United States Extended Warranty Market Size, Share, Trends and Forecast by Coverage, Application, Distribution Channel, End User, and Region, 2026-2034

United States Extended Warranty Market Summary:

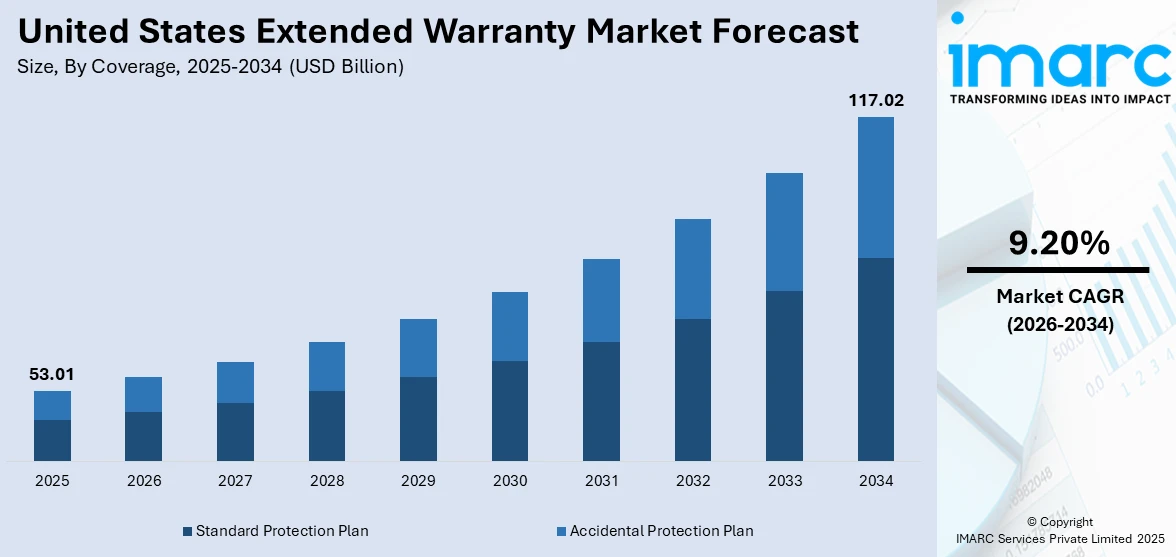

The United States extended warranty market size was valued at USD 53.01 Billion in 2025 and is projected to reach USD 117.02 Billion by 2034, growing at a compound annual growth rate of 9.20% from 2026-2034.

The United States extended warranty market is experiencing robust expansion driven by growing consumer awareness about protection plans that extend product lifespan and mitigate unexpected repair costs. The market benefits from increasing product sophistication across automobiles, electronics, and home appliances, which has made extended warranties more attractive to consumers seeking financial protection. Additionally, the expansion of e-commerce and digital sales channels has enhanced customer access and visibility, while retailers and third-party administrators continue to expand their protection plan portfolios.

Key Takeaways and Insights:

- By Coverage: Standard protection plan dominates the market with a share of 62% in 2025, driven by its affordability, transparent terms, and straightforward claims procedures that appeal to price-conscious consumers seeking reliable product protection.

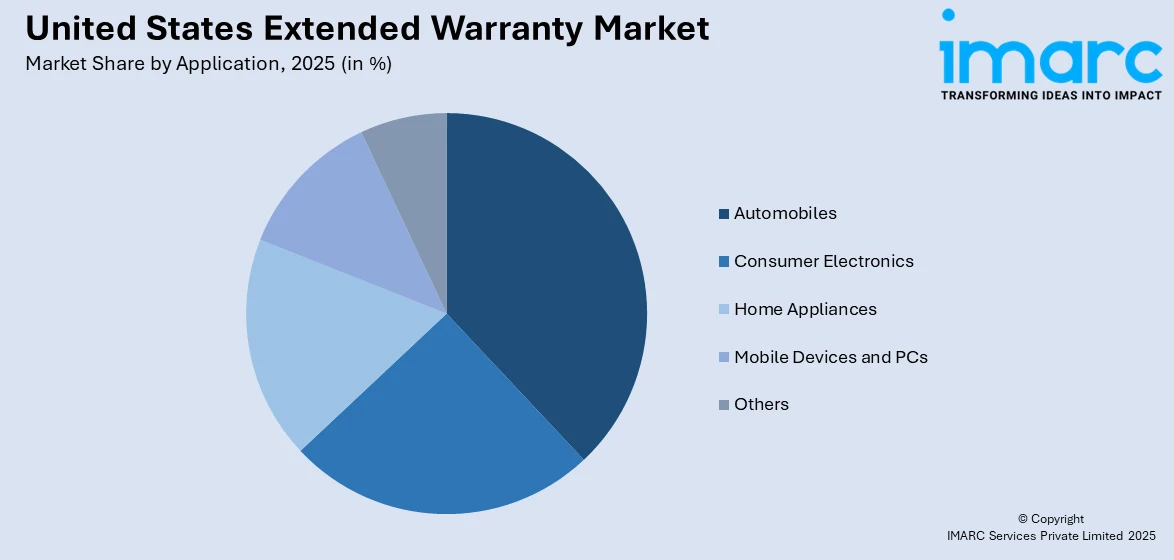

- By Application: Automobiles lead the market with a share of 30% in 2025, owing to high vehicle values, complex electronic systems, frequent mechanical failures, and strong dealer incentives that drive consumer adoption of extended auto warranties.

- By Distribution Channel: Retailers represent the largest segment with a market share of 45% in 2025, attributed to point-of-sale opportunities, consumer convenience, and the ability to bundle warranty offerings with product purchases across electronics and appliances.

- By End User: Individuals dominate with a market share of 69% in 2025, reflecting the strong consumer demand for personal protection plans covering high-value electronics, vehicles, and home appliances against unexpected repair expenses.

- Key Players: The United States extended warranty market features a competitive landscape characterized by the presence of several established and emerging players. Market participants compete by emphasizing product innovation, digital transformation, customer experience enhancement, and strategic partnerships to strengthen their market positioning and expand service offerings across multiple end-use segments.

To get more information on this market Request Sample

The United States extended warranty market is witnessing transformative growth as consumers increasingly recognize the value of protection plans in safeguarding their investments in high-value products. For instance, in June 2025, Victor Insurance unveiled a new global extended warranty offering to underwrite solutions for OEMs and insurers across vehicles and other durable goods, reflecting how major insurance players are expanding warranty services amid rising demand for reliable coverage. Rising repair costs across automotive, electronics, and appliance sectors have heightened consumer interest in extended coverage options that provide financial security against unexpected breakdowns. The market is further bolstered by technological advancements enabling streamlined claims processing, personalized warranty offerings based on usage patterns, and the integration of artificial intelligence for predictive maintenance and fraud detection. Manufacturers and retailers are increasingly integrating extended warranty packages as part of their value-added service portfolios to drive revenue and improve customer retention.

United States Extended Warranty Market Trends:

Digital Transformation and AI Integration in Warranty Services

The United States extended warranty market is experiencing significant digital transformation as providers leverage artificial intelligence and machine learning to enhance service delivery and operational efficiency. For example, in November 2025, Circuitry.ai and Service Xcelerator announced a strategic partnership to deploy AI-driven solutions that transform warranty, service, and claims operations for manufacturers and third-party administrators, enabling predictive repair insights and faster, more accurate claim handling, which clearly indicates how AI is being embedded into core warranty workflows. AI-driven systems enable predictive claim detection, dynamic pricing based on individual behavior and product usage, and personalized plan recommendations that improve customer experience. Digital platforms are streamlining backend processes including contract generation, claims processing, and fraud detection through pattern analysis, while mobile applications provide consumers with convenient access to warranty management and claims filing capabilities.

Rise of Subscription-Based and Flexible Warranty Models

The extended warranty industry is witnessing a notable shift toward subscription-based models and on-demand coverage options that provide consumers with greater flexibility in protecting their purchases. For example, in 2025, subscription-based extended car warranties emerged as a leading format in the U.S. market, with companies like Olive and Endurance offering flexible monthly plans that can be canceled at any time and tailored to individual needs, signaling that pay-as-you-go protection is becoming more mainstream. Pay-per-use warranty plans allow customers to activate coverage only when needed, reducing overall costs while maintaining protection availability. Monthly subscription services bundling multiple product warranties into single comprehensive packages are gaining popularity among consumers seeking simplified management of their protection plans. This trend reflects broader consumer preferences for flexible, commitment-free service arrangements across various industries.

Expansion of E-Commerce and Online Warranty Distribution

Online distribution channels are experiencing rapid growth in the extended warranty market as digital commerce continues to reshape consumer purchasing behaviors. This shift is supported by the rapid expansion of the U.S. e-commerce sector, which reached USD 1,236.5 billion in 2025 and is projected to grow to USD 2,160.3 billion by 2034, reflecting the increasing reliance on online purchasing across product categories. E-commerce platforms offer embedded checkout warranty options that seamlessly integrate protection plan purchases into the product buying journey, improving attachment rates and customer convenience. Online warranty marketplaces enable price comparison and plan customization, empowering consumers to make informed decisions about coverage options. The digital channel expansion is particularly significant for reaching younger demographics who prefer online transactions and expect seamless digital experiences.

Market Outlook 2026-2034:

The United States extended warranty market demonstrates exceptional growth potential throughout the forecast period, supported by escalating product complexity, rising repair costs, and increasing consumer awareness of protection plan benefits. The automotive segment will continue driving significant market expansion as vehicles incorporate more advanced technology systems requiring comprehensive coverage, while consumer electronics warranties are expected to grow rapidly alongside increasing device sophistication and premium product penetration. Telematics-based warranty models in the automotive sector will enable personalized pricing and enhanced customer engagement, while blockchain technology adoption promises improved transparency in warranty claims processing. The market generated a revenue of USD 53.01 Billion in 2025 and is projected to reach a revenue of USD 117.02 Billion by 2034, growing at a compound annual growth rate of 9.20% from 2026-2034.

United States Extended Warranty Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Coverage |

Standard Protection Plan |

62% |

|

Application |

Automobiles |

30% |

|

Distribution Channel |

Retailers |

45% |

|

End User |

Individuals |

69% |

Coverage Insights:

- Standard Protection Plan

- Accidental Protection Plan

The standard protection plan dominates with a market share of 62% of the total United States extended warranty market in 2025.

Standard protection plans have established themselves as the leading coverage type in the American market, primarily addressing mechanical and electrical breakdowns after manufacturer warranties expire. These plans provide essential reassurance for consumers purchasing appliances, electronics, and vehicles, offering predictable coverage terms and straightforward claims procedures that appeal to budget-conscious buyers. The accessibility and clear value proposition of standard protection plans make them the foundation upon which extended warranty providers build their product portfolios.

The widespread preference for standard protection plans reflects consumer demand for reliable, no-frills coverage that addresses the most common product failures without unnecessary complexity. These plans create a benchmark for the broader warranty market, enabling providers to develop tiered programs that add specialized coverage options atop the basic protection framework. The segment benefits from strong point-of-sale attachment rates as retailers and manufacturers position standard plans as essential complements to product purchases.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Automobiles

- Consumer Electronics

- Home Appliances

- Mobile Devices and PCs

- Others

The automobiles leads with a share of 30% of the total United States extended warranty market in 2025.

The automobile segment commands the largest application share in the extended warranty market, driven by the high value of vehicles and the substantial costs associated with modern automotive repairs. Reflecting this trend, in October 2025, Ford announced it will extend warranty coverage on nearly 1.45 million U.S. vehicles after a recall due to faulty rear-view cameras, underscoring how manufacturers are using extended coverage to support owners and manage repair liabilities. Extended auto warranties provide crucial protection against mechanical failures, powertrain malfunctions, and electronic system breakdowns that can result in expensive out-of-pocket expenses for vehicle owners. The increasing complexity of modern vehicles, featuring advanced technology integration and sophisticated electronic components, has heightened consumer interest in comprehensive warranty coverage.

The automotive warranty segment benefits from strong dealer incentives and manufacturer partnerships that promote extended coverage at the point of sale. Rising vehicle prices and longer ownership periods have further stimulated demand for protection programs that ensure financial security throughout the vehicle lifecycle. The segment offers substantial revenue potential for market participants through dealer alliances, aftermarket services, and packaged financing arrangements that bundle warranty coverage with vehicle purchases and lease agreements.

Distribution Channel Insights:

- Manufacturers

- Retailers

- Others

The retailers dominate with a market share of 45% of the total United States extended warranty market in 2025.

Retailers have emerged as the dominant distribution channel for extended warranties in the United States, capitalizing on direct consumer interaction at the point of sale to promote protection plan adoption. Major retail chains offer comprehensive warranty programs across electronics, appliances, and consumer goods, leveraging their established customer relationships and extensive store networks to drive attachment rates. The retail environment provides optimal conditions for warranty sales as consumers make purchasing decisions and consider product protection options simultaneously.

The retailer channel advantage extends to trained sales staff who can effectively communicate warranty benefits and address customer concerns during the purchasing process. Retail warranty programs often include value-added features such as no-hassle replacements, in-store service options, and bundled protection packages that enhance customer appeal. The channel continues to evolve with omnichannel strategies that integrate online warranty offerings with in-store purchase experiences.

End User Insights:

- Individuals

- Business

The individuals leads with a share of 69% of the total United States extended warranty market in 2025.

Individual consumers represent the largest end-user segment in the extended warranty market, reflecting strong personal demand for protection plans covering high-value purchases including vehicles, electronics, smartphones, and home appliances. The individual segment is driven by consumer awareness of potential repair costs and the desire for financial predictability when investing in expensive products. Personal warranty purchases often occur at the point of sale, where consumers weigh the immediate cost of coverage against potential future repair expenses.

The individual consumer segment benefits from increasing product sophistication that heightens perceived risk and warranty value. As households accumulate more electronic devices, smart home systems, and technologically advanced appliances, the cumulative investment in consumer products makes comprehensive warranty coverage increasingly attractive. Marketing efforts targeting individual consumers emphasize peace of mind, convenience, and financial protection, resonating with risk-averse buyers seeking to safeguard their personal technology investments.

Regional Insights:

- Northeast

- Midwest

- South

- West

The Northeast region demonstrates strong extended warranty adoption driven by high consumer awareness, substantial disposable incomes, and concentrated urban populations in major metropolitan areas including New York, Boston, and Philadelphia. The region's harsh winter climate increases demand for automotive warranties covering weather-related mechanical issues, while dense retail networks support robust electronics and appliance warranty attachment rates.

The Midwest region exhibits steady extended warranty market growth supported by strong automotive industry presence and practical consumer attitudes toward product protection. Vehicle ownership rates remain high across the region, driving substantial demand for auto extended warranties, while agricultural equipment and home appliance coverage represent significant market opportunities. The region's value-conscious consumers appreciate straightforward warranty terms and reliable coverage.

The South region currently dominates the United States extended warranty market, benefiting from rapid population growth, expanding retail infrastructure, and strong automotive sales across Texas, Florida, and other major states. The region's growing middle class demonstrates increasing interest in protection plans for vehicles, electronics, and home appliances, while favorable business conditions attract warranty providers establishing regional distribution networks.

The West region showcases significant extended warranty market potential driven by technology-forward consumer populations, high disposable incomes in California and Washington, and strong adoption of premium electronics and smart home devices. The region's innovation-oriented culture supports early adoption of digital warranty platforms and subscription-based coverage models, while substantial vehicle ownership generates steady demand for automotive warranty products.

Market Dynamics:

Growth Drivers:

Why is the United States Extended Warranty Market Growing?

Rising Product Complexity and Escalating Repair Costs

The increasing sophistication of consumer products across automotive, electronics, and appliance sectors represents a primary catalyst for extended warranty market expansion. Reflecting this complexity, Samsung announced in November 2025 that it is expanding its Samsung Care+ service to include extended warranty and software/screen protection for a broader range of home appliances such as refrigerators, washing machines, and smart TVs, highlighting how advanced features and integrated software in everyday devices are driving demand for post-purchase protection. Modern vehicles incorporate advanced software systems, integrated sensors, and complex electronic components that significantly increase potential repair costs when failures occur. Similarly, smart home devices, premium smartphones, and connected appliances feature intricate technology requiring specialized expertise and expensive replacement parts. This escalating complexity makes extended warranties increasingly attractive to consumers seeking protection against potentially devastating out-of-pocket expenses.

Growing Consumer Awareness and Changing Risk Perceptions

Consumer awareness regarding repair and replacement costs has increased significantly, driving expanded demand for protection plans across electronics, appliances, and automobiles. For example, a 2025 comparison guide from Auto Warranty Reviews highlighted how rising vehicle repair expenses, which have increased by as much as 39% since 2020, are prompting U.S. consumers to seek extended auto warranties to manage these costs and avoid financial risk, underscoring how visibility into real‑world repair pricing influences purchase decisions. Marketing campaigns by warranty providers, retailers, and manufacturers have effectively communicated the potential financial risks associated with product ownership beyond standard warranty periods. This heightened awareness has shifted consumer perceptions toward viewing extended warranties as prudent financial planning rather than unnecessary expenses. The democratization of product reviews and repair cost information through online platforms has further educated consumers about failure rates.

Expansion of E-Commerce and Digital Distribution Channels

The proliferation of e-commerce platforms and digital sales channels has dramatically enhanced customer access to extended warranty products, removing traditional barriers to purchase and comparison shopping. For example, the U.S. Federal Trade Commission (FTC) has reinforced consumer protections under the Magnuson‑Moss Warranty Act by warning companies in 2024 about illegal warranty restrictions that could limit repair options and mislead online buyers, part of broader government efforts to ensure fair warranty practices for products sold both offline and online, underscoring how regulatory oversight supports transparency and confidence in extended warranty offerings. Online warranty marketplaces enable consumers to easily compare coverage options, pricing, and terms across multiple providers, empowering informed purchasing decisions. Embedded warranty offerings within e-commerce checkout flows capture customer attention at optimal decision points, improving attachment rates. The digital transformation has also enabled new market entrants and innovative business models, driving improvements in coverage quality.

Market Restraints:

What Challenges the United States Extended Warranty Market is Facing?

Consumer Skepticism and Negative Perceptions of Warranty Value

Despite growing market acceptance, significant consumer skepticism regarding extended warranty value persists, limiting potential market penetration. Many consumers perceive extended warranties as unnecessary expenses based on assumptions about product reliability or past experiences with claim denials and coverage limitations. Negative publicity surrounding aggressive sales tactics and complicated claims processes has damaged industry reputation among certain consumer segments.

Competition from Alternative Protection Mechanisms

Extended warranty providers face increasing competition from alternative protection mechanisms including manufacturer-offered warranty extensions and credit card purchase protection benefits. Many premium credit cards automatically extend manufacturer warranties and provide purchase protection at no additional cost to cardholders, reducing perceived need for separate warranty purchases. Some manufacturers now offer extended warranty options directly to consumers at competitive prices.

Regulatory Scrutiny and Compliance Requirements

The extended warranty industry faces ongoing regulatory scrutiny regarding sales practices, coverage terms, and claims handling procedures across various state jurisdictions. Compliance with diverse state insurance regulations and consumer protection laws creates operational complexity and cost burdens for warranty providers operating nationally. Requirements for clear disclosure of coverage limitations can complicate sales processes.Competitive Landscape:

The United States extended warranty market exhibits a competitive landscape featuring established insurance companies, specialized warranty providers, and technology-driven new entrants competing for market share across diverse product categories. Leading players differentiate through comprehensive coverage options, streamlined claims processing, digital customer experiences, and strategic partnerships with retailers and manufacturers. The market has witnessed significant consolidation activity as larger players acquire specialized providers to expand capabilities. Technology investment represents a key competitive battleground, with providers deploying artificial intelligence, machine learning, and data analytics to improve underwriting accuracy, detect fraud, and personalize customer experiences.

Recent Developments:

- In October 2025, Endurance Vehicle Services CEO Justin C. Thomas has been named “Warranty Industry Champion” at the 2025 Warranty Innovation Awards, recognizing his leadership in advancing extended warranty and service contract innovation in the U.S. market. The accolade was presented during the 16th Annual Extended Warranty & Service Contract Innovations Conference in Chicago.

United States Extended Warranty Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Coverages Covered | Standard Protection Plan, Accidental Protection Plan |

| Applications Covered | Automobiles, Consumer Electronics, Home Appliances, Mobile Devices and PCs, Others |

| Distribution Channels Covered | Manufacturers, Retailers, Others |

| End Users Covered | Individuals, Business |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The United States extended warranty market size was valued at USD 53.01 Billion in 2025.

The United States extended warranty market is expected to grow at a compound annual growth rate of 9.20% from 2026-2034 to reach USD 117.02 Billion by 2034.

Standard protection plan dominated the United States extended warranty market with a share of 62%, driven by its affordability, transparent terms, straightforward claims procedures, and broad applicability across consumer products including appliances, electronics, and automobiles that appeal to price-conscious consumers.

Key factors driving the United States extended warranty market include rising product complexity and escalating repair costs, growing consumer awareness about protection plan benefits, expansion of e-commerce and digital distribution channels, increasing vehicle and electronic sales, product bundling strategies by retailers, and strong aftermarket service demand.

Major challenges include consumer skepticism regarding warranty value, competition from manufacturer warranty extensions and credit card purchase protection benefits, regulatory scrutiny and compliance requirements across state jurisdictions, and the availability of alternative diagnostic systems that reduce perceived need for extended coverage.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)