United States Engineering Plastics Market Size, Share, Trends and Forecast by Resin Type, End Use Industry, and Region, 2026-2034

United States Engineering Plastics Market Size and Share:

The United States engineering plastics market size was valued at USD 15.8 Billion in 2025. The market is projected to reach USD 27.3 Billion by 2034, exhibiting a CAGR of 6.28% from 2026-2034. The market is fueled by growing demand for light, tough, and high-performance materials in automotive, electronics, aerospace, and building industries. Advances in recyclable and bio-based resins and manufacturing processes are expanding product applications and sustainability. Heightened focus on fuel efficiency, miniaturization, and environmental regulations is also driving market growth. Strategic investments and local manufacturing benefits remain to bolster industry competitiveness, driving the overall growth of United States engineering plastics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 15.8 Billion |

| Market Forecast in 2034 | USD 27.3 Billion |

| Market Growth Rate 2026-2034 | 6.28% |

The increasing demand for lightweight materials in most industries is the principal driver fueling the need for engineering plastics within the United States. With industries like automotive, aerospace, electronics, and consumer products aiming to enhance performance, decrease energy usage, and simplify manufacturing, engineering plastics present an attractive answer. Their higher strength-to-weight ratio enables manufacturers to substitute conventional materials such as metals and ceramics without sacrificing structural integrity or performance. In transportation, reduced weight components have a direct impact on enhanced fuel efficiency and greater design flexibility. In electronics and appliances, weight saving is part of consumer expectation for ergonomic design and portability. This constant material change is also prompted by engineering plastics' chemical, corrosion, and wear resistance, which ensures longer product life and reliability. As a result, the trend towards light-weight engineering solutions has become the focus point in contemporary manufacturing strategies, enabling the broad application of engineering plastics in various high-value applications. According to the sources, in January 2024, BASF announced that from March 1, certain grades of its engineering plastics would be available in North America through Bamberger Amco Polymers, M. Holland, Nexeo Plastics, and Polimeros Nacionales.

.webp)

To get more information on this market Request Sample

The growing demand for high-performance materials with improved functional properties is yet another major driving force behind the United States engineering plastics market growth. Sectors are constantly looking for materials that can function well at extreme temperatures, aggressive chemicals, and mechanical stress without compromising on dimension stability or reliability. Engineering plastics meet these requirements with their thermal resistance, electrical insulation capabilities, and superior durability under stressful operating conditions. These characteristics make them extremely well-suited for electronics applications requiring precision parts, automotive components that go under the hood, and industrial equipment. Moreover, compatibility with sophisticated manufacturing technologies such as injection molding and 3D printing enables high-volume, cost-effective manufacturing. The capacity to tailor these plastics to particular performance requirements like, flame retardance, UV stability, or low friction—is an added bonus across specialized uses. As per the reports, in February 2025, Avient launched its Hammerhead™ FR Flame Retardant Composite Panels at NAHB IBS in Las Vegas, providing a thermoplastic answer for modular walls and ceilings with built-in flame resistance. Moreover, with growing complexity of product design and increasing performance demands, the contribution of engineering plastics to innovation and ensuring consistent product quality becomes even more instrumental to industrial advancement.

United States Engineering Plastics Market Trends:

Lightweight Alternatives Powering Automotive Innovation

Engineering plastics have emerged as vital across the U.S. industrial base because of their superior mechanical stability, resistance to heat, and capacity to contribute significantly to the reduction of weight. In cars, such plastics substitute heavier metal parts, cutting the car's weight by 30–50%, making vehicles more fuel-efficient and less polluting. Bumper systems, dashboard trim, and under-the-hood components are important items that enjoy greater durability and design flexibility offered by these materials. Their flexibility also enables easier production processes and greater design freedom. As electric vehicles (EVs) become more popular, engineering plastics help drive the transition by decreasing overall vehicle weight, thus increasing battery range. With pressure building from regulators on sustainability and emissions, the automotive industry ever more depends on these lightweight polymers. This shift makes engineering plastics essential to the transition towards greener, more energy-efficient vehicles, solidifying their place in the mobility future of the United States.

A Wide Range of Industrial Applications Drive Market Expansion

The ability of engineering plastics to go beyond auto applications to consumer electronics, household products, and sports accessories attests to their versatility. Their application in the case of helmets, ski boots, laptop enclosures, and optical discs speaks volumes of their versatility in high-performance as well as utility products. Such widespread applicability has led engineering plastics to become a crucial part of product longevity and functional characteristics. The increasing demand for miniaturized, resistant, and light-weight materials in appliances and electronics further amplified their demand. Industries also gain from these plastics' ability to resist chemicals, heat, and physical stress, making them the best candidates to replace metals and ceramics in high-precision, cost-sensitive settings. This trend towards material substitution also helps in lowering manufacturing costs and more design innovation. As US manufacturers seek to enhance efficiency and reliability across product lines, the need for engineering plastics will continue to grow, solidifying their strategic position in industrial and consumer uses alike.

Market Outlook and Sustainable Innovation

As per the United States engineering plastics market analysis the market is closely linked to material science progress and a general trend toward greater sustainability. Worth USD 27.5 billion in 2024, the American market for advanced materials, under which engineering plastics come, is anticipated to expand at a compound annual growth rate (CAGR) of 6.5% until 2032 to reach about USD 45.0 billion. This expansion is backed by R&D investments in bio-based and recyclable polymers, allowing for more sustainable options without sacrificing performance. As regulations for sustainability increase and demand for eco-friendly products among consumers grows, producers are intensely adopting circular economy concepts into plastic manufacturing and recycling. Engineering plastics, with their durable usage life and energy-saving processing, suit these objectives particularly well. Sustained innovation can also be observed in innovations involving high-heat polymers and reinforced composites, which position engineering plastics as a key player in addressing changing performance requirements for the aerospace, medical device, construction, and electronics industries in the American market.

United States Engineering Plastics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States engineering plastics market, along with forecasts at the regional and country/country and regional levels from 2026-2034. The market has been categorized based on resin type and end use industry.

Analysis by Resin Type:

- Fluoropolymer

- Ethylenetetrafluoroethylene (ETFE)

- Fluorinated Ethylene-Propylene (FEP)

- Polytetrafluoroethylene (PTFE)

- Polyvinylfluoride (PVF)

- Polyvinylidene Fluoride (PVDF)

- Others

- Liquid Crystal Polymer (LCP)

- Polyamide (PA)

- Aramid

- Polyamide (PA) 6

- Polyamide (PA) 66

- Polyphthalamide

- Polybutylene Terephthalate (PBT)

- Polycarbonate (PC)

- Polyether Ether Ketone (PEEK)

- Polyethylene Terephthalate (PET)

- Polyimide (PI)

- Polymethyl Methacrylate (PMMA)

- Polyoxymethylene (POM)

- Styrene Copolymers (ABS and SAN)

Fluoropolymers such as PTFE, PVDF, FEP, and ETFE are extensively used for their excellent chemical resistance, non-stick coating properties, and heat resistance. These resins are suitable for electrical insulation, chemical handling, and aerospace applications because of their toughness, low friction, and performance in harsh environments.

LCPs have high mechanical strength, resistance to chemicals, and stability in dimensions at elevated temperatures. Their low flow and rapid cycle times make them ideal for precision parts in electronics and automotive industries. Resins are applied in connectors, housings, and microwave-frequency components with the need for rigidity and thermal dependability.

Polyamides such as PA 6, PA 66, aramids, and polyphthalamides possess good tensile strength, abrasion resistance, and thermal performance. They find extensive applications in motor vehicle components, electrical insulation, and textile. Aramids are flame-resistant, whereas polyphthalamides are resistant to intense heat and chemical exposure in challenging engineering applications.

PBT is a crystalline, high-strength thermoplastic with good electrical properties, dimensional stability, and solvent resistance. PBT is used in various automotive connectors, electronic enclosures, and household appliances. Its quick processing and mechanical strength make it suitable for molded parts with consistent performance.

Polycarbonate is a clear, impact-resistant engineering plastic with very good dimensional stability and flame retardation. Because of its stability against mechanical stress and against temperature fluctuations, it finds its applications in safety glasses, car lenses, medical equipment, and electronic casings, where transparency and strength are both needed at the same time.

PEEK is a high-performance thermoplastic with excellent thermal, chemical, and mechanical properties. It is best suited for aerospace, medical, and industrial uses that need to be durable under severe conditions. PEEK has excellent wear resistance and processability and is utilized in surgical instruments, pump parts, and components subjected to heat and pressure.

PET finds extensive application for its strength, moisture resistance, and dimensional stability. It is commonly used in packaging, textiles, and increasingly in automotive and electrical components. Engineering-grade PET has very good surface finish and fatigue resistance, which makes it ideal for gears, housings, and precision-molded parts in harsh environments.

Polyimides are renowned for thermal stability, chemical resistance, and excellent electrical insulation properties. They find extensive applications in aerospace, electronics, and automotive industries for flexible printed circuits, insulating films, and high-temperature adhesives. PI functions well under extreme conditions with no loss of integrity in high-heat and high-stress applications.

PMMA, also referred to as acrylic, is a clear, light plastic utilized as a glass alternative in those applications where optical clarity and resistance to UV radiation are needed. It is applied in lighting, automobile lenses, and display boards. PMMA provides weatherability and visual appeal, although it has less impact resistance than polycarbonate.

POM, or acetal, is a rigid, tough engineering plastic with low friction and high dimensional stability. It is suited to precision components with low wear and high mechanical properties, e.g., gears, bearings, and fasteners for automotive and consumer products. POM is prized for machinability and resistance to fatigue.

ABS and SAN are general purpose styrene-based copolymers with impact resistance, stiffness, and appearance. ABS finds extensive applications in car interiors, consumer electronics, and toys because of its strength. SAN, which is transparent and chemical-resistant, finds applications in kitchenware and cosmetics packaging that need visual clarity and durability.

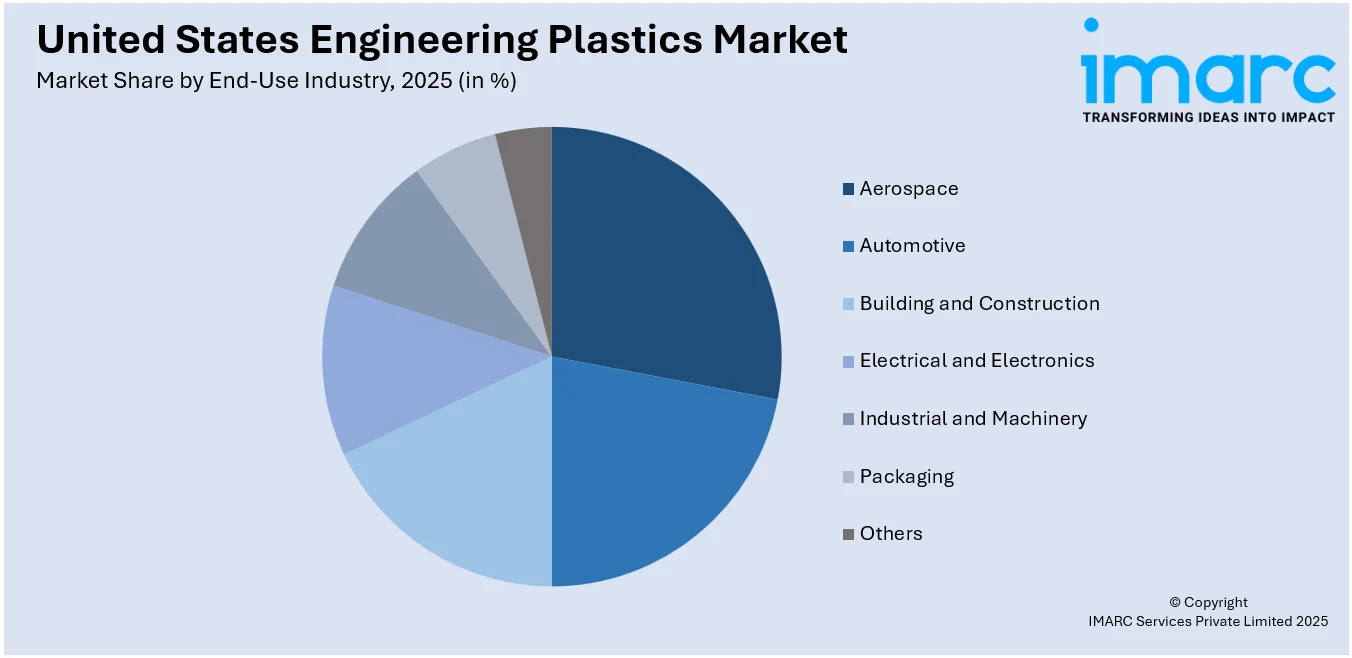

Analysis by End-Use Industry:

Access the comprehensive market breakdown Request Sample

- Aerospace

- Automotive

- Building and Construction

- Electrical and Electronics

- Industrial and Machinery

- Packaging

- Others

Engineering plastics play a critical role in aerospace due to their light weight, high strength, and ability to withstand heat. They find application in interior panels, insulation, ducts, and structural parts. They help save on weight while keeping things tough, enhancing fuel efficiency and performance, and they are well suited for both commercial aircraft and military use.

In the automotive industry, engineering plastics facilitate lightweighting of vehicles through improved fuel efficiency and design versatility. The plastics are extensively applied to engine covers, bumpers, fuel systems, and interior parts. Their heat, chemical, and mechanical stress resistance facilitates strength and longevity, complementing conventional and electric vehicle development.

Construction engineering plastics find applications in pipes, insulation, glazing, and structural applications because of their strength, corrosion resistance, and insulation qualities. The materials enhance building energy efficiency and longevity and provide solutions to today's infrastructure needs for light-weight, long-lasting, and weather-resistant components.

Engineering plastics play a vital role in electronics through electrical insulation, flame retardancy, and heat resistance. They are applied in circuit boards, connectors, cases, and insulation to facilitate miniaturization and safety in electronic devices. Their superior performance aids quick innovation in consumer electronics, telecommunication, and power equipment.

For industrial uses, engineering plastics are applied to gears, bearings, seals, and housings. Their ability to withstand wear, chemicals, and heat renders them suitable for harsh conditions. These materials minimize maintenance requirements and extend equipment life, helping to ensure more efficient, reliable manufacturing processes.

Engineering plastics are applied to specialized packaging uses involving strength, chemical resistance, and durability. They play a crucial role in pharmaceutical, industrial, and electronic packaging. They protect contents during transport and storage by providing additional product safety, tamper resistance, and shelf life.

Other end-use industries are healthcare, consumer products, and agriculture, where engineering plastics offer customized solutions for durability, flexibility, and hygiene. The uses run the gamut from medical equipment and protective equipment to furniture and irrigation parts. They are adaptable and compliant with regulations to be used across a broad array of niche applications.

Regional Analysis:

- Northeast

- Midwest

- South

- West

Northeast experiences consistent demand for engineering plastics fueled by the region's robust base in medical devices, electronics, and aerospace production. High research density and sophisticated research facilities lead to material development. Urban infrastructure schemes and high regulatory standards also drive the use of high-performance and sustainable engineering plastics.

The Midwest is a major hub for automotive and industrial machinery manufacturing, fueling demand for engineering plastics in components like gears, housings, and under-the-hood parts. The region benefits from established supply chains and skilled labor. Increasing automation and machinery upgrades further boost plastic utilization in high-performance engineering applications.

South shows strong growth in consumption of engineering plastics owing to increasing construction, packaging, and electronics industries. Friendly business environments, amplified manufacturing investments, and access to raw materials favor local plastic processing and utilization. Activity in the energy sector and infrastructure development also ensure higher use of performance plastics.

The West is a technology, aerospace, and clean energy leader, propelling advanced uses of engineering plastics. Silicon Valley and aerospace concentrations in California and Washington generate high demand for high-performance, lightweight materials. Regional environmental regulations and innovation-led markets also promote the use of recyclable and sustainable engineering plastics.

Competitive Landscape:

United States engineering plastics market outlook predicts continued growth fueled by growing demand in automotive, electronics, aerospace, and construction industries. As businesses more and more move towards light, high-performance materials, engineering plastics will find their applications broadened to structural parts, insulation, and long-lasting goods. The outlook is supported even further by the process of constant innovation in high-heat-resistant, chemically inert, and recyclable resins, as these matches changing environmental and regulatory requirements. Thanks to innovations in manufacturing technologies and rising emphasis on electric vehicles and energy-saving solutions, growth in the use of engineering plastics will remain fast-paced. Incorporation of bio-based and recyclable materials into product ranges also aids in long-term growth in markets. Moreover, robust domestic manufacturing capabilities and strategic research and development investments further improve competitiveness. Consequently, the United States engineering plastics market forecast for the future mirrors a bright course, characterized by technological innovation, green-oriented activities, and diversified end-use industries in industrial as well as consumer applications.

The report provides a comprehensive analysis of the competitive landscape in the United States engineering plastics market with detailed profiles of all major companies.

Latest News and Developments:

- May 2025: Avantium partnered with the Bottle Collective to develop fibre bottles integrating its 100% plant-based PEF polymer using Dry Moulded Fibre (DMF) technology. The collaboration enhanced bottle sustainability and barrier properties, supporting longer shelf life and environmental benefits in packaging, aligning with growing U.S. demand for bio-based engineering materials.

- May 2025: PPG launched EnviroLuxe Plus powder coatings containing up to 18% post-industrial recycled plastic (rPET) and free from PFAS. These coatings offered up to 30% lower carbon footprint while maintaining durability and aesthetics, meeting the demand for high-performance, sustainable polymer solutions in industrial and consumer engineering applications.

- February 2025: Polyplastics introduced PLASTRON LFT RA627P, a long fibre-reinforced thermoplastic made from polypropylene and regenerated cellulose fibre. Offering reduced weight, high specific rigidity, and excellent acoustic damping, the composite is targeted at advanced engineering applications like audio components, with plans for recycled-content variants to further reduce environmental impact.

United States engineering plastics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Resin Types Covered |

|

| End Use Industries Covered | Aerospace, Automotive, Building and Construction, Electrical and Electronics, Industrial and Machinery, Packaging, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States engineering plastics market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States engineering plastics market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the engineering plastics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The engineering plastics market in the region was valued at USD 15.8 Billion in 2025.

The United States engineering plastics market is projected to exhibit a CAGR of 6.28% during 2026-2034, reaching a value of USD 27.3 Billion by 2034.

Growth drivers of the United States engineering plastics market are mounting demand for light-weight and high-performance products, increase in automobile and electronics production, research and development of sustainable and recyclable polymers, and a growing focus on fuel efficiency and emission reduction, along with higher applications in aerospace, healthcare, and machinery industries because of their better thermal, mechanical, and chemical resistance compared to conventional materials.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)