United States Electric Car Market Size, Share, Trends and Forecast by Type, Vehicle Class, Vehicle Drive Type, and Region, 2026-2034

United States Electric Car Market Size and Share:

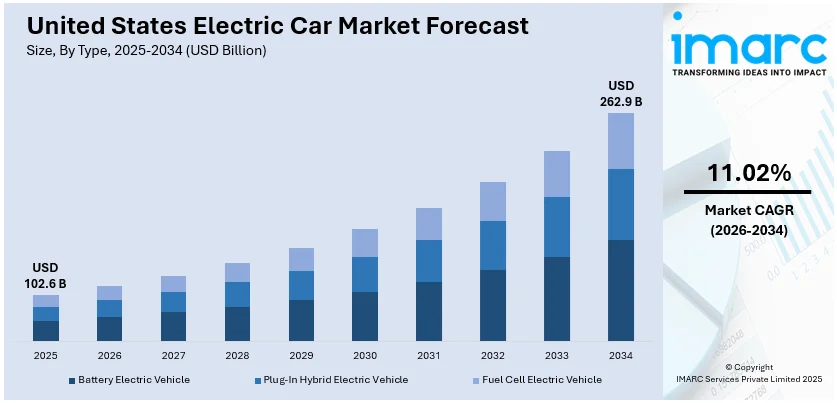

The United States electric car market size was valued at USD 102.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 262.9 Billion by 2034, exhibiting a CAGR of 11.02% from 2026-2034. The market is witnessing significant growth, fueled by government incentives, the rapid expansion of charging infrastructure, and continuous advancements in battery technology. Increasing consumer demand for sustainable and cost-efficient transportation, combined with diverse model availability, positions the market for continued expansion and innovation across various segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 102.6 Billion |

| Market Forecast in 2034 | USD 262.9 Billion |

| Market Growth Rate (2026-2034) | 11.02% |

Government incentives and regulatory measures are significant drivers of the U.S. electric car market. Federal and state incentives, such as tax credits, rebates, and grants, help lower the initial cost of electric vehicles (EVs), making them more accessible and appealing to consumers. For instance, according to the Internal Revenue Service, fuel cell EV or plug-in EV purchased during 2023-2032 are eligible for clean vehicle tax credit up to USD 7,500. Furthermore, regulations like fuel efficiency standards and zero-emission vehicle mandates compel manufacturers to expand EV offerings. Investments in charging infrastructure through programs such as the Bipartisan Infrastructure Law further support market growth. These initiatives not only expedite the shift toward sustainable transportation but also strengthen the market position of electric vehicles, making them more competitive with traditional internal combustion engine vehicles.

To get more information on this market Request Sample

Extensive benefits of ownership of electric cars in U.S. market and heightening customer awareness regarding environmental issues are fueling need in this evolving market. For instance, according to the United States Environmental Protection Agency, transportation contributes approximately 28% of total greenhouse gas (GHG) emissions in the United States, making it the nation's largest source of GHG emissions. Moreover, buyers are increasingly prioritizing lower operational costs, reduced carbon footprints, and advanced technologies, such as connectivity and autonomous features, offered by EVs. Improved battery technology, delivering longer range and faster charging, addresses key concerns like range anxiety, further strengthening consumer interest. Automakers are also responding with diverse EV models at varying price points, catering to a wide spectrum of preferences and needs, thus fueling market expansion.

United States Electric Car Market Trends:

Increasing Adoption of Electric SUVs

The U.S. electric vehicle market growth is heavily impacted by notable surge in need for electric SUVs, propelled by customer demands for versatile, spacious vehicles. Automotive firms are responding by offering a wide range of electric SUV models, providing competitive costs, proliferated range, and innovative features. This trend caters to the magnifying popularity of SUVs in the expanded automotive industry and highlights their appeal to outdoor enthusiast as well as families. In addition, with beneficial government incentives and enhanced charging infrastructure, the electric SUV segment is projected to witness significant expansion, further fortifying its role in the shift towards sustainable transportation. For instance, in September 2024, Audi of America unveiled its new SUV car line Audi Q6 e-tron, a technologically enhanced battery electric vehicle, which is set to launch before 2024 end.

Expansion of Charging Infrastructure

The rapid expansion of charging infrastructure is a significant trend driving the U.S. EV market value, addressing range anxiety and enhancing convenience for EV users. Public and private sector investments are driving the installation of fast-charging stations across urban and rural areas, enabling long-distance travel and improving accessibility. For instance, BP, a major oil and gas company, is planning to invest around USD 1 billion in EV fast-charging points across the U.S. by 2030. In addition, initiatives like the National Electric Vehicle Infrastructure (NEVI) program aim to create a nationwide network of chargers, accelerating EV adoption. Enhanced charging technologies, such as ultra-fast and wireless charging, are also emerging, reflecting the market's commitment to improving user experience and supporting growth.

Advancements in Battery Technology

Rapid innovations in battery technology are notably reshaping the electric vehicle market in the United States by significantly escalating vehicle range, improving performance, and lowering costs. The development of upgraded lithium-ion chemistries and enhanced solid-state batteries offer prospects for quicker charging times, better energy density, and prolonged operational lifespans. Such advancements are establishing EVs as more competitive with conventional internal combustion vehicles, incentivizing purchases across diverse customer sections. Additionally, efforts to localize battery production and secure raw materials domestically are addressing supply chain challenges, ensuring long-term growth. As battery efficiency and affordability improve, they remain a critical driver of the market's evolution. For instance, as per industry reports, new policies in the U.S. have mandated EV batteries to retain 80% of their initial charge capability after 8 years of utilization. In line with this, in January 2025, researchers at Dalhousie University, in partnership with the Canadian Light Source, reported to develop single-crystal electrode, a revolutionary material for Li-ion battery. This material exhibited durability with more than 20,000 charging cycles before attaining threshold of 80% capacity.

United States Electric Car Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States electric car market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on type, vehicle class, and vehicle drive type.

Analysis by Type:

- Battery Electric Vehicle

- Plug-In Hybrid Electric Vehicle

- Fuel Cell Electric Vehicle

Battery electric vehicle dominate the U.S. electric car market by type, owing to their zero-emission nature and extensive support from government incentives and infrastructure development. BEVs' increasing range capabilities, falling battery costs, and robust manufacturer investments have further strengthened their position. In addition, with no reliance on internal combustion engines, BEVs appeal to environmentally conscious consumers, contributing to their substantial market share. As charging networks expand and technological advancements continue, BEVs are projected to maintain leadership in the electric vehicle segment. For instance, as per industry reports, 1.3 million BEVs were sold across the U.S. in 2024, accounting for 8% of total market share of approximately 16 million vehicles sales across powertrain segment.

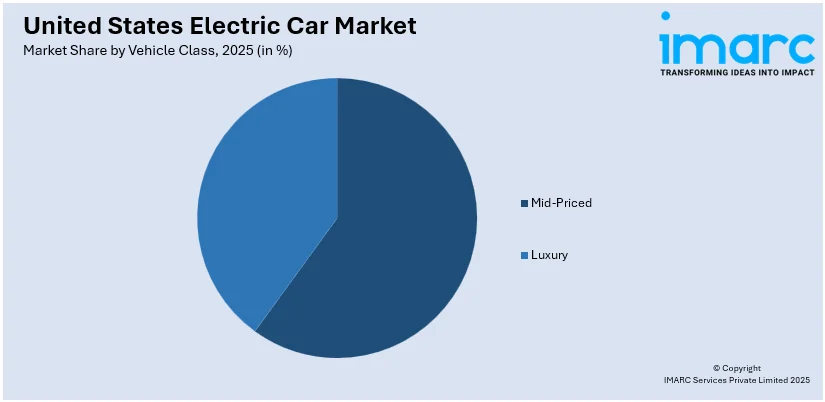

Analysis by Vehicle Class:

Access the comprehensive market breakdown Request Sample

- Mid-Priced

- Luxury

Mid-priced electric vehicles dominate the U.S. market by vehicle class, offering an ideal balance between cost-effectiveness and cutting-edge features. This segment caters to a broad customer base, offering competitive pricing without compromising on performance, range, or safety. In addition, with manufacturers focusing on expanding options in this category, mid-priced EVs have become accessible to middle-income consumers, accelerating adoption. The availability of tax incentives and financing options further supports the prominence of mid-priced EVs in the market. For instance, as per industry reports, several U.S-based automotive companies are actively striving to produce and launch affordable electric cars. Several upcoming EVs priced at USD 35,000 or less are expected to hit the market in the next few years (2025, 2026, and beyond), with models from Tesla, Ford, and Jeep leading the way. In line with this, the Kia EV3 is anticipated to have an initial pricing of approximately USD 35,000 when it launches in the U.S. post 2025. The effective pricing could be lowered to approximately USD 27,500 if it qualifies for the federal EV tax credit, making it a more affordable option for users.

Analysis by Vehicle Drive Type:

- Front Wheel Drive

- Rear Wheel Drive

- All-Wheel Drive

Front-wheel drive (FWD) electric vehicles lead the electric car market share in United States by drive type due to their cost-efficiency, practicality, and suitability for urban environments. FWD configurations offer enhanced traction and stability, especially in everyday driving conditions, making them a preferred choice for commuters. Furthermore, manufacturers favor FWD designs for their simplicity and lower production costs, which translate to more affordable options for buyers. As demand for versatile and accessible EVs grows, FWD vehicles continue to dominate this segment. For instance, in September 2024, GM announced launch of Chevy Blazer EV across the United States. This electric car is available in front-wheel drive variant and will be commercially available by the end of 2024.

Region Analysis:

- Northeast

- Midwest

- South

- West

The Western region holds the largest market share in the U.S. electric car market, driven by strong adoption in states like California, Oregon, and Washington. For instance, according to the Government of California, 34% of the total zero-emission vehicles sold across the U.S. are sold in California. Moreover, favorable policies, robust charging infrastructure, and high consumer environmental awareness contribute significantly to this dominance. The region's progressive regulations, such as zero-emission vehicle mandates, encourage manufacturers to prioritize EV sales. Additionally, the presence of key EV manufacturers and a tech-savvy population accelerates adoption. High urbanization rates and shorter commutes further support the region's leadership in EV market penetration, establishing the West as a critical hub for sustainable transportation in the United States.

Competitive Landscape:

The U.S. electric car market features a highly competitive landscape with established automakers like Tesla, General Motors, and Ford competing alongside international giants such as Volkswagen and Hyundai. For instance, as per industry reports, EVs market share in United States stood at 8.9% during the quarter of 2024, with General Motors exhibiting a 60% elevation in its sales, in comparison to Ford's 12% increase. Furthermore, several startups also contribute to innovation, driving technological advancements and product diversification. In addition, companies are actively focusing on expanding EV portfolios, improving battery performance, and enhancing affordability to capture market share. Strategic partnerships, investments in charging infrastructure, and localized manufacturing further intensify competition. Additionally, as regulatory pressures increase and consumer preferences shift, market players are emphasizing sustainability, performance, and cost-effectiveness to maintain a competitive edge.

The report provides a comprehensive analysis of the competitive landscape in the United States electric car market with detailed profiles of all major companies, including:

- Tesla

- Hyundai Group (incl. Kia)

- General Motors

- Ford Motor Company

- Volkswagen Group

- Rivian

- BMW

- Mercedes-Benz

- Volvo-Polestar

- Nissan

Latest News and Developments:

- In January 2025, Hyundai Motor America announced the availability of its electric cars on Amazon Autos, the largest U.S-based e-commerce company, making it the only car brand to offer direct vehicle procurements to its U.S. customers through this platform.

- In December 2024, General Motors, a U.S-based electric car developer, and ChargePoint revealed plans to boost EV infrastructure expansion across U.S. by collaboratively installing ultra-fast charging ports at strategic regions.

- In November 2024, Volkswagen announced significant investment of USD 5.8 billion under the joint venture initiative with Rivian, a U.S.-based electric cars startup. This collaboration with the companies in expanding and advancing their EVs business.

- In October 2024, Ford, U.S.-based automotive giant, announced plans to leverage its India-based production facility for manufacturing EVs for global market. Ford is planning to resume its operation in India to utilize the nation's expertise as a manufacturing hub.

United States Electric Car Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Battery Electric Vehicle, Plug-In Hybrid Electric Vehicle, Fuel Cell Electric Vehicle |

| Vehicle Classes Covered | Mid-Priced, Luxury |

| Vehicle Drive Types Covered | Front Wheel Drive, Rear Wheel Drive, All-Wheel Drive |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States electric car market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States electric car market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States electric car industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States electric car market was valued at USD 102.6 Billion in 2025.

The key factors driving the market include government incentives and regulations, technological advancements, changing consumer preferences, and the expansion of charging infrastructure. Additionally, environmental concerns and the desire for lower operating costs are influencing the shift towards electric vehicles.

IMARC estimates the United States electric car market to exhibit a CAGR of 11.02% during 2026-2034.

Battery Electric Vehicle accounted for the largest market share by type.

Tesla, Hyundai Group (incl. Kia), General Motors, Ford Motor Company, Volkswagen Group, Rivian, BMW, Mercedes-Benz, Volvo-Polestar, Nissan.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)