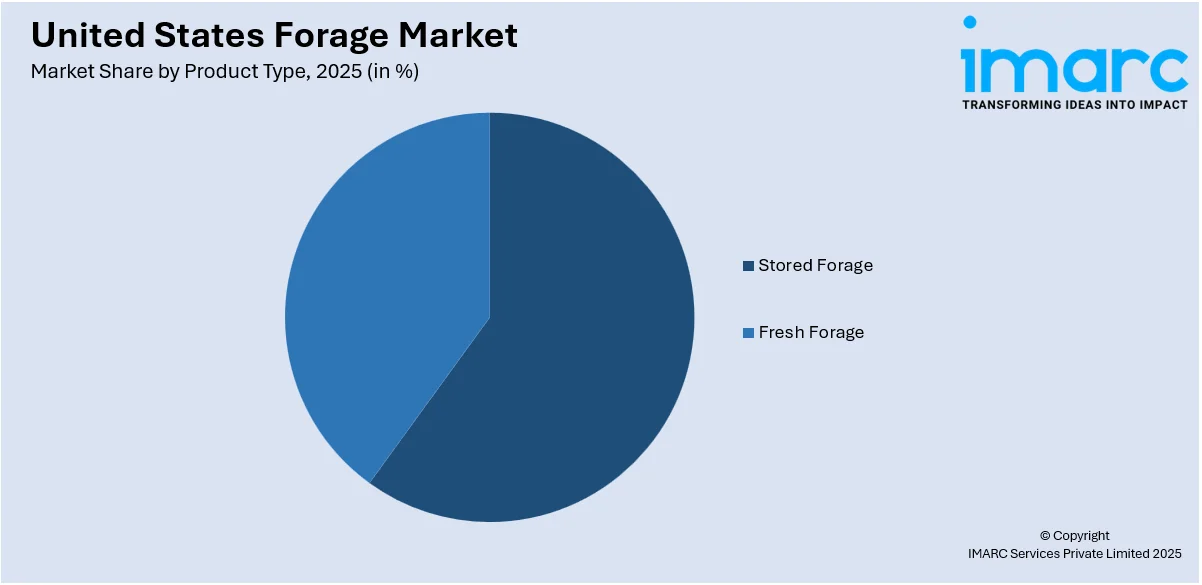

Analysis by Product Type:

Access the comprehensive market breakdown Request Sample

- Stored Forage

- Fresh Forage

Stored forage, including hay and silage, holds a significant share in the market due to its year-round availability and preservation of nutritional value. It guarantees a steady supply of feed during bad weather or off-season, which is essential for preserving the productivity and health of cattle. Stored forage makes bulk storage and shipping easier, which benefits large-scale animal operations. Modern storage technologies, such silage pits and bale wrapping, improve quality and cut down on waste, making stored fodder a vital tool for animal producers.

Due to its better nutrient density and palatability, fresh forage is the backbone of the market, especially for grazing systems. It enhances animal performance, encourages natural feeding behavior, and lowers feed processing expenses. The demand for new fodder has been strengthened by the growing use of rotational grazing techniques to improve pasture productivity and soil health. Fresh forage's market share is further increased by its environmental advantages, which include reduced soil erosion and carbon sequestration, which support sustainable agricultural practices.

Analysis by Animal Type:

- Ruminants

- Swine

- Poultry

- Others

Ruminants, such as cattle and sheep, dominate the market due to their reliance on high-fiber diets primarily derived from forages like grasses, legumes, and silage. The consumption of their products such as dairy and beef is rising due to these animals’ active conversion of forage to meat, milk, and wool. Feed resources promote the natural grazing pattern of livestock farming for enhanced ruminant productivity and health with minimal feed costs. The extensive land area dedicated to grazing further underscores the prominence of ruminants in the market.

Swine contributes significantly to the market due to the integration of forage crops into their diets for cost-effective and balanced nutrition. Because they incorporate forage crops into their diets for affordable and well-balanced nutrition, pigs make a substantial contribution to the forage market. Despite being mostly grain-fed, supplemental forage improves digestion and general health by offering vital fiber, vitamins, and minerals. Forage use is increased by the pork industry's emphasis on natural and sustainable feeding methods. The demand for forages tailored to swine dietary requirements has also increased due to the rise in popularity of small-scale and organic swine farming, which prioritizes pasture-based systems.

A significant portion of the market is devoted to poultry as farmers use forage-based systems to improve the nutrition and well-being of their birds. Feeding forage to chickens enhances their natural foraging activity, increases the quality of their eggs and meat, and reduces feed expenditures. Customers looking for sustainable and ethically sourced products are increasingly choosing free-range and pasture-raised chicken systems, which depend on the availability of fodder. Forage's significance in the poultry industry is further enhanced by the growing demand for natural and organic poultry products.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The dairy business in the Northeast, which mostly depends on premium fodder like grass hay and alfalfa, is the main driver of the forage market in this region. The production of silage and other effective forage farming techniques are encouraged by the scarcity of arable land. The need for fodder is also supported by the emphasis on organic dairy operations and ecological farming. Furthermore, the humid environment of that region supports the development of a variety of forage crops, and the productivity and profitability of regional livestock farms—which are frequently small to medium-sized—rely on steady forage supplies.

The Midwest, known as the “Corn Belt,” drives the forage market with its extensive production of corn silage and alfalfa. For efficient livestock feeding, the region's leading dairy and meat industries require high-quality fodder. Consistent supply is ensured by high-feed crop harvests made possible by favorable soil and climate conditions. Additionally, improvements in fodder storage and preservation technology increase use. Various forage crops are becoming more and more popular in the Midwest because of sustainable agriculture practices like rotational grazing and cover crops.

The Southern U.S. forage market benefits from its warm climate, supporting year-round production of forage crops like Bermuda grass and ryegrass. Because of its mild environment, the Southern U.S. forage market benefits from year-round cultivation of fodder crops including ryegrass and Bermuda grass. The demand for grazing and hay is driven by the booming beef cattle industry in places like Texas and Oklahoma. The widespread adoption of drought-tolerant forage types ensures production by addressing the issue of water constraints. Additionally, diversified forage production is encouraged by the rising popularity of rotational grazing and regenerative agriculture techniques, and the region's swine and poultry businesses are increasingly incorporating forage into their feed strategy.

In the West, forage demand is driven by large-scale dairy and beef operations, especially in states like California, the nation’s leading dairy producer. One important crop that is prized for its great nutritional value is alfalfa hay. Due to the region's arid climate, water-efficient forage varieties are purchased because irrigation is required. The growth of the forage business is aided by sustainability initiatives like carbon sequestration programs and soil health management. Furthermore, exporting premium fodder, especially to Asia, improves the region's standing in the market.

Competitive Landscape:

The highly competitive market has diverse players across production, processing, and distribution. Key participants include large-scale forage producers, regional cooperatives, and agricultural input companies. Prominent names like Forage Genetics International and Alforex Seeds drive innovation in seed genetics and forage crop development. Advancements in forage preservation technologies, sustainable farming practices, and increasing demand for high-nutrient forage fuel competition. Companies emphasize quality, efficiency, and sustainability to differentiate themselves. Export markets, especially in Asia, add competitive pressure. Collaborations between producers and research institutions further shape the market, focusing on climate resilience and productivity improvements to maintain a competitive edge. For instance, in June 2024, Yara North America, a leader in the field of crop nutrition and sustainable agriculture solutions, announced the launch of its newest incubator farm in collaboration with a Livingston County, New York, the farm that produces feed for dairy operations. The 150-acre incubator farm site is expected to develop into a knowledge center for environmental sustainability and dairy feed innovation after its first installation.

Latest News and Developments:

- In March 2024, The United States Eventing Association, Inc. (USEA) announced the return of Standlee as the "Official Forage of the USEA" for 2024. Standlee Premium Products, a leader in cultivating, distributing, and marketing premium Western forages, will also serve as the "Title Sponsor of the USEA Horse of the Year Leaderboard," a "Gold Sponsor of the USEA American Eventing Championships," and a "Contributing Sponsor of the USEA Young Event Horse Series.

- In October 2024, Renovo Seed made a significant announcement at the World Dairy Expo 2024, introducing OptiHarv, a new forage mix added to their portfolio. This innovative blend features a diverse combination of millets, peas, beans, barley, and brassicas, designed to produce high tonnage for baleage, haylage, or grazing.

United States Forage Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Crop Types Covered | Cereals, Legumes, Grasses |

| Product Types Covered | Stored Forage, Fresh Forage |

| Animal Types Covered | Ruminants, Swine, Poultry, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States forage market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States forage market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States forage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The forage market in the United States was valued at USD 24.4 Billion in 2025.

The key factors driving the United States forage market are the rising demand for livestock products, increasing adoption of sustainable farming practices, and expanding dairy and meat industries. Other factors include advancements in forage cultivation techniques, government support for agriculture, and a growing focus on soil health and climate-resilient crops.

The United States forage market is projected to exhibit a CAGR of 4.37% during 2026-2034, reaching a value of USD 35.8 Billion by 2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)