United States Dietary Supplements Market Size, Share, Trends and Forecast by Product Type, Form, Distribution Channel, Application, End User, and Region, 2026-2034

United States Dietary Supplements Market Summary:

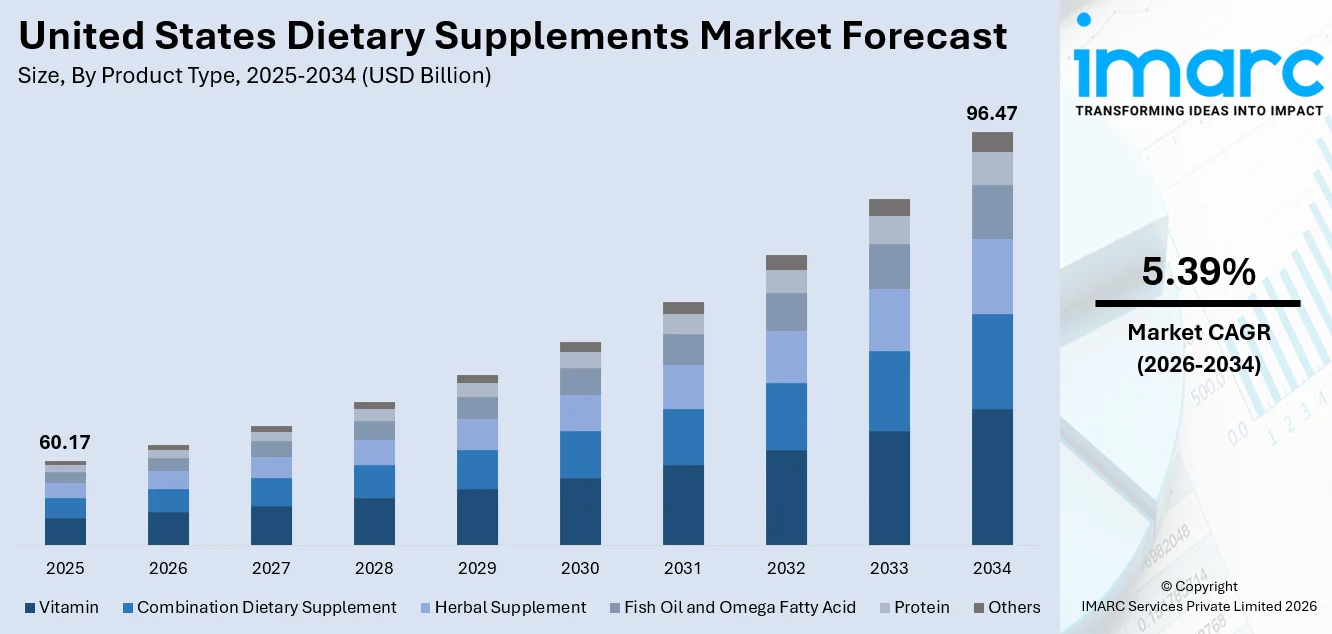

The United States dietary supplements market size was valued at USD 60.17 Billion in 2025 and is projected to reach USD 96.47 Billion by 2034, growing at a compound annual growth rate of 5.39% from 2026-2034.

The United States dietary supplements market is experiencing robust growth driven by increasing health consciousness and preventive healthcare focus among consumers. Rising awareness of nutritional deficiencies caused by busy lifestyles and processed food consumption is accelerating supplement adoption. The aging population seeking solutions for age-related health concerns and growing fitness trends among younger demographics further support market expansion. E-commerce growth and personalized nutrition innovations are enhancing product accessibility and consumer engagement across the dietary supplements market share.

Key Takeaways and Insights:

- By Product Type: Vitamin dominates the market with a share of 28% in 2025, driven by widespread consumer awareness of essential micronutrients, healthcare professional recommendations, and consistent demand for multivitamins supporting immunity, energy, and overall wellness maintenance.

- By Form: Capsules lead the market with a share of 34% in 2025, owing to consumer preference for convenient dosing, superior ingredient protection, precise formulation delivery, and ease of consumption compared to alternative supplement formats.

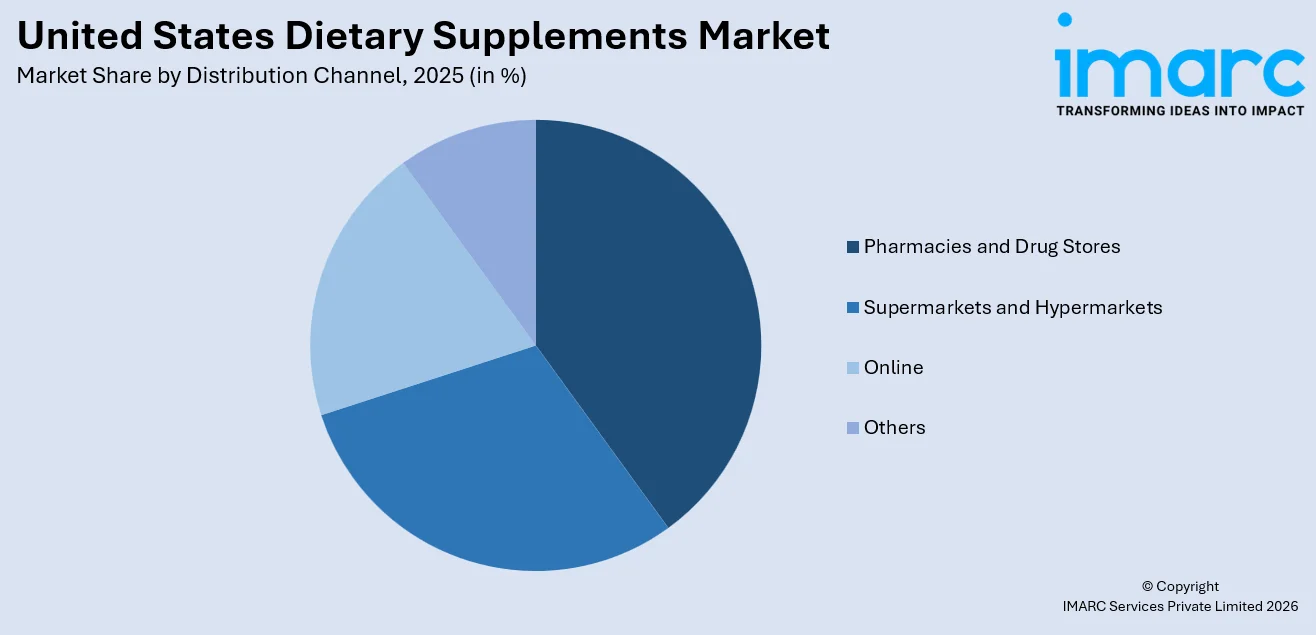

- By Distribution Channel: Pharmacies and drug stores represent the largest segment with a market share of 36% in 2025, attributed to consumer trust in healthcare-adjacent retail environments, professional guidance availability, established retail presence, and immediate product accessibility.

- By Application: General health exhibits clear dominance with a 34% share in 2025, fueled by growing preventive healthcare consciousness, desire to maintain overall wellness, and increasing adoption of daily supplement routines for nutritional gap management.

- By End User: Adults accounts for the largest share of 62% in 2025, driven by high health awareness, busy lifestyles creating nutritional gaps, fitness and wellness trends, and growing emphasis on proactive health management among working-age populations.

- By Region: South dominates with 37% market share in 2025, supported by large population base, growing health awareness, expanding retail infrastructure, and increasing disposable incomes driving supplement consumption across diverse demographic groups.

- Key Players: The United States dietary supplements market exhibits a moderately fragmented competitive structure with established pharmaceutical companies, specialized supplement manufacturers, and emerging direct-to-consumer brands competing through product innovation, quality certifications, and omnichannel distribution strategies.

To get more information on this market Request Sample

The United States dietary supplements market represents the largest national market globally, characterized by mature consumer awareness and sophisticated distribution networks. The market benefits from strong regulatory frameworks ensuring product quality and safety standards; for example, Amazon updated its U.S. dietary supplements policy in 2024 requiring third‑party annual verification for products sold on its platform, increasing compliance and transparency for major brands selling online. Growing emphasis on clean-label formulations and ingredient transparency is reshaping consumer purchasing decisions. Personalized nutrition solutions leveraging genetic testing and AI-driven recommendations are gaining traction among health-conscious consumers. The proliferation of e-commerce platforms and subscription-based models is enhancing market accessibility while enabling direct-to-consumer engagement. Strategic acquisitions and partnerships among industry players reflect ongoing consolidation and capability building across the value chain.

United States Dietary Supplements Market Trends:

Rise of Personalized Nutrition Solutions

Personalized nutrition is transforming the dietary supplements landscape as consumers increasingly seek tailored solutions matching their specific health needs. In 2025, nutrigenomics company GenoPalate partnered with The Vitamin Shoppe to make its DNA‑driven personalized nutrition kits and tailor‑made supplement formulas widely available through the retailer’s online platform, expanding access to customized wellness solutions. Advancements in biotechnology and artificial intelligence enable companies to offer customized supplements based on individual genetic profiles, health goals, and lifestyle factors.

Growing Demand for Clean-Label and Plant-Based Products

Consumer preference for clean-label supplements featuring transparent ingredient lists and natural formulations continues strengthening. In 2025, ACG Capsules introduced the industry’s first fully vegan printed capsules, made entirely from plant‑based polymers and certified by Vegan Action and The Vegetarian Society, enabling supplement brands to create truly animal‑free, transparent products. Plant-based and vegan supplement alternatives are gaining significant market traction as consumers prioritize sustainability and holistic wellness approaches. Manufacturers are responding with certifications including USDA Organic, Non-GMO Project Verified, and third-party testing to build consumer trust and differentiate products in an increasingly competitive marketplace.

Expansion of Functional Ingredients and Novel Formats

Functional ingredients including adaptogens, mushrooms, ashwagandha, and probiotics are experiencing rapid adoption as consumers seek targeted health benefits. In January 2024, Meaningful Partners LLC made a strategic growth investment in M2 Ingredients and its retail brand Om Mushroom Superfood, a leading producer of functional mushroom supplements, to scale distribution and meet rising demand for mushroom‑based wellness products. Novel delivery formats such as gummies, powders, and liquid supplements are expanding consumer appeal beyond traditional tablets and capsules.

Market Outlook 2026-2034:

The United States dietary supplements market is expected to remain favorable, driven by growing health awareness and shifting consumer preferences. Expansion of e-commerce and digital marketing innovations will enhance market accessibility and engagement. Additionally, an aging population and increasing prevalence of chronic health conditions will continue to support demand for preventive health solutions, positioning dietary supplements as a key component of proactive wellness strategies throughout the forecast period. The market generated a revenue of USD 60.17 Billion in 2025 and is projected to reach a revenue of USD 96.47 Billion by 2034, growing at a compound annual growth rate of 5.39% from 2026-2034.

United States Dietary Supplements Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Vitamin | 28% |

| Form | Capsules | 34% |

| Distribution Channel | Pharmacies and Drug Stores | 36% |

| Application | General Health | 34% |

| End User | Adults | 62% |

| Region | South | 37% |

Product Type Insights:

- Vitamin

- Combination Dietary Supplement

- Herbal Supplement

- Fish Oil and Omega Fatty Acid

- Protein

- Others

The vitamin dominates with a market share of 28% of the total United States dietary supplements market in 2025.

Vitamins represent the foundational category within dietary supplements, driven by widespread consumer awareness of essential micronutrients and their role in maintaining overall health. According to reports, in 2025, Nature Made was named the top vitamin brand in the U.S. News & World Report survey, earning eight #1 rankings across key vitamin segments including vitamin D, B12, and multivitamins, underscoring healthcare professional trust and product quality leadership. Multivitamins, vitamin D, vitamin C, and B-complex formulations remain consistently popular across all demographic groups for supporting immunity, energy levels, and general wellness maintenance.

Healthcare professional recommendations and extensive consumer education have established vitamins as a trusted entry point for supplement adoption. The segment benefits from continuous product innovation including clean-label formulations, convenient delivery formats such as gummies and effervescent tablets, and targeted formulations addressing specific life-stage requirements. Growing awareness of vitamin D deficiency and immune health support continues driving segment expansion, while personalized nutrition trends and digital health tools further enhance consumer engagement and adoption.

Form Insights:

- Tablets Capsules

- Capsules

- Powder

- Liquids

- Soft Gels

The capsules lead with a share of 34% of the total United States dietary supplements market in 2025.

Capsules maintain market leadership due to their superior ingredient protection, precise dosing capabilities, and consumer-friendly consumption experience. In 2025, Lonza highlighted continued innovation in capsule technology with its Capsugel Beadlets delivery system, enabling the combination of multiple actives in a single visually appealing capsule format that enhances both stability and consumer appeal. The format effectively masks unpleasant tastes and odors while ensuring ingredient stability and controlled release characteristics essential for optimal nutrient delivery and bioavailability.

Consumer preference for capsules extends across multiple supplement categories including vitamins, minerals, herbal extracts, and specialty formulations. The format accommodates both vegetarian and standard gelatin options, addressing diverse dietary preferences. Manufacturers continue enhancing capsule technologies with improved dissolution profiles and innovative coating solutions supporting targeted ingredient release, while incorporating advanced delivery systems, flavor masking, and stability improvements to boost bioavailability, consumer convenience, and overall product efficacy across various wellness applications.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Pharmacies and Drug Stores

- Supermarkets and Hypermarkets

- Online

- Others

The pharmacies and drug stores dominate with a market share of 36% of the total United States dietary supplements market in 2025.

Pharmacies and drug stores maintain distribution leadership through strong consumer trust in healthcare-focused retail environments. These channels provide professional guidance from pharmacists, immediate product availability, and a credible setting for health-related purchases, reinforcing confidence in supplement selection and usage. Consumers value personalized advice, reassurance on product quality, and convenience, making pharmacies a preferred destination for dietary supplements. This trust-driven approach continues to underpin the segment’s stability and growth.

Major pharmacy chains have expanded dedicated supplement sections, featuring premium brands, private-label products, and specialty formulations tailored to diverse health needs. Strategic shelf placement, pharmacist recommendations, and promotional activities drive higher conversion rates, while loyalty programs encourage repeat purchases. The channel is evolving with broader product assortments, digital health integration, and personalized wellness solutions. These innovations enhance consumer engagement, simplify decision-making, and strengthen the role of pharmacies as a trusted supplement distribution hub.

Application Insights:

- Energy and Weight Management

- General Health

- Bone and Joint Health

- Immunity

- Others

The general health leads with a share of 34% of the total United States dietary supplements market in 2025.

General health represent the broadest supplement category, encompassing products supporting overall wellness, nutritional gap management, and preventive healthcare objectives. In October 2025, Designs for Health announced a strategic minority investment from BDT & MSD Partners to support continued growth, product innovation, and expanded distribution of its research‑backed general wellness supplement solutions in the U.S. market. This segment attracts first-time supplement users seeking accessible solutions for daily health maintenance without targeting specific conditions or therapeutic outcomes.

The growing emphasis on proactive health management and holistic wellness approaches drives sustained demand for general health supplements. Multivitamin formulations, essential mineral complexes, and comprehensive wellness blends constitute primary product offerings within this segment. Consumer education initiatives, healthcare provider endorsements, and increasing awareness of preventive nutrition support continued segment expansion across diverse demographic groups, while convenient delivery formats and clean-label formulations further enhance accessibility, appeal, and long-term consumer adherence.

End User Insights:

- Children

- Adults

- Pregnant Females

- Geriatric

The adults dominate with a market share of 62% of the total United States dietary supplements market in 2025.

Adults represent the primary consumer demographic for dietary supplements, driven by heightened health awareness, busy lifestyles creating nutritional gaps, and increased focus on preventive healthcare. This population increasingly turns to supplements to support immunity, energy, mental wellness, fitness performance, and overall health maintenance. Convenience, efficacy, and trusted formulations guide purchasing decisions, making adults a key target segment for both mainstream and specialty supplement products designed to address everyday nutritional needs and lifestyle demands.

The segment includes diverse sub-demographics such as fitness enthusiasts, working professionals, and health-conscious individuals seeking convenient, effective nutritional solutions. Adults demonstrate strong purchasing power and a willingness to invest in premium formulations targeting specific health concerns. Rising interest in personalized nutrition, lifestyle-specific supplements, and targeted wellness solutions continues to drive adoption across adult age cohorts. This trend reinforces the importance of innovation, product differentiation, and consumer education in expanding market reach and engagement.

Regional Insights:

- Northeast

- Midwest

- South

- West

The south exhibits a clear dominance with a 37% share of the total United States dietary supplements market in 2025.

The South dominates the dietary supplements market, driven by its large population and increasing health awareness across diverse demographic groups. Growing interest in preventive health and personal wellness is encouraging consumers to adopt supplements that support immunity, nutrition, and fitness. This rising demand spans all age groups, contributing to steady market growth in both major urban centers and rapidly developing suburban areas, reinforcing the region’s leading role in the industry.

Expanding retail infrastructure and higher disposable incomes further accelerate supplement adoption. Widespread availability through pharmacies, supermarkets, and e-commerce platforms ensures consumers can easily access products that meet their health goals. Meanwhile, the region’s growing fitness culture and wellness-focused lifestyle trends shape purchasing behavior, strengthening the South’s market dominance and offering long-term growth potential for supplement manufacturers aiming to capture an increasingly health-conscious consumer base.

Market Dynamics:

Growth Drivers:

Why is the United States Dietary Supplements Market Growing?

Rising Health Consciousness and Preventive Healthcare Focus

Growing consumer awareness of health and wellness is fundamentally reshaping dietary supplement consumption patterns across the United States. Increasing concerns about lifestyle-related diseases including diabetes, hypertension, and obesity are prompting consumers to adopt proactive health management approaches through nutritional supplementation. According to the 2023 Council for Responsible Nutrition (CRN) Consumer Survey, approximately 74% of American adults report taking dietary or nutritional supplements, with over half identifying as regular users, a clear indication of mainstream uptake and trust in supplements for health maintenance. The shift toward preventive healthcare rather than reactive treatment is establishing supplements as integral components of daily wellness routines, particularly among health-conscious younger demographics prioritizing long-term wellbeing.

Aging Population and Age-Related Health Concerns

The expanding elderly population creates substantial demand for dietary supplements addressing age-related health challenges. According to demographic data, approximately 18% of the United States population is currently aged sixty-five years and above, representing a significant and growing consumer segment. Common concerns including joint stiffness, cognitive decline, bone density reduction, and cardiovascular health are driving seniors toward supplements containing calcium, vitamin D, omega-3 fatty acids, and cognitive support formulations. Healthcare professional recommendations for managing age-related nutritional deficiencies further accelerate supplement adoption among geriatric populations seeking to maintain independence and quality of life.

E-commerce Expansion and Digital Marketing Innovation

The rapid growth of e-commerce channels is transforming dietary supplement distribution and consumer engagement across the United States. Online platforms offer extensive product variety, detailed information, customer reviews, and competitive pricing that enhance purchasing convenience. The United States e-commerce market size reached USD 1,161.5 Billion in 2024, highlighting the immense scale and potential of online retail channels, which directly support the rising digital sales of dietary supplements. Retail e-commerce sales continue growing substantially, with supplement categories demonstrating strong online performance. Direct-to-consumer brands leveraging subscription models, personalized recommendations, and targeted social media marketing are successfully capturing younger consumer segments. The digital channel enables smaller specialty brands to reach national audiences without traditional retail distribution requirements, fostering market innovation and consumer choice expansion.

Market Restraints:

What Challenges the United States Dietary Supplements Market is Facing?

Regulatory Scrutiny and Quality Standardization Challenges

Dietary supplement manufacturers face challenges from strict regulations and uneven quality standards. Changing FDA rules and retailer-imposed third-party testing increase compliance costs, especially for smaller players. Navigating these complex requirements demands significant investment in quality assurance, documentation systems, and robust operational processes to ensure product safety, maintain market access, and meet regulatory expectations.

Consumer Skepticism and Misleading Marketing Concerns

Ongoing consumer distrust arises from misleading marketing and unverified health claims, creating market challenges. High-profile cases of inaccurate product claims weaken category credibility and confidence. Companies must invest in clinical research, transparent labeling, and honest communication strategies to establish and sustain consumer trust, ensuring that their products are perceived as reliable and scientifically supported.

Premium Pricing and Economic Sensitivity

High prices for premium dietary supplements limit adoption among price-conscious consumers. Economic uncertainty and inflation may lead consumers to cut discretionary spending or opt for lower-cost alternatives. Manufacturers face the challenge of managing rising input costs while maintaining perceived value, ensuring products remain attractive and competitive in a market sensitive to price fluctuations.

Competitive Landscape:

The United States dietary supplements market exhibits a moderately fragmented competitive structure with established multinational consumer health companies competing alongside specialized supplement manufacturers and emerging direct-to-consumer brands. Major players including Abbott, Nestlé Health Science, Amway, Herbalife, and Pfizer maintain significant market presence through extensive distribution networks, brand recognition, and continuous product innovation. Competition intensifies across product quality, scientific substantiation, pricing strategies, and omnichannel distribution capabilities. Strategic acquisitions and partnerships reflect ongoing consolidation as companies seek to expand product portfolios and market reach. Direct-to-consumer brands leveraging digital marketing and personalized nutrition platforms are disrupting traditional competitive dynamics while capturing health-conscious younger demographics.

Recent Developments:

- In December 2025, London-based wellness brand Jeevanaa launched its melatonin-free Deep Sleep and Deep Calm gummies in the U.S., combining herbal ingredients with science-backed enzymes and probiotics. Developed using AI-assisted formulations, these products offer American consumers a scientifically guided alternative to traditional sleep supplements, reflecting growing demand for innovative, non-melatonin sleep solutions in the U.S. market.

United States Dietary Supplements Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Vitamin, Combination Dietary Supplement, Herbal Supplement, Fish Oil and Omega Fatty Acid, Protein, Others |

| Forms Covered | Tablets, Capsules, Powder, Liquids, Soft Gels |

| Distribution Channels Covered | Pharmacies and Drug Stores, Supermarkets and Hypermarkets, Online, Others |

| Applications Covered | Energy and Weight Management, General Health, Bone and Joint Health, Immunity, Others |

| End Users Covered | Children, Adults, Pregnant Females, Geriatric |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The United States dietary supplements market size was valued at USD 60.17 Billion in 2025.

The United States dietary supplements market is expected to grow at a compound annual growth rate of 5.39% from 2026-2034 to reach USD 96.47 Billion by 2034.

Vitamin dominates with 28% market share driven by widespread consumer awareness of essential micronutrients, healthcare professional recommendations, and consistent demand for multivitamins supporting immunity, energy, and overall wellness.

Key factors driving the United States dietary supplements market include rising health consciousness, aging population demographics, e-commerce expansion, personalized nutrition trends, and growing preventive healthcare focus among consumers.

Major challenges include regulatory scrutiny and compliance requirements, consumer skepticism regarding product claims, inconsistent quality standards, premium pricing sensitivity, and competition from functional food alternatives.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)