United States Food Preservatives Market Size, Share, Trends and Forecast by Type, Function, Application, and Region, 2025-2033

United States Food Preservatives Market Size and Share:

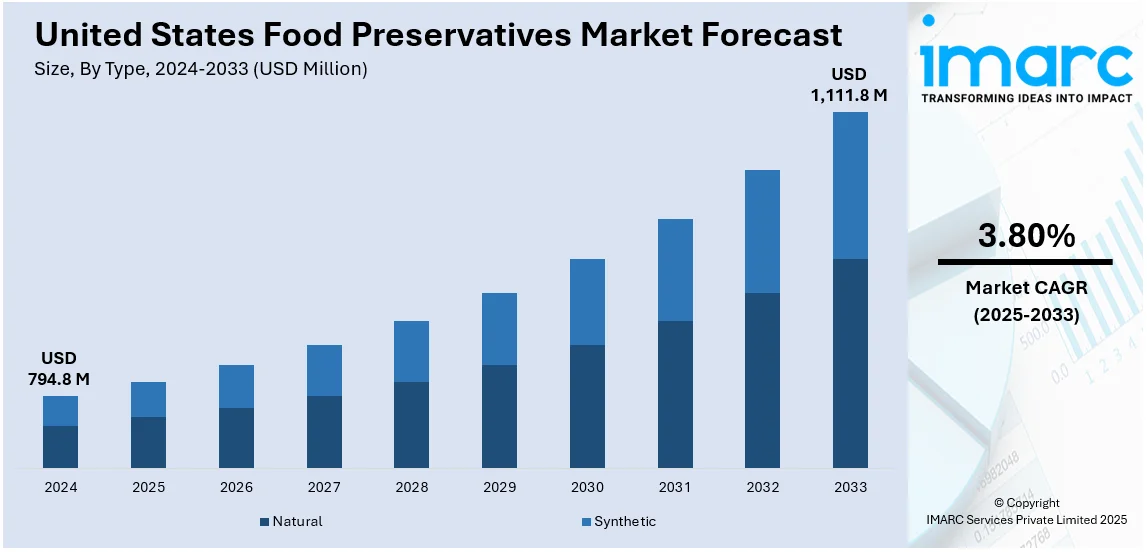

The United States food preservatives market size was valued at USD 794.8 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,111.8 Million by 2033, exhibiting a CAGR of 3.80% from 2025-2033. The market is driven by the growing demand for the convenience food products that have preservatives for retaining the shelf life of the product. Along with this, the rising utilization of preservatives in attaining food safety requirements is strengthening the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 794.8 Million |

| Market Forecast in 2033 | USD 1,111.8 Million |

| Market Growth Rate (2025-2033) | 3.80% |

The growing demand for convenience food is a significant driver of the market in the United States. The growing trend of ready to eat (RTE) food items is associated with the increasingly hectic lifestyle of the people. These food products consist of preservatives that help in retaining flavor, assimilation, and nourishment of the products for longer time. Packaged meats, dairy products, and snacks are mostly treated with preservatives, including antioxidants, antimicrobials, and acids, to protect against microbial contamination, oxidation, and spoilage. According to the IMARC Group’s report, the United States convenience food market is anticipated to reach US$ 165.58 Billion by 2032.

As per the data published on the website of the IMARC Group, the United States food safety testing market size reached USD 6.1 Billion in 2024. The growing concerns about quality control as well as foodborne illness are turning preservatives into a mandatory ingredient ensuring the safety of food products. Food preservatives help to stave off the growth of harmful bacteria, molds, and yeast from perishable food. These preservatives also aid in retaining the nutrient integrity, along with the sensory properties like flavor, texture, and the color of the food commodities. As food safety standards are becoming more stringent, manufacturers are utilizing preservatives efficiently for meeting regulatory requirements. The increasing focus on quality food, coupled with consumer demand for safer and more reliable food products, is promoting the use of preservatives in the US food and beverage (F&B) industry.

United States Food Preservatives Market Trends:

Rising demand for frozen food

Frozen food products require effective preservation for maintaining their quality and safety over time. With the increasing consumption of frozen meals, vegetables, and RTE food products, preservatives are becoming vital in extending the shelf life of these products to keep them safe during storage and transportation. Frozen food can be more convenient with longer shelf stability, but they are also susceptible to microbial growth, oxidation, and sensory degradation, which affects the flavor and texture. The use of preservatives, mainly antioxidants and antimicrobials, assist in enhancing the quality of the products. The expansion of online grocery shopping is catalyzing the demand for frozen food products, requiring preservatives for maintaining food quality during delivery, which is bolstering the growth of the market. The IMARC Group’s report shows that the United States frozen meat market is anticipated to reach US$ 81.6 Billion by 2032.

Growing demand for pet food

As more people are adopting pets, there is a rise in the demand for high-quality, nutritious, and shelf-stable pet food. Preservatives are essential for maintaining the freshness of pet food over a long period, even in products like dry kibble, canned food, and treats, which are often stored for months before consumption. Pet food manufacturers rely on these preservatives to protect food products against spoilage caused by bacterial growth, mold, and oxidation. Natural preservatives like mixed tocopherols and rosemary extracts are used for keeping fats and oils fresh in dry dog food, thereby preventing it from contamination in wet food. Such properties help in preserving taste, texture, and nutritional value, which are very important in purchasing decisions for pet parents. The data published on the website of IMARC Group shows that the United States dog food market is expected to reach US$ 28.1 Billion by 2032.

Shift to clean label products

The growing consumption of healthier food options is driving the demand for clean label products. Clean-label products are made with minimal and easily recognizable ingredients, free from artificial additives, and chemicals. The rising awareness among the masses about the potential health risks associated with synthetic preservatives is prompting manufacturers to adopt more natural preservation methods. As a result, they are switching to natural preservatives, such as rosemary extract, lemon juice, vinegar, and ascorbic acid (vitamin C), to replace synthetic chemicals like sodium benzoate and butylated hydroxyanisole (BHA). These naturally sourced substances provide similar functional benefits when it comes to prevent spoilage and maintain product shelf life while being appealing to people who prioritize clean and simple ingredients in their food. As per the IMARC Group’s report, the United States organic food market is exhibited to reach US$ 158.2 Billion by 2032.

United States Food Preservatives Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States food preservatives market, along with forecast at the country and regional levels from 2025-2033. The market has been categorized based on type, function, and application.

Analysis by Type:

- Natural

- Edible Oil

- Rosemary Extracts

- Natamycin

- Vinegar

- Others

- Synthetic

- Propionates

- Sorbates

- Benzoates

- Others

There is a growing demand for natural preservatives because of ongoing trends for clean-label and healthy food products. Ingredients like vinegar, salt, and essential oils appeal to those avoiding artificial additives. Their ability to align with organic and non-genetically modified organism (GMO) categories are driving the demand for natural preservatives.

Synthetic preservatives are widely used due to their cost-effectiveness, longer shelf-life, and their reliability in preserving processed food products. They are popularly employed in large-scale production, where natural preservatives might not scale or provide consistency.

Analysis by Function:

- Anti-Microbial

- Anti-Oxidant

- Others

Antimicrobial preservatives prevent the development of bacteria, yeast, and molds, preserving food safety and a longer shelf-life. They are key to curbing spoilage in perishable goods like dairy, meat, and baked goods. Their versatility across acidic and neutral potential of hydrogen (pH) ranges is making them essential for various food categories. Additionally, the rising regularity compliance for food safety standards are reinforcing the use of anti-microbial agents in processed food products.

Antioxidant preservatives assist in reducing the process of rancidity and nutritional degradation in food items. They also help to preserve flavor, colors, and nutritional content, which influences consumer desire for high-quality food goods. Besides this, natural anti-oxidants like tocopherols and ascorbic acid are also being used, catering to the demands of health-conscious consumers who prefer clean label products.

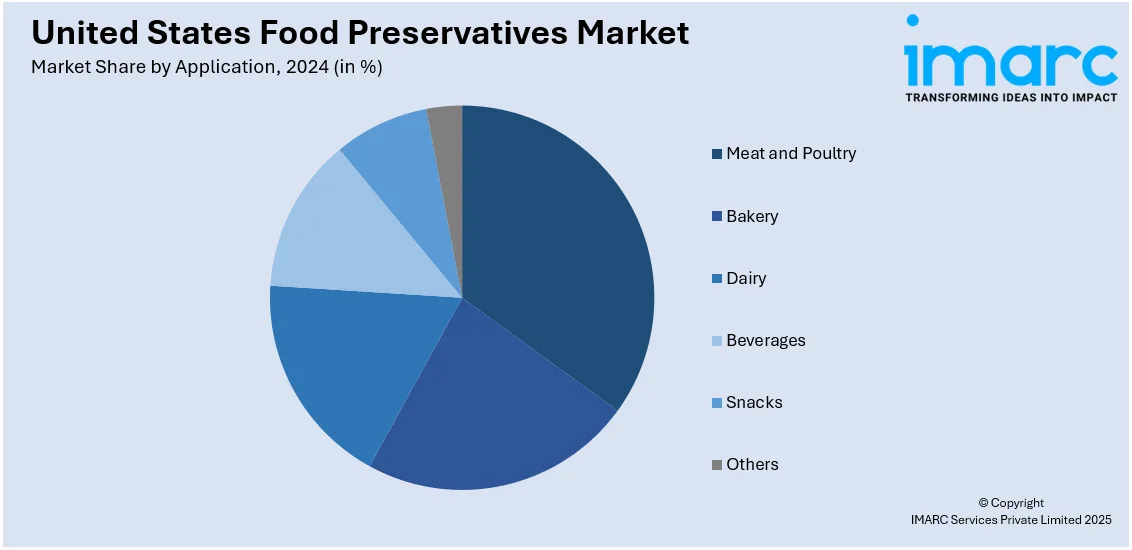

Analysis by Application:

- Meat and Poultry

- Bakery

- Dairy

- Beverages

- Snacks

- Others

Preservatives in meat help to prevent microbial development and oxidation, which ensures safety and extends the shelf life of highly perishable food products. They reduce foodborne illness risks while preserving texture and flavor during storage and transportation.

Bakery products are benefiting from preservatives that inhibit mold and yeast growth, prolonging freshness. They are vital in maintaining the shelf life of items with high moisture content, like cakes and pastries. Natural preservatives including vinegar extract is growing popularity in preserving baked goods in the longer distribution channels.

Dairy products are perishable and require preservatives like natamycin for preserving milk-based products and ensuring safety. The increasing demand for processed cheese, yogurts, and flavored milk is encouraging the adoption of efficient preservatives.

Preservatives are chemicals that protect juices, soft drinks, and alcoholic beverages against both microbiological development and flavor degradation. This is increasing the demand for natural and synthetic preservatives in ready-to-drink (RTD) beverages, catalyzing the growth of the market.

Antioxidants and antimicrobials are employed in preserving snacks that aid in preventing rancidity in oil-based products and maintaining freshness. They serve an important function in increasing the shelf life of packaged goods, such as chips and nuts, promoting their adoption in emerging economies.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The need for food preservatives is exacerbated in urban areas of the Northeast, such as New York and Boston. Preservatives are employed for ensuring the safety of convenience food products, which are driven by the flourishing foodservice and packaged food industries.

The Midwest is an agricultural and food processing hub, and it depends on preservatives for enabling its enormous food production ecosystem. With significant output in dairy, meat, and grain-based products, the region requires preservatives for both industrial-scale manufacturing and regional distribution.

The growing consumption of meat in the South is driving the demand for preservatives in the meat processing industry. Furthermore, high temperatures and humidity in the South create a conducive environment for microbial development, increasing food spoiling, which is supporting the market growth of preservatives.

The growing adoption of clean-label and organic products is shaped by the market in West. Additionally, the growth of plant-based and organic food industries in states like California promotes innovations in the production of preservatives to meet consumer expectations for safety and freshness.

Competitive Landscape:

Key players in the market are constantly innovating, and improving product safety, which is expanding their market reach. They are investing in research and development (R&D) activities for creating advanced preservative solutions, including natural and clean-label options that aligns with the health-conscious people. These key players are focusing on expanding manufacturing processes to meet the growing demand for processed and packaged food products while maintaining quality. Additionally, these major firms are collaborating with food producers and retailers to expand their market reach and enhance distribution networks. These key players are ensuring that their products meet strict regulatory standards, thereby gaining consumer confidence. Besides this, their efforts in marketing, consumer education, and addressing evolving food trends is increasing the adoption of preservative technologies across diverse food categories, ensuring the market remains dynamic and competitive, which is bolstering the market growth.

The report provides a comprehensive analysis of the competitive landscape in the United States food preservatives market with detailed profiles of all major companies.

Latest News and Developments:

- July 2024: Syensqo launched Riza, a natural range of antioxidants and flavors derived from rosemary, to replace artificial preservatives in food products and enhance their shelf life and quality.

United States Food Preservatives Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Functions Covered | Anti-Microbial, Anti-Oxidant, Others |

| Applications Covered | Meat and Poultry, Bakery, Dairy, Beverages, Snacks, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States food preservatives market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States food preservatives market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States food preservatives industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Food preservatives are substances added to food products that prevent spoilage, extend shelf life, and maintain freshness by inhibiting the growth of microorganisms like bacteria, mold, and yeast. They also prevent chemical changes, such as oxidation, which can cause rancidity in fats.

The United States food preservatives market was valued at USD 794.8 Million in 2024.

IMARC estimates the United States food preservatives market to exhibit a CAGR of 3.80% during 2025-2033.

The increasing consumption of ready-to-eat (RTE) food products is driving the demand for preservatives to maintain a longer shelf life. Rising concerns about food safety and quality is spurring the adoption of preservatives for improving freshness and preventing contamination, which is strengthening the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)