U.S. Edge Computing Market Size, Share, Trends and Forecast by Component, Organization Size, Vertical, and Region, 2025-2033

U.S. Edge Computing Market Size and Share:

The U.S. edge computing market size is anticipated to reach USD 7.2 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 46.2 Billion by 2033, exhibiting a CAGR of 23.7% from 2025-2033. The market is witnessing notable expansion, influenced by elevating need for real-time data processing, low-latency solutions, and IoT expansion. Moreover, crucial segments like retail, healthcare, and manufacturing are leveraging edge technologies to improve operational efficacy, data safety, and adherence with transforming privacy policies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2025 | USD 7.2 Billion |

| Market Forecast in 2033 | USD 46.2 Billion |

| Market Growth Rate (2025-2033) | 23.7% |

U.S. Edge Computing Market Analysis:

- Major Drivers: The magnifying dependence on real-time applications across manufacturing, healthcare, and finance drives U.S. edge computing market growth, addressing minimal latency requirements. Edge computing mitigates delays by facilitating local data processing, which is requisite for crucial applications including predictive maintenance, telemedicine, and financial transactions, establishing it as essential technology for operational efficacy.

- Key Market Trends: The exponential emergence in data generated by AI, machine learning, and big data analytics significantly boosts edge computing utilization. By distributing computational workloads closer to data sources, edge computing helps businesses reduce bandwidth utilization and streamline resources, positioning it as crucial enabler for enterprises seeking to leverage data-comprehensive technologies for enhanced U.S. edge computing market analysis capabilities.

- Market Challenges: Implementation complexity and high initial infrastructure costs present significant challenges for organizations adopting edge computing solutions. Additionally, ensuring data security and compliance across distributed edge networks requires sophisticated management tools and expertise, creating barriers particularly for small and medium enterprises looking to leverage edge technologies effectively in competitive market environments.

- Market Opportunities: The rapid proliferation of 5G networks creates substantial opportunities for U.S. edge computing market share expansion, enabling ultra-low latency applications including autonomous vehicles, AR/VR, and IoT implementations. Furthermore, increasing emphasis on data privacy compliance drives demand for localized processing solutions, presenting growth opportunities across healthcare, finance, and government sectors.

The magnifying dependence on real-time applications is a chief driver for United States edge computing market demand. Major sectors such as manufacturing, healthcare, and finance are rapidly opting for edge solutions to address the need for minimal latency in data processing applications. For instance, in October 2024, IBM launched Granite 3.0, featuring high-performing AI models designed for business. Granite Guardian 3.0 elevates AI safety, while new Mixture-of-Experts models facilitate effective inference with low latency, making them ideal for CPU-based implementations and edge computing applications. Furthermore, edge computing mitigates delays by facilitating local processing of data, which is requisite for crucial cases, such as predictive maintenance, telemedicine, and financial transactions. This capability to foster dependable and quick data analysis is establishing edge computing as a key technology for consumer satisfaction as well as operational efficacy.

.webp)

To get more information on this market, Request Sample

The exponential emergence in data generated by upgraded applications, including big data analytics, artificial intelligence (AI), and machine learning (ML), is significantly boosting the utilization of edge computing in the United States. Such applications demand quick data processing and substantial computational power to function efficiently. In addition, by distributing computational workloads closer to data sources, edge computing aid various businesses lower bandwidth utilization and streamline resources. This cost-effectiveness and adaptability position edge computing as a crucial enabler for enterprises seeking methods to utilize the full potential of data-comprehensive technologies. For instance, in July 2024, NTT Data, a global technology company with headquarters located in the U.S., launched its latest Edge AI platform to bolster OT/IT integration by converging AI-based processing to the edge.

U.S. Edge Computing Market Trends:

Amplifying Adoption of IoT Devices

The magnifying expansion of IoT devices in wide range of sectors is a major trend boosting the U.S. edge computing market. Various businesses are actively opting for edge computing to process data closer to IoT endpoints, improving real-time decision-making abilities and minimizing latency. Furthermore, this is particularly crucial for applications in healthcare services, smart cities, and industrial automation, where rapid data processing is requisite. Furthermore, the accelerating employment of IoT-based devices is encouraging several firms to leverage edge solutions for enhanced versatility and operational efficacy. For instance, in July 2024, VIA Technologies joined forces with Rutronik, an electrical company with robust presence and subsidiary in the U.S., to expand access to computer vision, edge AI, and cutting-edge IoT solutions across commerce, industrial, and retail segments. As demand for real-time processing grows, VIA’s MediaTek Genio-powered platforms address diverse edge computing needs with reduced latency, supporting the rising adoption of edge technology.

Rapid Proliferation of 5G Networks

The heightened deployment of 5G networks is revolutionizing the edge computing domain in the United States. For instance, as per industry reports, in North America, 5G accounts for 37% of all wireless connections in 2024. 5G facilitates minimized latency and swift data transfer speeds, establishing edge computing solutions as more effective for critical applications such as autonomous vehicles, augmented reality (AR), and virtual reality (VR). In addition, telecom operators are increasingly collaborating with edge solution firms to improve network abilities, offering new prospects for advancements. Furthermore, the synergy between edge computing and 5G is anticipated to reshape several industries by allowing real-time, seamless data processing.

Heightened Emphasis on Data Privacy and Compliance

As data privacy policies become stringent, several enterprises are shifting towards edge computing to guarantee adherence while sustaining operational efficacy. By locally processing the critical and sensitive data, edge solutions significantly lower the risks related to transmission of data to centralized cloud servers. As a result, this approach not only mitigates privacy challenges but also improves data security, specifically for crucial segments such as government, healthcare, and finance. In addition, the amplifying focus on safe data management and adherence is bolstering the utilization of edge computing across the United States. For instance, Utah's Consumer Privacy Act, effective December 31, 2023, applies to businesses earning over USD 25 million annually and either handling data for more than 100,000 consumers or deriving over 50% revenue from selling data of over 25,000 consumers.

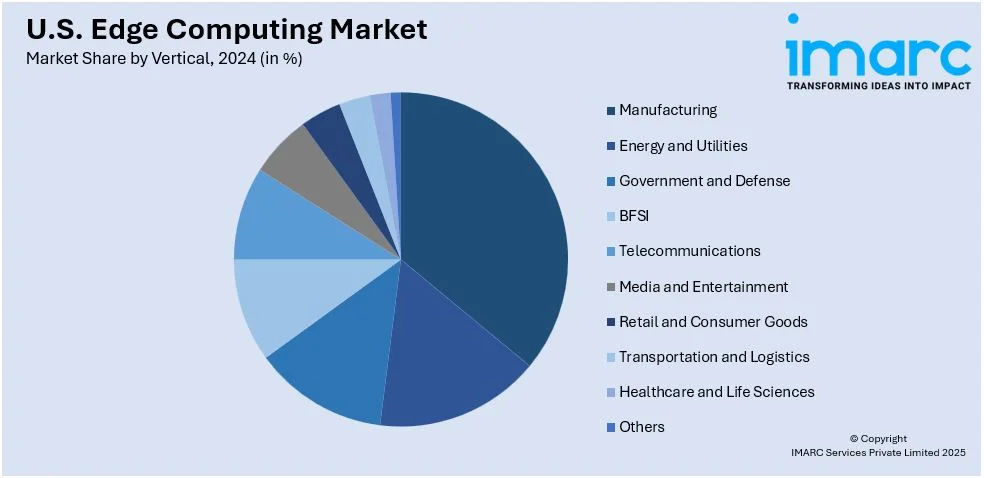

U.S. Edge Computing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the U.S. edge computing market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on component, organization size, and vertical.

Analysis by Component:

- Hardware

- Software

- Services

The hardware segment dominates the U.S. edge computing market, encompassing devices such as edge servers, gateways, and sensors. These components play a crucial role in processing and storing data locally, minimizing latency and reducing dependency on centralized data centers. Furthermore, increasing adoption across industries like manufacturing, healthcare, and retail drives the demand for robust hardware solutions. Advancements in compact, energy-efficient designs further enhance their appeal. As edge computing applications expand, the hardware market share is expected to grow steadily, underpinned by continuous innovation and the rising need for reliable edge infrastructure.

The software segment holds a significant share in the U.S. edge computing market, driven by the need for platforms that enable efficient data management, analytics, and application deployment at the edge. Key solutions include edge orchestration, virtualization, and AI-driven software that optimize real-time data processing. Moreover, industries increasingly rely on edge software for seamless integration with cloud systems and IoT networks. Additionally, this segment benefits from the rapid development of scalable and customizable solutions, making it integral to edge computing deployments across various sectors.

The services segment is a critical component of the U.S. edge computing market, covering consulting, deployment, and managed services. Enterprises are increasingly relying on expert guidance to design and implement edge infrastructure tailored to their specific needs. Besides, managed services, including monitoring and maintenance, ensure optimal performance and security of edge systems. In addition, this segment is experiencing growth due to the complexity of edge deployments and the rising demand for cost-effective, scalable solutions. As businesses seek to maximize returns on edge investments, the services market continues to expand.

Analysis by Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

Small and medium-sized enterprises (SMEs) represent a growing segment in the U.S. edge computing market, driven by the need for cost-effective, scalable solutions to enhance operational efficiency. SMEs are increasingly leveraging edge computing to process data locally, enabling faster decision-making and reducing reliance on centralized infrastructure. This technology supports resource optimization and enables SMEs to adopt IoT and AI-based applications within budget constraints. Additionally, edge computing offers improved data security, a critical concern for smaller organizations navigating stringent compliance requirements, thereby boosting its adoption in this segment.

Large enterprises dominate the U.S. edge computing market due to their significant investments in advanced technologies and infrastructure. These organizations utilize edge computing to support complex applications, such as AI-driven analytics, autonomous systems, and industrial IoT. By processing data closer to its source, large enterprises achieve reduced latency, enhanced real-time performance, and robust data security. Moreover, the scalability and reliability of edge solutions also align with the extensive operational demands of these businesses, particularly in sectors like manufacturing, healthcare, and finance, where efficiency and compliance are paramount.

Analysis by Vertical:

- Manufacturing

- Energy and Utilities

- Government and Defense

- BFSI

- Telecommunications

- Media and Entertainment

- Retail and Consumer Goods

- Transportation and Logistics

- Healthcare and Life Sciences

- Others

The manufacturing sector holds a substantial share of the U.S. edge computing market. Increasing adoption of smart factories and Industry 4.0 technologies has spurred demand for edge solutions to enable real-time data processing, predictive maintenance, and efficient operations. Besides this, edge computing helps manufacturers reduce latency in automated processes and ensures data security within production environments. This technology also supports advanced robotics, quality control, and supply chain optimization, making it an essential tool for improving productivity and competitiveness in the industry.

Edge computing is transforming the energy and utilities sector by enabling efficient real-time monitoring and management of distributed assets. The sector relies on edge solutions for applications such as smart grids, renewable energy integration, and predictive maintenance of infrastructure. By processing data locally, utilities can reduce latency and improve responsiveness, ensuring uninterrupted services. Additionally, edge computing aids in optimizing energy usage and ensuring compliance with regulatory standards, enhancing operational efficiency and reliability in energy distribution and generation.

The government and defense vertical is leveraging edge computing to enhance national security, disaster response, and public services. Edge solutions enable real-time data analysis for mission-critical operations, including surveillance, threat detection, and border control. Moreover, by processing sensitive information locally, edge computing ensures data confidentiality and faster decision-making. In defense, the technology supports autonomous vehicles, advanced communication systems, and battlefield intelligence, while government agencies utilize it to improve efficiency in service delivery and infrastructure management.

The BFSI sector utilizes edge computing to enhance customer experience, fraud detection, and risk management. Real-time processing of financial data ensures quicker transactions, reduced latency, and improved compliance with stringent data privacy regulations. Edge solutions enable banks and financial institutions to personalize services, process payments faster, and secure sensitive customer information. Additionally, insurance companies leverage edge computing for efficient claims processing and risk assessment, making it a valuable asset for operational excellence in BFSI.

The telecommunications sector is a major adopter of edge computing, driven by the rollout of 5G networks and the demand for ultra-low latency applications. Edge solutions support enhanced network performance, efficient bandwidth usage, and seamless delivery of services such as video streaming, AR/VR, and IoT applications. Furthermore, by processing data closer to users, telecom providers can reduce congestion and improve customer experience. This technology also plays a critical role in network virtualization and optimizing the deployment of next-generation communication infrastructure.

The media and entertainment industry is leveraging edge computing to enhance content delivery, live streaming, and gaming experiences. By processing data locally, edge solutions reduce buffering, latency, and bandwidth requirements, ensuring seamless performance for end-users. This technology also supports augmented and virtual reality applications, enabling innovative and immersive content. Additionally, with rising demand for high-quality digital experiences, edge computing has become integral to ensuring fast, reliable, and efficient delivery of media and entertainment services.

The retail and consumer goods sector is adopting edge computing to enhance customer engagement, inventory management, and supply chain efficiency. Edge solutions enable real-time analytics for personalized marketing, dynamic pricing, and improved point-of-sale experiences. Moreover, by processing data locally, retailers can ensure faster decision-making and optimize in-store operations. Edge computing also supports smart shelves, automated checkout systems, and predictive inventory planning, helping businesses streamline operations and improve customer satisfaction.

Edge computing is reshaping the transportation and logistics industry by providing route optimization, real-time tracking, and predictive maintenance of fleets. Local data processing reduces latency in critical applications such as autonomous vehicles and traffic management systems. Additionally, edge solutions improve warehouse operations, ensuring efficient inventory handling and supply chain transparency. By enhancing operational efficiency and safety, edge computing is becoming a cornerstone for innovation in transportation and logistics.

The healthcare and life sciences sector is a key adopter of edge computing, utilizing it for telemedicine, remote monitoring, and real-time diagnostic applications. Edge solutions process sensitive patient data locally, ensuring compliance with stringent privacy regulations and enhancing data security. This technology enables faster decision-making in critical care scenarios and supports advanced applications such as AI-driven diagnostics, wearable health devices, and robotic surgeries. Edge computing is crucial for improving patient outcomes and driving innovation in healthcare delivery.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region holds a notable share in the U.S. edge computing market, driven by its dense population centers and thriving industries like finance, healthcare, and education. The region's focus on data privacy and compliance fosters the adoption of edge solutions for secure, real-time processing. Major metropolitan areas such as New York and Boston serve as hubs for advanced technological deployment, with businesses leveraging edge computing to reduce latency and improve operational efficiency. In addition, the presence of tech-savvy enterprises further accelerates regional growth and innovation in edge computing applications.

The Midwest region’s market share in the U.S. edge computing market is bolstered by its expanding manufacturing and logistics industries. The region's focus on smart factory solutions and industrial IoT adoption has amplified the demand for edge computing to enable real-time data analytics and automation. Furthermore, states like Illinois and Michigan are leading in edge adoption, leveraging the technology for predictive maintenance and supply chain optimization. The region’s increasing reliance on edge computing further supports operational efficiency and scalability, ensuring its competitive advantage in critical industrial sectors.

The South commands a significant share of the U.S. edge computing market, driven by rapid advancements in energy, healthcare, and retail sectors. States like Texas and Florida are key contributors, adopting edge technologies to enhance operational agility and meet growing demands for localized data processing. The region’s diverse economy, coupled with investments in smart city projects, fosters edge adoption to enable real-time decision-making. Additionally, the South’s business-friendly environment and infrastructure improvements further support the expansion of edge computing solutions across various industries.

The West region plays a significant role the U.S. edge computing market due to its prominence in technology and innovation. Home to Silicon Valley and key technology firms, states like California and Washington drive the development and adoption of cutting-edge edge computing solutions. Industries such as entertainment, autonomous vehicles, and cloud services benefit from the region’s focus on low-latency, high-performance data processing. Moreover, the West’s commitment to sustainability also promotes edge computing for efficient resource management, cementing its role as a leader in this market segment.

Competitive Landscape:

The market is represented by intensified competition among major industry players, encompassing innovative startups, technology leaders, and cloud service firms. Leading companies are dominating the market with advanced edge solutions incorporated into their workspaces. In addition, emerging companies are actively emphasizing on niche segments, typically including real-time analytics and IoT applications. Furthermore, acquisitions and collaborations are extremely prevalent tactics to proliferate market foothold and improve abilities. Moreover, the heightening requirement for low-latency solutions across key sector is boosting technological innovations and facilitating strategic partnerships among stakeholders. For instance, in October 2024, Duos Edge AI formed a tactical partnership with Accu-Tech to bolster the implementation of edge computing ecosystem across the U.S. This move is expected to facilitate increased proliferation of edge computing abilities, catering to the amplifying need for enhanced connectivity and low-latency data processing in untapped markets.

The report provides a comprehensive analysis of the competitive landscape in the U.S. edge computing market with detailed profiles of all major companies.

U.S. Edge Computing Market News:

- In September 2025, ADLINK Technology launches a new portfolio of industrial computing platforms powered by Intel® Core™ 200S series processors. Covering Mini-ITX, ATX, PICMG 1.3, COM-HPC, and edge AI systems, these platforms deliver enhanced AI performance, energy efficiency, and I/O flexibility. Equipped with PCIe Gen5, DDR5, and Intel® UHD Graphics, they are optimized for industrial automation, robotics, transportation, gaming, medical imaging, and other edge AI applications, even in harsh environments.

- In September 2025, Premio launched the JCO-1000-ORN, a rugged, fanless edge AI computer powered by NVIDIA Jetson Orin NX and Nano modules, designed for harsh industrial environments. Supporting real-time AI inferencing, it operates from -20°C to 55°C and delivers up to 157 TOPS performance. Compatible with NVIDIA JetPack SDK 6.2, it features multiple I/O, modular expansion, and optional remote management. Model A is available now, while Model B, optimized for camera-rich applications, launches in Q4 2025.

- In July 2024, An Edge AI platform that is ultralight and fully managed was introduced by NTT DATA with the goal of accelerating IT/OT convergence for manufacturing and industrial applications. By combining data from sensors, gadgets, and systems into a single data plane, it makes on-premises, real-time AI choices possible. The platform increases operational efficiency and lowers complexity and costs by using small, task-specific AI models. Supported by data scientists and managed services from NTT DATA, it tackles edge computing and shadow IoT issues while streamlining AI adoption.

- In October 2024, ZEDEDA, a U.S.-based edge infrastructure company, and OnLogic, a U.S.-based industrial computer firm, partnered to introduce OnLogic Powered by ZEDEDA, a solution integrating OnLogic's durable industrial hardware with ZEDEDA's cloud-native edge orchestration software. This collaboration delivers a robust platform enabling enterprises to scale, maintain, and deploy edge computing workloads securely and efficiently.

- In February 2024, Casey’s General Stores Inc., a U.S.-based convenience store chain, collaborated with Acumera Reliant Platform to aid its edge computing and digital transformation ventures. Acumera will use its edge expertise to facilitate an expandable technology across 2600 locations or more in the U.S.

U.S. Edge Computing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services |

| Organization Sizes Covered | Small and Medium-sized Enterprises (SMEs), Large Enterprises |

| Verticals Covered | Manufacturing, Energy and Utilities, Government and Defense, BFSI, Telecommunications, Media and Entertainment, Retail and Consumer Goods, Transportation and Logistics, Healthcare and Life Sciences, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the U.S. edge computing market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the U.S. edge computing market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the U.S. edge computing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Edge computing refers to processing data closer to its source or end-users rather than relying on centralized cloud systems. This approach minimizes latency, enhances real-time data analysis, and reduces bandwidth use. It is widely applied in IoT devices, autonomous vehicles, healthcare, and smart city infrastructure.

The U.S. edge computing market size is anticipated to reach USD 7.2 Billion in 2025.

IMARC estimates the U.S. edge computing market to exhibit a CAGR of 23.7% during 2025-2033.

The market is driven by increasing demand for real-time data processing, advancements in IoT applications, and the proliferation of 5G technology. Additionally, growing adoption of edge solutions in industries like healthcare, manufacturing, and retail enhances operational efficiency and supports data-driven decision-making.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)