U.S. Feminine Hygiene Products Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

U.S. Feminine Hygiene Products Market Size and Share:

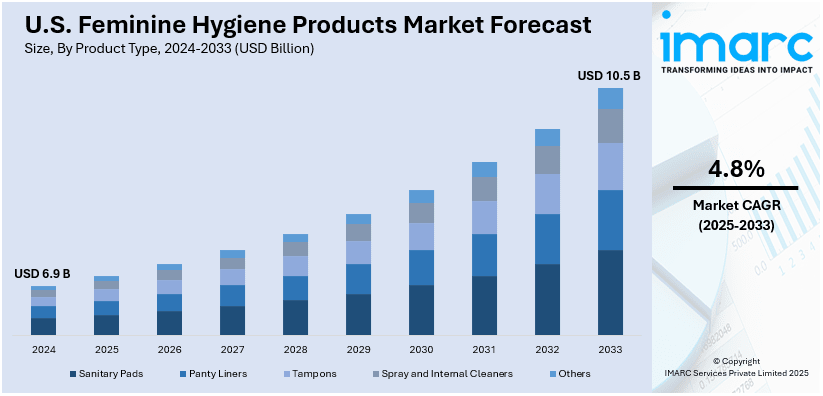

The U.S. feminine hygiene products market size was valued at USD 6.9 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 10.5 Billion by 2033, exhibiting a CAGR of 4.8% from 2025-2033. The market is driven by the growing demand for safe and comfortable hygiene products among women, heightened availability of various women’s hygiene products in pharmacies, and increasing focus on creating innovative items, such as organic tampons, and reusable menstrual cups.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.9 Billion |

| Market Forecast in 2033 | USD 10.5 Billion |

| Market Growth Rate (2025-2033) | 4.8% |

As more women are entering the workforce there is a rise in the demand for convenient sanitary products that align with their busy lifestyle. This increases the need for solutions that provide comfort, discretion, and ease of use during long work hours. Because of their convenience and portability menstrual pads, tampons, and panty liners are preferred by women. The rising trend of compact and travel-friendly packing is encouraging brands to innovate products that fits the needs of working women. Additionally, there is an increase in the adoption of sustainable options like menstrual cups, which offer long-lasting use and cost-effectiveness. Also, workplace wellness programs are normalizing discussions about menstrual health, reducing stigma, and promoting access to quality products.

Rising hygiene awareness among women is prioritizing the use of menstrual health and personal care products. Widespread discussions about menstruation are breaking societal taboos and emphasizing the importance of safe and hygienic practices. Increased public health campaigns and educational initiatives are also encouraging the adoption of feminine hygiene products. Thus, allowing women to gain access to accurate information, which directly influences the sales of hygiene products. This is creating an increased need for the innovative organic cotton tampons, menstrual cups, and biodegradable pads. Health-conscious users are aware about potential health risks of synthetic chemicals, leading to a preference for eco-friendly and natural alternatives.

U.S. Feminine Hygiene Products Market Trends:

Increase in product innovation

Ongoing product innovations are driving the market for feminine hygiene products. Brands are creating innovative items, such as organic tampons, reusable menstrual cups, and biodegradable pads to address environmental issues. These advancements not only tackle environmental concerns but also attract users looking for chemical-free and skin-safe items. For instance, in May 2024, researchers from Purdue University developed biodegradable superabsorbent materials from hemp, providing a sustainable alternative to petroleum-based products. These materials are designed for hygienic applications and offer increased absorption and significantly reduce environmental impact. Technological advancements also elevate the performance of feminine hygiene products through features like slender design, absorbency, and leak prevention. They provide greater convenience with their smart packaging and compact designs, making them suitable for people with busy lifestyle. Other innovations include odor-neutralizing materials and hypoallergenic components, which gives better hygiene and comfort. The market is further revolutionized by the advent of subscription models that can provide a wide variety of customized products.

Expansion of pharmacy stores

The expansion of pharmacy stores is influencing the accessibility of feminine hygiene products in the U.S. Widespread distribution of pharma stores across urban and rural areas makes them a reliable source for buying feminine hygiene products. Their long operating hours and strategic locations also add to accessibility so that women can purchase products whenever required. They offer diversified feminine hygiene products, from conventional options like sanitary napkins and tampons to eco-friendly and reusable alternatives. Pharmacists often provide guidance on product selection, helping women make informed decisions about their menstrual health. The integration of in-store and online services, such as click-and-collect options, further elevates the shopping experience. In October 2024, Amazon Pharmacy announced its plan to expand its same-day prescription delivery service to 20 more U.S. metro areas by 2025. This will facilitate quick and reliable access to essential medications and feminine hygiene products.

Rising use of sanitary napkins

The increasing adoption of sanitary napkins is a key element propelling the U.S. feminine hygiene products market. Growing awareness among women regarding menstrual hygiene and the expanding range of innovative product choices is driving the demand. Sanitary napkins are commonly viewed as one of the most practical and easily available menstrual hygiene options, attracting women from various demographics. Their simplicity and single-use aspect render them a popular option, particularly for beginners and young users. Improvements in product design and technology are enhancing the attractiveness of sanitary napkins. Thus, addressing the demands of contemporary users who desire both comfort and efficiency. Moreover, international organizations and governing agencies are advocating for menstrual health education and the provision of cost-effective choices. So, that a greater number of women can get access to sanitary napkins. For example, in May 2024, United Nations Women in its news story addressed that in the United States, 1 in 4 teenagers and 1 in 3 adults find it challenging to purchase period products, particularly teenagers and people of color from low-income families. UN Women suggested lowering taxes on menstrual products to enhance their affordability and accessibility. They also highlighted the importance of enhancing product distribution, particularly in neglected regions, and informing communities to eradicate stigma associated with menstruation.

U.S. Feminine Hygiene Products Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the U.S. feminine hygiene products market, along with forecast at the country and regional levels from 2025-2033. The market has been categorized based on product type, and distribution channel.

Analysis by Product Type:

- Sanitary Pads

- Panty Liners

- Tampons

- Spray and Internal Cleaners

- Others

Sanitary pads hold considerable United States hygiene products market share due to their high absorbency and suitability for different flow. They are available in various sizes and materials, catering to diverse needs. Their accessibility in both urban and rural areas further drive the demand.

Panty liners offer a comfortable solution for maintaining hygiene. They are popular for daily use or during lighter period flow. Growing awareness about vaginal health and the availability of ultra-thin and breathable options is influencing their adoption.

Tampons are popular among women with active lifestyles or those involved in sports. Their compact size and advanced designs, meet the evolving preferences for both comfort and sustainability.

Spray and internal cleaners are specialized solutions for odor control and cleanliness. The availability of gentle, pH-balanced formulations is catalyzing the demand for feminine hygiene products.

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Beauty Stores and Pharmacies

- Online Stores

- Others

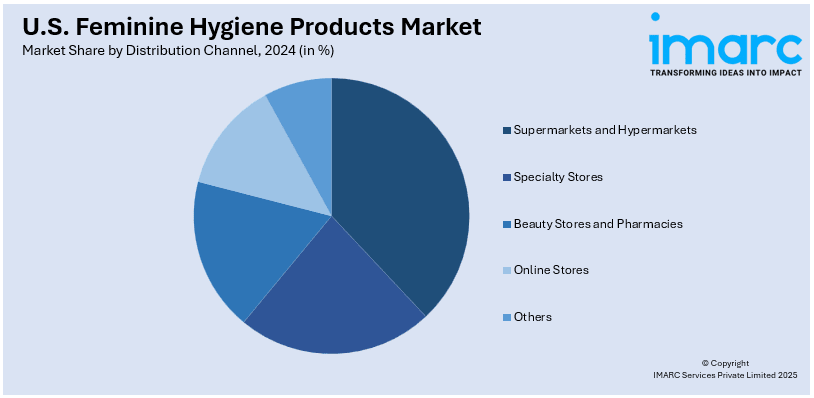

Due to their ability to offer a diverse range of feminine hygiene products, supermarkets and hypermarkets are one of the leading segments of the feminine hygiene industry. Women prefer these stores for their widespread presence and competitive pricing. They offer multiple brands under one roof, providing convenience to buyers.

Specialty stores ease access to eco-friendly and premium feminine hygiene products, catering to the demand for sustainable products. They attract niche customers, seeking customized solutions and products, thereby building customer trust and loyalty.

Beauty stores and pharmacies appeal to buyers searching for intimate hygiene solutions alongside skincare and wellness products. Pharmacies include pharmacist recommendations, which build credibility. On the other hand, beauty stores focus on premium and innovative options, catering to health-conscious and luxury-oriented shoppers.

Online platforms are growing rapidly due to their convenience and access to a wider product range. Features like subscription services and competitive pricing further fuels their popularity among younger, tech-savvy buyers.

Regional Analysis:

- Northeast

- Midwest

- South

- West

With its densely populated urban areas, the Northeast region shows strong demand for feminine hygiene products. Access to premium and organic options is prevalent due to the presence of specialty and high-end retail stores.

In the Midwest, growing demand from both urban and rural areas influence the market dynamics. While the rural regions are majorly dependent on cost-effective and traditional products, urban centers are adopting premium options. Awareness campaigns and government programs also enhance demand in underserved areas.

The South constitutes a vast and diverse market, comprising a significant share. Growing awareness about menstrual health among women is leading to higher demand for effective feminine hygiene solutions. Expansion of retail networks, including supermarkets and pharmacies, facilitate accessibility in this region.

The West has the highest adoption rate of innovative and sustainable feminine hygiene products. High environmental consciousness in states like California drives the demand for organic and biodegradable options. The region’s tech-savvy population also influences the online sales and subscription services.

Competitive Landscape:

Key players in the market are innovative high-quality products to meet diverse customer needs. They are investing heavily to create organic and sustainable options, catering to the growing demand for environmentally conscious products. For instance, in November 2024, The Honey Pot launched its Witch Hazel Intimate Wash & Wipes to offer gentle care. These products are designed for intimate hygiene, aiming to soothe and cleanse sensitive areas. They contain natural ingredients like witch hazel for comfort and pH balance. Leading companies are also involved in awareness campaigns, creating a healthy environment to normalize menstrual health. For easy accessibility of their products, leading brands are utilizing extensive distribution networks like supermarkets and specialty stores. Strategic partnerships and celebrity endorsements, along with social media campaigns also drive brand visibility and customer trust. Major contributors run campaigns and loyalty programs to retain existing customers and attract new customers.

The report provides a comprehensive analysis of the competitive landscape in the U.S. feminine hygiene products market with detailed profiles of all major companies.

Latest News and Developments:

- July 2024: Virginia Tech researchers developed an eco-friendly menstrual pad that turns blood into gel for better absorption. The innovative product improves hygiene and reduces mess, as well as lowers the risk of toxic shock syndrome.

- April 2024: Pinkie Pads launched a new tween-focused line in Walmart stores to cater to younger girls. The product line aimed to provide comfortable and discreet feminine hygiene solutions to teenage users.

U.S. Feminine Hygiene Products Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Sanitary Pads, Panty Liners, Tampons, Spray and Internal Cleaners, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Beauty Stores and Pharmacies, Online Stores, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the U.S. feminine hygiene products market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the U.S. feminine hygiene products market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the U.S. feminine hygiene products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Feminine hygiene products are items designed to maintain cleanliness and hygiene during menstruation and for personal care. These consist of sanitary pads and tampons, along with menstrual cups and intimate cleansers. They are utilized for regulating menstrual flow and mitigate odor, alongside providing comfort.

The U.S. feminine hygiene products market was valued at USD 6.9 Billion in 2024.

IMARC estimates the U.S. feminine hygiene products market to exhibit a CAGR of 4.8% during 2025-2033.

Growing awareness about menstrual health is expanding the United States feminine hygiene products market size. The increasing demand for sustainable and organic items, along with advancements in product design, is also driving market expansion. In addition to this, the accessibility of products via various channels and endorsements from celebrities also catalyzes the demand.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)