United States Drones Market Size, Share, Trends and Forecast by Type, Component, Payload, Point of Sale, End Use Industry, and Region, 2026-2034

United States Drones Market Size and Share:

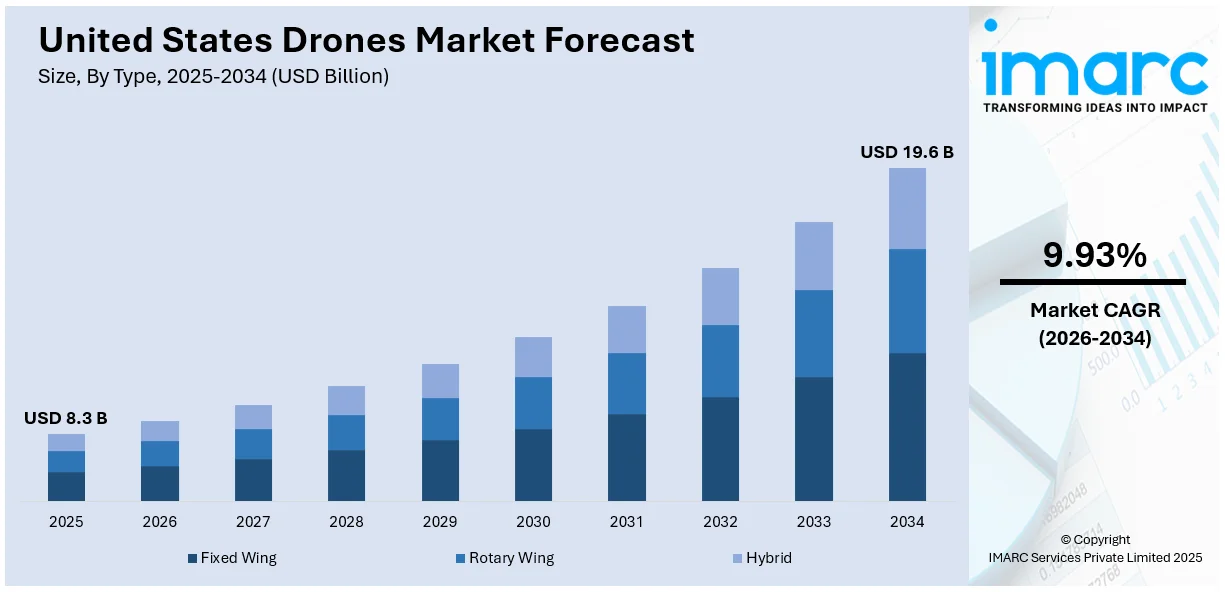

The United States drones market size was valued at USD 8.3 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 19.6 Billion by 2034, exhibiting a CAGR of 9.93% from 2026-2034. The market is growing rapidly with the advancement in technology and the increasing applications in agriculture, logistics, public safety, and infrastructure. Key factors that drive United States drones market growth and innovation are legislative backing, refined autonomous functionality, and widening implementation in commercial and industrial operations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 8.3 Billion |

|

Market Forecast in 2034

|

USD 19.6 Billion |

| Market Growth Rate (2026-2034) | 9.93% |

United States Drones Market Analysis:

- Major Market Drivers: Increased adoption of drones in the agriculture and logistics industries leads to market growth. Leading AI integration, better battery life, and sensor capabilities drive innovation. FAA regulatory support facilitates commercial uses. Increased precision farming solution demand spurs growth in agricultural use, which accounts for a major United States drones market share.

- Key Market Trends: Advancement of autonomous drone technology defines present market trends. Growth of last-mile delivery services fuels commercial penetration levels. Precision farming applications in agriculture keep on growing at a rapid pace. Safety features and systems designed for obstacle avoidance enhance operational reliability. Artificial intelligence (AI) and machine learning (ML) integration capabilities fuel technological innovation for many drones applications.

- Competitive Landscape: The market is characterized by the high level of competition between defense contractors and start-ups in the technology sector. The existing players concentrate on hardware development, software creation, and autonomous capabilities improvement. Collaboration between drone makers and service providers through strategic partnerships consolidates industry positions.

- Challenges and Opportunities: Compliance requirements for regulation pose operating difficulties while providing opportunity for standardization. Issues of privacy and management of airspace need innovative solutions. Increasing e-commerce demand provides huge delivery service opportunities. Infrastructure inspection and emergency response application prospects are huge for growth opportunities in United States drones market analysis and expansion plans.

To get more information on this market Request Sample

The US drone market is growing significantly with technological advancements and increased adoption in various sectors. Agricultural usage of United States drones is particularly seen in precision farming, which can provide optimal solutions for crop performance monitoring, soil testing, and pest control application. For instance, in January 2025, Drone Nerds, a U.S. provider of enterprise and agricultural drones, partnered with ABZ Innovation to expand its spraying drone lineup. The collaboration introduces L30 and L10 PRO series that offer advanced solutions for American farms of different sizes. The logistics sector also contributes to United States drones market demand, as drones are increasingly deployed for last-mile delivery services, reducing costs and delivery times for e-commerce businesses.

Regulatory developments, particularly from the Federal Aviation Administration (FAA), ascertained the growth of the drone market by ensuring their safe use during operation and giving a clear guideline for commercial use. For instance, in March 2024, the FAA Remote ID regulation became effective in the U.S. for all registered drone pilots in order to ensure safety and security as drones become a vital part of modern aviation. Additionally, advances in drone technology, including better sensors and the introduction of battery life improvements along with AI-driven automation, expand the possibilities for drones in the commercial and recreational sectors.

United States Drones Market Trends:

Increased Adoption in Agriculture

The drone market in the United States is seeing significant adoption in agriculture because of the increasing need for efficient and precise farming practices. Drones are used for crop monitoring, soil analysis, and pesticide application, and this allows farmers to gather real-time data that helps them make more informed decisions. Moreover, organizations are creating innovative solutions, which in turn reducing operational costs, minimizing environmental impact, and improving crop yields. For instance, in December 2024, Agri Spray Drones announced partnership with EAVision, a drone manufacturer specializing in agricultural technology. This collaboration introduces the EAVision J100 to provide advanced drone solutions to farmers and applicators across the United States. Precision agriculture with drones is likely to continue to expand as more farmers look to embrace technology to help overcome labor shortages and manage resources. Additionally, with the advancement of affordable, user-friendly drone technology, smaller farms are also reaping the benefits of these innovations.

Growth of Drone Delivery Services

The demand for drone-based delivery services is steadily increasing in the United States, driven by the growth of e-commerce and consumer expectations for faster, more efficient delivery options. Drone technology for last-mile delivery aims to reduce operational costs, enhance delivery speeds, and improve customer satisfaction. In line with this, drones can bypass traffic congestion and deliver goods directly to consumers, offering a more sustainable and cost-effective solution than traditional methods. For instance, in August 2024, Flytrex, the drone-based food delivery service, announced hitting 100,000 deliveries in North Carolina and Texas. This achievement sets it as the biggest drone food delivery service in the U.S. and allows for 70 percent of all its four service area households to make regular uses on the platform. As regulatory frameworks continue to evolve and more drones are integrated into logistics networks, drone delivery is expected to become a mainstream solution for both large and small-scale businesses.

Advancements in Autonomous Drone Technology

The United States is on the cutting edge of the autonomous drone technology that is advancing at rapid pace. With AI-driven systems and advanced sensors, the drones are getting increasingly autonomous in nature, reducing human intervention for a more efficient and reliable result. The capabilities of drones performing mapping, inspection, and surveillance are much improved and less subject to human interference. For instance, in December 2024, Israeli company XTEND secured an USD 8.8 Million contract with the U.S. Department of Defense to supply Precision Strike Indoor & Outdoor (PSIO) drones, integrating AI-driven precision strike capabilities for indoor and outdoor combat missions, with U.S. production beginning in Q1 2025. Moreover, autonomous drones are particularly valuable in industries like construction, infrastructure inspection, and emergency response, where high-risk environments and large-scale operations demand precision and safety. Furthermore, as these technologies evolve, autonomous drones will likely play a larger role in both commercial and governmental operations.

United States Drones Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States drones market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on type, component, payload, point of sale, and end use industry.

Analysis by Type:

- Fixed Wing

- Rotary Wing

- Hybrid

Fixed-wing drones are characterized by their airplane-like design, featuring wings that provide lift during forward motion. These drones are widely used for long-range operations such as mapping, surveillance, and agriculture, where extended flight time and coverage area are critical. Their ability to carry larger payloads and operate efficiently in fixed routes makes them popular in industries like energy and defense. However, their design limits vertical takeoff and landing (VTOL) capabilities, requiring additional infrastructure like runways or launchers for deployment.

Rotary-wing drones generally known as helicopters or quadcopters with the ability of hovering, and takeoff, landing vertically prove to be much versatile. Hence, they prefer applications where precise maneuverability matters the most with respect to aerophotography, inspection as well as surveillance for public security. Their compactness is useful in crowded cities and inner operations. While rotary-wing drones typically have shorter flight durations and lower payload capacities than fixed-wing models, their ease of use and adaptability have driven widespread adoption across both recreational and commercial sectors.

Hybrid drones integrate characteristics of both fixed-wing and rotary-wing configurations. This, in turn, offers the capability of vertical takeoff and landing, combined with longer flight durations. Such applications are being implemented in sectors like agriculture, delivery, and even military, for increased flexibility and efficiency. In recent times, the biggest US drone companies are increasingly investing in hybrid drone technology to improve the efficiency of operation and extend its capabilities. Hybrid drones have been designed to overcome the constraints associated with other types of drones, including long-range capabilities while not requiring launch infrastructure. This segment represents an innovative solution for complex operational needs, bridging the gap between endurance and maneuverability, making it a growing focus in the U.S. drone market.

Analysis by Component:

- Hardware

- Software

- Accessories

The hardware segment encompasses the physical components of drones, including frames, propellers, motors, sensors, cameras, and batteries. These elements are critical to the functionality, durability, and performance of drones. Advances in materials, miniaturization of components, and integration of cutting-edge technologies like LiDAR and thermal imaging have driven innovation in this segment. In the U.S. market, demand for high-quality and reliable hardware is fueled by industries such as construction, agriculture, and defense, where robust drone performance is essential for achieving operational efficiency and precision.

Software is the backbone of drone operation, enabling navigation, data processing, and analytics. This segment includes flight control systems, mapping tools, data analysis platforms, and artificial intelligence-driven applications. U.S. industries rely on sophisticated software to perform complex tasks such as real-time monitoring, predictive maintenance, and autonomous flight. As regulatory requirements and operational demands evolve, the development of secure, user-friendly, and scalable software solutions has become a key focus, ensuring seamless integration of drones into commercial and industrial workflows.

Accessories enhance drone functionality and usability, including items such as spare parts, carrying cases, landing pads, and additional payloads like cameras and sensors. These components are vital for customizing drones to specific operational needs, extending their lifespan, and ensuring optimal performance. In the U.S. market, demand for high-quality accessories is driven by both recreational and commercial users seeking to maximize the value and efficiency of their drones. Innovations in modular designs and specialized attachments have made accessories a critical aspect of the overall drone ecosystem.

Analysis by Payload:

- <25 Kilograms

- 25-170 Kilograms

- >170 Kilograms

Drones with payload capacities below 25 kilograms holds a prominence in the U.S. market, favored for their versatility and ease of operation. These lightweight drones are widely used in sectors such as agriculture, real estate, media, and public safety. They typically carry cameras, sensors, and other lightweight equipment, making them ideal for tasks like aerial photography, surveying, and inspection. Their affordability and ability to meet various regulatory standards contribute to their widespread adoption among both recreational and commercial users.

Drones in the 25-170 kilogram payload category are suited for more demanding applications requiring moderate lifting capabilities. They are commonly employed in logistics, industrial inspections, and military reconnaissance. These drones can carry larger sensors, delivery packages, or specialized equipment, making them a preferred choice for organizations needing increased operational flexibility. Their capability to perform in challenging environments, coupled with advancements in battery technology and power management, has bolstered their role in the U.S. drone market.

Drones with payload capacities exceeding 170 kilograms are primarily utilized in heavy-duty and specialized applications. These include cargo transportation, emergency response, and military operations where significant payloads such as medical supplies or surveillance systems are required. In the U.S., this segment is gaining attention as companies and agencies explore the potential for large-scale autonomous delivery and long-range missions. Despite regulatory and technical challenges, these high-capacity drones represent a growing frontier in the drone market, driven by advancements in aerodynamics and propulsion systems.

Analysis by Point of Sale:

- Original Equipment Manufacturers (OEM)

- Aftermarket

The OEM segment includes companies that design, manufacture, and sell drones and their integrated systems. These manufacturers provide complete, ready-to-use solutions, catering to both commercial and recreational markets. OEMs often offer customized drones for specific industries such as agriculture, defense, and construction, where tailored features are essential. In the U.S., leading OEMs emphasize innovation and quality, leveraging advanced technologies to meet evolving operational requirements. Their focus on direct sales channels and partnerships with enterprise clients contributes significantly to the drone market’s growth.

The aftermarket segment involves the sale of replacement parts, accessories, and upgrades for existing drones. This includes components like batteries, cameras, sensors, and software updates. The U.S. aftermarket caters to both hobbyists and professionals seeking to enhance performance, extend the lifespan of their drones, or adapt them for specific tasks. With a growing number of drone users and the expansion of industries integrating drones, the demand for aftermarket products has surged. This segment is essential for supporting operational continuity and enabling cost-effective maintenance.

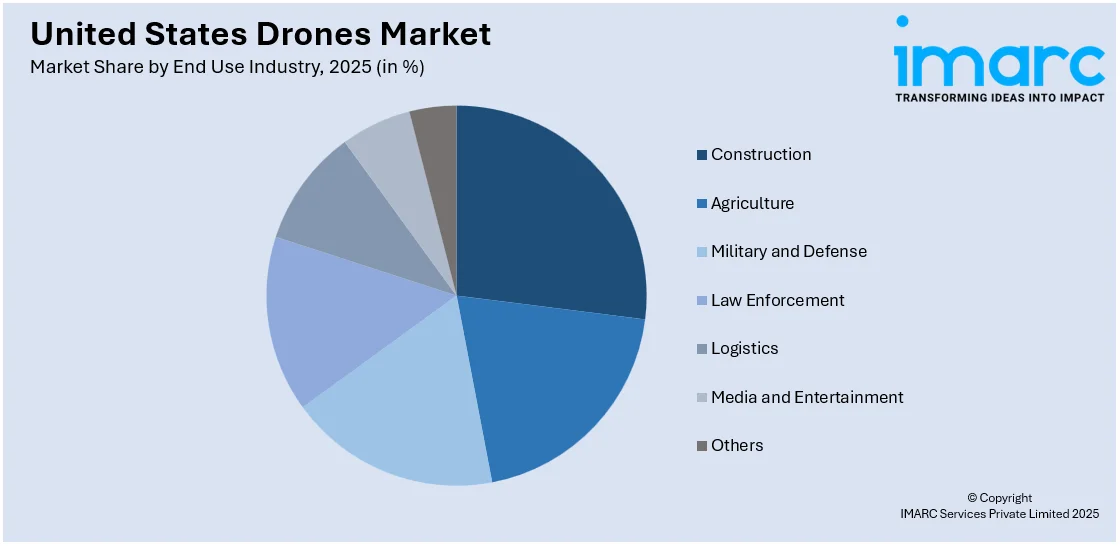

Analysis by End Use Industry:

Access the comprehensive market breakdown Request Sample

- Construction

- Agriculture

- Military and Defense

- Law Enforcement

- Logistics

- Media and Entertainment

- Others

Drones in the construction industry are extensively used for site surveys, progress monitoring, and safety inspections. Their ability to capture high-resolution aerial imagery and create accurate 3D maps enhances project management and resource allocation. In the U.S., construction firms increasingly rely on drones to reduce costs, improve efficiency, and minimize risks, making them a vital tool for large-scale infrastructure and commercial projects.

Drones have transformed U.S. agriculture by enabling precision farming practices. They are used for crop monitoring, soil analysis, irrigation management, and pesticide application. Equipped with advanced sensors and imaging technologies, agricultural drones help optimize yields and reduce resource waste. Their ability to collect real-time data is instrumental for farmers seeking sustainable and data-driven solutions.

The U.S. military and defense sectors utilize drones for surveillance, reconnaissance, and combat operations. Their ability to operate in challenging environments, gather intelligence, and execute targeted missions makes them indispensable. Advanced technologies, including autonomous navigation and AI integration, drive the development of military drones, ensuring operational superiority and strategic advantage.

Law enforcement agencies across the U.S. deploy drones for crowd monitoring, search and rescue operations, and crime scene analysis. Their versatility and real-time data capabilities enhance situational awareness and decision-making. With compact designs and high maneuverability, drones are becoming a crucial asset for improving public safety and operational efficiency, contributing to the U.S. drones market share.

Drones in logistics are revolutionizing last-mile delivery, warehouse management, and inventory tracking. U.S. companies are exploring drone-based solutions to overcome challenges in remote or urban areas, reducing delivery times and costs. Advances in payload capacity and autonomous navigation are driving adoption in this sector, addressing efficiency and sustainability goals.

The media and entertainment industry widely employs drones for capturing dynamic aerial footage and cinematic shots. Their ability to provide unique perspectives and high-quality visuals has transformed content production in the U.S., from films and commercials to live events. Lightweight, easy-to-operate drones have democratized aerial photography, making them accessible to both professionals and hobbyists.

Regional Analysis:

- Northeast

- Midwest

- South

- West

According to the United States drones market forecast, the Northeast region is characterized by its urban density and advanced infrastructure, is a significant market for drones. Industries such as real estate, construction, and media heavily utilize drones for tasks like aerial surveys, photography, and infrastructure inspection. This region's focus on innovation and technological adoption, along with stringent regulatory frameworks, drives demand for reliable and versatile drone solutions.

The Midwest is a prominent hub for agricultural applications of drones, given its expansive farmlands and focus on precision farming. Drones are widely used for crop monitoring, irrigation management, and soil analysis, enhancing productivity and sustainability. Additionally, industrial sectors, including manufacturing and energy, contribute to the growing demand for drones in this region for inspection and maintenance purposes.

The Southern United States, with its diverse industries, is a rapidly expanding market for drones. Agriculture, oil and gas, and logistics are key drivers of demand. The region's favorable weather and large rural areas make it ideal for drone applications in precision farming and pipeline inspections. Additionally, the use of drones for public safety and disaster response is gaining traction in this region.

The Western United States is a significant contributor in drone innovation, driven by a strong technology sector and aerospace presence. The region sees significant use of drones in media production, environmental monitoring, and wildfire management. California, in particular, is a hub for drone startups and research, making the West a key contributor to advancements in drone technology, applications, and establishing as a largest us drone manufacturers.

Competitive Landscape:

The United States drones market is intensely competitive with diversified players across various sectors, such as manufacturing, technology, and services. Key players are mainly focused on advanced drone hardware, software, and autonomous capabilities for the increasing commercial, industrial, and recreational demands. Ongoing innovation in drone technology, including AI integration, enhanced sensors, and longer battery life, also intensifies the competition. Moreover, regulatory compliance with the Federal Aviation Administration (FAA) is another critical factor that shapes market dynamics. For instance, in May 2024, Amazon received approval from the Federal Aviation Administration to fly delivery drones farther distances without ground spotters, enabling expansion in College Station, Texas. Its collision-avoidance technology allows for safe Beyond Visual Line of Sight (BVLOS) operations that advance the Prime Air drone delivery program. Furthermore, companies are increasingly partnering with industry-specific service providers to expand their offerings and address unique market needs, positioning themselves for long-term growth.

The report provides a comprehensive analysis of the competitive landscape in the United States drones market with detailed profiles of all major companies, including:

- SZ DJI Technology Co. Ltd

- Yuneec (ATL Drone)

- Parrot SA

- Lockheed Martin Corporation

- Autel Robotics Co. Ltd

- 3D Robotics Inc

- Wing Aviation LLC

- UVify Inc.

- Holy Stone

- AgEagle Aerial Systems Inc.

- Draganfly Inc.

Latest News and Developments:

- September 2025: Lockheed Martin’s Skunk Works unveiled the Vectis stealth Collaborative Combat Aircraft drone, designed for U.S. and allied warfighters, offering multi-mission flexibility, high survivability, and advanced autonomy.

- September 2025: Uber Eats announced a partnership with Flytrex to begin drone-based meal deliveries in select U.S. test markets, marking a significant step in expanding autonomous, hands-free food delivery nationwide.

- June 2024: Red Cat Holdings announced a Letter of Intent to acquire FlightWave Aerospace Systems, integrating the Edge 130 VTOL drone into its military, government, and commercial UAV portfolio to enhance ISR capabilities and long-range autonomous operations.

- In April 2024, DoorDash partnered with Wing, Alphabet’s drone delivery service, to launch drone deliveries in the U.S. Consumers can now order select Wendy’s items through DoorDash, with drones handling deliveries under the pilot program.

- In August 2024, Mississippi State University’s Agricultural Autonomy Institute (AAI) partnered with Hylio, a Texas-based drone manufacturer, to advance agricultural spray drone technology, enhancing autonomous solutions for farmers alongside traditional methods like tractors and crop-dusting planes.

- In September 2024, Rotor Technologies Inc. introduced the Sprayhawk, the world’s largest agricultural drone. This USD 900,000 UAV enhances efficiency in large-scale farming with its 110-gallon capacity and ability to spray 240 acres per hour.

- In November 2024, Amazon introduced Prime Air drone delivery in Tolleson, Arizona, providing under one-hour deliveries from its same-day facility. They offer over 50,000 items, with a five-pound weight limit and an applicable service fee.

United States Drones Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Fixed Wing, Rotary Wing, Hybrid |

| Components Covered | Hardware, Software, Accessories |

| Payloads Covered | <25 Kilograms, 25-170 Kilograms, >170 Kilograms |

| Point of Sales Covered | Original Equipment Manufacturers (OEM), Aftermarket |

| End Use Industries Covered | Construction, Agriculture, Military and Defense, Law Enforcement, Logistics, Media and Entertainment, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States drones market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States drones market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States drones industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States drones market was valued at USD 8.3 Billion in 2025.

The market is driven by defense applications, commercial adoption in agriculture and logistics, technological advancements, and regulatory support. Increased automation, surveillance needs, and expanding drone deliveries further accelerate market growth and innovation.

IMARC estimates the United States drones market to reach USD 19.6 Billion in 2034, exhibiting a CAGR of 9.93% during 2026-2034.

Some of the major players in the United States drones market include SZ DJI Technology Co. Ltd, Yuneec (ATL Drone), Parrot SA, Lockheed Martin Corporation, Autel Robotics Co. Ltd, 3D Robotics Inc, Wing Aviation LLC, UVify Inc., Holy Stone, AgEagle Aerial Systems Inc., Draganfly Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)