United States E-Invoicing Market Report by Channel (B2B, B2C, and Others), Deployment Type (Cloud-based, On-premises), Application (Energy and Utilities, FMCG, E-Commerce, BFSI, Government, and Others), and Region 2025-2033

Market Overview:

The United States e-invoicing market size reached USD 3,850.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 19,140.0 Million by 2033, exhibiting a growth rate (CAGR) of 18.20% during 2025-2033. The increasing adoption of remote working models that necessitate digital solutions for business processes, rising demand for quicker and transparent transactions, and the growing adoption by BFSI sector are among the key factors driving the United States e-invoicing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3,850.0 Million |

| Market Forecast in 2033 | USD 19,140.0 Million |

| Market Growth Rate (2025-2033) | 18.20% |

United States E-invoicing Market Analysis:

- Major Drivers: The increasing adoption of remote working models necessitating digital business process solutions drives significant market demand. Rising regulatory compliance requirements and transparency standards compel organizations to implement e-invoicing systems. Growing BFSI sector adoption minimizes fraud risks and enhances operational security for financial transactions effectively.

- Key Market Trends: Digital transformation acceleration across industries promotes widespread e-invoicing adoption for streamlined operations. Cloud-based deployment preferences increase due to scalability, cost-effectiveness, and accessibility benefits thus supporting the United States e-invoicing market growth. Integration with advanced technologies like AI, blockchain, and ML enhances invoice processing accuracy and security.

- Market Challenges: Initial implementation costs and system integration complexities pose barriers for small enterprises adopting e-invoicing solutions. Data security concerns and cyber threat risks create hesitation among businesses handling sensitive financial information. Legacy system compatibility issues complicate smooth transition processes.

- Market Opportunities: Based on the United States e-invoicing market analysis, the government digitization initiatives create substantial growth opportunities for e-invoicing solution providers nationwide. SME segment expansion offers untapped potential for customized, affordable e-invoicing platforms. Emerging technologies integration presents opportunities for enhanced automation and intelligence capabilities.

E-invoicing is a process of sending and receiving invoices between the supplier and a consumer in the digital format. It is the planned system wherein business-to-business (B2B) invoices are electronically prepared and authenticated by the goods and services tax network (GSTN). It relies on cloud-based solutions that improve accuracy and data quality, prevent delayed payments, and accelerate invoice-processing time. It also aids in tracking business transactions and lowering the cost incurred in system design, implementation, training, maintenance, and customization.

The increasing adoption of remote working models that necessitate digital solutions for business processes, including invoicing, which makes e-invoicing more relevant, is strengthening the growth of the market in the United States. Moreover, the escalating demand for quicker, transparent transactions is driving the need for e-invoicing to meet the customer expectations effectively in the country. In addition, the growing adoption of e-invoicing in the banking, financial services and insurance (BFSI) industry to minimize the incidences of fraud and data breaches is influencing the market positively in the country. Apart from this, the increasing preference for self-service in all aspects of transactional interactions is propelling businesses operating in the country to adopt e-invoicing solutions that offer this feature. Furthermore, the rising number of companies constantly striving to improve internal efficiency is catalyzing the demand for e-invoicing that helps reduce manual efforts and errors.

United States E-invoicing Market Trends/Drivers:

Increase in regulatory compliance

One of the significant factors driving the demand for e-invoicing in the US is the increasing need for regulatory compliance. Government agencies are setting stricter standards for financial transactions, emphasizing transparency, accuracy, and real-time reporting. E-invoicing enables businesses to meet these standards effectively. By automating the invoicing process, companies can ensure that their financial records are precise and up to date. This streamlined approach not only helps in audit trails but also in compliance with tax regulations, ultimately reducing the risks associated with manual errors and fraud.

Rise in operational efficiency

Another important factor is the pursuit of operational efficiency. Traditional paper-based invoicing can be cumbersome, slow, and prone to human error. E-invoicing automates many of the steps involved, from creation to settlement, which reduces the time it takes to complete these tasks. This automation leads to faster payment cycles, improved cash flow, and a decrease in administrative costs. Companies who adopt e-invoicing often find that they can reallocate resources to more strategic areas of their business, thereby improving overall productivity and profitability.

United States E-invoicing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States e-invoicing market report, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on channel, deployment type, and application.

Breakup by Channel:

To get more information on this market, Request Sample

- B2B

- B2C

- Others

B2B represents the most popular distribution channel

The report has provided a detailed breakup and analysis of the market based on the channel. This includes B2B, B2C, and others. According to the report, B2B represented the largest market segment. In B2B, e-invoicing involves the digital exchange of invoices between companies. Both the sender and the receiver generally have accounting systems that can generate, send, and receive invoices electronically. This allows for an automated reconciliation process, speeding up payment and reducing errors. B2B e-invoicing is highly beneficial for large enterprises that deal with a high volume of transactions, as it streamlines the accounts payable and accounts receivable processes. The secure nature of e-invoicing platforms also ensures the integrity and confidentiality of financial information between businesses.

B2C e-invoicing is a bit different, as it is geared towards the public rather than businesses. In this model, businesses send electronic invoices directly to the consumer, typically via email or through a customer portal on the website of the company. These invoices often come in accessible formats like PDF and may include options for online payment, making it convenient for consumers to settle their bills. B2C e-invoicing is increasingly popular in industries like retail, utilities, and healthcare.

Breakup by Deployment Type:

- Cloud-based

- On-premises

Cloud-based account for the majority of the market share

A detailed breakup and analysis of the market based on the deployment type has also been provided in the report. This includes cloud-based and on-premises. According to the report, cloud-based accounted for the largest market share. Cloud-based e-invoicing solutions are hosted on remote servers and accessed via the internet. Users can send, receive, and manage invoices from any device that has an internet connection, providing a high degree of flexibility and mobility. Cloud-based platforms are typically subscription-based and handle all the backend maintenance, security, and updates, which frees businesses from the need to maintain hardware and software on-site. This type of deployment scales easily, which makes it ideal for businesses that experience fluctuating volumes of invoicing. The use of cloud-based e-invoicing solutions is generally quicker to implement, less resource-intensive, and more cost-effective for small to medium-sized businesses.

On-premises e-invoicing solutions are installed and run from servers located within the organization's physical location. This gives the organization complete control over its invoicing data and processes, which can be crucial for businesses that deal with sensitive or highly regulated information. Customization is another key advantage; on-premises solutions can be tailored to fit specific business needs, including integration with existing systems.

Breakup by Application:

- Energy and Utilities

- FMCG

- E-Commerce

- BFSI

- Government

- Others

E-commerce hold the largest share in the market

The report has provided a detailed breakup and analysis of the market based on the application. This includes energy and utilities, FMCG, e-commerce, BFSI, government, and others. According to the report, e-commerce accounted for the largest market share. E-invoicing is an integral part of e-commerce, which enhances operational efficiency and customer experience. E-invoicing automates the billing process, allowing for immediate invoicing as soon as a purchase is made. This results in quicker payment cycles and improved cash flow for businesses. Additionally, e-invoices can be easily tracked and managed, which provides valuable data for accounting and auditing purposes. They are also more secure and less prone to errors compared to manual invoicing methods.

E-invoicing in the energy and utilities sector can be a game-changer, particularly in terms of operational efficiency and customer relations. These businesses often deal with a large volume of invoices for various services like electricity, gas, and water. E-invoicing enables quick, accurate billing and offers consumers an easy way to pay online. For utility providers, the electronic system simplifies the tracking of payments and usage, which is crucial for demand forecasting and resource allocation. E-invoicing also aids in regulatory compliance, a vital aspect in this highly regulated industry.

The fast-moving consumer goods (FMCG) industry often involves complex supply chains and high volumes of transactions. E-invoicing helps in streamlining these processes by enabling real-time updates and quick reconciliations. The automation of invoicing reduces the scope for errors and fraud, improving both efficiency and reliability. It also allows for better data analytics, enabling companies to make more informed decisions related to inventory management, seasonal trends, and customer preferences.

Government organizations are increasingly adopting e-invoicing to improve transparency, accountability, and efficiency in public spending. This technology aids in reducing paperwork, thus cutting down on administrative costs. It also facilitates faster approval workflows and payment cycles. Moreover, e-invoicing in government sectors helps in maintaining a higher level of compliance and allows for easier monitoring and auditing.

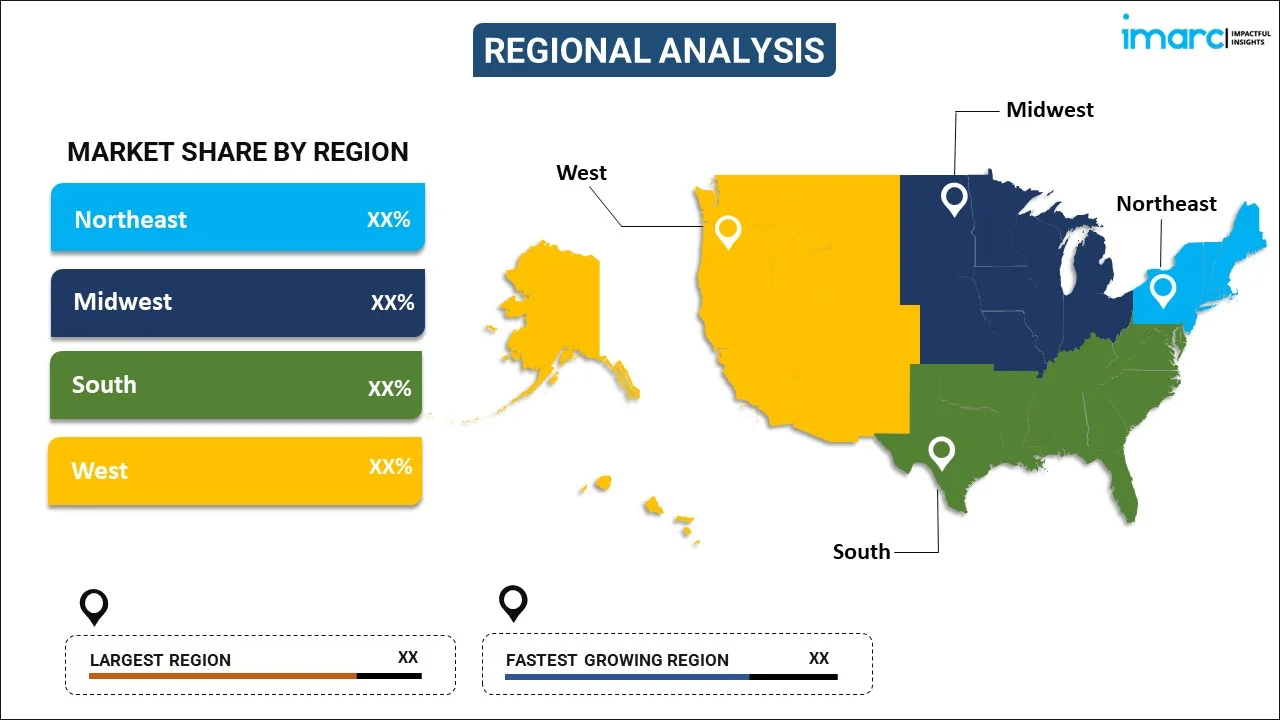

Breakup by Region:

- Northeast

- Midwest

- South

- West

South exhibits a clear dominance, accounting for the largest e-invoicing market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include the Northeast, Midwest, South, and west. According to the report, South accounted for the largest market share.

The increasing number of small and medium-sized enterprises (SMEs) that need more efficient invoicing solutions represents one of the primary factors driving the demand for e-invoicing in the South US. Moreover, the rising adoption of e-invoicing as a green solution that minimizes paper waste due to the growing environmental consciousness among the masses is influencing the market positively in the region. Besides this, the increasing complexity of supply chains, particularly in industries like manufacturing and retail, that necessitates the use of e-invoicing for better accuracy and tracking is bolstering the market growth in the region.

Competitive Landscape:

Leading players are incorporating advanced technologies, such as blockchain, artificial intelligence (AI), machine learning (ML), and the internet of things (IoT) in e-invoicing systems to ensure data integrity and security. It also provides an immutable ledger that records all transactions, which makes it nearly impossible to alter or forge invoices. These advancements also automate the reconciliation process, identify anomalies, and even predict payment behaviors and helps in examining through vast amounts of data to provide actionable insights, streamlining invoice management, and reducing the scope for human errors. These technological solutions can identify patterns in invoicing and payments and assist businesses forecast their financials better and can alert them to potential issues like late payments or irregularities that may suggest fraud.

The market research report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

United States E-invoicing Market News:

- In August 2024, Ecosio, a top supplier of e-invoicing and EDI, was acquired by Vertex, Inc. in order to improve worldwide compliance and streamline business-to-business transactions. Through the integration, a scalable platform for Continuous Transaction Controls, VAT reporting, and jurisdictionally compliant e-invoicing will be created. Vertex's global reach is increased, compliance procedures are streamlined, and global expansion is supported by the move. With additional earn-outs, the deal has an initial investment of $69 million and is anticipated to close by Q3 2024.

- In January 2024, The Digital Business Networks Alliance (DBNAlliance), a nonprofit, launched a U.S. e-invoicing exchange network to streamline B2B document exchange. Using a four-corner model, the network connects suppliers, buyers, and service providers, improving efficiency, accuracy, and security in invoicing. DBNAlliance sets standards, policies, and guidelines, supporting access points. With over 30 members, including major energy, supply chain, and life sciences companies, the alliance aims to simplify electronic document exchange and enhance B2B payments.

United States E-invoicing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Channels Covered | B2B, B2C, Others |

| Deployment Types Covered | Cloud-Based, On-Premises |

| Applications Covered | Energy and Utilities, FMCG, E-Commerce, BFSI, Government, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States E-invoicing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States e-invoicing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States e-invoicing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States e-invoicing market was valued at USD 3,850.0 Million in 2024.

We expect the United States e-invoicing market to exhibit a CAGR of 18.20% during 2025-2033.

The rising need for transparency in invoicing, along with the growing adoption of e-invoicing, as it helps in reducing human errors and processing time, while increasing data quality and invoice accuracies, is primarily driving the United States e-invoicing market.

The sudden outbreak of the COVID-19 pandemic has led to the escalating deployment of e-invoicing, owing to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of various products and services.

Based on the channel, the United States e-invoicing market can be segmented into B2B, B2C, and others. Currently, B2B holds the largest market share.

Based on the deployment type, the United States e-invoicing market has been divided into cloud-based and on-premises, where cloud-based currently exhibits a clear dominance in the market.

Based on the application, the United States e-invoicing market can be categorized into energy and utilities, FMCG, e-commerce, BFSI, government, and others. Currently, e-commerce accounts for the majority of the total market share.

On a regional level, the market has been classified into Northeast, Midwest, South, and West, where South currently dominates the United States e-invoicing market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)