United States Fertilizer Market Size, Share, Trends and Forecast by Product Type, Product, Product Form, Crop Type, and Region, 2026-2034

United States Fertilizer Market Summary:

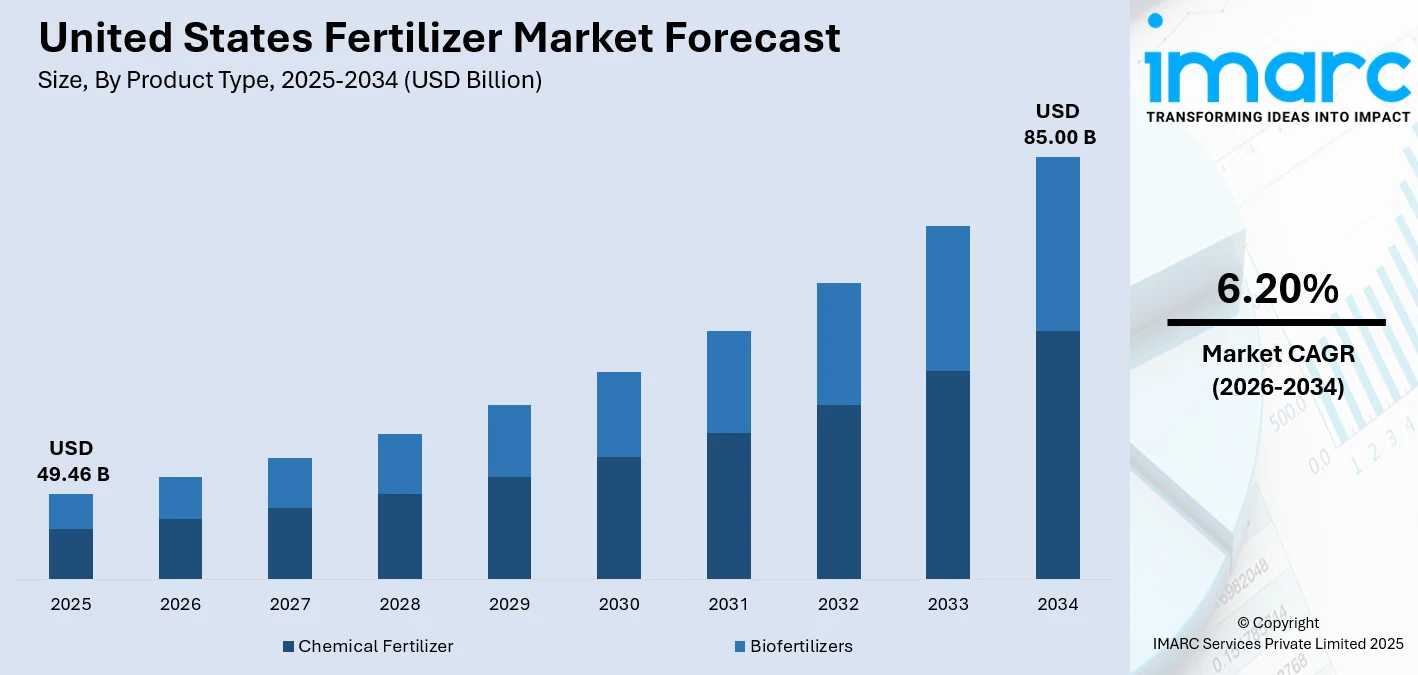

The United States fertilizer market size was valued at USD 49.46 Billion in 2025 and is projected to reach USD 85.00 Billion by 2034, growing at a compound annual growth rate of 6.20% from 2026-2034.

The market is driven by expanding agricultural production demands, increasing adoption of precision farming techniques, and the growing need for enhanced crop yields across diverse farming operations. The emphasis on sustainable agricultural practices and soil health optimization further propels demand for various fertilizer formulations. Additionally, supportive government policies promoting domestic agricultural productivity and food security contribute to sustained market expansion. These factors collectively influence the United States fertilizer market share.

Key Takeaways and Insights:

- By Product Type: Chemical fertilizer dominates the market with a share of 83% in 2025, driven by their ability to provide specific nutrients and their economical nature.

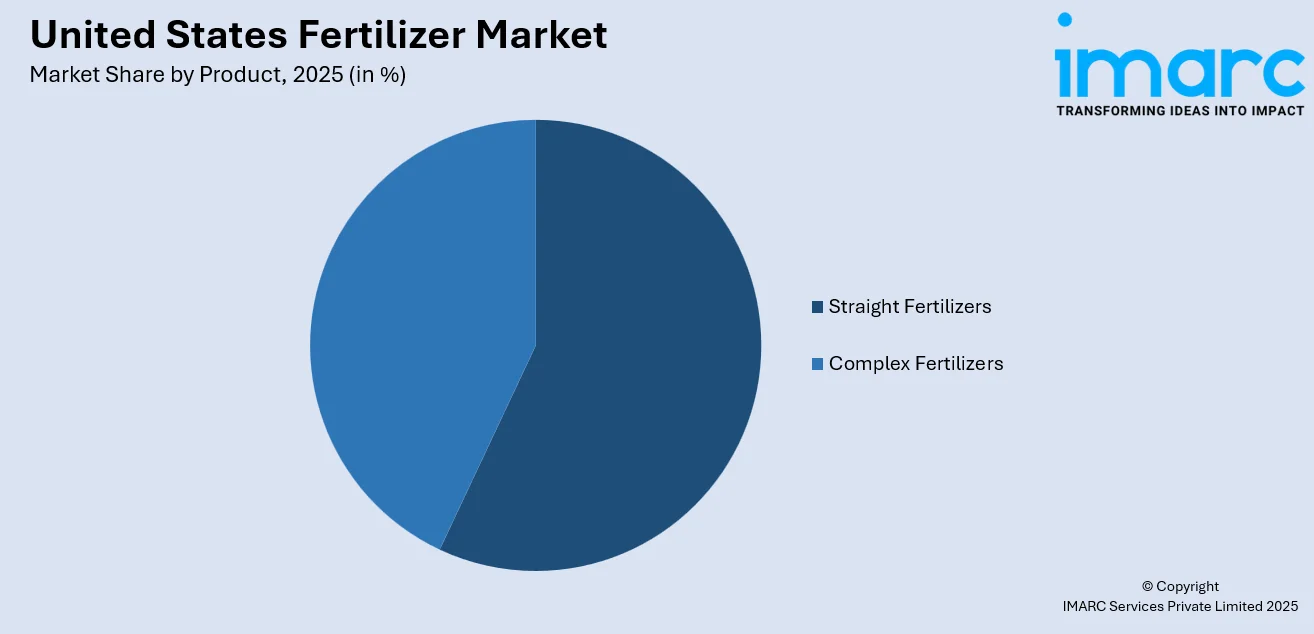

- By Product: Straight fertilizers lead the market with a share of 57% in 2025, owing to targeted nutrient delivery capabilities at affordable costs for farmers, as this addresses specific soil deficiencies.

- By Product Form: Dry represents the largest segment with a market share of 68% in 2025, driven by its improved storage stability and compatibility with traditional-application equipment.

- By Crop Type: Grains and cereals dominate the market with a share of 40% in 2025, owing to huge-scale production of corn, wheat, and soybean consumes enormous amounts of fertilizers.

- By Region: South leads the market with a share of 30% in 2025, driven by varied agricultural practices as well as year-round growing seasons that favor multiple harvests.

- Key Players: The United States fertilizer market exhibits a consolidated competitive landscape, with established manufacturers competing across product segments through distribution network expansion, product innovation, and strategic partnerships with agricultural cooperatives to enhance market penetration. Some of the key players operating in the market include CF Industries Holdings, Inc., Haifa Group, ICL Group Ltd., Koch Industries Inc., Nutrien Ltd., Sociedad Química y Minera de Chile SA, The Andersons Inc., The Mosaic Company, Wilbur-Ellis Company LLC, and Yara International ASA.

To get more information on this market Request Sample

The United States fertilizer market continues to demonstrate robust growth momentum supported by multiple converging factors. Rising global food demand necessitates increased agricultural productivity, compelling farmers to adopt advanced fertilization strategies to maximize yields. According to reports, in December 2024, the USDA invested $116 Million through the Fertilizer Production Expansion Program to expand eight domestic fertilizer facilities, boosting supply, lowering costs for farmers, and creating rural jobs, further strengthening the market’s foundation. Moreover, the growing emphasis on sustainable farming practices encourages the development and utilization of specialized fertilizer formulations designed to minimize environmental impact while maximizing crop nutrition and soil health. Government initiatives supporting domestic agriculture and food security create favorable conditions for sustained market expansion across all regions. Technological advancements in precision agriculture enable optimized fertilizer application, reducing waste and improving nutrient uptake efficiency throughout the growing season.

United States Fertilizer Market Trends:

Growing Adoption of Precision Agriculture Technologies

The integration of precision agriculture technologies represents a transformative trend reshaping fertilizer application practices across the United States. Farmers increasingly leverage variable rate application systems, GPS-guided equipment, and soil sensing technologies to optimize nutrient delivery based on field-specific requirements. In June 2025, U.S. Sugar partnered with Everglades Equipment to implement John Deere’s GPS‑guided fertilizer applicators and other precision tools across its 255,000‑acre operation to improve efficiency and reduce input waste, signaling broader commercial adoption of precision tech. Moreover, this technology-driven approach enables targeted fertilizer placement, reducing overall consumption while improving crop response rates.

Increasing Preference for Slow-Release and Controlled-Release Fertilizers

A notable shift toward slow-release and controlled-release fertilizer formulations characterizes current market dynamics. These advanced products deliver nutrients gradually over extended periods, aligning nutrient availability with plant uptake patterns throughout growth cycles. In May 2024, ICL Group began shipments of controlled‑release fertilizers featuring biodegradable coating technology, enhancing nutrient use efficiency while addressing sustainability concerns in agricultural nutrient delivery. Furthermore, agricultural operations benefit from reduced application frequency, lower labor requirements, and minimized nutrient losses through leaching or volatilization. The environmental advantages associated with these formulations, including decreased groundwater contamination risk and reduced greenhouse gas emissions, align with sustainability mandates driving agricultural sector transformation.

Rising Interest in Specialty and Enhanced Efficiency Fertilizers

The market witnesses expanding interest in specialty fertilizers incorporating enhanced efficiency technologies such as nitrification inhibitors and urease inhibitors. These additives improve nitrogen use efficiency by controlling the conversion and release of nutrients in soil environments. According to reports, U.S. patents were granted for three nitrogen stabilizer technologies, reducing volatilization, nitrification, and leaching, reflecting the growing adoption of enhanced-efficiency fertilizers tailored to U.S. crop and soil conditions. Furthermore, farmers pursuing higher yields and improved return on fertilizer investments increasingly select products offering enhanced performance characteristics. The development of customized fertilizer blends addressing specific soil conditions and crop requirements further drives specialty product adoption among operations focused on premium crop production.

Market Outlook 2026-2034:

The United States fertilizer market revenue is projected to experience sustained growth throughout the forecast period, supported by continued agricultural expansion and modernization initiatives. Increasing investment in research and development activities focused on innovative fertilizer technologies will introduce advanced product offerings addressing evolving farmer requirements. The transition toward sustainable agriculture and regenerative farming practices will shape demand patterns, favoring environmentally responsible formulations. Regional agricultural diversification and expansion of specialty crop cultivation will create opportunities for targeted fertilizer solutions generating incremental revenue streams across market segments. The market generated a revenue of USD 49.46 Billion in 2025 and is projected to reach a revenue of USD 85.00 Billion by 2034, growing at a compound annual growth rate of 6.20% from 2026-2034.

United States Fertilizer Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Chemical Fertilizer | 83% |

| Product | Straight Fertilizers | 57% |

| Product Form | Dry | 68% |

| Crop Type | Grains and Cereals | 40% |

| Region | South | 30% |

Product Type Insights:

- Chemical Fertilizer

- Biofertilizers

Chemical fertilizer dominates with a market share of 83% of the total United States fertilizer market in 2025.

Chemical fertilizers maintain dominant market positioning due to their established track record in delivering measurable yield improvements across major commodity crops. These synthetically manufactured products provide concentrated nutrient content in standardized formulations, enabling precise application according to agronomic recommendations. In 2025, Nutrien’s North American operations achieved a 94 percent ammonia operating rate, with nitrogen sales of 10.7 to 11.0 Million Tonnes and potash sales of 14.0 to 14.5 Million Tonnes, underscoring strong operational performance and reliable U.S. fertilizer supply. Moreover, the extensive production infrastructure and distribution networks supporting this segment ensure widespread availability at competitive pricing.

The segment benefits from continuous product innovation introducing improved formulations with enhanced nutrient release characteristics and reduced environmental impact. Manufacturers invest in developing specialty products incorporating micronutrients and secondary nutrients addressing comprehensive crop nutrition requirements across diverse agricultural applications. The integration of these fertilizers with precision agriculture technologies optimizes application efficiency, supporting sustainable intensification strategies pursued by progressive farming operations. Strong farmer familiarity and proven performance ensure sustained demand across varied cropping systems and regional agricultural practices nationwide.

Product Insights:

Access the comprehensive market breakdown Request Sample

- Straight Fertilizers

- Nitrogenous Fertilizers

- Urea

- Calcium Ammonium Nitrate

- Ammonium Nitrate

- Ammonium Sulfate

- Anhydrous Ammonia

- Others

- Phosphatic Fertilizers

- Mono-Ammonium Phosphate (MAP)

- Di-Ammonium Phosphate (DAP)

- Single Super Phosphate (SSP)

- Triple Super Phosphate (TSP)

- Others

- Potash Fertilizers

- Muriate of Potash (MoP)

- Sulfate of Potash (SoP)

- Secondary Macronutrient Fertilizers

- Calcium Fertilizers

- Magnesium Fertilizers

- Sulfur Fertilizers

- Micronutrient Fertilizers

- Zinc

- Manganese

- Copper

- Iron

- Boron

- Molybdenum

- Others

- Nitrogenous Fertilizers

- Complex Fertilizers

Straight fertilizers lead with a share of 57% of the total United States fertilizer market in 2025.

Straight fertilizers dominate market positioning due to its versatility in addressing specific nutrient deficiencies identified through soil testing protocols. These single-nutrient formulations, including nitrogenous, phosphatic, and potash fertilizers, allow farmers to customize nutrient programs based on actual field requirements rather than applying pre-mixed ratios. According to sources, Nutrien announced plans to expand its urea and UAN capacity at its Lima, Ohio facility—boosting nitrogen production and supporting reliable supply of straight fertilizers critical to U.S. crop nutrition strategies.

The segment encompasses diverse product categories ranging from commodity-grade urea and diammonium phosphate to specialty micronutrient formulations targeting specific crop needs. Agricultural operations benefit from the ability to blend straight fertilizers into customized formulations matching precise soil and crop requirements throughout the growing season. The cost-effectiveness of straight fertilizer procurement compared to pre-formulated blends drives adoption among commercial farming operations managing extensive acreage. Strong distribution networks ensure widespread availability across agricultural retailers and cooperatives serving diverse regional markets.

Product Form Insights:

- Dry

- Liquid

Dry exhibits a clear dominance with a 68% share of the total United States fertilizer market in 2025.

Dry dominate the product form segment through significant advantages in handling, storage, and application logistics critical to large-scale agricultural operations. Granular and prilled formulations offer superior stability during extended storage periods and compatibility with conventional spreading equipment utilized across major farming regions. As per sources, in August 2024, Nutrien opened a 40,000 sq. ft. dry fertilizer terminal in Minnesota, handling 20,000 Tons of nitrogen, potash, and phosphate, enhancing storage, distribution, and availability for large-scale U.S. farms. Moreover, the reduced transportation costs associated with concentrated dry products compared to liquid alternatives enhance economic attractiveness for operations managing significant acreage.

Manufacturing advancements continue improving dry physical characteristics including particle size uniformity, hardness, and dust reduction during handling operations. These quality improvements enhance application accuracy and minimize product degradation during storage and transportation across distribution networks. The extensive infrastructure supporting dry fertilizer distribution through retail outlets, cooperatives, and direct delivery services ensures convenient access for agricultural operations throughout diverse geographic regions. Long shelf life and resistance to environmental degradation make dry formulations particularly suitable for seasonal purchasing and extended on-farm storage requirements.

Crop Type Insights:

- Grains and Cereals

- Pulses and Oilseeds

- Fruits and Vegetables

- Flowers and Ornamentals

- Others

Grains and cereals lead with a market share of 40% of the total United States fertilizer market in 2025.

Grains and cereals represent the leading crop application segment reflecting predominant agricultural production patterns across the United States. Corn, wheat, soybeans, and other crops within the grains and cereals category cultivated across the Midwest and Great Plains require substantial fertilizer inputs to achieve optimal yields. The high nutrient demands of grains and cereals during critical growth stages drive consistent fertilizer consumption volumes. In February 2025, Nutrien projected U.S. corn plantings at 91-93 Million acres and soybean plantings at 84-86 Million acres, supporting strong fertilizer demand during spring application.

Fertilizer programs for grains and cereals incorporate multiple application timings including pre-plant, at-planting, and in-season applications addressing crop nutrient requirements throughout development stages. The emphasis on maximizing grains and cereals production efficiency encourages adoption of advanced fertilizer technologies including enhanced efficiency products and variable rate application systems. Ongoing research into grains and cereals nutrient management recommendations continues refining fertilization practices supporting improved productivity and environmental stewardship across producing regions nationwide.

Regional Insights:

- Northeast

- Midwest

- South

- West

South dominates with a market share of 30% of the total United States fertilizer market in 2025.

South maintains market leadership supported by favorable climatic conditions enabling extended growing seasons and diverse crop production activities. States within the South host significant agricultural activities ranging from cotton and rice cultivation to specialty crop production requiring year-round fertilizer applications. The regional agricultural diversity in the South creates demand for varied fertilizer formulations addressing multiple crop nutrient requirements. Warm temperatures and adequate rainfall patterns across the South support intensive farming operations throughout the calendar year.

Agricultural expansion in the South continues driving fertilizer consumption growth as operations increase cultivated acreage and intensify production practices. The warm climate across the South allows multiple cropping cycles annually, multiplying fertilizer application opportunities compared to northern regions with limited growing seasons. Regional infrastructure development in the South enhances fertilizer distribution efficiency, supporting timely product availability for critical application windows. Strong agricultural traditions and established farming communities across the South sustain consistent demand for quality fertilizer products.

Market Dynamics:

Growth Drivers:

Why is the United States Fertilizer Market Growing?

Expanding Agricultural Production Requirements

The escalating global demand for food products necessitates continuous enhancement of agricultural productivity, positioning fertilizers as essential inputs for achieving targeted yield improvements. Population growth and dietary shifts toward protein-rich foods increase pressure on agricultural systems to maximize output from available arable land. Farmers respond by intensifying production practices including optimized fertilization strategies designed to extract maximum productivity from cultivated acreage. The emphasis on maintaining food security and supporting export competitiveness drives sustained investment in fertilizer applications across diverse crop categories.

Advancement of Precision Agriculture Technologies

The proliferation of precision agriculture technologies creates favorable conditions for optimized fertilizer utilization and market expansion. Sophisticated sensing systems, geospatial mapping technologies, and data analytics platforms enable field-specific nutrient management programs addressing variable soil conditions within individual farms. According to reports, in December 2024, approximately 68% of large U.S. crop farms utilize precision agriculture technologies, including yield monitors and soil maps, to optimize fertilizer use and input management. Moreover, these technological capabilities support efficient fertilizer deployment, reducing waste while improving crop response to applied nutrients. The demonstrated return on investment from precision fertilizer applications encourages broader adoption among progressive agricultural operations, stimulating demand for conventional and specialty fertilizer products.

Government Support for Domestic Agricultural Development

Comprehensive government programs supporting domestic agricultural development contribute significantly to fertilizer market growth dynamics. Policy initiatives addressing farm income stability, conservation practices, and agricultural research provide frameworks encouraging productive land management incorporating appropriate fertilization. Technical assistance programs help farmers implement improved nutrient management practices aligned with environmental stewardship objectives while maintaining production efficiency. The regulatory environment balancing agricultural productivity with environmental protection creates opportunities for innovative fertilizer technologies offering performance advantages alongside sustainability benefits.

Market Restraints:

What Challenges the United States Fertilizer Market is Facing?

Volatility in Raw Material Pricing

Fluctuations in raw material costs create uncertainty affecting fertilizer pricing and farmer purchasing decisions. Natural gas prices significantly influence nitrogen fertilizer production economics, while phosphate and potash production costs depend on mining and processing expenses. Price volatility impacts farm input budgeting and may delay or reduce fertilizer purchases during periods of elevated costs, constraining market growth potential.

Environmental Regulations and Sustainability Concerns

Increasing environmental scrutiny of agricultural nutrient management practices imposes operational constraints potentially limiting fertilizer application rates and methods. Regulations addressing water quality protection, greenhouse gas emissions, and ecosystem preservation require modified fertilization approaches in sensitive areas. Compliance requirements may increase operational complexity and costs for agricultural operations navigating evolving regulatory frameworks while maintaining productive farming activities.

Alternative Nutrient Sources and Organic Farming Expansion

Growing consumer preference for organically produced foods drives expansion of organic farming practices relying on non-synthetic nutrient sources. The conversion of conventional farmland to certified organic production reduces demand for chemical fertilizers within transitioning operations. Alternative nutrient sources including composted materials, animal manures, and biofertilizers compete with synthetic products in markets emphasizing sustainable agricultural practices.

Competitive Landscape:

The United States fertilizer market features a structured competitive environment characterized by established market participants operating across multiple product categories and geographic regions. Market leaders leverage extensive production facilities, comprehensive distribution networks, and strong relationships with agricultural retailers and cooperatives to maintain positioning. Competition centers on product quality, pricing competitiveness, technical support services, and supply chain reliability meeting seasonal demand patterns. The market demonstrates ongoing consolidation activity as participants pursue operational efficiencies and expanded market presence. Innovation in product formulations and delivery technologies serves as a competitive differentiator, with companies investing in research activities developing enhanced efficiency products addressing sustainability requirements alongside performance expectations.

Some of the key players include:

- CF Industries Holdings, Inc.

- Haifa Group

- ICL Group Ltd

- Koch Industries Inc.

- Nutrien Ltd.

- Sociedad Quimica y Minera de Chile SA

- The Andersons Inc.

- The Mosaic Company

- Wilbur-Ellis Company LLC

- Yara International ASA

Recent Developments:

- In August 2024, Itafos, a North American fertilizer multinational, announced expansion in Brazil, opening a new office in Luís Eduardo Magalhães, Bahia. The move aims to increase regional sales from 20% to 30% by 2025, strengthen farmer relationships, and leverage local grain production and strategic logistics for competitive market positioning.

United States Fertilizer Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Chemical Fertilizer, Biofertilizers |

| Products Covered |

|

| Product Forms Covered | Dry, Liquid |

| Crop Types Covered | Grains and Cereals, Pulses and Oilseeds, Fruits and Vegetables, Flowers and Ornamentals, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Companies Covered | CF Industries Holdings, Inc., Haifa Group, ICL Group Ltd, Koch Industries Inc., Nutrien Ltd., Sociedad Quimica y Minera de Chile SA, The Andersons Inc., The Mosaic Company, Wilbur-Ellis Company LLC, and Yara International ASA |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The United States fertilizer market size was valued at USD 49.46 Billion in 2025.

The United States fertilizer market is expected to grow at a compound annual growth rate of 6.20% from 2026-2034 to reach USD 85.00 Billion by 2034.

Chemical fertilizer held the largest United States fertilizer market share, driven by proven effectiveness in rapidly delivering essential nutrients to crops, widespread availability across agricultural supply chains, compatibility with existing farming equipment, and cost-effectiveness for large-scale commercial farming operations.

Key factors driving the United States fertilizer market include expanding agricultural production requirements, advancement of precision agriculture technologies, government support for domestic agricultural development, and increasing adoption of sustainable farming practices.

Major challenges include volatility in raw material pricing affecting production costs, stringent environmental regulations constraining application practices, expansion of organic farming reducing synthetic fertilizer demand, and supply chain disruptions impacting product availability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)