United States Feed Additives Market Size, Share, Trends and Forecast by Source, Product Type, Livestock, Form, and Region, 2026-2034

United States Feed Additives Market Summary:

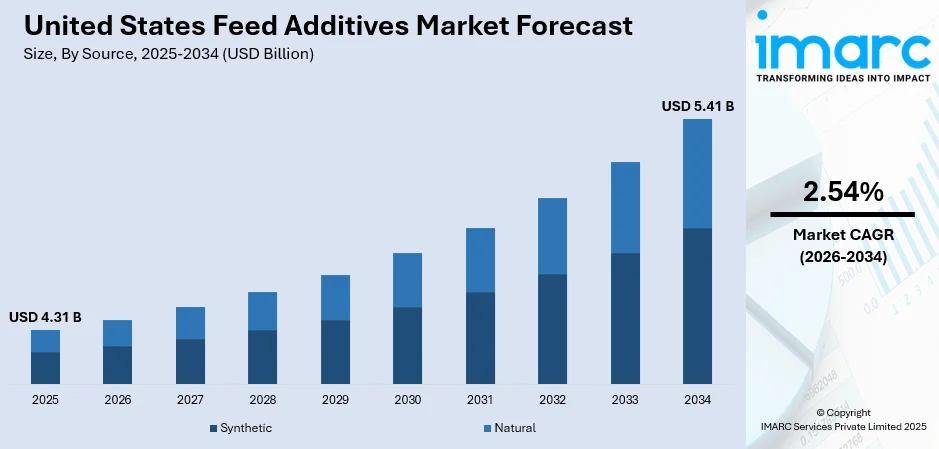

The United States feed additives market size was valued at USD 4.31 Billion in 2025 and is projected to reach USD 5.41 Billion by 2034, growing at a compound annual growth rate of 2.54% from 2026-2034.

The United States feed additives market is experiencing steady expansion, driven by the growing demand for high-quality animal protein products and increasing focus on livestock health optimization. The market benefits from a well-established livestock production infrastructure, particularly in the poultry, swine, and cattle sectors. Rising consumer awareness regarding food safety and quality standards continues to propel the adoption of advanced feed additive solutions across commercial farming operations nationwide.

Key Takeaways and Insights:

-

By Source: Synthetic dominates the market with a share of 73.92% in 2025, owing to its cost-effective manufacturing processes, consistent quality standards, and superior bioavailability characteristics that enhance nutrient absorption in livestock.

-

By Product Type: Amino acids lead the market with a share of 16.84% in 2025. This dominance is driven by their essential role in protein synthesis, muscle development, and overall metabolic functions critical for optimal animal growth and productivity.

-

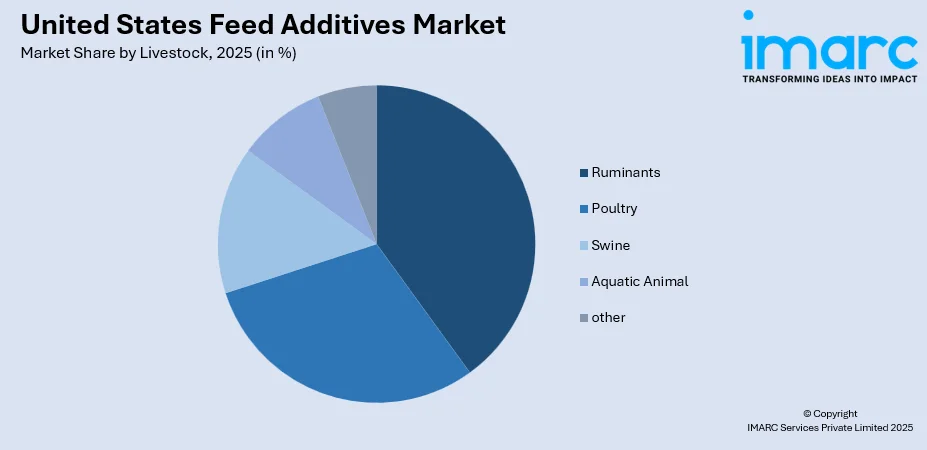

By Livestock: Poultry comprises the largest segment with 36.93% share in 2025, driven by the extensive commercial poultry farming operations, rising consumption of chicken meat, and increasing adoption of specialized feed additives for broiler optimization.

-

By Form: Dry exhibits a clear dominance in the market with 67.95% share in 2025, reflecting strong preference for powdered and granular formulations that offer superior storage stability, extended shelf life, and seamless integration with existing feed processing infrastructure.

-

Key Players: Key players are fueling the market growth by expanding product portfolios, investing in research and development (R&D) for innovative formulations, and strengthening distribution networks. Their strategic partnerships with livestock producers boost adoption rates and ensure consistent product availability across diverse agricultural segments.

To get more information on this market Request Sample

The United States feed additives market continues to evolve, as livestock producers seek innovative solutions to enhance animal health, optimize feed conversion ratios, and meet stringent food safety requirements. As per USDA, total poultry industry sales reached USD 70.2 Billion, an increase from USD 67.4 Billion in 2023, underscoring the substantial demand for specialized nutritional supplements. Market participants are increasingly focusing on antibiotic-free alternatives, precision nutrition technologies, and sustainable feed solutions to address evolving regulatory requirements and consumer preferences. The integration of digital monitoring systems and advanced formulation technologies enables producers to deliver targeted nutritional interventions that maximize livestock productivity while minimizing environmental impact. With a strong emphasis on productivity, quality output, and sustainable farming practices, the market is expected to witness stable growth and long-term investment opportunities.

United States Feed Additives Market Trends:

Integration of Precision Nutrition Technologies

Advanced digital technologies are transforming feed additive formulation and delivery systems across the United States livestock sector. Precision nutrition platforms leverage real-time farm data, sensor technologies, and artificial intelligence (AI) to optimize additive dosing based on specific animal requirements and environmental conditions. As per IMARC Group, the United States AI market size reached USD 41,532.7 Million in 2025. These innovations enable producers to maximize nutrient utilization, reduce waste, and achieve superior feed conversion ratios while maintaining consistent product quality across diverse farming operations.

Rising demand for animal protein products

Growing consumption of meat, dairy, and eggs in the United States is a major factor driving the feed additives market. According to the annual report released by the Meat Institute and The Food Industry Association (FMI), in 2024, Americans purchased meat an average of 54 times, over once weekly, signifying a 4% rise from 2023. As consumer preferences are shifting towards protein-rich diets, livestock producers are under pressure to increase output while maintaining quality. Feed additives help improve animal growth rates, nutrient absorption, and overall productivity, enabling farmers to meet rising demand efficiently. Poultry, swine, and cattle producers increasingly rely on additives to support faster weight gain and better feed conversion. This consistent demand for animal-based food products directly supports the long-term growth of the feed additives market.

Expansion of commercial and intensive livestock farming

The expansion of large-scale and intensive livestock operations is another important driver of the United States feed additives market. Commercial farming systems require consistent animal performance, predictable growth cycles, and standardized nutrition programs. Feed additives help maintain uniform quality across large herds and flocks while supporting high productivity levels. As farms scale up, manual feeding adjustments become impractical, increasing reliance on scientifically formulated feed solutions. This structural shift towards organized, technology-driven livestock production continues to strengthen demand for advanced feed additives across multiple animal categories.

Market Outlook 2026-2034:

The United States feed additives market is positioned for sustained growth throughout the forecast period, supported by expanding livestock production, technological advancements, and evolving regulatory frameworks. The market generated a revenue of USD 4.31 Billion in 2025 and is projected to reach a revenue of USD 5.41 Billion by 2034, growing at a compound annual growth rate of 2.54% from 2026-2034. Rising demand for premium animal protein products and increasing investments in livestock health optimization will continue driving market expansion. Natural, functional, and performance-enhancing additives are gaining attention as producers look for safer and more effective feeding solutions.

United States Feed Additives Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Source |

Synthetic |

73.92% |

|

Product Type |

Amino Acids |

16.84% |

|

Livestock |

Poultry |

36.93% |

|

Form |

Dry |

67.95% |

Source Insights:

- Synthetic

- Natural

Synthetic dominates with a market share of 73.92% of the total United States feed additives in 2025.

Synthetic feed additives lead the market due to their consistent quality, precise nutrient composition, and reliable performance across large-scale livestock operations. Commercial farms prefer synthetic additives because they offer predictable results in terms of growth promotion, feed efficiency, and disease prevention. These additives are produced under controlled conditions, ensuring uniform potency and longer shelf life compared to natural alternatives. Their cost-effectiveness at scale makes them suitable for intensive poultry, swine, and cattle production systems that demand standardized nutrition and stable output levels.

Another key reason for the dominance of synthetic feed additives is their compatibility with modern feed formulations and automated manufacturing processes. Synthetic additives blend easily with compound feed, premixes, and concentrates, enabling accurate dosage control. They also support targeted nutritional interventions for specific growth stages and production goals. Strong availability, well-established supply chains, and familiarity among feed manufacturers further reinforce their widespread adoption across the United States livestock and animal nutrition industry.

Product Type Insights:

- Amino Acids

- Lysine

- Methionine

- Threonine

- Tryptophan

- Phosphates

- Monocalcium Phosphate

- Dicalcium Phosphate

- Mono-Dicalcium Phosphate

- Defulorinated Phosphate

- Tricalcium Phosphate

- Others

- Vitamins

- Fat-Soluble

- Water-Soluble

- Acidifiers

- Propionic Acid

- Formic Acid

- Citric Acid

- Lactic Acid

- Sorbic Acid

- Malic Acid

- Acetic Acid

- Others

- Carotenoids

- Astaxanthin

- Canthaxanthin

- Lutein

- Beta-Carotene

- Enzymes

- Phytase

- Protease

- Others

- Mycotoxin Detoxifiers

- Binders

- Modifiers

- Flavors and Sweeteners

- Flavors

- Sweeteners

- Antibiotics

- Tetracycline

- Penicillin

- Others

- Minerals

- Potassium

- Calcium

- Phosphorus

- Magnesium

- Sodium

- Iron

- Zinc

- Copper

- Manganese

- Others

- Antioxidants

- BHA

- BHT

- Ethoxyquin

- Others

- Non-Protein Nitrogen

- Urea

- Ammonia

- Others

- Preservatives

- Mold Inhibitors

- Anticaking Agents

- Phytogenics

- Essential Oils

- Herbs and Spices

- Oleoresin

- Others

- Probiotics

- Lactobacilli

- Stretococcus Thermophilus

- Bifidobacteria

- Yeast

Amino acids lead with a share of 16.84% of the total United States feed additives market in 2025.

Amino acids are essential for optimizing animal growth, improving protein utilization, and enhancing feed efficiency. Livestock such as poultry, swine, and cattle require precise amino acid profiles for muscle development, immunity, and overall health. Supplementing feed with synthetic or crystalline amino acids allows farmers to meet these nutritional requirements without overfeeding protein, reducing costs and minimizing nitrogen excretion. Their role in improving growth rates and feed conversion ratios makes amino acids a critical component of modern livestock nutrition programs.

Additionally, amino acids support sustainable and cost-effective livestock production, which is increasingly important in the United States. They allow producers to formulate low-protein diets without compromising animal performance, lowering environmental impact by reducing ammonia emissions from manure. Their versatility across species and compatibility with compound feeds further enhance their adoption. As awareness about precision nutrition grows, amino acids remain a preferred choice for producers aiming to maximize productivity, efficiency, and profitability in large-scale, intensive farming operations.

Livestock Insights:

Access the comprehensive market breakdown Request Sample

- Ruminants

- Calves

- Dairy Cattle

- Beef Cattle

- Others

- Poultry

- Broilers

- Layers

- Breeders

- Swine

- Starters

- Growers

- Sows

- Aquatic Animal

- Others

Poultry represents the leading segment with a 36.93% share of the total United States feed additives market in 2025.

Poultry leads the United States feed additives market due to the sector’s high production volume and consistent demand for meat and eggs. As per the Organic Trade Association (OTA), in the United States, sales of organic dairy and eggs increased remarkably by 7.7% to reach USD 8.5 Billion in 2024. Poultry producers rely heavily on feed additives, such as amino acids, vitamins, minerals, and enzymes, to ensure optimal growth, improve feed conversion ratios, and enhance immunity. Intensive poultry farming systems require precise nutrition to maintain uniform flock performance, reduce disease risks, and achieve faster weight gain. The rapid turnover and short production cycles of poultry make feed additives essential for sustaining profitability and meeting growing consumer demand efficiently.

Moreover, the poultry segment’s focus on antibiotic-free and sustainable production practices further drives feed additive adoption. Producers use functional additives like probiotics, organic acids, and performance enhancers to support gut health and prevent infections without antibiotics. The sector’s organized, large-scale operations allow for easy integration of feed additives into compound feed and premixes. Combined with rising domestic and export demand for high-quality poultry products, these factors solidify poultry as the leading segment in the United States feed additives market.

Form Insights:

- Dry

- Liquid

Dry exhibits a clear dominance with a 67.95% share of the total United States feed additives market in 2025.

Dry feed additives maintain commanding market position owing to their superior storage stability, extended shelf life, and compatibility with conventional feed processing equipment prevalent across United States livestock operations. Powdered and granular formulations offer ease of handling, precise dosing capabilities, and seamless integration with existing mixing and pelleting infrastructure utilized by commercial feed manufacturers nationwide.

The preference for dry formulations reflects practical considerations, including reduced transportation costs, simplified inventory management, and lower contamination risks compared to liquid alternatives. Large-scale poultry and dairy farms particularly favor dry additives for their consistent dispersion characteristics and reliable performance under variable environmental conditions. Advancements in encapsulation and granulation technologies continue to enhance the stability and delivery efficiency of dry feed additive formulations.

Regional Insights:

- Northeast

- Midwest

- South

- West

The Northeast region maintains moderate feed additive consumption, driven primarily by dairy operations and specialty livestock production. The region demonstrates increasing adoption of premium and organic feed additive solutions aligned with consumer preferences for sustainably produced animal products.

The Midwest region represents a significant concentration of feed additive consumption supported by extensive corn and soybean production that provides foundational feedstock for livestock operations. States, including Iowa, Nebraska, and Illinois, host major feed manufacturing facilities serving diverse livestock sectors.

The South region demonstrates substantial demand for poultry-specific feed additives, driven by concentrated broiler production operations in Georgia, Alabama, and Arkansas. This region holds a substantial share of the national poultry output requiring specialized nutritional formulations. Rising focus on enhanced feed efficiency and disease prevention is further boosting additive adoption in this region.

The West region exhibits growing demand for cattle and dairy feed additives supported by extensive ranching operations in Texas, California, and Colorado. Dairy-specific formulations and ruminant nutrition solutions represent key growth areas within this geographic segment. Increasing investments in large-scale dairy farms are driving consistent demand for advanced feed additives.

Market Dynamics:

Growth Drivers:

Why is the United States Feed Additives Market Growing?

Focus on animal health and disease prevention

Ensuring animal health and preventing disease outbreaks is a key driver of the feed additives market in the United States. As of November 20, 2024, 616 dairy farms across the United States were confirmed positive for the bird flu virus since the initial case reported on March 25, 2024. Intensive livestock and poultry production systems increase the risk of infections, gut disorders, and stress-related conditions, which can reduce growth rates and profitability. Feed additives, such as probiotics, prebiotics, organic acids, and vitamins, help maintain gut health, improve immunity, and reduce susceptibility to diseases. By providing a preventive nutritional approach, these additives minimize the need for antibiotics, aligning with growing regulatory restrictions and consumer demand for antibiotic-free meat and dairy. Healthier animals require fewer medical interventions, experience lower mortality rates, and exhibit better feed conversion ratios, directly contributing to farm efficiency and profitability. The increasing adoption of preventive nutrition strategies and awareness about the economic benefits of disease-free livestock further fuels the demand for specialized feed additives in the United States market.

Technological Advancements in Feed Formulation

Technological advancements are playing a crucial role in driving the United States feed additives market by enabling more precise, efficient, and targeted nutrition solutions for livestock, poultry, and aquaculture. Modern feed formulation software, digital monitoring systems, and automated feed processing equipment allow producers to optimize additive inclusion rates, balance nutrient profiles, and tailor diets to specific growth stages and production goals. Innovations in biotechnology have led to the development of high-performance enzymes, probiotics, amino acids, and other functional additives that improve feed digestibility, boost immunity, and enhance overall animal productivity. Additionally, advancements in analytical techniques and real-time monitoring enable farmers to track animal health, feed intake, and growth metrics, ensuring optimal additive efficacy and minimizing wastage. The integration of technology into feed additive development and application not only improves farm profitability but also supports sustainable and antibiotic-free livestock production, making innovation a key driver of market growth in the United States.

Regulatory Restrictions on Antibiotic Growth Promoters

Regulatory initiatives limiting antibiotic usage in animal feed are accelerating adoption of alternative feed additives throughout the United States livestock sector. In March 2024, the FDA fiscal year 2025 budget proposed a substantial investment totaling USD 7.2 Billion, including USD 15 Million dedicated to ensuring safe and nutritious food supply. These regulatory frameworks are encouraging producers to transition towards antibiotic-free production systems where innovative feed additives serve as essential tools for maintaining animal health and productivity. Feed additives, such as probiotics, prebiotics, enzymes, organic acids, and phytogenic compounds, enhance gut health, improve nutrient absorption, and support immunity without relying on antibiotics. These alternatives help maintain optimal growth rates, feed efficiency, and overall livestock performance while complying with regulatory standards. As a result, manufacturers are investing in R&D activities to create innovative, antibiotic-free feed solutions, making regulatory pressure a key factor driving market expansion.

Market Restraints:

What Challenges the United States Feed Additives Market is Facing?

Import Dependency on Key Raw Materials

Import dependency on key raw materials increases cost volatility and supply uncertainty in the United States feed additives market. Fluctuating exchange rates, trade restrictions, and logistics disruptions raise production costs for manufacturers. These challenges limit pricing flexibility, affect profit margins, and slow capacity expansion, ultimately constraining market growth and long-term investment confidence.

Raw Material Price Volatility

Fluctuations in raw material prices represent ongoing challenges for feed additive manufacturers and end-users throughout the United States market. Commodity price variations, energy costs, and supply chain disruptions create uncertainty in production planning and pricing strategies. These economic factors influence purchasing decisions and market adoption patterns across livestock sectors.

Limited awareness among small-scale farmers

Many small-scale livestock and poultry producers in the United States lack awareness about the benefits of feed additives, restricting market penetration. These farmers may rely on traditional feeding practices and perceive additives as unnecessary or expensive. Limited knowledge about proper dosage, nutritional advantages, and economic returns can reduce adoption rates. Without adequate education and support from feed additive suppliers, smallholders may underutilize or misuse products, impacting effectiveness. Overcoming awareness gaps and providing training is essential to expand market reach, but it remains a persistent challenge for the industry.

Competitive Landscape:

The United States feed additives market demonstrates a moderately consolidated competitive structure, characterized by the presence of established multinational corporations and specialized regional players. Major market participants leverage extensive R&D capabilities, global supply chain networks, and comprehensive product portfolios to maintain competitive positioning. Companies are increasingly focusing on strategic acquisitions, partnership agreements, and technological innovation to expand market presence and address evolving customer requirements. The competitive landscape emphasizes sustainable product development, precision nutrition solutions, and customer-centric service models that support livestock producers in achieving optimal production outcomes.

United States Feed Additives Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Sources Covered | Synthetic, Natural |

| Product Types Covered |

|

| Livestocks Covered |

|

| Forms Covered | Dry, Liquid |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The United States feed additives market size was valued at USD 4.31 Billion in 2025.

The United States feed additives market is expected to grow at a compound annual growth rate of 2.54% from 2026-2034 to reach USD 5.41 Billion by 2034.

Synthetic dominated the market with a share of 73.92%, owing to cost-effective manufacturing, consistent quality standards, and superior bioavailability characteristics.

Key factors driving the United States feed additives market include rising demand for high-quality animal protein, focus on livestock health and productivity, growing adoption of nutritionally balanced feed, need for disease prevention, and increasing emphasis on food safety and sustainable animal farming practices.

Major challenges include volatile raw material prices, stringent regulatory approvals, rising production costs, concerns over additive safety, limited awareness among small farmers, and pressure to reduce antibiotic usage while maintaining animal health and feed performance.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)