U.S. Electronic Warfare Market Size, Share, Trends and Forecast by Product, Capacity, Platform, and Region, 2025-2033

U.S. Electronic Warfare Market Size and Share:

The U.S. electronic warfare market size is anticipated to reach USD 4.8 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 6.8 Million by 2033, exhibiting a CAGR of 4.60% from 2025-2033. The market is expanding rapidly, driven by rising threats in the electromagnetic spectrum, continual advancements in unmanned and autonomous systems, the integration of AI for real-time threat detection, and the modernization of legacy defense platforms, with a strategic focus on achieving electromagnetic spectrum dominance and enhancing network-centric warfare capabilities.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2025 | USD 4.8 Million |

| Market Forecast in 2033 | USD 6.8 Million |

| Market Growth Rate (2025-2033) | 4.60% |

The market in the United States is primarily driven by the increasing reliance on the space-based assets for communications and for intelligence purposes. The growing concern with strengthening electronic warfare and cybersecurity capabilities is driving the growth of the market since defense organizations are increasingly investing in high-end technologies to address their security threats. Strategic acquisition and partnership enable companies to provide innovative solutions to global markets, which are seeing increasing demand for enhanced defense systems and operational readiness. On 6th August 2024, SIXGEN announced its acquisition of Boldend to enhance innovation in U.S. defense and national security. This strategic move strengthens SIXGEN’s capabilities in electronic warfare and advanced cybersecurity solutions, aligning with its mission to support the department of defense and government agencies in addressing complex national security challenges.

Additionally, the increased use of next-generation stealth technologies is driving the need for more advanced electronic warfare systems that can counter stealth-enabled threats. Increasing demands for autonomous systems in contested environments have fueled the quest for the advancement of electronic warfare. Cutting-edge technologies mounted on unmanned platforms have increased the capability to mitigate threats and reduce operational efficiencies, which make them key elements in new defense doctrines and the progression of electronic warfare systems across the globe. On April 2, 2024, Kratos Defense & Security Solutions, Inc. successfully demonstrated the electronic warfare capabilities of its XQ-58A Valkyrie. This milestone highlights the Valkyrie’s ability to perform advanced threat mitigation and operational support in contested environments. The demonstration reinforces Kratos' position in delivering innovative unmanned systems to enhance U.S. defense and national security efforts.

U.S. Electronic Warfare Market Trends:

Growing Investments in Electronic Warfare Technology

The growing importance of improving electromagnetic spectrum superiority is pushing massive investments in electronic warfare technology. Governments all over the world are focusing more on developing advanced capabilities for meeting the challenges of modern combat and ensuring mission readiness. These advances facilitate the integration of latest technologies to ensure robust support for operations, further strengthening the defense systems. Increased demands for sophisticated electronic warfare capabilities reveal their significance in current defense policies and stimulate mutual partnerships between governments and key defense companies in establishing solid, agile, and efficient warfare systems. For example, On 5th December 2024, HII announced a USD 6.7 Billion contract award from the U.S. air force to enhance its electronic warfare capabilities. The indefinite-delivery/indefinite-quantity contract spans 10 years, focusing on advancing electromagnetic spectrum superiority through innovative technologies and operational support. This underscores HII's pivotal role in bolstering national defense systems and mission readiness.

Continual Advancements in Vehicle Protection Systems

Growing needs to protect military vehicles against changing threats spur the advancement of electronic warfare countermeasures. Multi-class soft kill technologies are becoming the state-of-the-art means against effectively countering guided missile attacks and other hostile measures. It enhances vehicle survivability as it disrupts enemy targeting systems, ensuring operational continuity under a range of complex combat scenarios. Thus, the growing adoption of these technologies underscores a global movement toward equipping armed forces with cutting-edge protective measures. Further increasing the defense budget and advancements in technology will continue to spur the development and deployment of advanced vehicle protection systems for mission success and resilience in the battlefield. In November 2024, BAE systems announced a follow-on contract from the U.S. army to advance its multi-class soft kill system (MCSKS) electronic warfare countermeasures. These technologies aim to protect ground combat vehicles from guided missiles and other threats, ensuring enhanced survivability and mission success in modern combat scenarios.

Rising Threats in Cyberspace and Electronic Domains

The increasing use of cyber and electronic warfare tactics is a major driver shaping the U.S. electronic warfare market share. Nation-states are using the electromagnetic spectrum as a means to disrupt communication, target critical infrastructure, and conduct covert operations. Therefore, these threats have heightened the need for robust countermeasures and advanced defense systems, which has invested heavily in electronic warfare technology. U.S. defense agencies are highly invested in research and development to remain technologically ahead of this changing game. As the threats are becoming more advanced, the need for a real-time spectrum monitoring system, jamming, and secure communication systems is increasing, ensuring operational readiness and the reduction of risks from hostile actions. This is also pushing the innovation of the defense contractors and creating new collaborations for the development of cutting-edge systems that advance national security.

U.S. Electronic Warfare Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the U.S. electronic warfare market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product, capacity, and platform.

Analysis by Product:

- EW Equipment

- Jammer

- Countermeasure System

- Decoy

- Directed Energy Weapon

- Others

- EW Operational Support

Electronic warfare (EW) equipment plays a critical role in the United States market and forms the backbone of new defense strategies. These include high-performance radar jammers, signal disruptors, and spectrum monitoring tools for situational awareness and countering adversarial threats. Integrating them into defense platforms ensures superiority in operational capabilities and supports the U.S. military's position of safeguarding critical assets while gaining dominance in contested environments.

Assistance in electronic warfare is crucial for achieving mission success and preparedness in rapidly changing combat situations. This encompasses immediate spectrum evaluation, threat recognition, and implementation of countermeasures to mitigate opposing actions. By integrating cutting-edge technologies with proficient operational tactics, EW assistance ensures effective coordination among military divisions. This capability enhances the U.S. defense system, delivering a critical edge in safeguarding national interests and upholding global dominance.

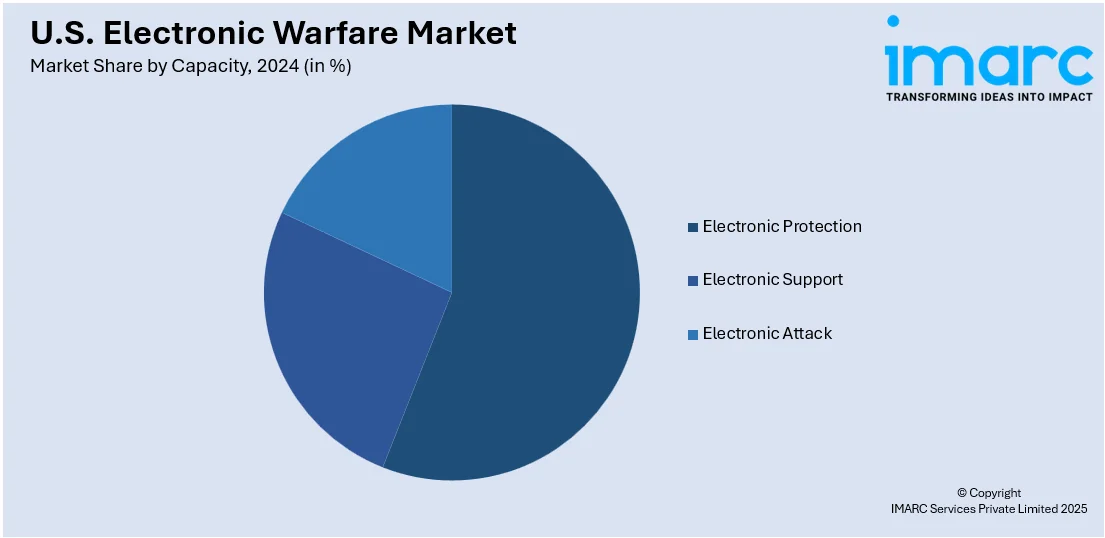

Analysis by Capacity:

- Electronic Protection

- Electronic Support

- Electronic Attack

Electronic protection protects the integrity and functionality of military communication and operational systems in contested environments. By protecting signals from jamming, spoofing, or interception, it ensures continuity of operations and effectiveness of a mission. Advanced protective technologies such as anti-jamming systems and encrypted communications are key in the U.S. electronic warfare market, addressing the increasing complexity of modern threats and the resilience of defense infrastructure.

Electronic support involves detection, intercept, and analysis of electromagnetic signals to help forces in critical situational awareness. This capability identifies potential threats, enemy intentions, and tactical advantages. In the U.S. electronic warfare market, electronic support is a core for intelligence gathering and threat monitoring, thus developing spectrum analysis tools and real-time monitoring systems to secure operational superiority.

Electronic attack is disruption, degradation, or neutralization of adversary systems through electromagnetic means. Techniques including jamming, deception, and directed-energy attacks play key roles in the suppression of enemy communication and radar capabilities. In the U.S. electronic warfare market, electronic attack capabilities hold considerable priority, with a tremendous investment in advanced jamming technologies and offensive countermeasures, allowing an opportunity to proactively counter these threats and dominate a contested environment.

Analysis by Platform:

- Land

- Naval

- Airborne

- Space

Land-based systems are crucial in the U.S. electronic warfare market as they safeguard ground forces from emerging threats. These systems have advanced capabilities that include jamming enemy communications, neutralizing improvised explosive devices, and protecting armored vehicles. Electronic warfare technologies integrated into ground operations increase situational awareness, protect critical assets, and ensure mission success in complex and contested environments.

Naval platforms are a very important part of the U.S. electronic warfare market. Threats are countered in maritime domains. The advanced electronic support measures installed on ships and submarines help in detecting, intercepting, and disrupting enemy signals. These systems assure fleet security by countering anti-ship missiles, enhancing the capabilities of radar, and securing communications. With an increase in the usage of unmanned maritime systems, electronic warfare remains a growing factor in naval operations.

Airborne platforms are crucial in the U.S. electronic warfare market to provide unmatched capabilities for threats to be detected and suppressed in the threat environment. State-of-the-art aircraft and drone technologies can perform electronic attacks, disrupt enemy radar, and gain air superiority while securing it. These critical systems support offensive and defense missions, ensure operational readiness in modern air combat scenarios with tactical advantages, and obtain dominance in multi-domain operations.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region plays an important role in the U.S. electronic warfare market due to the concentration of technology hubs, defense contractors, and research institutions in the region. Massachusetts and New York are the states having advanced laboratories and innovation centers that develop leading-edge electronic warfare technologies. R&D has a strong focus, with collaboration with federal agencies; this drives innovation and maintains the technological edge for the United States in defense capabilities.

The Midwest significantly propels the electronic warfare market, due to its solid manufacturing base and defense industries. Ohio and Michigan are known for producing advanced electronic components and systems essential for modern defense tech. The region prioritizes industrial efficiency and military program collaboration, strengthening the supply chain and ensuring the reliability of electronic warfare systems nationwide.

The South is one of the most prominent region in the U.S. electronic warfare market due to its strategic military bases and growing presence of aerospace and defense companies. The states of Texas and Florida have numerous defense contractors and innovation hubs, providing an opportunity for the development of cutting-edge electronic warfare solutions. It is also near critical military installations, thereby ensuring the easy testing and deployment of technologies to enhance national security efforts and operational readiness.

The West region is important as it leads in high-tech industries and defense innovation. The California and Washington states have the world's most known technology companies and defense contractors, which specialize in electronic warfare systems. The expertise in artificial intelligence, cybersecurity, and satellite technology is driving the advancement of electronic warfare capabilities, ensuring that cutting-edge solutions are integrated into meeting evolving defense challenges.

Competitive Landscape:

Leading US-based key players of the electronic warfare market are innovating and developing strategic advancements to be relevant to the changing needs of the defense. Research and development investments are undertaken by these companies to create highly sophisticated systems that can adapt to today's combat challenges. Among such technologies, the development is given to real-time spectrum monitoring, AI-driven threat detection, and autonomous systems, which can enable effective efficiency and faster responses to the operational needs of military teams. Defense agencies' collaborations with other countries in the world and interoperability are being nurtured into integrated solutions to achieve the multi-domain compatible outcomes. Companies are modernizing their legacy systems and bringing forth integrated advanced capabilities for improving performance in complex scenarios. This builds up defense systems, positions the industry better in confronting emerging threats with superiority.

The report provides a comprehensive analysis of the competitive landscape in the U.S. electronic warfare market with detailed profiles of all major companies, including:

- Lockheed Martin Corporation

- L3Harris Technologies Inc.

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- Thales USA Inc.

Latest News and Developments:

- On 21st November 2024, RTX’s Raytheon announced a strategic collaboration with Terma across multiple defense areas, including electronic warfare. This partnership aims to advance innovative defense solutions and strengthen operational capabilities globally. By leveraging their combined expertise, the collaboration underscores their commitment to supporting modern defense and security requirements.

- On 4th September 2024, Northrop Grumman announced that its integrated viper electronic warfare suite has been approved for flight testing. Designed for advanced threat detection and countermeasures, this suite enhances survivability and mission success for military aircraft. This milestone reflects Northrop Grumman's commitment to delivering cutting-edge electronic warfare capabilities to support national defense and operational readiness.

- On 1st October 2024, Sivers Semiconductors has been awarded USD 5.6 Million from the Northeast Microelectronics Coalition (NEMC) Hub to advance critical chip technology. The funding will support collaboration with partners BAE Systems, MIT Lincoln Laboratory, and Columbia University to develop self-interference cancellation circuits for electronic warfare systems and commercial applications.

- On 18th September 2024, SRC, a not-for-profit company, has developed an electronic warfare payload, Ghost Mantis, that can be fitted onto uncrewed collaborative combat aircraft to counter emerging threats and provide expanded capability. It is designed to provide capabilities on affordable platforms while being modular and reconfigurable. It aims to enhance the capabilities of collaborative combat aircraft by detecting and emulating threats.

U.S. Electronic Warfare Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Capacities Covered | Electronic Protection, Electronic Support, Electronic Attack |

| Platforms Covered | Land, Naval, Airborne, Space |

| Regions Covered | Northeast, Midwest, South, West |

| Companies Covered | Lockheed Martin Corporation., L3Harris Technologies Inc., Northrop Grumman Corporation, Raytheon Technologies Corporation, Thales USA Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the U.S. electronic warfare market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the U.S. electronic warfare market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the U.S. electronic warfare industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Electronic warfare (EW) involves the use of electromagnetic spectrum technologies to monitor, disrupt, or neutralize enemy operations while ensuring secure communications and operational efficiency. Applications include military communication protection, radar jamming, threat detection, and support for multi-domain operations in air, land, naval, and space environments.

The U.S. electronic warfare market size is anticipated to reach USD 4.8 Million in 2025.

IMARC estimates the U.S. electronic warfare market to exhibit a CAGR of 4.60% during 2025-2033.

The market is driven by increased reliance on space-based assets, advancements in stealth and autonomous systems, and investments in cutting-edge technologies to counter evolving threats and ensure operational readiness. Strategic collaborations and a focus on multi-domain operations further support market growth.

Some of the major players in the U.S. electronic warfare market include Lockheed Martin Corporation., L3Harris Technologies Inc., Northrop Grumman Corporation, Raytheon Technologies Corporation, and Thales USA Inc., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)