United States Digital Signature Market Size, Share, Trends and Forecast by Component, Deployment Model, Enterprise Size, Industry Vertical, and Region, 2025-2033

United States Digital Signature Market Size and Share:

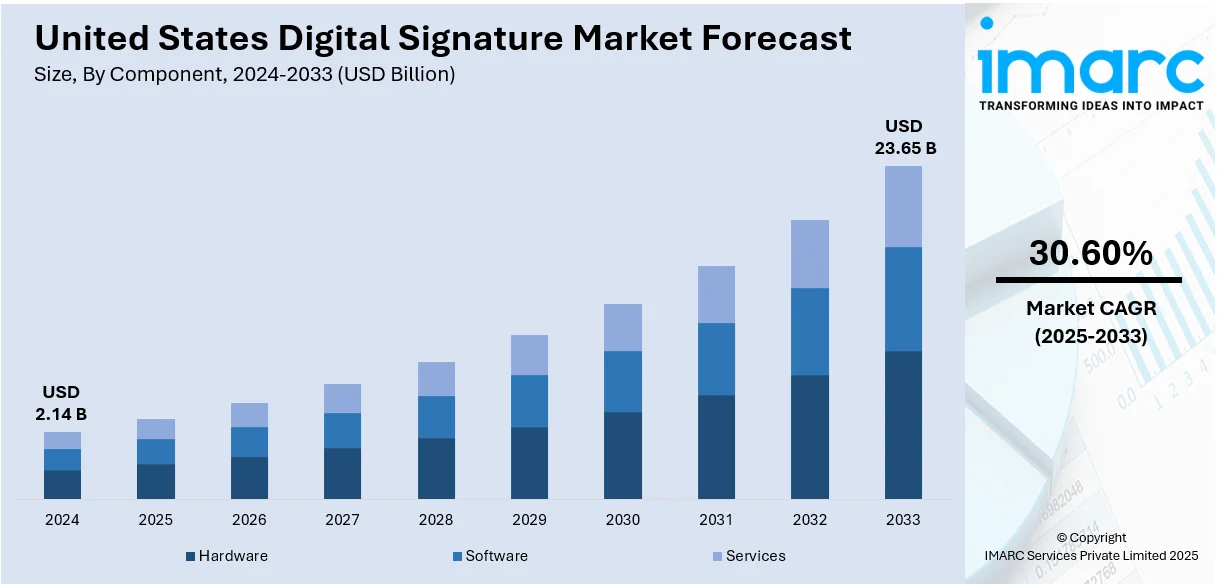

The United States digital signature market size was valued at USD 2.14 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 23.65 Billion by 2033, exhibiting a CAGR of 30.60% from 2025-2033. The growth of the market is due to the increasing demand for secure authentication methods, regulatory requirements mandating electronic documentation, advancements in cryptographic technologies, and the growing emphasis on cost-effective, paperless processes. The United States digital signature market share continues to expand due to rising adoption across industries and the growing focus on safeguarding data integrity in digital operations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.14 Billion |

| Market Forecast in 2033 | USD 23.65 Billion |

| Market Growth Rate (2025-2033) | 30.60% |

There is a rise in implementation of stringent laws and standards that require organizations to adopt secure and legally binding electronic documentation processes. This creates a growing need for digital signature solutions that guarantee compliance while enabling smooth digital transactions. Additionally, the increasing demand for secure authentication and verification techniques to safeguard sensitive data is driving the use of digital signatures. These solutions provide quicker, accurate processes, removing the dangers linked to manual or paper-based approaches. In addition, the extensive move towards digital processes, driven by remote work practices, is boosting the need for paperless operations. Organizations strive to lower operational expenses and improve efficiency by incorporating digital signature solutions into their current systems.

Furthermore, continuous advancements in cryptographic technologies and encryption techniques are enhancing the dependability and scalability of digital signature solutions. Improved functionalities, including multi-factor authentication and blockchain integration, additionally appeal to organizations in pursuit of strong security. In addition to this, companies are utilizing digital signatures to lower costs related to the management, storage, and mailing of physical documents. These solutions provide an affordable option to conventional documentation methods, enhancing their market attractiveness. Apart from this, digital signature solutions offer scalable choices that suit companies of every size, from small startups to large corporations. Services hosted in the cloud provide adaptability and smooth compatibility with current digital tools, promoting usage. Additionally, organizations use digital signatures to reduce risks such as fraud, identity theft, and document alteration. Employing sophisticated encryption and robust authentication methods enhances confidence in online transactions.

United States Digital Signature Market Trends:

Growing Demand for Secure and Efficient Transactions

IMARC Group forecasts that the cybersecurity market will attain US$ 172.65 Billion by 2032, demonstrating a growth rate (CAGR) of 8.20% from 2024 to 2032. The increasing cyber threats and the need for safe online transactions are bolstering the United States digital signature market growth. Businesses and individuals are moving toward digital platforms, which is driving the demand for methods that ensure both authenticity and integrity of online transactions. Digital signatures provide an encrypted and tamper-evident way to validate contracts, agreements, and communications, which is crucial in sectors like finance, healthcare, and government. The growing reliance on e-commerce and remote work is further driving this need for trusted electronic verification. Moreover, digital signatures comply with various regulatory standards, ensuring their legality in digital transactions. With a rising focus on fraud prevention and streamlined processes, organizations are opting for electronic signatures to maintain secure and legally binding interactions, ultimately offering a favorable digital signature market outlook.

Improved Client Experience and Operational Efficiency

Digital signatures enhance operational efficiency by streamlining workflows, reducing manual processes, and shortening the time required to finalize agreements and contracts. With the ability to sign documents remotely, organizations can eliminate delays caused by physical paperwork and in-person signatures, enabling faster decision-making and contract execution. This speed and convenience significantly improve the client experience, allowing businesses to cater to clients more effectively and reduce customer frustration. Additionally, the automation of document management processes, such as storage, tracking, and retrieval, boosts efficiency. This transformation, particularly in industries such as finance, healthcare, and real estate, helps organizations stay competitive in an increasingly fast-paced business environment. For example, in 2024, SIGNiX announced the integration of TruStage Digital Signatures into Hawthorn River’s loan origination software for community banks. This partnership offers secure and compliant digital signature and remote notarization features, optimizing loan processing and improving client experience. The goal of the integration is to minimize paperwork, enhance efficiency, and facilitate scalability for financial institutions.

Government Digital Transformation and Efficiency

Government entities are implementing digital signature solutions to optimize operations, boost accessibility, and increase efficiency in handling documents and services. The transition to digital signatures decreases dependence on physical documents, lessens mistakes, and accelerates processing times, which is essential for handling high transaction volumes. Moreover, digital signatures assist in maintaining legal compliance and security, providing a reliable means for identity verification and safeguarding confidential data. By updating outdated systems, government agencies fulfill the need for improved service delivery while also offering citizens quicker, more convenient access to services. In 2024, the Social Security Administration (SSA) revealed the shift of more than 30 frequently used forms from physical signatures to digital ones, affecting 14 million annual submissions. The goal of this modernization is to streamline procedures, minimize mistakes, and enhance user experience, all while upholding robust anti-fraud safeguards.

United States Digital Signature Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States digital signature market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on component, deployment model, enterprise size, and industry vertical.

Analysis by Component:

- Hardware

- Software

- Services

Software provides essential tools and platforms to develop, validate, and manage electronic signatures, enabling businesses to streamline operations and ensure security. Digital signature tools include programs for signing documents, verifying authenticity, and automating workflows, often integrated with enterprise systems like document management, customer relationship management (CRM), and enterprise resource planning (ERP) solutions. These tools enhance operational efficiency, reduce processing times, and support regulatory compliance, meeting industry standards. Key features include multi-factor authentication, audit trails, and encryption to safeguard sensitive data. The sector is experiencing significant growth due to the increasing need for secure, legally compliant digital transactions across industries, particularly in finance, healthcare, legal, and government sectors. Remote work trends and global digital transformation initiatives are further driving the United States digital signature market demand, as businesses seek cost-effective, environment-friendly alternatives to traditional paper-based processes, improving overall productivity and sustainability.

Analysis by Deployment Mode:

- On-premises

- Cloud-based

On-premises provides organizations enhanced control over their data and security measures. This model suits companies needing total control over their document management systems and confidential data, especially in heavily regulated fields like finance, healthcare, and government. By implementing digital signature solutions within their own infrastructure, organizations can guarantee adherence to internal security policies and customize the system to align with specific operational needs. Furthermore, the on-premises model enables tailored integrations with current enterprise systems, providing enhanced flexibility regarding scalability and features.

Cloud-based is rapidly gaining traction because of its convenience, scalability, and cost-effectiveness. This model allows organizations to access digital signature solutions from anywhere, supporting remote work and global collaboration. Cloud providers deliver automated updates and upkeep, guaranteeing that firms consistently access the newest features and security improvements without extra effort. Furthermore, cloud-based digital signature platforms are highly scalable, enabling organizations to easily expand or adjust their usage based on evolving business needs.

Analysis by Enterprise Size:

- Small and Medium-sized Enterprises

- Large Enterprises

Large enterprises are adopting digital signatures to streamline complex workflows, enhance document security, and improve operational efficiency across multiple departments and global locations. These organizations face extensive regulatory requirements and manage high transaction volumes, necessitating advanced security features like multi-factor authentication, encryption, and tamper-proof audit trails to safeguard sensitive information. Digital signatures enable the fast, secure signing of contracts, agreements, and legal documents, eliminating the need for physical paperwork and reducing the risk of errors or delays. By integrating digital signature platforms with enterprise resource planning (ERP), customer relationship management (CRM), and document management solutions, large enterprises can automate approval processes, accelerate decision-making, and reduce administrative overhead. These solutions also promote seamless collaboration between internal teams and external stakeholders, ensuring compliance with industry standards and legal frameworks. Additionally, the adoption of digital signatures supports sustainability goals by reducing paper consumption, aligning with corporate environmental, social, and governance (ESG) initiatives.

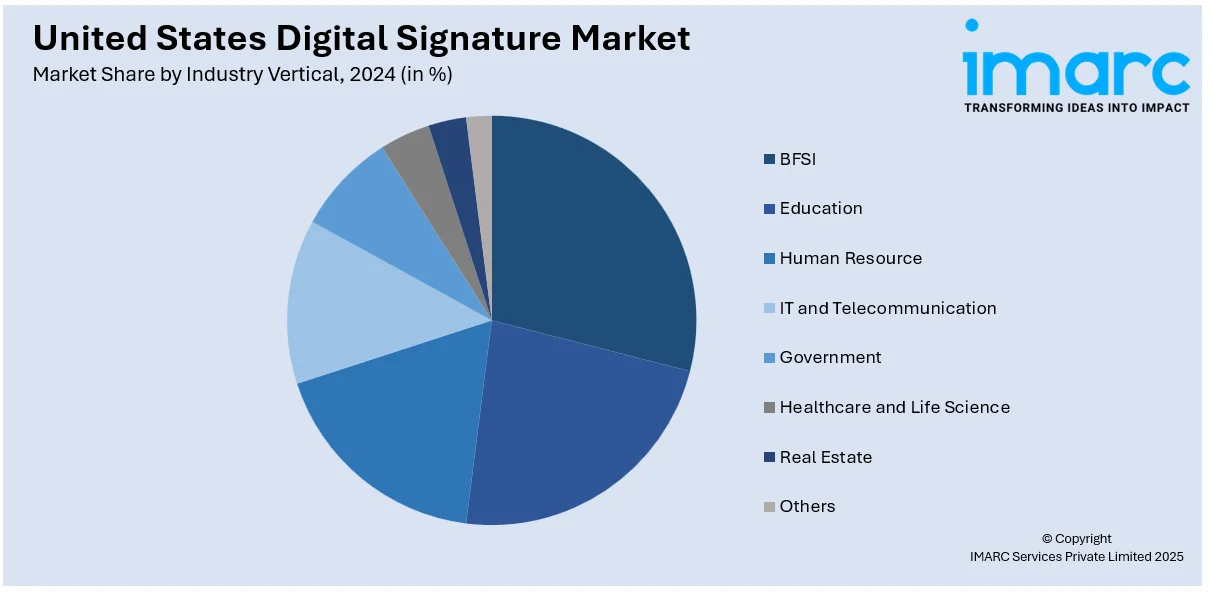

Analysis by Industry Vertical:

- BFSI

- Education

- Human Resource

- IT and Telecommunication

- Government

- Healthcare and Life Science

- Real Estate

- Others

BFSI stand as the largest component in 2024, holding 21.6% of the market. The BFSI sector possesses a significant share of the market, driven by the sector's critical need for secure, efficient, and legally compliant solutions to manage the increasing volume of transactions and documentation. Financial institutions rely on digital signatures to streamline processes such as loan approvals, account openings, insurance claims, and contract signings, significantly reducing paperwork and expediting decision-making. Enhanced security protocols, including encryption, identity authentication, and tamper-proof audit trails, align with the BFSI sector's stringent regulatory requirements. Additionally, digital signatures support cost savings and operational efficiency, enabling financial organizations to meet customer expectations for seamless and remote digital services. The ongoing push for digital transformation, coupled with growing adoption of paperless workflows, further solidifies the BFSI sector's leading role in driving market expansion for digital signature technologies.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast is crucial to the market, fueled by a concentration of sectors including finance, healthcare, government, and legal services. These industries are heavily regulated, leading to a significant need for secure, efficient, and legally compliant digital signature solutions. The area hosts numerous top technology companies that foster the use of advanced digital tools and innovations.

The Midwest region is experiencing notable growth, particularly within the manufacturing, agriculture, and logistics sectors. As businesses in these industries adopt digital workflows to streamline operations and enhance operational efficiency, the demand for secure and reliable digital signature solutions is on the rise. Additionally, financial institutions and insurance companies in the Midwest are adopting digital signatures to modernize document management and enhance client experiences.

The South is a rapidly growing region in the market, fueled by its diverse economic base spanning sectors such as energy, healthcare, real estate, and technology. The continued emphasis on modernization and efficiency in both public and private sectors propels digital signature adoption.

The West is a vital segment in the market, largely because of the presence of leading technology companies and the continued push toward digital transformation. Silicon Valley and other tech hubs are leading the way in adopting innovative solutions, including digital signatures, to facilitate secure and efficient business transactions across various industries. The tech-driven landscape in this region encourages rapid adoption of new technologies, creating a favorable environment for digital signature solutions.

Competitive Landscape:

Major participants in the market are concentrating on strategic actions to boost their market visibility and address the increasing demand. They are also enhancing partnerships and collaborations to enter new sectors and capitalize on emerging opportunities. Moreover, there is considerable emphasis on creating cloud-based solutions to address remote work trends and providing scalable, adaptable services for companies of every size. Marketing initiatives highlight the cost-effectiveness, safety, and ecological advantages of embracing digital signatures. Businesses are putting money into sophisticated encryption technologies to enhance security and dependability, guaranteeing adherence to changing regulatory requirements. Numerous companies are enhancing their product lines by incorporating digital signatures into more extensive document management and workflow solutions to deliver smooth user experiences. In 2025, The HIPAA Journal addressed the utilization of e-signatures in accordance with HIPAA regulations, indicating that electronic signatures are permissible if they meet legal standards, guarantee user verification, and safeguard protected health information (PHI).

The report provides a comprehensive analysis of the competitive landscape in the United States digital signature market with detailed profiles of all major companies, including:

- SIGNiX Inc

- AlphaTrust Corporation

- ePadLink

- Symtrax

- PandaDoc Inc.

- Nitro Software Inc.

- Lightico

- Formstack

- Adobe

- Entrust Corporation

Latest News and Developments:

- January 2025: OneSpan revealed its involvement in the 27th Annual Needham Growth Conference, which took place from January 14–17, 2025, in New York. As a frontrunner in digital banking security and eSignatures, OneSpan will conduct both in-person and virtual investor meetings to explore its solutions for secure digital transactions and workflows.

- August 2024: The National Institute of Standards and Technology (NIST) announced its initial finalized post-quantum encryption standards, featuring algorithms intended to withstand possible threats from quantum computers. These benchmarks, including FIPS 203 (ML-KEM) for overall encryption and FIPS 204 (ML-DSA) for digital signatures, are designed to protect electronic data. NIST urges immediate integration to ensure preparedness for future quantum-based cybersecurity challenges.

- May 2024: aconso launched its HR document management solutions in the US, featuring tools like Genius Document Creation that automate document workflows and integrate digital signature capabilities. By reducing document creation time by 80%, aconso enables HR teams to handle high volumes efficiently while ensuring compliance and ease of use. This expansion supports US organizations in managing increasing document demands with integrated digital tools.

- December 2023: TruStage announced its collaboration with SIGNiX to enhance digital signature services for over 5,400 financial institutions in the United States. The partnership introduces advanced features such as identity verification, remote online notarization, and secure automation to improve compliance and user experience. This integration aims to modernize document signing and streamline financial transactions.

United States Digital Signature Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services |

| Deployment Models Covered | On-premises, Cloud-based |

| Enterprise Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Industry Verticals Covered | BFSI, Education, Human Resource, IT and Telecommunication, Government, Healthcare and Life Science, Real Estate, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States digital signature market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States digital signature market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States digital signature industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The digital signature market in the United States was valued at USD 2.14 Billion in 2024.

The growth of the United States digital signature market is driven by the increasing demand for secure authentication methods, regulatory requirements mandating electronic documentation, advancements in cryptographic technologies, and the growing emphasis on cost-effective, paperless processes. The shift toward digital transformation and the rising need for safeguarding data integrity further propel the adoption of digital signature solutions across industries.

IMARC estimates the United States digital signature market to exhibit a CAGR of 30.60% during 2025-2033.

Some of the major players in the United States digital signature market include SIGNiX Inc, AlphaTrust Corporation, ePadLink, Symtrax, PandaDoc Inc., Nitro Software Inc., Lightico, Formstack, Adobe, Entrust Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)