United States Electronic Shelf Label Market Size, Share, Trends and Forecast by Type, Component, Technology, Application, and Region, 2025-2033

United States Electronic Shelf Label Market Size and Share:

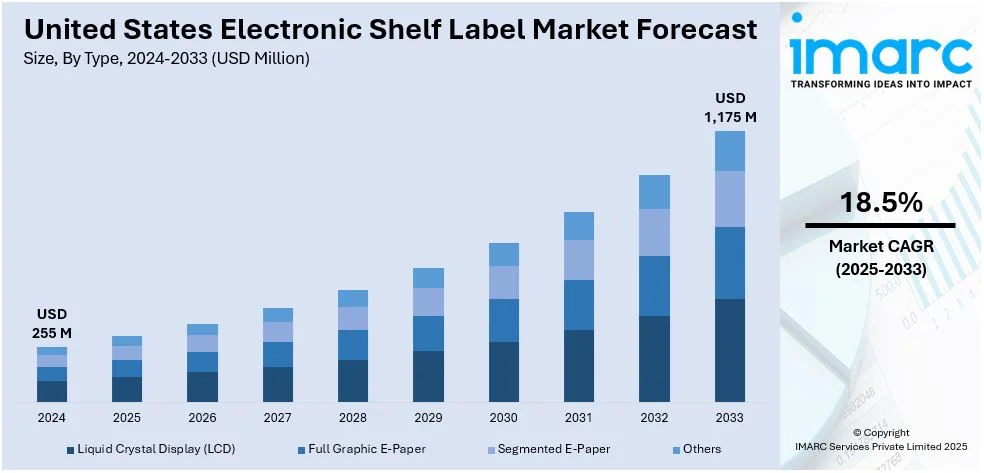

The United States electronic shelf label market size was valued at USD 255 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,175 Million by 2033, exhibiting a CAGR of 18.5% from 2025-2033. The market is propelled by the increasing demand for operational efficiency and cost reduction, rising adoption of IoT and wireless technologies in retail, growing need for real-time pricing and inventory management, shift toward contactless and digital shopping experiences, and expansion of smart retail and automated store solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 255 Million |

|

Market Forecast in 2033

|

USD 1,175 Million |

| Market Growth Rate (2025-2033) | 18.5% |

The United States electronic shelf label market is growing due to the increasing adoption of automation and digitalization in the retail sector. For instance, Walmart deployed a complete automation system in March 2021 for its Distribution Centers (DCs) and Fulfillment Centers (FCs) in Texas. Additionally, in April 2023, Walmart stated its intention to automate 65% of its retail locations by the end of 2026. In order to encourage the growth of the market, Walmart said in May 2023 that it will also install electronic shelf labels in 500 locations over the course of the upcoming 18 months. Besides this, the rising demand for real-time pricing accuracy, particularly in supermarkets, hypermarkets, and specialty stores, is a key driver of market growth.

The electronic shelf label market share is also propelled by technological advancements, such as wireless communication, IoT connectivity, and cloud-based platforms. According to the IMARC Group, the global IoT market size reached USD 1,022.6 Billion in 2024 and is projected to reach USD 3,486.8 Billion by 2033, exhibiting a CAGR of 14.6% during 2025-2033. Electronic shelf labels are gaining popularity among retailers due of their energy-efficient e-paper displays that come with higher readability and longer battery life. The increasing usage of analytics and data-driven decision-making tools also propels demand for electronic shelf labels, which provide rich customer and sales insights. The trend of personalized shopping experiences, supported by interactive electronic shelf labels, is also driving adoption in retail environments.

United States Electronic Shelf Label Market Trends:

Increased demand for operational efficiency

Increasing demand for operational efficiency in the United States retail market is a key trend driving the United States electronic shelf label market size. According to the IMARC Group, the United States retail market is projected to grow at a CAGR of 2.40% during 2024-2032. As retailers seek to cut costs and improve productivity, electronic shelf labels stand out as a valuable proposition that can automate price update processes, inventory management, and other changes of promotional information. The efficiency of electronic shelf labels results in reduced labor costs, enhanced accuracy on prices, and streamlined ways of managing the store. They also allow centralizing the price control, which makes the implementation of a consistent pricing strategy easier.

Adoption of IoT and wireless technologies

Integration of IoT and wireless communication technologies is one of the main trends that supports the adoption of electronic shelf labels in the United States. IoT-enabled electronic shelf labels make use of wireless technologies such as radiofrequency (RF), infrared (IR), and near-field communication (NFC) to enable smooth communication between the labels and central systems. They also provide real-time updates for price, promotion, and inventory levels across all the different stores. This keeps customers and personnel well-informed. IoT integration also provides an opportunity for retailers to gather valuable data regarding how products perform and more information about behavior trends and inventory channels that can be used to improve operations.

Shift toward contactless and digital shopping experiences

The shift toward contactless and digital shopping experiences is unprecedentedly picking up in the United States. Consumers increasingly prefer touchless experiences and, after the COVID-19 pandemic, are giving stores more opportunities to innovate with minimal touch. Electronic shelf labels serve an important purpose in that regard since they can update pricing and product information digitally without human intervention. They can also be integrated with mobile applications and in-store kiosks to allow consumers easy access to product information, promotions, and real-time updates. This follows the trend where consumers demand safer, more convenient, and technology-driven shopping experiences.

United States Electronic Shelf Label Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States electronic shelf label market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, component, technology, and application.

Analysis by Type:

- Liquid Crystal Display (LCD)

- Full Graphic E-Paper

- Segmented E-Paper

- Others

Affordability and effective display of dynamic content are making the LCD segment grow in the United States electronic shelf label market. They are known for their flexibility, offering clear, vibrant displays that cater to retail environments with frequent content changes. In the electronics and supermarket sectors, they are highly effective and provide a robust solution for efficient store management.

Full graphic E-paper labels are growing in popularity in the United States due to their ability to show high-quality, full-color images and detailed content with minimal power consumption. They have better readability even in bright environments and are well-suited for premium retail applications where aesthetics and clarity are of paramount importance. Long battery life and energy efficiency further enhance their market share.

Segmented E-paper labels are widely used in the US retail sector for their simplicity, energy efficiency, and cost-effectiveness. Generally, these labels display limited text or numerical information, making them suitable for environments such as grocery stores or pharmacies. Their ability to function with low energy consumption and maintain clear visibility even under direct light drives their popularity, particularly in large-scale deployments.

Analysis by Component:

- Hardware

- Software

Hardware comprises the physical components that electronic shelf label systems require, such as displays, communication modules, microcontrollers, and batteries. All these components are crucial to the functionality and performance of electronic shelf labels, supporting real-time price updates, energy efficiency, and durability, which are key requirements for retail applications.

The software segment represents platforms and solutions that manage and control electronic shelf labels. In this category, content management systems, cloud-based software, and integration with retail management systems are included. Software enables retailers to change product information, pricing, and promotions remotely and increases operational efficiency while providing a seamless user experience. It significantly drives electronic shelf label adoption.

Analysis by Technology:

- Radiofrequency

- Infrared

- NFC

- Others

Radiofrequency technology is widely used in the United States electronic shelf label market as it offers long-range communication and high reliability in large retail environments. Radiofrequency-based electronic shelf labels allow for smooth updates to pricing and inventory data on multiple shelves at once. The technology is preferred for its low power consumption, stability, and efficiency in managing large-scale deployments in stores.

Infrared technology is utilized in electronic shelf labels for short-range communication. It updates the price and information regarding the inventory with absolute accuracy and speed with much less interference. Though this technology is not as broadly used as radiofrequency, it offers benefits such as low consumption of energy and high-security data. It is applied in smaller, closer environments where close-range communications are sufficient.

Near field communication (NFC) technology in the electronic shelf label market enables easy, short-range data exchange between labels and devices such as smartphones or NFC-enabled price checkers. This technology improves consumer experience by offering rapid access to product information. NFC-enabled electronic shelf labels are being increasingly used in stores that are seeking to incorporate advanced customer interactions and enable personalized promotions through direct communication with consumer devices.

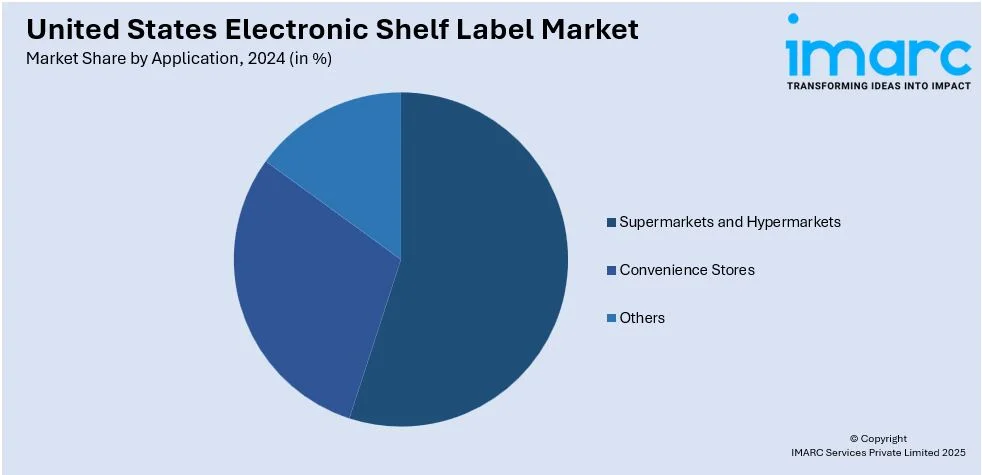

Analysis by Application:

- Supermarkets and Hypermarkets

- Convenience Stores

- Others

Supermarkets and hypermarkets use electronic shelf labels to manage dynamic pricing, promotions, and product information on large inventories in stores. Electronic shelf labels improve efficiency as they reduce manual price changes and update information in real time. They also enable clearer, up-to-date information on products, which helps streamline store management and increase sales in high-traffic retail environments.

Electronic shelf labels benefit convenience stores by allowing the quick update of several products' pricing and promotional information with limited effort. Electronic shelf labels assist in organizing business operations by ensuring correct prices, with a low cost of labor. They also have a compact design and low power consumption, making them suitable for convenience store operations, where high product turnover and changes in price often occur, to improve store efficiency and consumer satisfaction.

The others category comprises a wide range of retail environments, including pharmacies, specialty stores, and DIY outlets. Electronic shelf labels are widely adopted in these sectors for their ability to provide clear, dynamic pricing and real-time inventory updates. Their versatility and energy efficiency make them suitable for diverse applications, helping retailers manage pricing accuracy, customer engagement, and inventory control across various niche retail markets.

Regional Analysis:

- Northeast

- Midwest

- South

- West

Region-wise, the market has been classified into Northeast, Midwest, South, and West.

The Northeast region in the United States is one of the leading adopters of electronic shelf labels, given its high population and major retail chains. Thus, demand for operational efficiency and customer engagement through electronic shelf labels is high in cities such as New York and Boston. Retailers in this region are also early adopters of digital innovations.

Modest growth is witnessed in the market for electronic shelf labels in the Midwest as retailers seek ways to increase pricing accuracy and gain operative efficiency. Industry growth is also driven by the wide-ranging retail structures in the area, which include large-scale supermarkets and small convenience store franchises. Cost-effectiveness, combined with labor optimization, are other motivating factors for electronic shelf label adoption in this region.

The South is witnessing robust growth in the electronic shelf label market, as the retail industry in its states of Texas, Florida, and Georgia is booming. Electronic shelf labels are being used in supermarkets, hypermarkets, and other convenience stores for updating pricing, improving customer satisfaction, and efficient working mechanisms. Retailers are consequently investing in this technology to increase their efficiency in catering to the rising demand and high expectations from customers.

Competitive Landscape:

The key United States electronic shelf label market players are driving growth through strategic innovations and partnerships. They continuously increase their product offerings with sophisticated technologies such as improved battery life, cloud connectivity, and integration with retail management systems to support seamless pricing updates and inventory management. In addition, players are increasing their market reach by partnering with leading retailers, thus allowing for mass adoption of electronic shelf labels. Research and development (R&D) investments ensure that smart, scalable solutions continue to evolve to meet the growing demand for digital retail transformations.

The report provides a comprehensive analysis of the competitive landscape in the United States electronic shelf label market with detailed profiles of all major companies.

Latest News and Developments:

- 23 December 2024: Poland-based Neuroshop has launched a new line of cutting-edge electronic shelf labels in the United States and the Middle East that aim to completely transform customer experiences and improve in-store management. These new-generation electronic shelf labels are equipped with Online Backoffice and ERP integration, providing price updates in real time.

- 17 December 2024: The Fresh Market, a leading fresh food supermarket franchise in America, has announced a partnership with VusionGroup to introduce electronic shelf labels and digitized management of inventory for all of its retail locations across the country. By 2025, Vusion 360 solutions will be installed in every Fresh Market store, including VusionCloud and Memory Store Analytics.

- 8 August 2024: Ace Hardware, an Illinois-based hardware retail collective, has entered into a collaboration with VusionGroup to implement cutting-edge electronic shelf label solutions throughout its physical stores across the country. As part of this partnership, Ace Hardware will utilize the VusionCloud management software and the VusionOX IoT operating system to enable price updates in real-time.

- 6 June 2024: Walmart has announced the installation of electronic shelf labels in 2,300 of its physical stores by 2026. With this technology, Walmart employees will be able to update product prices in real time using mobile applications, improving efficiency and enhancing store management.

United States Electronic Shelf Label Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Liquid Crystal Display (LCD), Full Graphic E-Paper, Segmented E-Paper, Others |

| Components Covered | Hardware, Software |

| Technologies Covered | Radiofrequency, Infrared, NFC, Others |

| Applications Covered | Supermarkets and Hypermarkets, Convenience Stores, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States electronic shelf label market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States electronic shelf label market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States electronic shelf label industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

An electronic shelf label is a digital price tag used in retail environments to display product information, such as price, name, and barcode. It uses e-ink or LCD technology to update pricing and other details remotely, offering convenience, accuracy, and improved operational efficiency for retailers.

The United States electronic shelf label market was valued at USD 255 Million in 2024.

IMARC estimates the United States electronic shelf label market to exhibit a CAGR of 18.5% during 2025-2033.

The increased demand for contactless shopping experiences, rising labor costs and the need for operational efficiency, advancements in IoT and wireless communication technologies, growing emphasis on sustainability and energy efficiency, and expansion of retail chains and smart stores are the primary factors driving the United States electronic shelf label market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)