United States E-Learning Market Size, Share, Trends and Forecast by Technology, Provider, and Application, and Region, 2026-2034

United States E-Learning Market Summary:

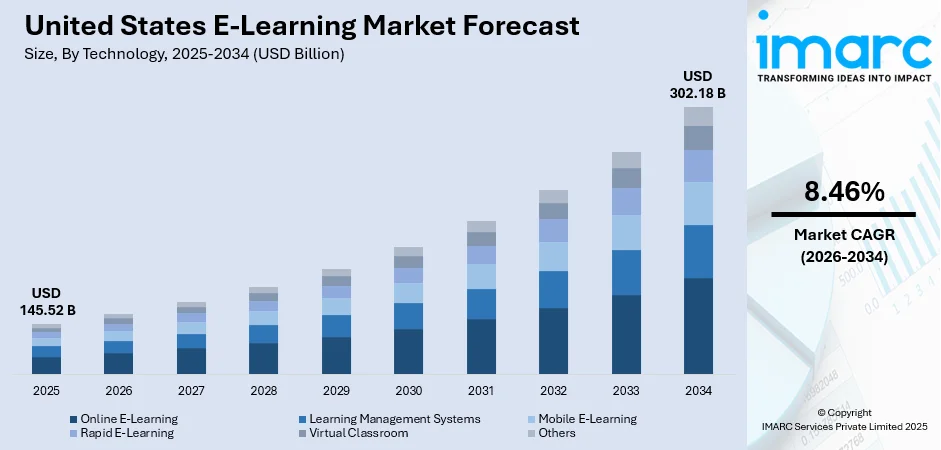

The United States e-learning market size was valued at USD 145.52 Billion in 2025 and is projected to reach USD 302.18 Billion by 2034, growing at a compound annual growth rate of 8.46% from 2026-2034.

The United States e-learning market is rapidly expanding, fueled by widespread adoption of digital learning technologies in schools, universities, and corporate organizations. Increased high-speed internet access and smart device usage have enabled seamless online education delivery. Educational institutions are leveraging advanced learning management systems to provide flexible, accessible courses to diverse learners. Simultaneously, growing focus on professional development and workforce upskilling drives enterprises to implement comprehensive e-learning solutions, further boosting the U.S. e-learning market.

Key Takeaways and Insights:

-

By Technology: Online e-learning dominates the market with a share of 28.72% in 2025, driven by the flexibility and accessibility of web-based educational platforms enabling learners to access content remotely.

-

By Provider: Content leads the market with a share of 60.08% in 2025, owing to the increasing demand for interactive and engaging educational materials tailored to various learning objectives and curricula.

-

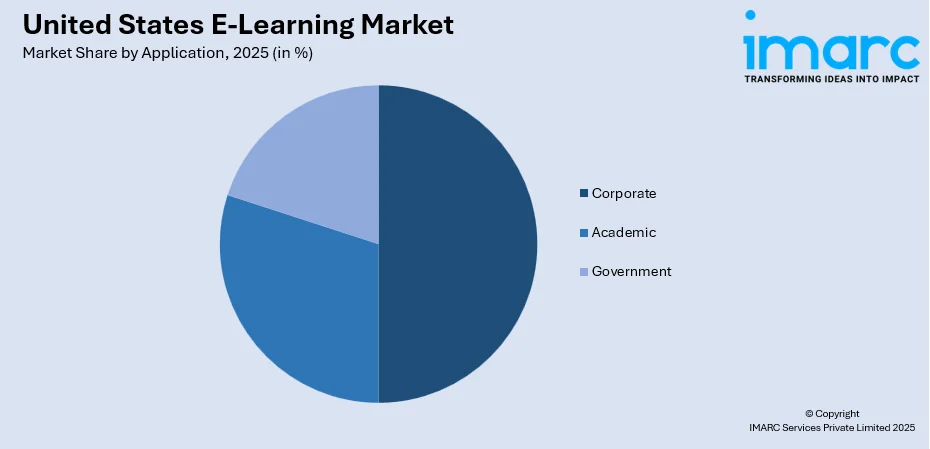

By Application: Corporate represents the largest segment with a market share of 50% in 2025, driven by the growing emphasis on employee skill development and compliance training programs.

-

Key Players: The United States e-learning market exhibits a fragmented competitive landscape with established technology providers and specialized content developers competing across diverse educational segments through strategic partnerships and platform innovations.

To get more information on this market Request Sample

The United States e-learning market is experiencing transformative growth as digital education solutions become integral to academic and professional development ecosystems. Educational institutions across K-12 and higher education segments are increasingly embracing virtual learning environments to enhance student engagement and accommodate diverse learning preferences. For example, the Northside Independent School District in Texas is accelerating the launch of a virtual high school program for the 2026 school year to expand access to online learning under a new state law, highlighting how local education agencies are operationalizing virtual education at scale. The integration of artificial intelligence and machine learning technologies is enabling personalized learning pathways that adapt to individual learner needs and performance patterns. Corporate and government organizations are adopting e-learning platforms to deliver scalable, consistent training. Advanced technologies like virtual reality, augmented reality, and gamification create immersive experiences, enhancing knowledge retention, learner engagement, and overall workforce competency.

United States E-Learning Market Trends:

Integration of Artificial Intelligence and Adaptive Learning Technologies

The United States e-learning market is witnessing accelerated adoption of artificial intelligence-powered learning solutions that deliver personalized educational experiences. Adaptive learning platforms utilize sophisticated algorithms to analyze learner behavior patterns and customize content delivery accordingly. For example, Udemy reported in Q2 2025 that its “AI‑assisted role‑play and automated assessments” features are reshaping learner engagement and helping enterprise clients scale personalized training across global workforces. These intelligent systems provide real-time feedback and recommendations that optimize learning outcomes while reducing time-to-competency for diverse learner populations across academic and corporate training environments.

Rise of Immersive Learning Through Extended Reality Technologies

Extended reality technologies encompassing virtual reality and augmented reality are transforming traditional e-learning paradigms by creating immersive educational environments. These technologies enable learners to engage with complex concepts through interactive simulations and three-dimensional visualizations. For instance, in January 2025, AR/VR education company zSpace unveiled its Imagine Learning Solution, a headset‑free AR/VR laptop platform designed to bring immersive learning experiences into elementary classrooms across the United States, demonstrating how extended reality is being operationalized in K‑12 education. Educational institutions and corporate training departments are increasingly deploying extended reality solutions to enhance practical skill development in technical disciplines where hands-on experience is essential.

Expansion of Microlearning and Mobile-First Learning Solutions

The growing preference for bite-sized learning content accessible through mobile devices is reshaping e-learning content development strategies across the United States. Microlearning modules deliver focused educational content in concise formats that accommodate busy professional schedules and varied attention spans. For example, in September 2025, Whatfix launched AI Agents, including an Authoring Agent that uses natural‑language prompts to automate instructional content creation, helping organizations generate microlearning and just‑in‑time training directly within enterprise applications. Mobile-optimized learning platforms are enabling seamless access to educational resources across multiple devices, thereby supporting continuous learning initiatives and just-in-time knowledge acquisition.

Market Outlook 2026-2034:

The United States e-learning market is positioned for sustained growth as digital transformation continues to reshape educational and professional development landscapes. Technological innovations in artificial intelligence, cloud computing, and immersive technologies are expected to create increasingly sophisticated and engaging learning experiences. The continued emphasis on workforce development and lifelong learning across industries will sustain demand for scalable e-learning solutions. The market generated a revenue of USD 145.52 Billion in 2025 and is projected to reach a revenue of USD 302.18 Billion by 2034, growing at a compound annual growth rate of 8.46% from 2026-2034.

United States E-Learning Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Technology |

Online E-Learning |

28.72% |

|

Provider |

Content |

60.08% |

|

Application |

Corporate |

50% |

Technology Insights:

- Online E-Learning

- Learning Management Systems

- Mobile E-Learning

- Rapid E-Learning

- Virtual Classroom

- Others

The online e-learning dominates with a market share of 28.72% of the total United States e-learning market in 2025.

Online e-learning includes a wide array of digital educational platforms and tools accessible via internet-connected devices, allowing learners to engage with course materials and interactive content anytime, anywhere. Its growth is supported by widespread high-speed broadband access and increasingly advanced web-based learning interfaces. These platforms enable multimedia content delivery, real-time collaboration, and interactive learning experiences, making education more flexible, engaging, and accessible for diverse learner groups across academic, professional, and corporate settings.

The expansion of online e-learning is driven by the growing adoption of cloud-based infrastructure, which provides seamless content accessibility and scalable solutions for educational institutions and corporate training programs. Integrated advanced analytics within these platforms allow educators and trainers to monitor learner progress, assess engagement, and refine instructional strategies based on performance insights. This combination of cloud technology and data-driven learning enhances the effectiveness, flexibility, and reach of digital education across diverse learner populations.

Provider Insights:

- Services

- Content

The content leads with a share of 60.08% of the total United States e-learning market in 2025.

The content provider segment encompasses the development and distribution of educational materials including courses, curricula, assessments, and multimedia learning resources tailored to various academic and professional disciplines. According to reports, in September 2025, NetDragon Websoft highlighted its AI Content Factory, a scalable AI‑driven platform for adaptive content production, when it showcased its education technology solutions at UNESCO’s Digital Learning Week, demonstrating how AI is being used to generate culturally adaptive learning resources at scale.

Content providers are increasingly focusing on creating engaging and interactive materials that incorporate video lectures, simulations, and gamified elements to enhance learner engagement and knowledge retention. The demand for high-quality educational content is driven by the growing emphasis on competency-based learning and the need for regularly updated materials that reflect evolving industry standards and technological advancements. Content providers are leveraging artificial intelligence to develop adaptive learning materials that personalize educational pathways based on individual learner profiles and performance metrics.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Academic

- K-12

- Higher Education

- Vocational Training

- Corporate

- Small and Medium Enterprises

- Large Enterprises

- Government

The corporate dominates with a market share of 50% of the total United States e-learning market in 2025.

The corporate application segment is witnessing robust growth as organizations increasingly recognize the strategic value of continuous employee development in maintaining competitive advantage. Corporate e-learning solutions enable standardized training delivery across geographically distributed workforces while providing flexibility for employees to complete learning modules according to their schedules and learning preferences. For example, AInative corporate elearning platform Mindsmith raised a $4.1 million seed round in November 2025 to accelerate its enterprise footprint and product development, highlighting investor confidence in nextgeneration AIdriven training solutions tailored to corporate needs.

Large enterprises are increasingly adopting comprehensive learning management systems that integrate with human resource platforms to monitor employee skill development and align training programs with organizational competency frameworks. The growing need to meet regulatory compliance standards and professional certification requirements across industries further drives investment in corporate e-learning infrastructure. By leveraging these systems, companies can deliver targeted training, ensure workforce upskilling, and maintain industry standards, reinforcing both employee performance and organizational growth in a structured, scalable manner.

Regional Insights:

- Northeast

- Midwest

- South

- West

The Northeast region demonstrates strong e-learning adoption driven by the concentration of prestigious educational institutions and corporate headquarters in states like New York and Massachusetts. The region benefits from advanced digital infrastructure and a highly educated workforce that embraces technology-enabled learning solutions for continuous professional development.

The Midwest region is experiencing growth in e-learning adoption fueled by manufacturing, healthcare, and logistics sector reskilling programs. Community colleges and vocational training institutions in this region are increasingly leveraging digital learning platforms to deliver workforce development programs aligned with evolving industry requirements.

The South holds the largest share of the United States e-learning market, driven by substantial digital infrastructure investments and high participation in K-12 and higher education programs. Populous states including Texas, Florida, and Georgia are experiencing rapid e-learning adoption supported by state-sponsored initiatives and corporate upskilling programs.

The West region serves as the epicenter for e-learning technology innovation, with Silicon Valley leading developments in artificial intelligence-powered learning platforms and extended reality educational solutions. The region hosts the largest concentration of edtech startups and established technology companies driving advancements in adaptive learning and immersive educational technologies.

Market Dynamics:

Growth Drivers:

Why is the United States E-Learning Market Growing?

Increasing Demand for Flexible and Accessible Learning Solutions

The growing preference for flexible learning alternatives that accommodate diverse schedules and learning preferences is significantly driving the United States e-learning market expansion. Professionals seeking to advance their careers and students pursuing educational opportunities increasingly favor online learning platforms that enable self-paced study and remote access to quality educational content. For example, the Alamo Colleges District announced the creation of a School for Online Learning in November 2025 to unify and expand access to more than 160 online programs under a coordinated framework designed to support working adults, parents, and others needing flexible educational options. The proliferation of mobile devices and widespread internet connectivity has democratized access to educational resources, enabling learners from various demographic and geographic backgrounds to participate in digital learning programs.

Rising Corporate Investment in Employee Training and Development

Organizations across industries are significantly increasing their investments in employee training and development programs delivered through e-learning platforms. The rapid pace of technological change and evolving skill requirements are compelling enterprises to implement scalable training solutions that ensure workforce competencies remain aligned with business objectives. For example, in July 2025 the U.S. Departments of Education and Labor implemented a Workforce Development Partnership to integrate federal education and workforce systems, streamline federally funded adult education and career technical training programs, and enhance support for digital and online training initiatives nationwide. E-learning platforms enable cost-effective delivery of standardized training content to distributed workforces while providing analytics capabilities to measure learning outcomes and demonstrate return on training investments. The emphasis on regulatory compliance and professional certification requirements is further driving corporate adoption of digital learning management systems.

Technological Advancements Enhancing Learning Experiences

Continuous technological innovation is transforming e-learning experiences through the integration of artificial intelligence, virtual reality, and advanced analytics capabilities. These technologies enable personalized learning pathways that adapt to individual learner needs, immersive simulations that enhance practical skill development, and data-driven insights that optimize instructional effectiveness. For example, in November 2025 Lenovo partnered with immersive learning firm VR Vision to develop AI‑augmented VR training solutions that deliver adaptive, data‑driven learning experiences for workforce training in sectors like manufacturing and automotive, illustrating how enterprises are deploying cutting‑edge tech to elevate digital learning. Cloud computing infrastructure supports seamless content delivery and collaborative learning environments while ensuring scalability to accommodate growing user bases. The convergence of these technologies is creating increasingly sophisticated and engaging learning experiences that rival or surpass traditional educational delivery methods.

Market Restraints:

What Challenges the United States E-Learning Market is Facing?

Digital Divide and Infrastructure Disparities

Persistent disparities in internet connectivity and access to digital devices across different regions and socioeconomic groups present significant challenges to equitable e-learning adoption. Rural and underserved communities often lack the high-speed broadband infrastructure necessary for seamless participation in bandwidth-intensive online learning experiences. Addressing these infrastructure gaps requires substantial investment and coordinated efforts from public and private stakeholders.

Concerns Regarding Learning Effectiveness and Engagement

Questions persist regarding the effectiveness of e-learning in achieving learning outcomes comparable to traditional face-to-face instruction. Maintaining learner engagement and motivation in digital environments remains challenging, particularly for extended educational programs requiring sustained focus and discipline. The absence of direct interpersonal interaction can impact collaborative learning experiences and the development of soft skills that benefit from in-person practice.

Quality Assurance and Credentialing Challenges

Ensuring consistent quality across diverse e-learning offerings and establishing credible assessment mechanisms remain ongoing challenges for the market. The proliferation of online courses and credentials has created concerns about standards validation and employer recognition of digital certifications. Developing robust quality assurance frameworks that maintain educational integrity while preserving the flexibility advantages of e-learning requires continued attention from accreditation bodies and industry stakeholders.

Competitive Landscape:

The United States e-learning market exhibits a dynamic competitive landscape characterized by the presence of established technology conglomerates, specialized educational content providers, and innovative startup ventures. Market participants are differentiating their offerings through technological innovation, content quality, and strategic partnerships with educational institutions and corporate clients. Leading players are investing significantly in artificial intelligence and analytics capabilities to enhance personalization and demonstrate measurable learning outcomes. Consolidation activity through mergers and acquisitions is enabling market leaders to expand their product portfolios and strengthen their market positions across diverse educational segments.

Recent Developments:

- In May 2025, Udemy (NASDAQ: UDMY) has launched its Innovation Studio, a strategic initiative to accelerate personalized, immersive, AI‑powered skilling experiences and prototype new learning modalities. Its first program, AI for Business Leaders, targets executive reskilling and reflects Udemy’s evolution toward outcome‑oriented, adaptive workforce learning.

United States E-learning Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Online E-Learning, Learning Management Systems, Mobile E-Learning, Rapid E-Learning, Virtual Classrooms, Others |

| Providers Covered | Services, Content |

| Applications Covered |

|

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The United States e-learning market size was valued at USD 145.52 Billion in 2025.

The United States e-learning market is expected to grow at a compound annual growth rate of 8.46% from 2026-2034 to reach USD 302.18 Billion by 2034.

Online e-learning holds the largest technology share at 28.72%, driven by the flexibility and accessibility of web-based learning platforms that enable remote content access.

Key factors driving the United States e-learning market include increasing demand for flexible learning solutions, rising corporate investment in employee training, technological advancements in AI and immersive technologies, and expanding internet connectivity.

Major challenges include digital divide and infrastructure disparities across regions, concerns regarding learning effectiveness and engagement in virtual environments, quality assurance and credentialing complexities, and cybersecurity risks associated with digital learning platforms.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)