United States Enterprise Asset Management Market Size, Share, Trends and Forecast by Component, Deployment, Organization Size, Application, Industry Vertical, and Region, 2025-2033

United States Enterprise Asset Management Market Size and Share:

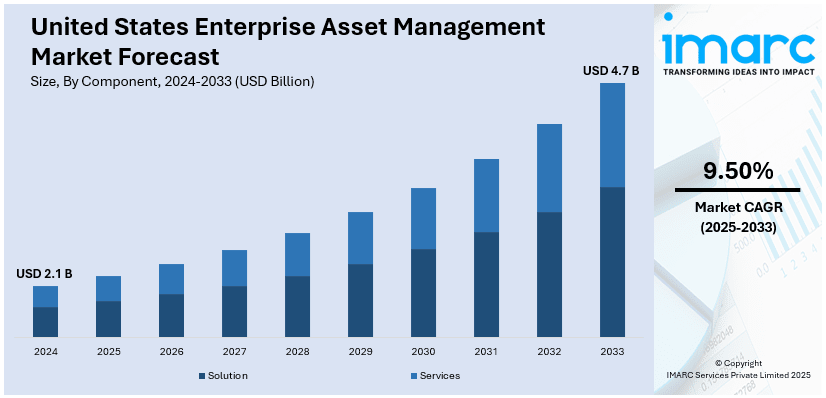

The United States enterprise asset management market size was valued at USD 2.1 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 4.7 Billion by 2033, exhibiting a CAGR of 9.50% from 2025-2033. The US market is driven by the growing usage of mobile enterprise asset management solutions, which allow remote monitoring of assets, along with the advanced analytical tools, which facilitates the collection, processing, and analysis of big data.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 4.7 Billion |

| Market Growth Rate (2025-2033) | 9.50% |

The constantly improving data analytics application in asset management is helping organization within the Unites States enterprise asset management industry to make more informed and proactive decisions about asset utilization and maintenance. Advanced analytics tools, when integrated into enterprise asset management solutions, allow an organization to collect, process, and analyze big data from numerous sources, such as Internet of Things (IoT) sensors, operational logs, and maintenance records. This facilitates real-time information with respect to asset performance, which helps in identifying inefficiencies, predicting failures, and optimizing maintenance allocations. The data published on the website of the IMARC Group predicted that the United States data analytics market size will exhibit a growth rate (CAGR) of 26.80% during 2024-2032.

Employee mobility prominently empowers organizations to drive operations efficiency and responsiveness, causing advancement in the development of the market. Mobile-enabled enterprise asset management systems allow employees to access up-to-date asset data, track ongoing maintenance activities, and update work orders straight from their mobile devices, from anywhere. Such mobility features can tremendously impact industries that mainly include field operations, such as utilities, transport, and construction. Workforce mobility carry out better communication and collaboration across teams, wherein managers can monitor performance, allocate tasks dynamically, and change schedules when necessary. The increased demand for workforce management, especially in the US is impelling the growth of the market. IMARC Group’s report projected that United States workforce management market size will exhibit a growth rate (CAGR) of 9.50% during 2024-2032.

United States Enterprise Asset Management Market Trends:

Growing emergence of IoT and sensors

The driving force of the market is IoT and sensor growth which can change how assets are monitored and managed by organizations. IoT-enabled sensors provide real-time data on asset performance, condition, and usage, thus allowing businesses insight into their operations that was previously unavailable. This data forms the foundation of predictive maintenance strategies that allow identification and intervention of potential problems before the onset of expensive downtime or failure. Integrating IoT encourages decision-making performance by enabling real-time actionable insights directly into enterprise asset management systems. For example, one could use sensors to detect the overheating or abnormal vibrations of a machine and trigger a maintenance request or schedule a repair automatically. The IMARC Group’s report predicted that the US IoT integration market size will exhibit a growth rate (CAGR) of 27% during 2024-2032.

Increasing automation

As per the data published on the website of the IMARC Group, the United States healthcare asset management market size reached USD 12.2 Billion in 2024. Automated enterprise asset management solutions facilitate the administration of medical equipment facilities and critical assets without consuming too much manual effort, while bringing efficiencies in the operation. Automated enterprise asset management employs advanced technologies, such as artificial intelligence, machine learning, and robotics, for providing maximum optimization in asset monitoring, maintenance, and management. This, in turn, reduces the dependence on manual techniques, thus rendering faster operations while being cost-effective. The key advantage of automation is the provision of predictive and prescriptive maintenance capability at all levels. Automated enterprise asset management systems analyze inputs from IoT-enabled sensors along with historical performance data to forecast imminent failures and recommend what corrective action can be applied.

Regulatory compliance

Regulatory compliances are one of the major factors behind the market as organizations from all industries are adhering to strict standards and legal requirements. Ensuring safety, environment, and operational efficiency through rigorous regulations, organizations are resorting to advanced enterprise asset management solutions for monitoring accurate records, assets, and compliance. Automated systems can speed up compliance management by keeping evidence of inspections, documenting events, and generating reports for audits. For example, compliance regulations established for a variety of industries, such as healthcare, energy, and transportation are difficult and must be followed stringently, demonstrating that their assets meet regulatory standards. These enterprise asset management systems enable the automation of scheduling inspections and maintenance tasks to ensure compliance with regulatory requirements timely. The rising usage of digital asset management for regulatory compliance, especially in the US, is supporting the growth of the market. According to the IMARC Group’s report, the US digital asset management market to reach US$ 8,978.1 Million by 2032.

United States Enterprise Asset Management Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States enterprise asset management market, along with forecast at the country and regional levels from 2025-2033. The market has been categorized based on component, deployment, organization size, application, and industry vertical.

Analysis by Component:

- Solution

- Services

Adoption of software to manage asset performance is accelerating momentum for enterprise asset management solutions. Some of the functions of enterprise asset management solutions include predictive maintenance, real-time monitoring, and other analytical features that help improve asset utilization and minimize downtime.

The services segment consists of consultation, implementation, and maintenance services, which are important to organizations for utilizing the full value of enterprise asset management systems. Enterprise asset management related services are gaining traction as organizations require specialized skills for system integration and optimization.

Analysis by Deployment:

- On-premises

- Cloud-based

On-premises deployment, where solution and application infrastructure can be installed and managed on-premises, remains the preferred choice among larger organizations that regard data security and privacy as requirements that are more stringent than any other. This allows full control over the hardware, software, and infrastructure, which proves to be crucial for industries, such as utilities, manufacturing, and defense.

Cloud-based deployment is rapidly becoming the most adopted form of hosting due to its various features, such as cost-effectiveness, on-demand scalability, and ease of accessibility. Many organizations are shifting to cloud-based enterprise asset management solutions as these require less capital investment in infrastructure compared to the traditional solutions, thereby ultimately reducing information technology (IT) costs incurred by the businesses.

Analysis by Organization Size:

- Small and Medium-sized Enterprises

- Large Enterprises

With their focus on operational efficiency and cost reduction, small and medium-sized enterprises are quickly adopting enterprise asset management solutions. Affordable and cloud-based enterprise asset management solutions allow small and medium-sized enterprises to enjoy the same advanced functionalities with less investment in infrastructure. Oftentimes, these companies are looking for a more flexible yet user-friendly system for streamlining maintenance schedules, tracking assets, and maximizing resource usage, all features available through customized enterprise asset management solutions.

Comprehensive, customized, and highly integrated enterprise asset management solutions are required by large enterprises for managing a multitude of assets in different places. More often, these large enterprises operate large-scale infrastructure, hence necessitating live monitoring, predictive maintenance, and regulations compliance.

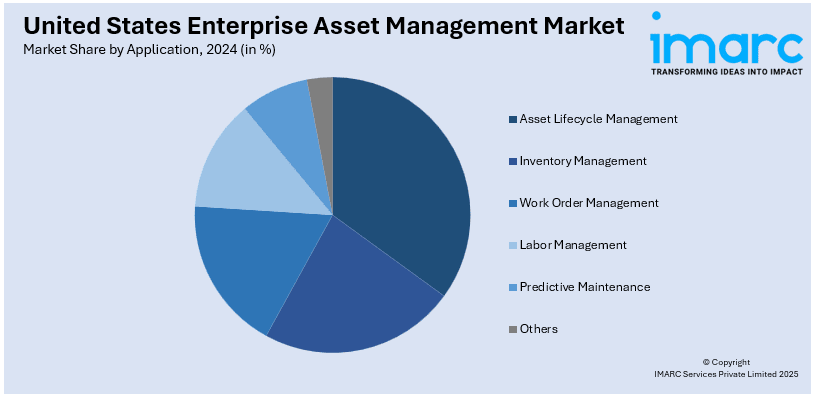

Analysis by Application:

- Asset Lifecycle Management

- Inventory Management

- Work Order Management

- Labor Management

- Predictive Maintenance

- Others

Asset lifecycle management is a pivotal application in enterprise asset management because it deals with tracking and managing assets within companies, from their acquisition to their disposal. The application in this aspect is important because it assist in maximizing value, minimizing costs, and providing operational efficiency over the long run are extremely important.

The inventory management of spare parts, materials, and tools is crucial and required during maintenance and repair operations. The strong inventory management functionalities offered by enterprise asset management systems help the organization keep track of stock levels and order supplies automatically, thus reducing the cost of carrying inventory. It also reduces the downtime due to non-availability of parts, thereby ensuring that maintenance work is performed smoothly without interruptions and shortages.

Work order management allows organizations to administer the maintenance work in an efficient way using work orders, from creating and assigning, to tracking. It allows businesses to optimize their workflows and improve communication between different teams while prioritizing their work based on urgency.

Labor management in enterprise asset management ensure the deployment of optimized workforces through tracking worker’s schedules, skills, and productivity. This application ensures companies place the right workers on the right work to improve workforce efficiency and reduce operating costs.

Predictive maintenance is becoming critical in the enterprise asset management space because it analyzes the use of data analytics and Internet of Things (IoT) enabled sensors to communicate and predict when the assets are more likely to fail. Given this, potential problems can be identified beforehand, companies can conduct maintenance only when they are necessary, thereby minimizing any downtime incurred and prolonging the life of assets.

Analysis by Industry Vertical:

- Manufacturing

- Transportation and Logistics

- Government

- IT and Telecommunications

- Energy and Utilities

- Healthcare

- Education

- Others

Enterprise asset management holds a valuable status in the manufacturing sector as it manages production assets with minimal downtime and more enhanced efficiency. Enabling manufacturers to monitor industry asset conditions so that health of manufacturing machinery is tracked, production schedules are optimized, and equipment are proactively maintained to avoid expensive breakdowns.

Enterprise asset management solutions serve the transport and logistics sectors by managing fleets, vehicles, and other infrastructures. These systems are designed to maintain vehicles for organizations, track maintenance schedules, and optimize fleet utilization.

Enterprise asset management solutions help in the efficient management of public infrastructure, different assets including equipment owned by the government sector. The biggest advantage is that enterprise asset management assists in compliance, asset maintenance, and public safety infrastructure, such as roads, bridges, and facilities.

Enterprise resource management systems help manage network equipment, data centers, and in information technology (IT) and telecommunications infrastructures. These systems ensure that assets, such as servers, routers, and switches are effectively managed, thereby reducing downtime and enhancing service delivery to the customers.

Enterprise resource management solutions hold critical importance in the energy and utilities sector, where managing large asset portfolios, from power plants and grids to pipelines and distribution systems, which are vital for operational efficiency. Such systems help avoid equipment failures, optimize maintenance schedules, and ensure safety and regulatory compliance.

With the help of enterprise resource management solutions, healthcare establishments like hospitals and medical centers are able to better manage their vital assets, such as medical equipment and facilities. The enterprise resource management encourages efficiency in equipment usage, compliance with health regulations, coupled with reducing equipment downtime.

From schools to universities, all educational institutions are utilizing enterprise resource management solutions for managing their campus assets, including buildings, classrooms, and educational equipment. Maintenance of the facilities and their proper resource utilization along with the reduction of operational costs are a few advantages of this system.

Regional Analysis:

- Northeast

- Midwest

- South

- West

Enterprise asset management is an important market in the Northeast of the United States due to the industrial base that includes manufacturing, energy, and healthcare. It is due to the presence of major metro cities like New York, Boston, and Philadelphia with their large-scale industries that need advanced asset management systems in order to ensure operational efficiency and compliance with regulations, and asset optimization.

The mid-western part of the country is considered the 'factory' of the United States and creates the requirement for enterprise asset management solutions having a huge industrial base in the automobile, manufacturing, and energy industries. As these industries try to extract efficiencies from production lines, manage their machines, and comply with regulations, the application of enterprise asset management technologies is essential.

The South is a rapidly growing industrial region, with focus on areas, such as transport, energy, and agriculture and all dependent on very effective asset management. States like Texas have large energy and oil sectors, and hence enterprise asset management systems are becoming useful for maintaining equipment, resources, and sufficient downtimes.

The West is not only home to massive industries like technology, telecommunications, and healthcare, but it also a relevant market for the growth of the enterprise asset management solutions. Organizations based in Silicon Valley and across tech hotspots desire high-performance facilities to make huge installations for managing their centralized IT infrastructure that involves data centers and telecommunication equipment.

Competitive Landscape:

Key players in the market presents outstanding innovative solutions and services, thereby shaping the industry. Some of these players are investing in developing state-of-the-art enterprise asset management platforms with integrated IoT, artificial intelligence (AI), and cloud computing technologies, creating a competitive marketplace. Such enterprise asset management solutions help businesses optimize asset utilization while reducing operational costs and improve efficiency overall. The growing demand for predictive maintenance, real-time monitoring, and data analytics in various industry sectors like manufacturing, energy, and healthcare is being addressed by key players with their constant innovations in the enterprise asset management solutions. They also provide consultancy, implementing and supporting services so that organizations can leverage maximum benefits from enterprise asset management systems.

The report provides a comprehensive analysis of the competitive landscape in the United States enterprise asset management market with detailed profiles of all major companies.

Latest News and Developments:

- September 2024: Blue Mountain entered into the agreement with RCM Technologies to elevate the life sciences enterprise asset management, combining pre-validated software with domain expertise for improved regulatory compliance and operational efficiency.

United States Enterprise Asset Management Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Deployments Covered | On-premises, Cloud-based |

| Organization Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Applications Covered | Asset Lifecycle Management, Inventory Management, Work Order Management, Labor Management, Predictive Maintenance, Others |

| Industry Verticals Covered | Manufacturing, Transportation and Logistics, Government, IT and Telecommunications, Energy and Utilities, Healthcare, Education, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States enterprise asset management market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States enterprise asset management market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States enterprise asset management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Enterprise asset management presents technological solutions as well as services to manage and optimize enterprise physical assets throughout the asset lifecycle at a holistic level. Maintenance scheduling, inventory control, and predictive analysis are all covered under enterprise asset management applications. It basically ensures the efficient use of the assets by the facility, in the manufacturing, utilities, and healthcare industries, and reduces downtime, compliance violation, and operational costs within the asset evaluation.

The United States enterprise asset management market was valued at USD 2.1 Billion in 2024.

IMARC estimates the United States enterprise asset management market to exhibit a CAGR of 9.50% during 2025-2033.

The demand for enterprise asset management solutions in the United States is being propelled by the uptake of digital technologies such as IoT, AI, and cloud computing designed to optimize asset performance and minimize costs. Furthermore, managing compliance with regulations encourages any organization towards the predictive maintenance of its assets to increase uptime and at the same time drives a wider adoption of enterprise asset management solutions to satisfy demands for sustainability in asset management.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)