United States Electrical Steel Market Size, Share, Trends and Forecast by Type, Application, End Use Industry, and Region, 2026-2034

United States Electrical Steel Market Size and Share:

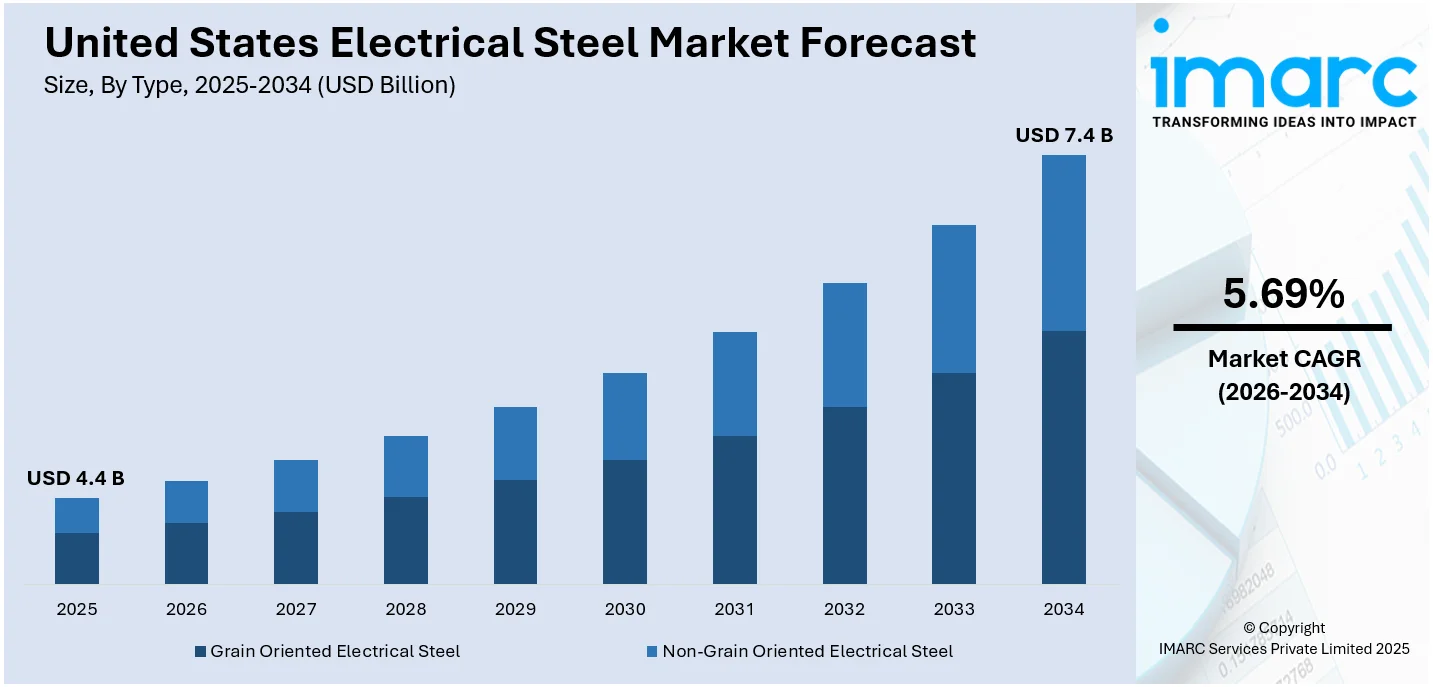

The United States electrical steel market size was valued at USD 4.4 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 7.4 Billion by 2034, exhibiting a CAGR of 5.69% from 2026-2034. Midwest currently dominates the market due to the growing emphasis on improving the efficiency of power transmission and distribution systems, rising shift towards renewable energy sources, and rapid advancements in material science and manufacturing processes represent some of the key factors bolstering the United States electrical steel market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 4.4 Billion |

| Market Forecast in 2034 | USD 7.4 Billion |

| Market Growth Rate 2026-2034 | 5.69% |

The rapid adoption of electric vehicles (EVs) in the U.S. is a key driver of electrical steel demand. EVs depend on high-performance motors that require non-grain-oriented electrical steel due to its magnetic efficiency and adaptability. As automakers expand their EV lineups and cleaner transportation is promoted nationwide, the demand for efficient electric motors continues to rise. Supporting this growth, infrastructure development is accelerating. As of February 2024, the U.S. had over 61,000 publicly accessible EV charging stations—more than double the number in 2020. This expansion directly increases demand for electrical steel, as transformers and grid components within charging networks rely heavily on it for optimal energy performance and reliability.

To get more information on this market Request Sample

The push toward renewable energy is significantly driving the U.S. electrical steel market. In 2024, the U.S. installed nearly 50 GW of solar capacity, accounting for 66% of new electricity-generating capacity. Wind turbines, solar inverters, and energy storage systems all rely on components that use electrical steel, particularly grain-oriented steel for transformers. As investments in sustainable power sources grow, there is an increasing demand for efficient energy conversion and transmission systems. Electrical steel plays a critical role in reducing energy loss and ensuring grid stability. This shift to cleaner energy not only boosts demand for electrical steel but also encourages innovation to meet the technical needs of next-generation power systems.

United States Electrical Steel Market Trends:

Expansion of Domestic Manufacturing Capacity

The increasing demand for electrical steel in the U.S. is fueling a tremendous increase in domestic production capacities. As energy-efficient products increase and electric cars (EVs) gain increasing prominence, the demand for high-performance electrical steel, particularly for uses such as EV motors and renewable energy systems, rises. As an illustration, ArcelorMittal is putting down $1.2 billion for a non-grain-oriented electric steel plant in Alabama and planning to make 150,000 metric tons each year. These types of factories will aid various industries, among which automotive, transport, and clean energy in general, electric motors and generators especially, figure prominently. By increasing domestic production, the U.S. can decrease its dependence on imports, improve its industrial foundation, and provide a stable supply of materials required for green energy technologies such as wind turbines, solar energy, and EV charging stations. This transition also aligns with the larger green energy transformation.

Technological Advancements in Steel Production

Technological innovation is transforming the U.S. electrical steel industry, especially with the creation of sophisticated steel grades with improved performance for energy-efficient use. The industry is emphasizing the enhancement of magnetic properties in electrical steel, including minimizing core losses and enhancing permeability, which is vital in applications such as transformers, electric motors, and renewable energy systems. Such improvements not only serve the growing demand for energy-saving products but also enable manufacturers to achieve compliance with changing regulatory norms. Consequently, research and development focus strongly on producing better electrical steel that maximizes energy use across various sectors such as EVs and renewable energy.

Impact of Trade Policies and Tariffs

Trade policies and tariffs have had a significant impact on the U.S. electrical steel market, impelling the rising costs for manufacturers. For example, the reinstatement of a 25% tariff on steel imports has increased steel prices, which could raise the average cost of producing a vehicle by over $1,500. Whereas these tariffs are intended to shield local steel production, they also create supply chain disruption and increase lead times for critical components involved in industries such as clean energy and automotive production. Manufacturers are thus being challenged to be cost-effective while fulfilling increased demand for advanced electrical steel. This transition still has an impact on production tactics and forces firms to seek creative solutions to reduce costs while providing a consistent supply of key materials.

United States Electrical Steel Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States Electrical Steel market, along with forecast at the regional levels from 2026-2034. The market has been categorized based on type, application, and end use industry.

Analysis by Type:

- Grain Oriented Electrical Steel

- Non-Grain Oriented Electrical Steel

Non-grain oriented (NGO) electrical steel holds the majority share of 73.2% in the U.S. market due to its versatility and widespread use in rotating machinery, such as motors and generators. Unlike grain-oriented steel, NGO steel has uniform magnetic properties in all directions, making it ideal for applications that require efficient energy conversion in dynamic systems. The rising demand for EVs, home appliances, and industrial machinery has significantly increased the need for this type of steel. Additionally, the push for energy efficiency and the transition toward electrification in transportation and manufacturing sectors further fuel its demand. Its adaptability across various industries makes NGO electrical steel a cornerstone material in modern energy and mobility solutions.

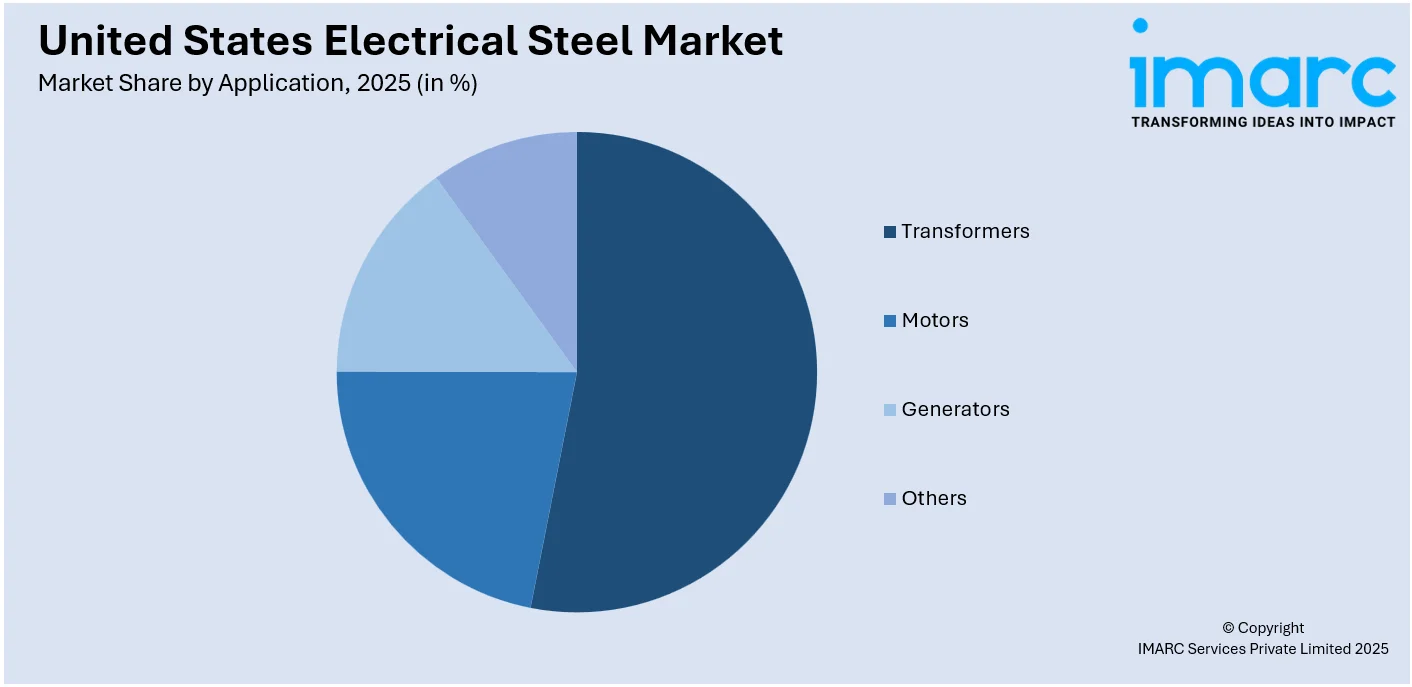

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Transformers

- Motors

- Generators

- Others

Based on the United States electrical steel market forecast, the transformers represent the largest share of 53.2% due to their widespread use in power generation, transmission, and distribution systems. Electrical steel is a vital component in transformer cores, where its magnetic properties help minimize energy loss and improve efficiency. With the ongoing modernization of the national grid, along with the expansion of renewable energy installations, there is a growing need for high-performance transformers that can handle fluctuating loads and ensure reliable energy flow. The shift toward energy-efficient infrastructure and stricter regulatory standards further drives demand for advanced electrical steel in transformers. Additionally, increased electrification in urban areas and the rise of EVs contribute to the growth of transformer deployment, solidifying their dominant market position.

Analysis by End Use Industry:

- Energy and Power

- Automobiles

- Household Appliances

- Building and Construction

- Others

The energy and power sector dominates market with 35.4% due to its critical need for high-efficiency magnetic materials used in power generation, transmission, and distribution. Electrical steel is essential in the manufacturing of transformers, generators, and motors, which are key components of the power grid. As the nation modernizes its aging infrastructure and shifts toward more sustainable energy sources, the demand for reliable and efficient electrical components continues to rise. The push for grid stability, energy efficiency, and reduced transmission losses further strengthens the reliance on electrical steel in this sector. Additionally, increased investment in renewable energy projects like wind and solar farms has amplified the need for electrical steel, reinforcing the sector’s dominant position in United States electrical steel market outlook.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Midwest leads the U.S. electrical steel market due to its long-standing industrial foundation, strategic location, and well-developed infrastructure. This region has a rich history in steel production, supported by a skilled and experienced workforce. Its central position in the country makes it ideal for efficient distribution and access to major manufacturing hubs. The transportation network, including railways and highways, further enhances logistics and supply chain capabilities. Additionally, the region continues to attract investments in advanced manufacturing technologies, which supports innovation in electrical steel production. These combined strengths make the Midwest a natural leader in the market, with strong connections to key industries like automotive, energy, and heavy equipment manufacturing.

Competitive Landscape:

The competitive landscape is characterized by intense innovation, strategic capacity expansion, and a focus on high-performance products. Key players compete by investing in research and development to improve the efficiency and quality of electrical steel, particularly for use in EVs, renewable energy systems, and smart grids. Market participants are also working to secure long-term supply chains and reduce reliance on imports. The growing emphasis on domestic manufacturing, supported by favorable policies, is shifting competitive dynamics. Additionally, collaboration with end-use industries and technological partnerships are common strategies used to enhance market presence and meet evolving industry standards for sustainability, efficiency, and energy performance.

The report provides a comprehensive analysis of the competitive landscape in the United States electrical steel market with detailed profiles of all major companies, including:

- AK Steel International B.V.

- Arnold Medical Technologies

- Cleveland-Cliffs Inc

- United States Steel Corporation

Latest News and Developments:

- March 2025: Hyundai Steel announce that it is planning to invest USD 5.8 billion to construct an Electric Arc Furnace-integrated steel mill in Louisiana. It will construct 2.7 million metric tons of steel a year with an emphasis on automotive steel. Production is planned for commercial launch in 2029, employing more than 1,300 workers.

- February 2025: ArcelorMittal proclaimed proposals to construct a USD 1.2 billion electrical steel plant in Alabama that will have an annual capacity to generate 150,000 metric tons of non-grain-oriented electrical steel. The project will start in late 2025 and commence production in 2027 and will create as many as 1,500 jobs and serve many industries.

- June 2024: JFE Steel announced that its JGreeX green steel was selected by Eaton Corporation for utilization in IT data center transformers. This marks the first application of JGreeX in the United States.

- March 2023: US Steel introduced InduX, a new non-grain oriented electrical steel for EVs, generators, and transformers with production for the USD 450 million project taking place at Big River Steel in Arkansas.

United States Electrical Steel Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Grain Oriented Electrical Steel, Non-Grain Oriented Electrical Steel |

| Applications Covered | Transformers, Motors, Generators, Others |

| End Use Industries Covered | Energy and Power, Automobiles, Household Appliances, Building and Construction, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Companies Covered | AK Steel International B.V., Arnold Medical Technologies, Cleveland-Cliffs Inc, United States Steel Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States electrical steel market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States electrical steel market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States electrical steel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States electrical steel market was valued at USD 4.4 Billion in 2025.

The United States electrical steel market was valued at USD 7.4 Billion in 2034 exhibiting a CAGR of 5.69% during 2026-2034.

Key factors driving the U.S. electrical steel market include increased demand for energy-efficient electrical devices, advancements in renewable energy technologies, growth in electric vehicles, and rising industrial automation. Additionally, government regulations promoting energy efficiency and investments in infrastructure development further support market expansion.

Some of the major players in the United States electrical steel market include AK Steel International B.V., Arnold Medical Technologies, Cleveland-Cliffs Inc, United States Steel Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)